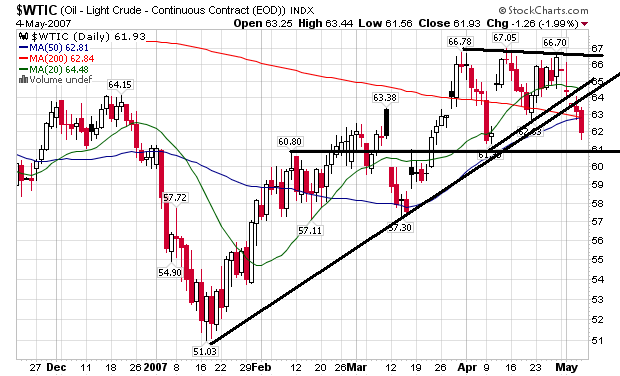

As we start this trading week, the situation is entirely reversed. oil is trading below its moving averages and the marked trend lines.

So -- what happened? Traders reacted to the US oil inventory situation announced on Wednesday by selling oil contracts.

However, I would also mention that while the technicals have reversed, the fundamentals haven't. OPEC's production is still down and world demand is still up -- especially with India and China growing at high rates. Both of those point to higher prices in the future. As IBD noted this morning:

June crude lost $1.26 to 61.93 a barrel. That's $4.53, or 7%, ceded this week. But some traders call this a correction within a rising market. They point to Nigerian output problems and an imminent surge in gasoline demand in the U.S. as summer drivers hit the road, all bullish factors. June gasoline dropped 3.12 cents to $2.2164 a gallon. But prices at the pump are at $3.