From CNBC to the big blogs to cocksure doomers, everybody "knows" that the price of Oil and the US Dollar are linked, right?

Wrong.

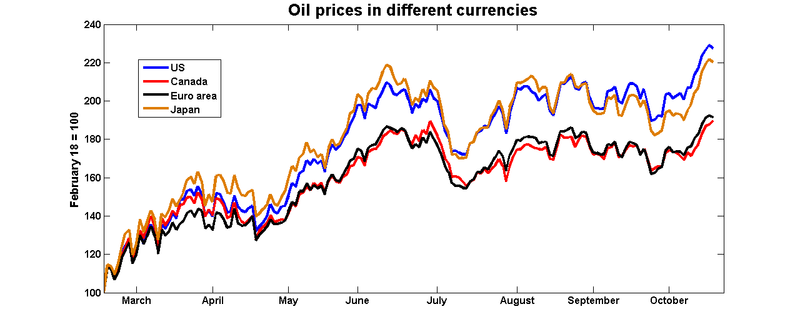

Professor Stephen Gordon of the Laval University, who blogs at Worthwhile Canadian Initiative, has periodically posted a graph that serves to debunk that claim. I asked him earlier this week if he could update his graph, so I could see if it was still the case, and he graciously obliged. Here it is:

Since March, Oil in dollars has risen 130%, in Yen 120%, in Euros and Loonies 90%. So about 2/3 of the rise in the latter has been about Oil itself, not the dollar -- and in the case of the Yen, over 90%. About 90% of the move since June in Euros and Loonies has been about Oil. And since the Chinese government has made sure that the Yuan hasn't budged against the dollar this year, it's up 230% in their currency too.

The price of Oil: It's about the Dollar ... and the Yen ... and the Euro ... and the Loonie. It's about "stuff" vs. "currency", NOT about Oil vs. the dollar.