Financial Sector Is Improving Thanks to Rate Hike Talk

Financial Sector is Strengthening Relative to the SPYs

Personal Income and Spending Up

Chart of the Last 7 Months of Changes

The Fed Sure Would Like Some Help from Fiscal Policy (Yellen)

Financial Sector is Strengthening Relative to the SPYs

The XLF is Near New Highs

The KIEs are Making New Highs

The XLF/SPY Ratio is Low

Personal Income and Spending Up

Personal income increased $71.6 billion (0.4 percent) in July according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $60.1 billion (0.4 percent) and personal consumption expenditures (PCE) increased $42.0 billion (0.3 percent).

Real DPI increased 0.4 percent in July and Real PCE increased 0.3 percent. The PCE price index was unchanged from June. Excluding food and energy, the PCE price index increased 0.1 percent in July.

Chart of the Last 7 Months of Changes

1-Year Chart of the Retail Sector ETF

1-Year Chart of the XLPs

1-Year Chart of the XLYs

The Fed Sure Would Like Some Help from Fiscal Policy (Yellen)

Beyond monetary policy, fiscal policy has traditionally played an important role in dealing with severe economic downturns. A wide range of possible fiscal policy tools and approaches could enhance the cyclical stability of the economy. For example, steps could be taken to increase the effectiveness of the automatic stabilizers, and some economists have proposed that greater fiscal support could be usefully provided to state and local governments during recessions. As always, it would be important to ensure that any fiscal policy changes did not compromise long-run fiscal sustainability.

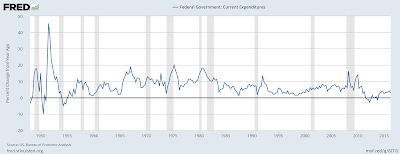

Chart of Current Federal Expenditures

Chart of the YOY Percentage Change in Federal Expenditures