This morning the BLS reported that consumer inflation remained unchanged (seasonally adjusted) in June, declining -0.2% NSA. Year-over-year prices have fallen - 2.1% into deflation. YoY consumer deflation is only surpassed by 1949's -2.9% in the post-Depression era.

The 2009 first half inflation data unfolded in accord with the optimistic scenario I laid out in January:

In the Optimistic scenario, the fiscal and monetary stimuli, together with intelligent new political leadership in Washington, halt the meltdown perhaps by mid-year, and wage reductions remain the exception. In the Pessimistic scenario, the stimuli fail, and wage reductions spread, leading to a wage-price deflationary spiral.

In the Optimistic scenario, monthly inflation remains positive, but perhaps at 1/3 to 1/2 the level of last year. By the end of June, first half 2009 inflation will be in the 1.4%-2.2% range. Year over year, however, as the 2008 numbers are replaced, DEflation will be realized, falling to (-2.0%) - (-2.7%) range....

In the Pessimistic scenario, monthly inflation remains near 0%-1% in the first half, and is firmly negative, though less than 2008 in the second half. By mid-year, YoY DEflation will be somewhere in the (-3%) - (-4.5%) range....

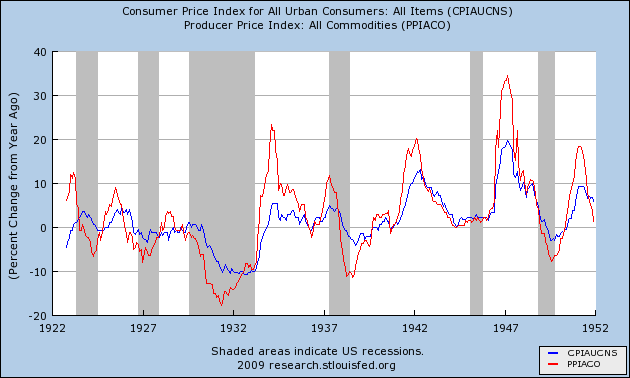

In the pre-World War 2 era of deflationary busts, including the Great Depression, PPI for commodities bottomed and turned around either before or simultaneously with CPI. when YoY CPI bottomed, the bust ended. Such a bottom coincided with increased demand. Here is the consumer and commodity inflation data during the deflationary 1920-1950 era demonstrating this point:

Note that commodities (in red) almost always turned up before the economy as a whole did. Typically CPI (in blue) bottomed on a year-over-year basis at the end of deflationary recessions, including the Great Depression.

In June, for the first time, YoY commodity deflation may have bottomed, rising from -13.4% to -13.2% YoY. This month's CPI is almost certainly the bottom for that metric. That the deflation in both YoY and CPI has bottomed is likely to be confirmed next month, when the comparisons will be to August 2008 when CPI was -0.4% NSA. It is noteworthy that as of this morning, 3 of the 5 coincident indicators known to be used by members of the NBER to date the end of recessions -- real retail sales, aggregate hours worked, and industrial production -- all appear to have bottomed, consistent with the pre-WW2 deflationary bust scenario outlined above.