- by New Deal democrat

One particularly useful leading indicator that is handicapped by being reported only quarterly, and late, is the Senior Loan Officer Survey. This tells us whether banks have been tightening or loosening credit standards in the preceding quarter.

It has a 30 year history and has typically reported net tightening about 1 year before a recession, with a fair amount of variability, rapidly intensifying as the recession is about to start, typically showing net tightening about 1 or 2 quarters after corporate profits peak:

But the problem is, for example, that we won't learn about the first Quarter of 2017 for several more weeks. So I have been looking to find a proxy that is reported on a more frequent and timely basis. I have now found it: the Chicago Fed's Financial Conditions Index.

Here is the detailed explanation, according to the Chicago Fed:

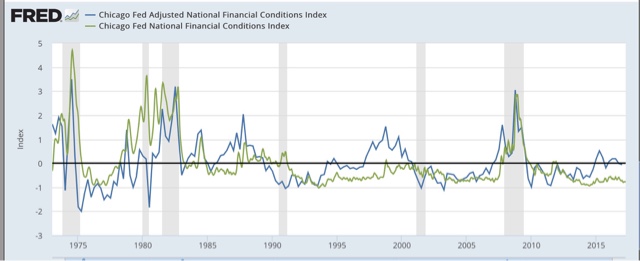

The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems. Because U.S. economic and financial conditions tend to be highly correlated, we also present an alternative index, the adjusted NFCI (ANFCI). This index isolates a component of financial conditions uncorrelated with economic conditions to provide an update on how financial conditions compare with current economic conditions

.....

A zero value for the NFCI can be thought of as the U.S. financial system operating at historical average levels of risk, credit, and leverage. The ANFCI removes the variation in these indicators attributable to economic activity, as measured by the three-month moving average of the Chicago Fed National Activity Index (CFNAI), and inflation, according to its three-month total based on the Personal Consumption Expenditures (PCE) Price Index. As such, a zero value for the ANFCI corresponds with a financial system operating at historical average levels of risk, credit, and leverage consistent with economic activity and inflation.

Positive values of the NFCI indicate financial conditions that are tighter than on average, while negative values indicate financial conditions that are looser than on average. Similarly, positive values of the ANFCI indicate financial conditions that are tighter on average than would be typically suggested by current economic conditions, while negative values indicate the opposite.

The NFCI is made up of over a dozen components, including 2 year Swaps and Libor vs. the TED spread, which also are components of the Conference Board's "leading credit index" that is one of the 10 components of the monthly Index of Leading Indicators.

Here is what the Financial Conditions Index, averaged quarterly, looks like compared with the Senior Loan Officer Survey:

This is a pretty close match, except that the Senior Loan Officer Survey's crossover point between tightening and loosening equates to a -0.5 reading on the NFCI.

When we compare the Adjusted Financial Conditions Index with the NFCI, we see that while it is more volatile, it appears to lead by about 6 months:

What this tells us is that background economic conditions tend to move in the direction of credit standards.

What this tells us is that background economic conditions tend to move in the direction of credit standards.

Additionally, the Chicago Fed also touts the Leverage subindex of the NFCI as leading GDP:

So in the next graph we can see the AFNCI (blue) compared with the Senior Loan Officer Survey (red) and the Leverage subindex (purple):

Both the AFNCI and the Leverage subindex appear to lead the Senior Loan Officer Survey by a year or more, but are noisy as for example in 1990 and 2001, where at least one of the two had already turned negative, indicating loosening compared with economic conditions, a year before the Senior Loan Officer Survey spiked coincident with recessions.

Putting this all together, the history of the Financial Conditions Indexes suggest that a positive value of the ANFCI or the Leverage subindex, or a reading higher than -0.5 in the NFCI, correlate with a tightening of credit conditions. Values above +0.5 (as adjusted in the case of the NFCI) should put us on higher alert for a recession, and values above +1.0 signal danger, in 1-3 years in the case of the ANFCI or the Leverage subindex, or 1 year or less in the case of the NFCI.

So in the next graph we can see the AFNCI (blue) compared with the Senior Loan Officer Survey (red) and the Leverage subindex (purple):

Both the AFNCI and the Leverage subindex appear to lead the Senior Loan Officer Survey by a year or more, but are noisy as for example in 1990 and 2001, where at least one of the two had already turned negative, indicating loosening compared with economic conditions, a year before the Senior Loan Officer Survey spiked coincident with recessions.

Putting this all together, the history of the Financial Conditions Indexes suggest that a positive value of the ANFCI or the Leverage subindex, or a reading higher than -0.5 in the NFCI, correlate with a tightening of credit conditions. Values above +0.5 (as adjusted in the case of the NFCI) should put us on higher alert for a recession, and values above +1.0 signal danger, in 1-3 years in the case of the ANFCI or the Leverage subindex, or 1 year or less in the case of the NFCI.

Finally, here is a close-up of the last two years of the weekly values of the ANFCI (blue), the NFCI (green), and the Leverage subindex (purple) [In this graph I have added +0.5 to the NFCI per my comment above]:

Note that the ANFCI did reach above +0.5 for one month two years ago. But all 3 have been below zero for the last six months. This suggests that when the Senior Loan Officer Survey is reported next month, it is at very least likely to be neutral, and more likely than not will show a slight loosening of credit. In broader terms, it means that we now have a useful weekly indicator that tells us that credit conditions are not forecasting a recession.

I will begin to report this each week.