Housing starts in the U.S. fell in May, signaling the slump in home construction will continue to depress growth.

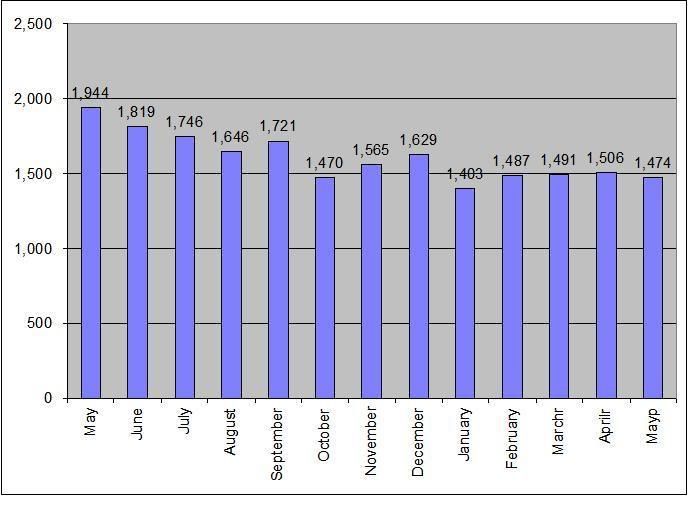

Builders broke ground on new houses at an annual rate of 1.474 million, down 2.1 percent from 1.502 million the prior month, the Commerce Department said today in Washington. Building permits rose 3 percent to 1.501 million from 1.457 million.

Lower prices and more incentives have failed to spur interest as buyers wait for even bigger bargains, leaving builders with a glut of unsold properties. A jump in mortgage rates and stricter rules to qualify borrowers with poor credit ratings, known as subprime customers, may reduce demand even more in coming months, economists said.

``There is still some more downside to the housing market,'' said Nariman Behravesh, chief economist at Global Insight Inc. in New York. ``Mortgage rates started up again and there is still a shakeout going on in subprime.''

Here's a chart of housing starts. Notice that although this months figures were down, total starts have stabilized over the last 5 months at 1.4 - 1.5 million/year. That does not mean housing starts will stay at these levels. But for now the market has found equilibrium.