-by New Deal democrat

The Federal Reserve's report on household debt burdens was released last week, covering the July - September quarter. According to the bank,

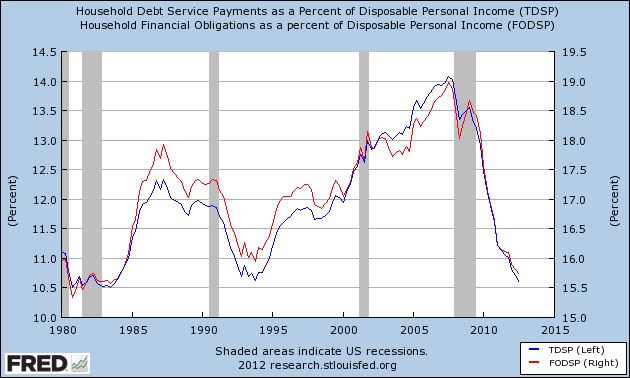

The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.Both measures declined substantially, after a relative pause about a year ago for several quarters. I've combined the two measures into a single graph:

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

Both debt service payments (blue line) and total household onligations (red line) are now less than at any time since 1984. While in recent quarters the rate of decrease has slowed, debt service payment are now only 0.1% above their all time low.

Earlier this year CNBC reported that :

U.S. home owners are refinancing their mortgages at the fastest clip since 2005, but the difference now is they are putting cash in, not taking it out.This equates to about 0.6% of all retail spending per month.

At the going rate, 25 percent of all first-lien U.S. mortgages will be refinanced this year, according to LPS Applied Analytics. That represents about $7.1 billion —just through June of this year — in savings on monthly payments, according to economists at Freddie Mac, who ran the numbers for this report.

I have long suspected that, before this cycle is over, households would set new all time lows for debt service. That looks very likely now. If anything, refinancing has increased in the last few months with new record lows in mortgage rates, and is probably keeping the economy from tipping back into recession.