- by New Deal democrat

Our economic news drought ends tomorrow with the CPI report, and I’ve beaten the issue of unemployment to death, so today let’s turn to the leading sectors from the Establishment Survey portion of the jobs report, where as I’ve been reporting for months, the situation is considerably better.

Since I’ve been paying special attention to the manufacturing and construction sectors, let’s start by taking an overall look at them:

Going back 40 years, prior to a recession at least one of the two has been in a downturn, with the other at most flat. But while manufacturing employment has been flat in the past year, construction employment has continued to boom.

Average weekly hours in the manufacturing sector is one of the 10 “official” leading indicators, and here the story is downright positive:

Hours have always declined prior to or just entering a recession. By contrast, since January of this year, average hours have *increased* from 40.2 to 41.0 per week.

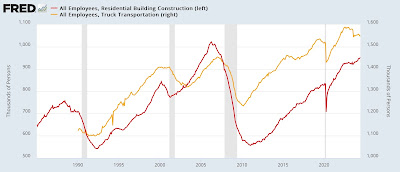

Let’s next take a look at several leading sub-sectors. Truck transportation has indeed declined sharply, following a major bankruptcy in the sector last summer. Residential construction jobs, by contrast, have bucked the trend of higher mortgages and lower starts, and have continued to increase in the past year:

Temporary help services have been in a severe downtrend for over two years:

I don’t have any special insight into this, but it appears that some kind of secular change is taking place.

One other sector - not a leading one, but as it is large and important, worth mentioning - that is also under stress is professional and business jobs:

These are only up 0.3% in the past year. In the past entire 85 year history of this series, that weakness has never happened outside of a recession.

But let’s bring this back to where I began above. Manufacturing and construction together make up the vast bulk of the goods producing sector, and that in the aggregate has always turned down in advance of a recession; but it is still increasing:

In summary, when we look at the leading sectors of the labor economy, while a few pockets - trucking and temporary help - are in real downturns, the bulk of the indicators are pointing higher. Until I see broader weakness in the goods-production measures of the jobs report, I see no support there for a recession beginning in the next few months.