- by New Deal democrat

As promised, let me parse the JOLTS survey for May, which was reported yesterday.

As a quick refresher, this survey decomposes the employment market into openings, hires, quits, and layoffs. In 2024 the data were most consistent with a “soft landing,” but the actions of the new Administration, especially on trade, have exacerbated the fear that this might transform into a “hard” landing, a/k/a a recession.

Yesterday was a good “soft landing” report.

To start, here are job openings, hires, and quits all normed to 100 as of just before the pandemic:

Openings are “soft” data and have generally trended higher going all the way back to the turn of the Millennium. They have remained above their pre-pandemic levels, and this month increased by 374,000 to 7.769 million. Voluntary quits also rose by +78,000 to 3.293 million. On the other hand, actual hires declined by -112,000 to 5.503 million.

Both hires and quits remain below their pre-pandemic levels, but above their level through much of last year, consistent with a continuation of the “soft landing” scenario as shown in the below graph of the past 12 months:

Now let’s turn our attention to several components are slight leading indicators for jobless claims, unemployment and wage growth.

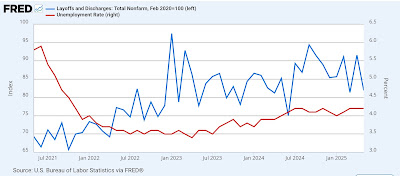

Recently one item of concern has been layoffs and discharges, which generally have averaged higher since last July. In May, they declined by -188,000 to 1.601 million, one of the three lowest readings since then, and about average since the beginning of 2023:

This is better than both the increase in the unemployment rate over the past year (red, right scale) to new levels in the past year, as well as the recent trends in new and continuing jobless claims (not shown), both of which typically follow with a short lag.

Finally, the quits rate (left scale) typically leads the YoY% change in average hourly wages for nonsupervisory workers (red, right scale):

In May the quits rate rose 0.1% to 2.1%, tied with its highest rate in the past 12 months. Although in the past few months the trend has been a slight improvement, this is still below any post-pandemic reading before last September. Nevertheless, the downshift that began late last summer has not yet been reflected in average hourly wages, which tend to follow with a lag. Thus this continues to suggest that wage growth will decelerate further on a YoY basis over the next few months.

The last few JOLTS reports have all been consistent with the “soft landing” scenario remaining intact through May. Tomorrow we will find out whether the June employment report continues to support this.