- by New Deal democrat

Like the character in the "Bring out your dead!" Monty Python skit, the American consumer keeps protesting that s/he isn't dead yet.

So why, given wages that are several percent below their 2010 peak, do consumers keep spending?

Let's go back to the paradigm for the American consumer that I first set forth 6 years ago. In order to increase spending, the American consumer must either:

- have a wage increase

- be able to refinance debt at lower rates, thus freeing up cash

- be able to cash in an appreciating asset

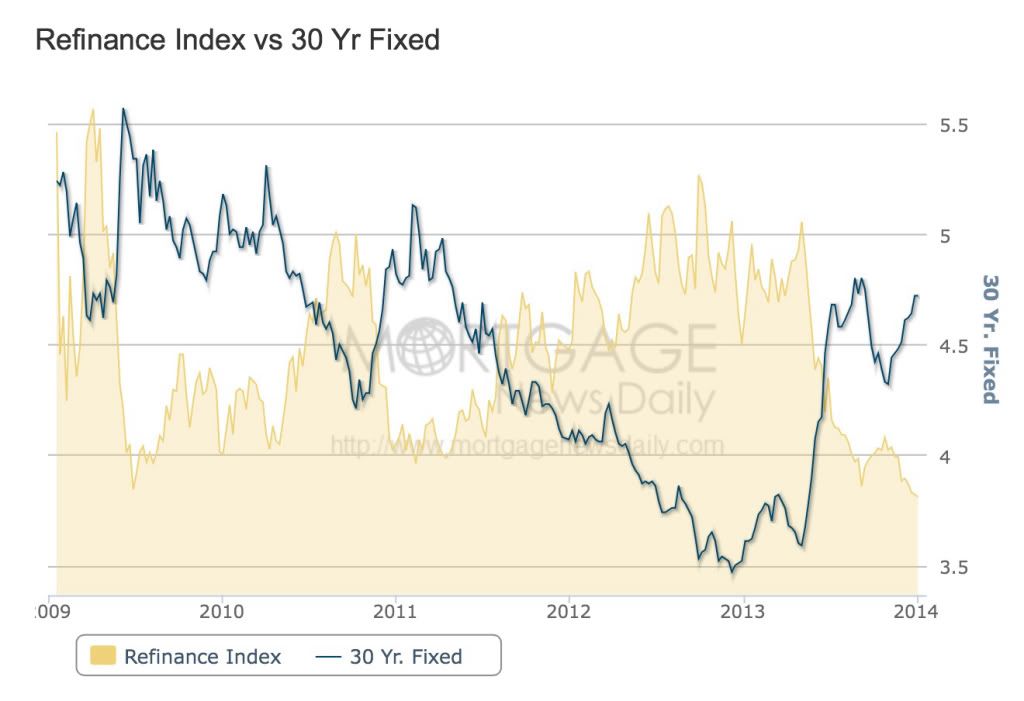

On the other hand, as shown in this graph from Mortgage News Daily, the increase in interest rates has well and truly killed refinancing:

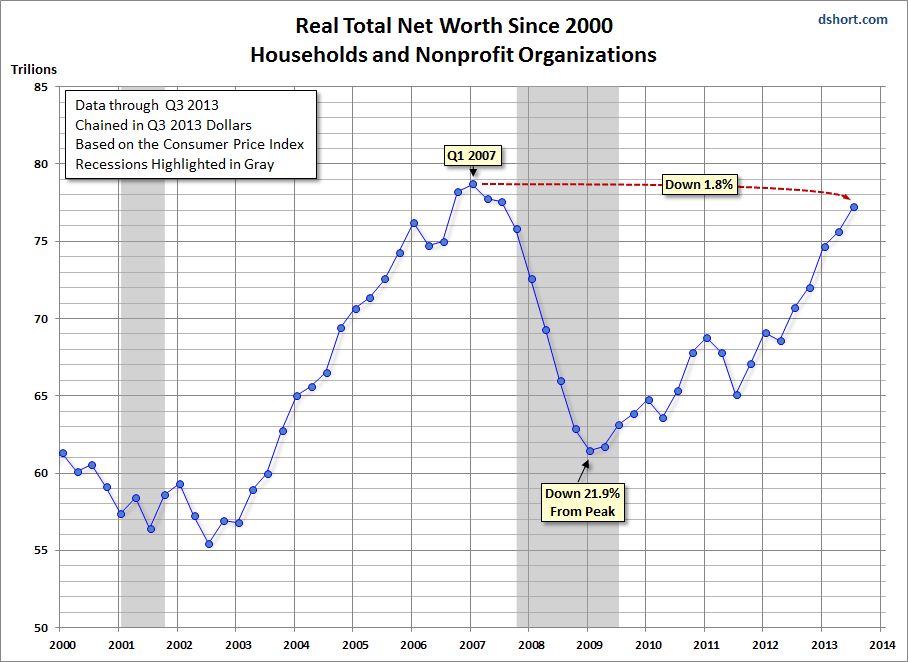

Finally, here is a graph of Americans' total net household worth, via Doug Short:

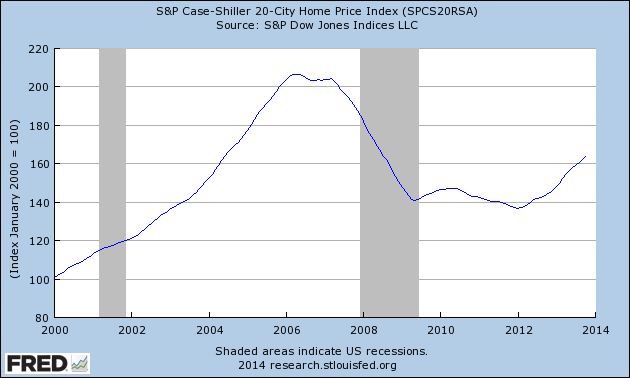

Why has household net worth almost completely rebounded? Mainly because of increasing house values, as shown in this graph of the Case Shiller index:

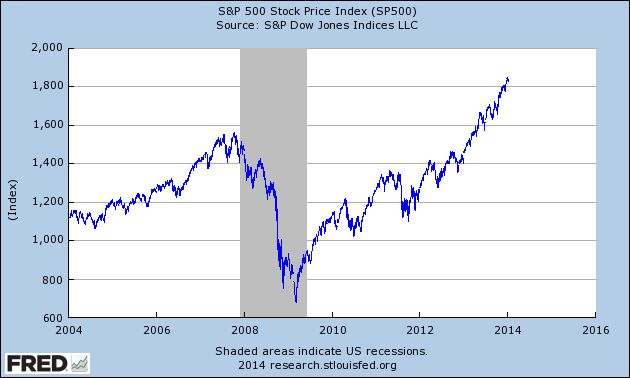

Secondly, more affluent households who rode out the downturn in the markets during the Great Recession are seeing their 401k balances completely recover along with stock prices, as shown in this graph of the S&P 500:

We know that there is a wealth effect, and for now the wealth effect is picking up where debt refinancing left off.

As an aside, here is the graph of those "Not in the Labor Force, Want a Job Now" I ran on Friday:

Notice the spike downward in the last 6 months. I do not think it is coincidental that it mirrors the graph of household worth above. The Altnata Fed has reported that in the last couple of years the percentage of those leaving the workforce due to retirements has increased, and I suspect that the recent spike in net worth has caused a stampede of Boomers for the exits.