- by New Deal democrat

Between 1931 and the mid-1950s, the yield curve never inverted, and yet there were 5 recessions (1938, 1945, 1948, 1950, and 1954). In particular, the 1938 "recession within the depression" was one of the worst of the 20th century.

So in a low inflation and low interest rate environment, where the yield curve may not invert, are there other signals from the bond market that are reasonably reliable?

A month ago I noted that spreads between corporate bonds and government securities have a very spotting record during more deflationary eras.

Today let's approach the issue from another angle. Is there something about the *intensity* of Fed moves that correlates with recessions? Below is a graph of the YoY change in the Fed funds rate since 1955, minus 1.5%, so that a YoY increase of 1.5% in the Fed funds rate = 0:

Twelve to eighteen months prior to 8 of the last 9 recessions, the Fed increased rates YoY by 1.5% or more.There were 4 false positives, two of which involved hikes of 1.5% or 1.75% (1962 and 1966), and one potentially false negative (a 1.5% increase in the Fed funds rate preceded the 1957 recession by 21 months). In the case of the false positives, there were slowdowns in GDP growth even though there was no outright recession.

So, in the most generous interpretation, a YoY Fed rate hike of 1.5% or more is almost certain to be followed by a slowdown, and more often than not by a recession. That's pretty decent even if not perfect.

That suggests that the very gradual Fed rate hikes of the last several years need not give us much concern. And indeed there is one (and only one) episode in the last 60 years that seems to bear this out. In the first half of the 1960s, the Fed gradually raised rates from 1% to 5% (blue line in the graph below):

These rate hikes coincided with economic growth of between 5% to 10% annually! Only when the Fed increased the pace of their hikes beginning in late 1965 did a slowdown occur, as shown by annualized real GDP in the graph below:

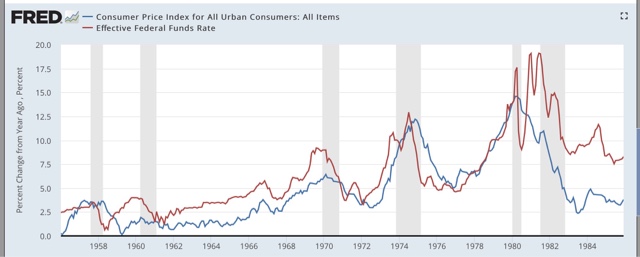

Of course, correlation is not causation, and one obvious candidate for causation is that the Fed is simply reacting to an increase in inflation either already underway or correctly anticipated. To check this, the below two graphs show the YoY% change in inflation, together with the YoY change in the Fed funds rates:

Indeed, with a few exceptions, sharp 1.5%+ increases in the Fed funds rate YoY tend to occur along with equally sharp increases in inflation.

But there are several exceptions, all having to do with the low interest rate environment.

In the first place, as recently as 2011, inflation rose from 1% to 3.8%. The Fed stood pat. No recession occurred.

Now let's take a look at the 1950s:

Here we have two completely different examples. In the period of 1954-57, the Fed hiked rates by a total of 2.25% while inflation went from negative to just under 4%. In contrast, during the inflationary 1960s-1980s period, the Fed raised rates by 2% or more multiple times without a recession ensuing.

In contrast, in the 1958-60 period, inflation remained under 2%, but the Fed aggressively raised rates from under 1% to 4%, and a recession ensured.

What we are left with is, even without looking at the yield curve, we can say that *either* a sharp rise in interest rates, *or* a sharp rise in inflation, almost always precedes to a slowdown, and more often than not precedes a recession. Right now, we have neither.