Friday, for instance, we learned that U.S. employment grew in April at its slowest pace in more than two years, as payrolls rose by just 88,000 while the unemployment rate inched up to 4.5% from 4.4%.

That marks a three-month average decline in job growth to 118,000 from a 12-month average of 157,000, "a significant drop-off," says Daniel Genter, chief investment officer of Los Angeles-based RNC Genter Capital. It's also "a trend that's likely to continue," he says.

Though the jobs report was weak, the Institute for Supply Management reported stronger-than-expected readings for both its manufacturing and non-manufacturing indexes. Yet the week before, the Commerce Department said gross domestic product grew at a seasonally adjusted annual rate of 1.3% in the first quarter, the slowest growth since the first quarter of 2003.

1.) The economic trend is definitely slowing. Overall GDP growth is clearly slowing. GDP has been dropping from the 2.5% range to 1.3 range.

2.) Employment is a lagging indicator. Employers will do everything they can with current employees before adding new ones.

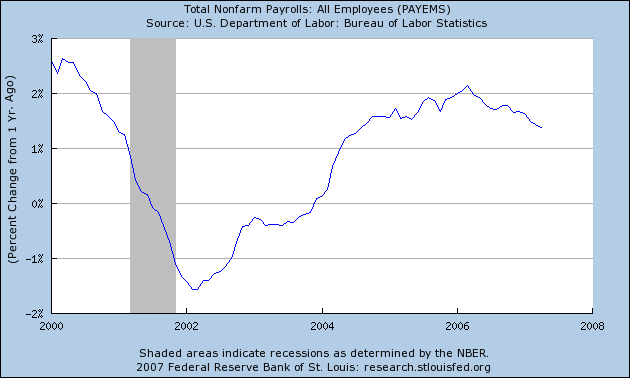

The year-over-year percent change in employment is still positive. Here is a chart from the St. Louis Federal Reserve.

Notice that while the trend is still positive, it has been decreasing at a constant rate since about the first quarter of 2006.

3.) While the ISM data was positive, it was one month's worth of data. Here is a chart from Martin Capital that places the ISM information in a more detailed context.

Notice that

-- The Industrial ISM was hovering between 50 and 54 for the last few months, indicating just enough activity keep the economy out of recession. Last month was a postive spike out of this activity level, but it is only one month of activity.

-- the year-over-year chart of industrial production is still down.

-- capacity utilization is still heading lower.

In other words, the usage of industrial assets is still saying things are slowing down. We'll need a few more months of ISM manufacturing data to confirm the trend.

In addition, compare the national ISM with the following regional manufacturing information.

From the Richmond Fed:

Manufacturing activity in the central Atlantic region continued to contract in April, according to the Richmond Fed’s latest survey. Respondents reported somewhat sharper declines in factory shipments with the pace of decrease of new orders and backlogs on par with March. Employment and capacity utilization declined at slower rates, and delivery times edged lower. In addition, manufacturers reported that growth in inventories remained on pace with March.

From the Philly Fed:

Activity in the region’s manufacturing sector was basically unchanged again this month, according to firms polled for the Business Outlook Survey. The index for general activity was near zero, and indicators for new orders, shipments, and employment were only slightly positive, suggesting little change from March. Regarding future activity, the region’s manufacturing executives were somewhat more optimistic this month than they were in March.

From the New York Fed:

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers were flat again in April. The general business conditions index edged up 2 points, to 3.8, rebounding only marginally from March.

From the Kansas City Fed:

Tenth District manufacturing activity rebounded strongly in April, and expectations for future factory activity remained high following a strong increase last month. The price indexes in the survey were largely unchanged, with raw materials price indexes easing somewhat and finished goods price indexes rising only slightly.

It looks like the Kansas City area may be responsible for the increase.

Let's sum up.

-- The employment picture is slowing.

-- GDP growth is slowing.

-- The positive news from manufacturing may be the result of one region having a good month.