That being said, the fundamental supply and demand picture in the oil market is pretty easy to figure out. With India and China growing robustly you get an additional two billion people demanding oil. On the supply side, we haven't had a huge oil fiend find in a long time (I think decades).

So ...

Consumers are likely to pay a lot more at the pump, too. The Energy Department predicts that far higher average oil prices will force gasoline prices to even out at $3.11 next year, up 10% from the average price of $2.81 this year.

World crude prices have long tracked the thirst for oil in the U.S., which consumes about a quarter of the world's oil output. But recent months have shown how decoupled the oil market is becoming from the economic ups and downs of the world's largest energy consumer.

.....

"If I had to describe [2007] in one image, it would be dancing on thin ice," says Fatih Birol, chief economist at the International Energy Agency, which serves as an energy watchdog for rich countries. Global spare capacity is so thin, he says, "that any little thing now can influence price."

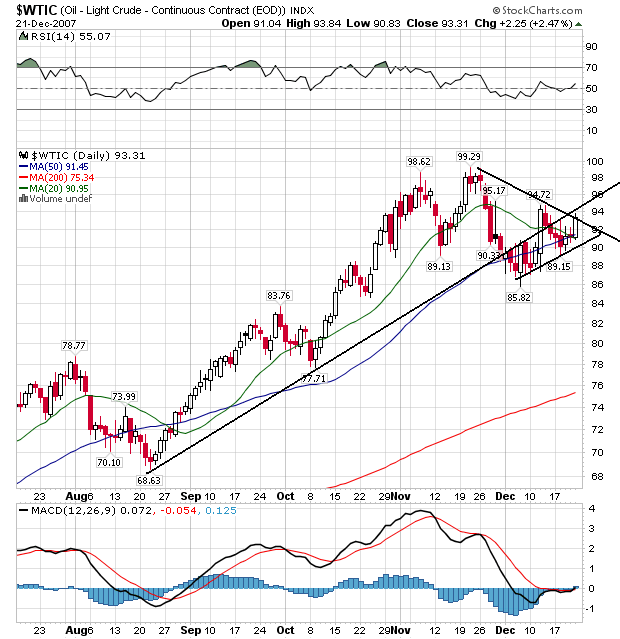

Let's see what the charts have to say.

On the multi-year chart, we have a very strong uptrend in place. In addition, the sharpness of the angle is increasing. The latest rally started in late 2003 and has been running up ever since. Earlier this year we the market broker through last year's highs, indicating further upside potential for prices.

On the daily chart, notice that prices have broken through support from the rally started in late August. However, prices have not dropped in a big way. Instead they are consolidating in the upper 80s and lower 90s.

Short version: there's no reason to think this chart won't go higher barring the ever-present unforeseen event.