- by New Deal democrat

Yesterday I referred to the business cycle analysis of Prof. Edward Leamer of UCLA, who wrote in 2007 that:

The timing [pre-recession] is: homes, durables, nondurables, and services. Housing is the biggest problem in the year before a recession... durables is the biggest problem during the recessionHe found that housing typically begins to decline 5 quarters before recession, with durables and nondurables hitting their peak 4 quarters before the recession, and gently declining until the recession hits.

Retail sales include both durable goods (like cars and appliances) and non-durables, so it is a mix of consumer purchases. Although it is one of the 4 series believed to be tracked by the NBER in dating recessions, it actually has a slight tendency to lead, and in particular to lead employment.

So what kind of decline, if any, is expected from real retail sales in advance of recessions? Usually, but not always, at least 2%.

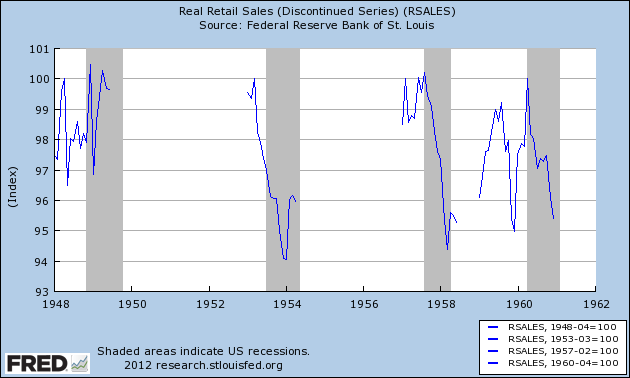

Here are the immediate post- World War 2 recesssions:

Note that in three of them, the actual peak was reached at the outset of the recession, which is what you would expect from an NBER coincident indicator. But 3 of the 4 experienced at least a 2% decline within 6 months prior to the onset of the recession.

I neglected to include the 1970 recession in the above graph, but there was also a 3% decline from the November 1968 peak prior to the onset of that recession as well.

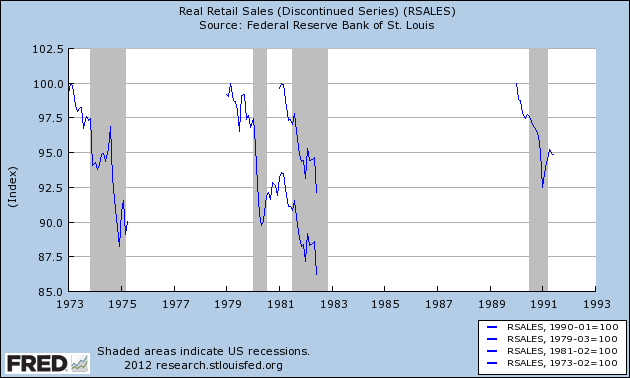

Here are the 1970's and 1980's. In all 4 of these cases there was a decline of 2.5% in real retail sales before the onset of the recession:

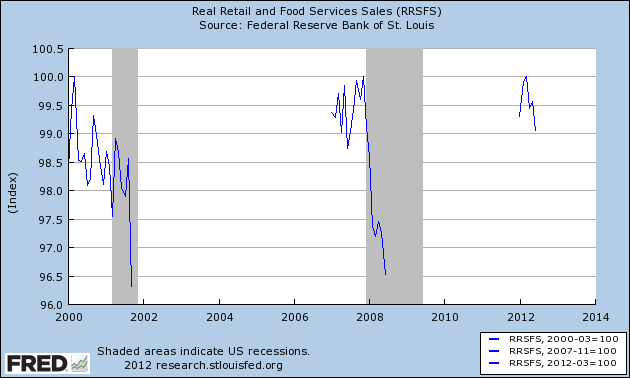

Now here are the last two recessions up to the present:

There was a 2% decline in the year leading up to the recession of 2001, and a 2% decline in 2007 before the peak was made in the 3 months before the onset of the "great recession." Notice that we have had slightly less than a 1% decline in the last three months.

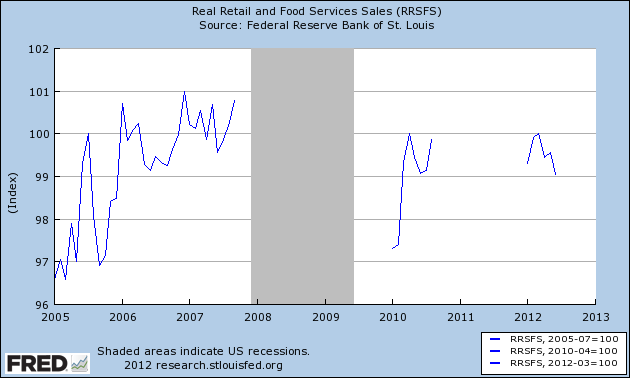

But a 1% or even 2% decline in real retail sales doesn't necessarily imply contraction. For example, note from the below graph that there was a 3% decline in 2005, and 1% or greater declines in both 2006 and 2010 without triggering contraction.

To summarize, 9 of the 11 recessions since World War 2 have been preceded by a 2% or greater decline in real retail sales in the months immediately preceding the recession. The two others only experienced a 1% decline, although the decline quickly accelerated to more than 2% once the recession began.

So our present situation does not preclude being in recession by this metric, but it is more likely from past experience that as of mid-year, real retail sales only indicated a slowdown rather than an actual contraction.