- by New Deal democrat

The big monthly number this week was, of course, April's relatively poor +116,000 jobs report. The internals were generally better, with all of the leading components such as temporary jobs and manufacturing jobs and hours, improving. The employment participation ratio, however, continued to be cause for consternation, as was the flat average hourly earnings. In other monthly reports, auto sales improved over March and were only below February's pace. Income and spending were positive, with income less than spending for a change. ISM manufacturing for April came in stronger than expected. Factory orders for March were weaker. Construction spending was flat, due to a decline in government spending. Both private residential and non-residential spending were up significantly. ISM services came in weak but still positive.

In summary, the weakening payrolls numbers in particular show that the Oil choke collar is working exactly as advertised. Any time the economy shows signs of sustained recovery, the collar kicks in and chokes it off - leading to a decline in energy prices and renewed strength in the economy. Since gasoline prices are seasonally strong in the spring and weak in the fall, the economy weakens in the spring and strengthens in the fall. I am surprised that mainstream economists haven't picked up on this, as it explains so much. I'll have an extended commentary at the end of this post.

First, let's turn to the high frequency weekly indicators . Thankfully, these are showing no sign whatsoever of the economy rolling over, although a few are weak.

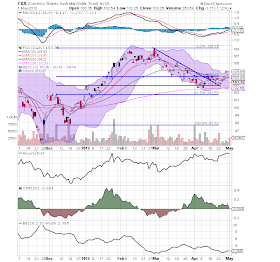

Let's start with energy prices, as the Oil choke collar remains engaged:

Gasoline prices fell for the third straight week, down .04 to $3.83. Oil fell sharply, down $6.44 for the week on the poor payrolls report, to $98.49. Oil remains at, and gasoline above, the point where they can be expected to exert a constricting influence on the economy. The 4 week average of Gasoline usage, at 8692 M gallons vs. 8943 M a year ago, was off -2.8%. For the week, 8661 M gallons were used vs. 9084 M a year ago, for a decline of -4.7%. Note that these comparisons are vs. YoY declines from 2010 to 2011 as well.

Unlike the monthly jobs report, Employment related indicators were all positive:

The Department of Labor reported that Initial jobless claims fell 23,000 to 365,000 last week, the lowest reading in 4 weeks. The four week average rose by 750 to 383,500. As I said last week, for the entire last year the YoY% decrease in initial claims has been between 8% and 12%. So far we have stayed stay in that range, so it seems more likely that we are seeing a quirk of seasonality (the seasonal tightening of the Oil choke collar?) than a more ominous sign.

The American Staffing Association Index rose two more points to 93. It is just two points below the all time records from 2006 and 2007 for this week. It is possible that it could exceed all readings but those of 2006 by June sometime.

The Daily Treasury Statement finished April at $148.6 vs. $138.4 B for April 2011. For the last 20 reporting days, $134.7 B was collected vs. $131.5 B a year ago, an increase of $3.2 B, or +2.4%. This is a weak showing for the 20 day average.

Housing reports were once again positive:

The Mortgage Bankers' Association reported that the seasonally adjusted Purchase Index increased +2.9% from the prior week, and was also up 3.0% YoY. The Refinance Index fell -0.7%.This index is at the upper end of its 2 year generally flat range. Because the MBA's index was substituted for the Federal Reserve Bank's weekly H8 report of real estate loans in ECRI's WLI, I've begun comparing the two. This index had been negative YoY for 4 years, until turning positive one month ago. This week, real estate loans held at commercial banks declined -0.3% w/w, but remained up, +0.7% on a YoY basis. On a seasonally adjusted basis, these bottomed in September and are now up +1.4%.

YoY weekly median asking house prices from 54 metropolitan areas at Housing Tracker were up +4.2% from a year ago. YoY asking prices have been positive now for close to 5 months. Trulia's seasonally- and inventory-adjusted list price index also turned positive YoY in April. The seasonally adjusted index bottomed in January.

Sales were once again solidly positive.

The ICSC reported that same store sales for the week ending April 28 fell -0.3% w/w and +4.2% YoY. Johnson Redbook reported a 2.9% YoY gain. Shoppertrak did not report. The 14 day average of Gallup daily consumer spending remained favorable at $69 vs. $63 in the equivalent period last year. Consumer retail spending has been a consistent and important positive sign for the economy for well over a year.

Money supply was mixed for the week, but remains positive for the month and year:

M1 rose +0.4% last week, and was up +1.9% month over month. Its YoY level increased to +18.3%, so Real M1 is up 15.7%. YoY. M2 declined -0.4% for the week, but was up +0.4% month over month. Its YoY advance fell slightly to +9.6%, so Real M2 was up 7.0%. Real money supply indicators continue to be strong positives on a YoY basis.

Bond yields fell and credit spreads widened slightly again:

Weekly BAA commercial bond rates were flat at 5.15%. Yields on 10 year treasury bonds fell -.02% to 1.98%. The credit spread between the two widened to 3.17%. Falling bond yields and widening spreads, as has happened for the last month, are a sign of weakness, although we remain significantly under the October maximum credit spread.

Rail traffic turned slightly positive this week.

Money supply was mixed for the week, but remains positive for the month and year:

M1 rose +0.4% last week, and was up +1.9% month over month. Its YoY level increased to +18.3%, so Real M1 is up 15.7%. YoY. M2 declined -0.4% for the week, but was up +0.4% month over month. Its YoY advance fell slightly to +9.6%, so Real M2 was up 7.0%. Real money supply indicators continue to be strong positives on a YoY basis.

Bond yields fell and credit spreads widened slightly again:

Weekly BAA commercial bond rates were flat at 5.15%. Yields on 10 year treasury bonds fell -.02% to 1.98%. The credit spread between the two widened to 3.17%. Falling bond yields and widening spreads, as has happened for the last month, are a sign of weakness, although we remain significantly under the October maximum credit spread.

Rail traffic turned slightly positive this week.

The American Association of Railroads reported a +0.1% increase in total traffic YoY, or +600 cars. Ex-coal, non-intermodal traffic was down by 12,100 cars, or -4.1% YoY. Intermodal traffic was up 12,700 carloads, or +5.5%. Railfax;s graph of YoY traffic continued to show that rail hauling of cyclically sensitive materials remains in strong improvement. Coal remained the weak point, down 20,500 carloads, although 7 other of the 20 total types of carloads declined.

Turning now to high frequency indicators for the global economy:

The TED spread rose .01 to 0.390, near the bottom of its recent 2 1/2 month range. This index remains slightly below its 2010 peak. The one month LIBOR remained flat at 0.239. It is well below its 12 month peak set 3 months ago, remains below its 2010 peak, and has returned to its typical background reading of the last 3 years.

The Baltic Dry Index at 1157 rose only 1 point from one week ago. It is now about 1/3 of the way back from its February 52 week low of 670 to its October 52 week high of 2173. The Harpex Shipping Index rose 12 to 428 in the last week, and is up 53 from its February low of 375.

Finally, the JoC ECRI industrial commodities index rose very slightly 124.96 to 124.99. This indicator appears to have more value as a measure of the global economy as a whole than the US economy.

In summary, there is some weakness in withholding tax collections, bond yields and credit spreads, and rail traffic, although none are actually negative. Every other weekly indicator remains solidly positive.

Usually in these weekly posts I try to keep it as exciting as watching paint dry, with a minimum of commentary. That way even if you disagree with my summary, you still have the numbers to bring you right up to date on the pulse of the economy. With the recent spate of "misses" in the monthly reports, I want to re-post a little of my commentary over the last 5 months, because this weakness wasn't just foreseeable, it was foreseen and most of it is perfectly explainable by the Oil choke collar.

In early December, with signs of a strengthening economy all around, I concluded my weekly column with the following:

On the bright side, neither danger signal I wrote of above has materialized other than briefly. G*d bless the American consumer, who continues to spend like a champ. And gasoline usage except for one week hasn't dipped precipitously. I expect the weakness to continue, I expect the Oil choke collar to loosen, and then I expect the economy to pick up again as a result.

Turning now to high frequency indicators for the global economy:

The TED spread rose .01 to 0.390, near the bottom of its recent 2 1/2 month range. This index remains slightly below its 2010 peak. The one month LIBOR remained flat at 0.239. It is well below its 12 month peak set 3 months ago, remains below its 2010 peak, and has returned to its typical background reading of the last 3 years.

The Baltic Dry Index at 1157 rose only 1 point from one week ago. It is now about 1/3 of the way back from its February 52 week low of 670 to its October 52 week high of 2173. The Harpex Shipping Index rose 12 to 428 in the last week, and is up 53 from its February low of 375.

Finally, the JoC ECRI industrial commodities index rose very slightly 124.96 to 124.99. This indicator appears to have more value as a measure of the global economy as a whole than the US economy.

In summary, there is some weakness in withholding tax collections, bond yields and credit spreads, and rail traffic, although none are actually negative. Every other weekly indicator remains solidly positive.

Usually in these weekly posts I try to keep it as exciting as watching paint dry, with a minimum of commentary. That way even if you disagree with my summary, you still have the numbers to bring you right up to date on the pulse of the economy. With the recent spate of "misses" in the monthly reports, I want to re-post a little of my commentary over the last 5 months, because this weakness wasn't just foreseeable, it was foreseen and most of it is perfectly explainable by the Oil choke collar.

In early December, with signs of a strengthening economy all around, I concluded my weekly column with the following:

With the vital exception of real wage deflation, the picture now is very similar to that of a year ago. Having dodged a double-dip recession, the economy then showed signs of becoming a self-sustaining recovery, only to be strangled by the Oil choke collar (with an assist by the tsunami in Japan) in March. It looks like we've dodged another bullet, but the Oil choke collar is tightening again.In my January outlook for 2012, I wrote:

for the second half of 2012, the indicators are really in agreement -- there will be growth.... my best judgment is that we will avoid recession, but that at least one quarter of negative GDP, with the likelihood greater in this quarter than the second quarter, can't be ruled out.Then at the end of February, with initial jobless claims at new lows but gasoline at new highs, exactly as they had been in February 2011, I wrote:

Last year [this same weekend] I concluded my column by saying that I expected Oil to win its duel with initial jobless claims. It did as initial claims flattened and then rose in the summer. I expect the same result this year. While as I said yesterday I expect U-3 unemployment to decline to under 8% by May, that is a lagging indicator. Consumers are better able to handle $4 a gallon gasoline than they were in 2008, but depleted most of their savings since then last year. If an Oil shock is going to bring on more than a stall this spring and summer, watch the weekly same store retail sales comparisons. They held up well all last year. If their YoY readings start going under +2%, that will be a danger sign. If consumers also retrench further than they already have in terms of gasoline usage, i.e., a one week YoY usage decline of more than 10%, or a 4 week YoY decline of more than 7.5%, that would be another strong danger signal.Obviously the non-winter winter helped us with the first quarter, but the weakness began one month ago with the March payrolls number and has only intensified since. The effect of the Oil choke collar is perfectly predictable, it worked like a charm in 2011 and it is working like a charm this year as well.

On the bright side, neither danger signal I wrote of above has materialized other than briefly. G*d bless the American consumer, who continues to spend like a champ. And gasoline usage except for one week hasn't dipped precipitously. I expect the weakness to continue, I expect the Oil choke collar to loosen, and then I expect the economy to pick up again as a result.