- by New Deal democrat

Consumer inflation for April was +0.3%, the lowest monthly advance since last August. The number was helped by a big decline in energy prices, down -2.7% for the month, and also by used cars, down -0.4% for the month. In this post I’ll report on the impact on wages. I’ll put up a separate post with more general comments later.

Since nominal nonsupervisory wages rose 0.4% in March,“real” wages rose less than 0.1% (rounded to 0.0%) in April:

On a YoY basis, real wages are still down -1.7%, slightly above March’s -1.8% reading:

This remains a terrible number historically. Under ordinary circumstances, this would absolutely be recessionary.

But these are not ordinary circumstances, as inflation was goosed in part by stimulus payments last spring. This will be a more “normal” comparison in a couple of months, as a comparison with the stimulus months fades.

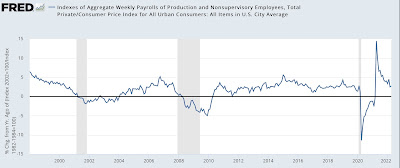

The better measures is real aggregate payrolls for nonsupervisory workers, i.e., the total of payrolls for the entire country, normalized for inflation. These are up 2.7% YoY, a slight increase from last month:

Real aggregate payrolls turning negative YoY is frequently something that happens shortly before recessions (and likely is a causative agent), although there are some false positives.

A closer look, however, shows that real aggregate payrolls are only up +0.5% in the past 6 months, and flat for the last 3 months:

In other words, unless wage increases actually accelerate from here (unlikely), we really need inflation to stay down for the rest of this year. Otherwise, consumer spending (70% of the economy) is going to flag and likely contribute to an economic downturn. Not to mention being a bad thing for working families.