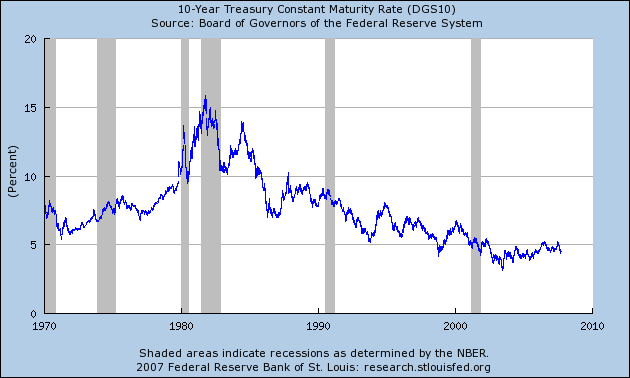

10-Year Treasury

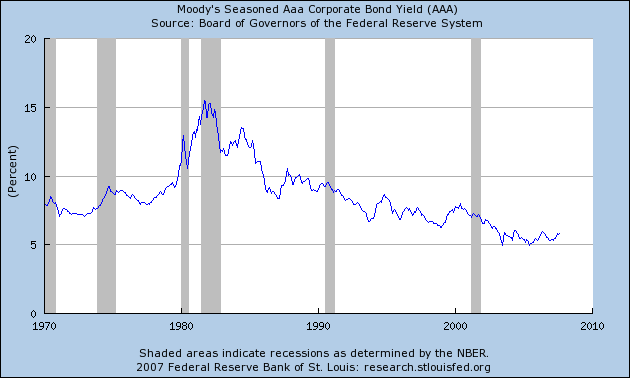

AAA Seasoned Corporate Papar

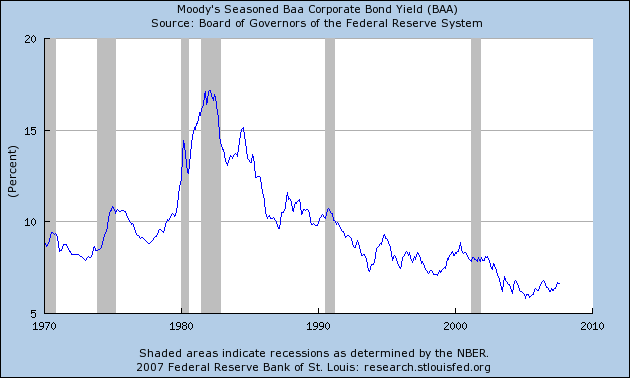

BBB Seasoned Corporate Paprt

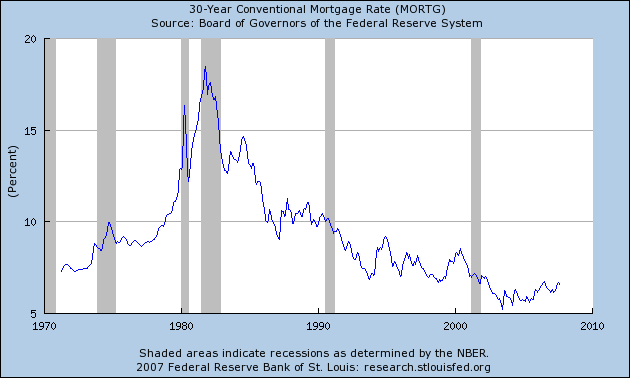

30-Year Conventional Mortgage

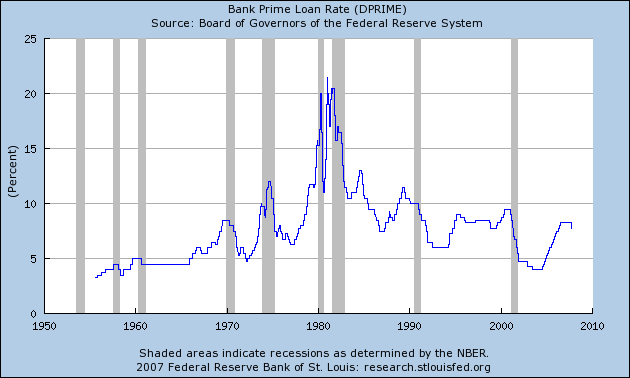

Prime Lending Rate

In other words, the current cost of money is far from restrictive. That means the problems in the economy are probably not driven by money being too expensive, but one of confidence. Lenders are still concerned about borrowers ability to pay back a loan even over a short time period. Lower rates won't solve that problem: there is still a ton a bad debt in the system.