- by New Deal democrat

I normally don’t bother with existing home sales, since it is the least economically important of housing data, but it’s a really slow news week, so ...

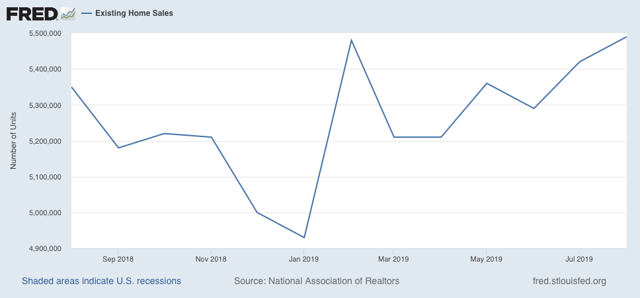

September existing home sales were reported at 5.38 million annualized by the NAR. While that is a decline from August’s revised 5.50 million rate, it is better than all of this past spring’s numbers, which formed the recent trough in this series (Note: this morning’s data not shown):

So the overall trend remains higher, as is to be expected with lower mortgage rates.

The NAR is squirrelly about graphs of its longer term data, but I can tell you that the peak for this expansion was approximately 5.75 million annualized sales in November 2017. Increasing interest rates in 2018, assisted by the continuation of rising prices, caused sales to declined throughout 2018.

I expect the gradually rising trend to continue so long as mortgage rates remain near multi-year lows. At the same time, high prices relative to median household income will put a “choke collar” on growth, restraining much upside.

NOTE: Tomorrow is a travel day for me, so no posting then. New home sales and initial jobless claims will be reported Thursday, so I expect to chime back in then.

NOTE: Tomorrow is a travel day for me, so no posting then. New home sales and initial jobless claims will be reported Thursday, so I expect to chime back in then.