- by New Deal democrat

From the BEA:

Real residential fixed investment decreased 9.8% [in the 4th quarter of 2013].

Are all you Doubting Thomases out there starting to pay attention?

More later ....

Update:

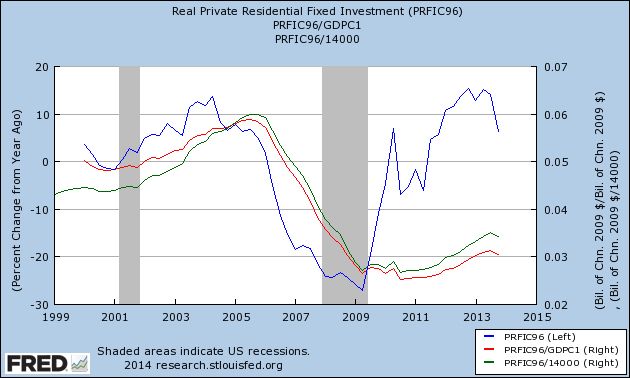

Here's the updated graph of private fixed residential investment (green), as measured as a YoY% (blue), and as measured as a percentage of GDP (red):

I expected that real residential investment would decline measured as a YoY%, but the absolute decline is a bit of a surprise.

What I want you to pull from the graph above is that the order is (1) decline of fixed private residential investment as a percentage YoY comes first, followed by (2) decline as a share of GDP (the measure favored by Professor Leamer as the first portion of the economy to decline prior to a recession) , and finally by (3) absolute decline.

I want to emphasize that this does NOT mean we are inexorably sliding into a recession from here. Housing could certainly bounce back. But it does add another brick in the wall of evidence supporting my forecast of a decline in housing starts and permits in the first half of this year at least. It also does raise a yellow caution flag to watch for further signs of deterioration in the economy as we head towards 2015.