- by New Deal democrat

About a month ago, I came across a post on Mish's blog claiming we were DOOMED because real wages had plummeted by 5% in the first quarter of this year alone, based on productivity and unit labor costs. As I normally do, I actually clicked through on the link to find the source data. A few minutes of poking around showed decisively that Mish's reasoning was fallacious. Since a lot of his own commenters called him on it, I didn't see any need to pile on.

Unfortunately, this claim has just come back big time, being touted by a Pulitzer Prize winning journalist, David Cay Johnston, and picked up by Prof. Brad DeLong. It is utter nonsense. I left a couple of comments at Prof. DeLong's blog, but I wanted to back up my claims with the graphical truth.

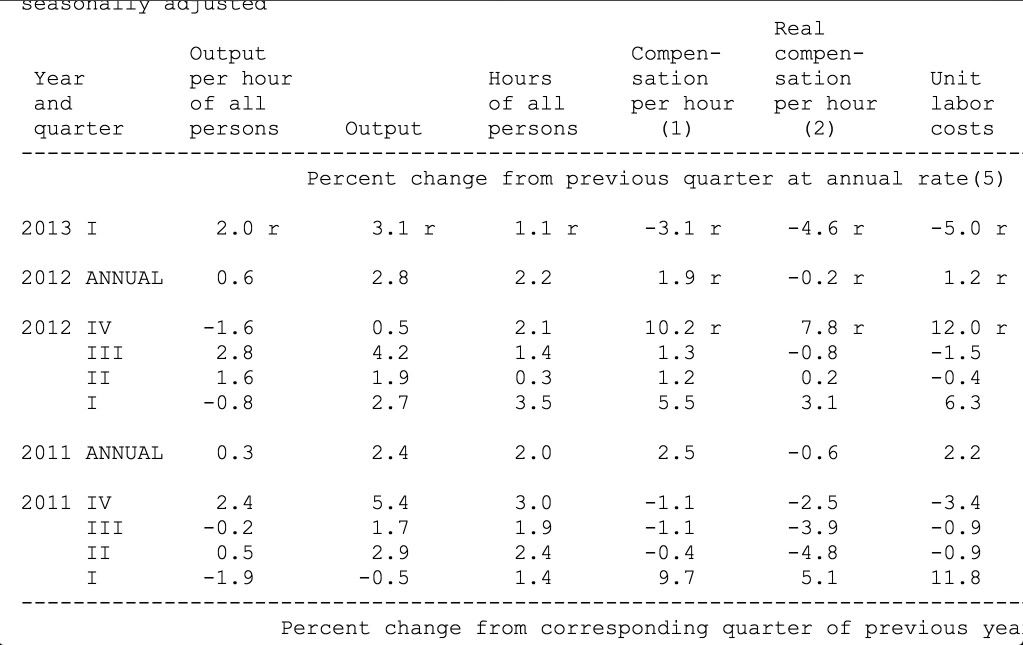

To begin with, as the BLS makes clear, it's definition of "wages" in this report includes non-standard compensation, i.e., things like bonuses. This turns out to be important, because when you examine the table helpfully provided with the report, particularly the sixth column from the left, "real compensation per hour," you see the -4.6% statistic for the first quarter of this year touted by Mish and Johnston. And literally directly below it, you see the increase of +7.8% for the 4th quarter of last year. Don't believe me? Here's a copy of the table:

And here is the table with the raw index values:

Notice that the index bottomed in 4Q 2011 and rose since then, but just as with the similar statistic of real personal income, there is a big spike from discretionary income being moved forward to the last quarter of last year to minimize any impact from the expiration of the Bush tax rates. And just like real personal income, compensation after the spike is still higher than compensation before it.

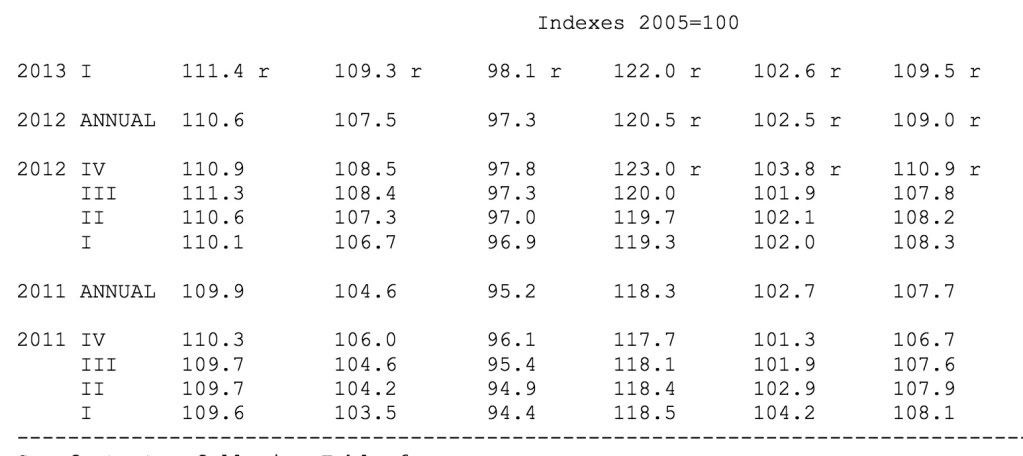

Here's the longer term graph of real compensation per hour for the last half century:

The best case to make is that real wages in this series have stagnated for over 5 years. They peaked in Q1 2011, declined almost 3% over the next 3 quarters, and have increased roughly 1% since then.

The second claim made by Johnston is:

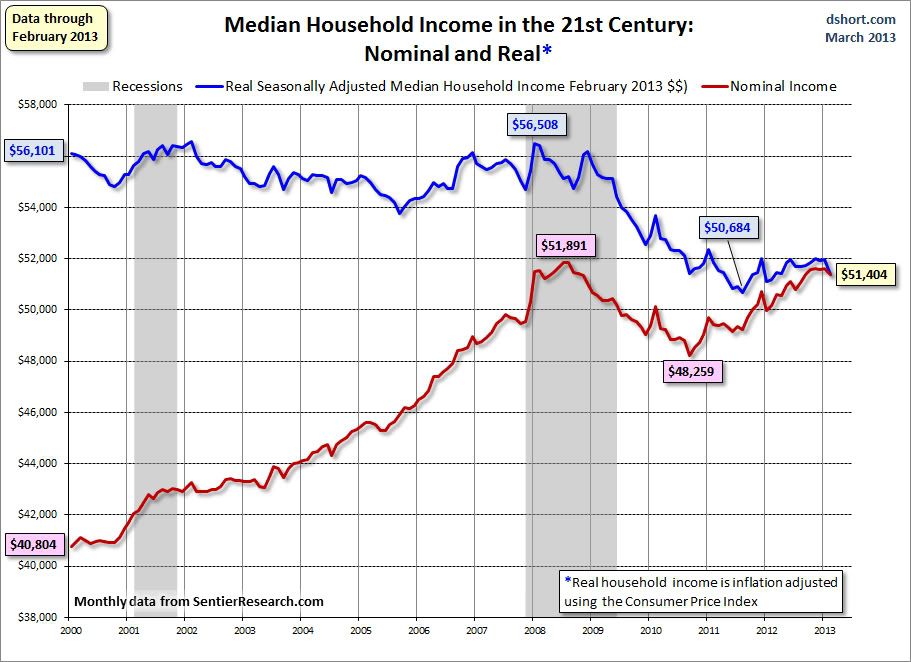

It is not like this new wage news can be dismissed as an anomaly, either. It is evidence of a troubling trend – falling incomes for the 99 percent.Did you notice the subtle change? Johnston starts by implying that falling wages are part of a trend, but then cites an income statistic. But there's a big difference, since income includes things like bank interest and Social Security benefits.

....

From 2007 to 2011 the average pretax income of the bottom 90 percent fell from $35,173 to $30,437. That is a drop of more than $4,500. It is also a decline of nearly 13 percent.

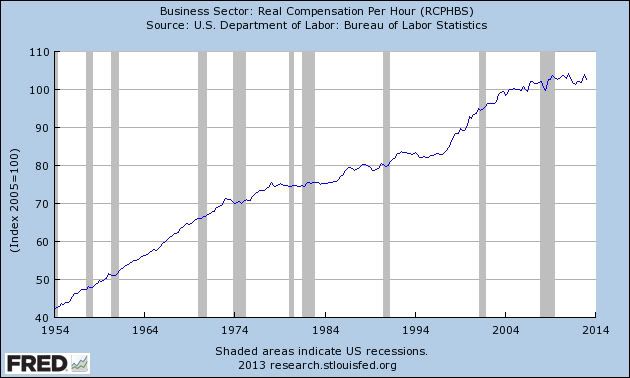

This too is nonsense as alleged proof of falling real wages, and I saw it coming a month ago, after Doug Short posted an update about median household income. It got picked up widely, and was widely misinterpreted by Doomers as a decrease in *wages.* It ain't so. Here's Doug Short's graph:

Notice that median household income declined about 10% into 2011, and since then has slowly risen, although it is still about 7% under its 2007 pre-recession peak.

The data Johnston uses is similar to that tracked by Doug Short. Ultimately it comes from a study by Saez and Piketty on worsening income inequality. They make the case - and I have no reason to doubt that it is absolutely true - that income inequality has worsened since the onset of the great recession. Just like the "median household income" tracked by Doug Short, Saez and Piketty find a large drop in "average pretax income" from 2007 through 2011.

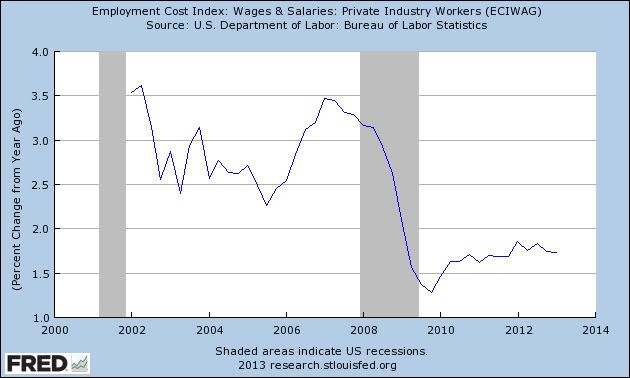

But the index isn't measuring wages. It is measuring income, which includes in that mix households with wage-earners, households where one or more adults is unemployed, and households where one or more adults is retired. Here's the relevant passage from Sentier Research, which compiles the data used by Doug Short:

Just to be sure, I contacted them directly and they confirmed the above to me.

Similarly, footnote 3 to the paper reported by Saez and Piketty indicates that data from all households was used.

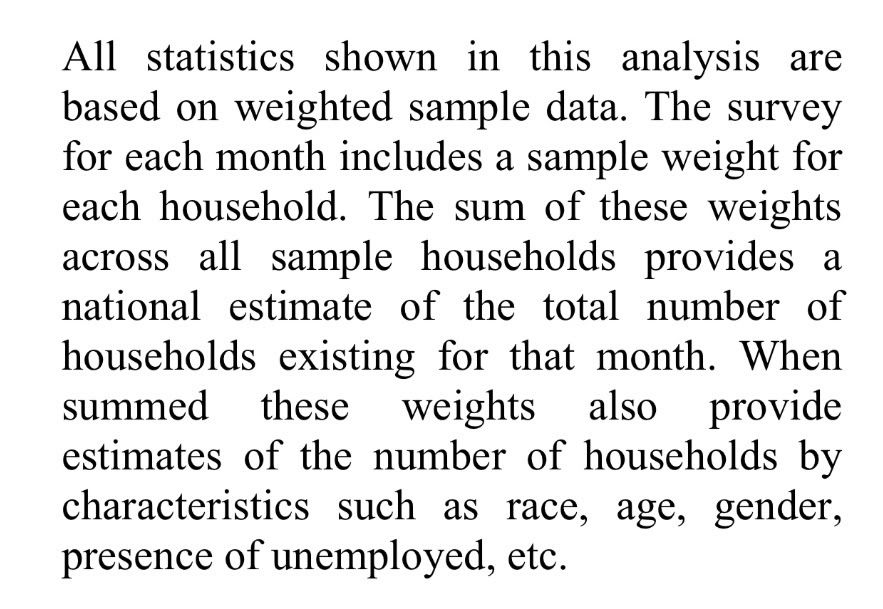

Well, as you probably already know, there is a major demographic shift as Boomers retire, meaning that a larger number of persons and households are non-wage-earning households. Further, we know from the employment to population ratio, a lot of people have dropped out of the workforce:

Note that even in the case of retirement, salary or wage income stops and is replaced only by Social Security and pension income plus any income of past savings or investment, such as certificates of deposit, return on which has functionally fallen to zero in the last 5 years. In other words, it's almost always a lot lower than the previous wage and salary income. So the decline in income as measured by Doug Short and by Saez and Piketty mirrors the downward change in the employment to population ratio, because they are measuring very similar things.

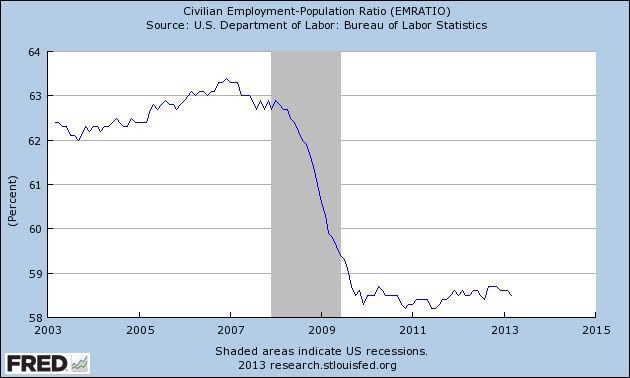

What we really want to know is what is happening with the median wage, and something about the spread in wages. And as it happens, there is a statistic that comes out every quarter that tell us what the median wage is. It's called the Employment Cost Index, and here it what it shows as to wages:

With median wages rising only about 1.5% YoY or so, even a 2% YoY inflation rate causes most Americans to lose ground.

Don't get me wrong. As I've hopefully made clear many times on this blog, I consider real wage stagnation to be one of the biggest problems we face. Creating more jobs and increasing real wages ought to be Washington's highest priority.

But what we have here is a Pulitzer prize winning journalist who apparently either isn't following up on his sources - or in the case of first quarter unit wages, hasn't even looked 1/4 inch further down the column. Or else we have intellectually dishonest Doomer scaremongering, grafting together income data of questionable relevance to actual wages, with one cherry-picked subsequent quarter of wage data showing a decline from a previous high. I want to hope it is just the former, but given the evidence, it's hard for me to entirely dismiss the idea that it's the latter.