U.S. new-vehicle sales are expected to rise in November from a year earlier, adjusted for two fewer sales days this year .... [C]ar sales are seen rising 3.8% in the U.S. from a year ago. Without the adjustment for there being 23 selling days this year and 25 last year, the auto Web site's estimate is 4.5% below last year's sales and down 15% from October...."The ICSC reported that same store sales fell -0.1% last week, the second minimal decline in a row. On a YoY basis, sales are up 2.4%, and

The overall annualized sales rate in November is projected to be 10.3 million, down slightly from October's 10.43 million rate.

ICSC Research expects same-store sales for November could beShopperTrak an increase of 0.7% in mall retail sales compared with a year ago, and also up 7.5% from the previous week.

as strong as up 5 to 8 percent.

During Tim Geithner's somewhat contentious appearance before Congress today, some Republicans took every opportunity to get their shots in. Congressman Michael Burgess (Asshat-TX), was no exception. He got his sound bite in -- "I don't think you should be fired, I think you never should have been hired," or something to that effect. Whatever, he's entitled to his opinions, but not his own facts.

It's what the Congressman said immediately before that that intrigues me, as he and Geithner duelled on the merits of different economic policies, Burgess being all about "cut taxes and get out of the way." He said, and I quote:

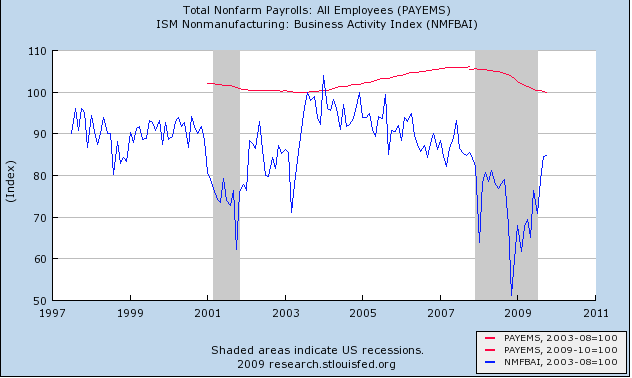

“When I came here in 2003 we were in a jobless recovery. Tax relief was passed in May of 2003 and as a consequence, by July of that year we were adding jobs at a significant [ed. note: he stresses "significant"] rate. It [referring to tax relief] seems to have worked fairly well.”

Watch it here at 3:57 into the video.

Well, if by "significant" he means a 25,000 add in July 2003 followed by a

-42,000 loss in August, then he's on to something. Otherwise, he's just a lying sack of shit (whose office was oddly unable to answer my simple question as to what the hell he was talking about):

Business as usual: Just make stuff up.

P.S. Congressman, if you're out there, just drop your response in the comments section.

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 529,000. This is 10.6 percent (±8.7%) below the revised September estimate of 592,000 and is 30.7 percent (±8.3%) below the October 2008 rate of 763,000.

1) Markets tend to return to the mean over time.

2) Excesses in one direction will lead to an opposite excess in the other direction.

3) There are no new eras -- excesses are never permanent.

4) Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

5) The public buys the most at the top and the least at the bottom.

6) Fear and greed are stronger than long-term resolve.

7) Markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names.

8) Bear markets have three stages -- sharp down, reflexive rebound, and a drawn-out fundamental downtrend.

9) When all the experts and forecasts agree -- something else is going to happen.

10) Bull markets are more fun than bear markets.

Print them out and keep them handy. You'll be glad you did.

With Congressional Democrats in near-panic amid forecasts that unemployment will remain high through next November’s midterm elections, a party leader said on Thursday that the House will pass a new “jobs bill” before Dec. 18.

Senate Democrats likewise are weighing options. And the signals from Congress follow by a day the White House’s announcement that President Obama will follow his “Forum on Jobs and Economic Growth” on Dec. 3 with a “Main Street Tour” starting the next day in Allentown, Pa., and continuing to other hard-hit places in coming months.

With more than half of last winter’s $787 billion package of tax cuts and stimulus spending still in the pipeline, Representative Steny H. Hoyer, the Democratic majority leader from Maryland, said the new measure should not be called another stimulus bill.

“I don’t want it to be as broad as that,” he said. “I want it to be very targeted on jobs.”

He indicated that the legislation might include money for public jobs, which many liberals have advocated; tax credits to employers for new hires, an Obama campaign proposal that was shelved early this year amid concern that businesses might game their payrolls; and additional spending for infrastructure and road projects.

First, this is an overall good idea. With unemployment at 10.2% every little bit helps.

But it's also important to remember exactly what has happened in the economy and where we are in the cycle to understand exactly what is going on. And no -- the following is not an endorsement of bad times; it is simply an explanation of the facts without a judgment attached.

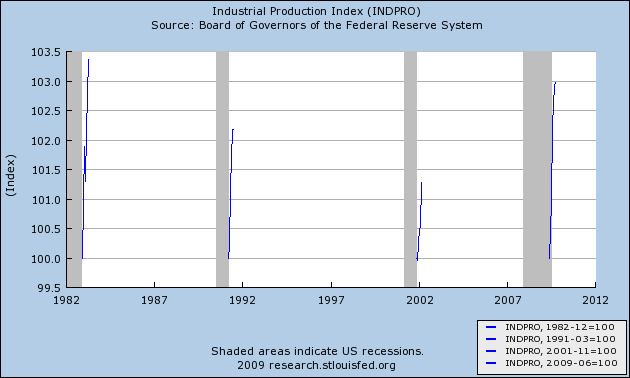

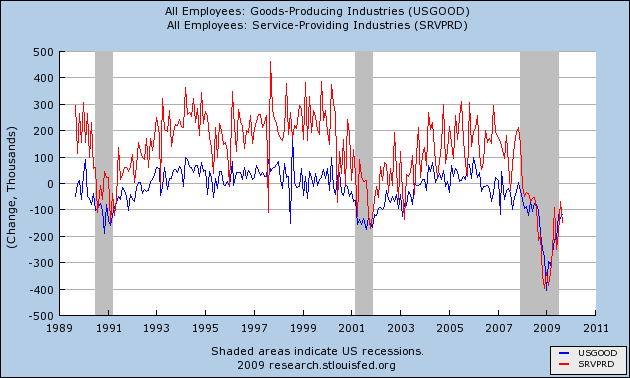

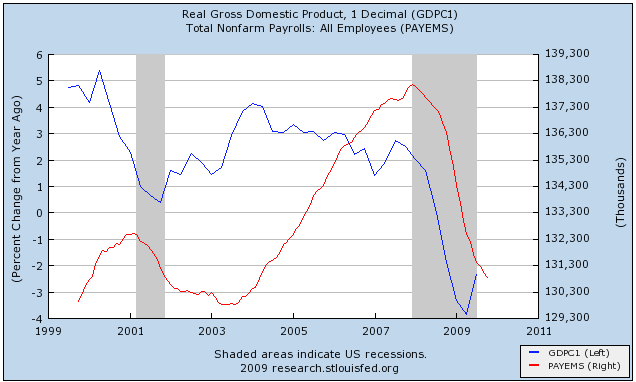

At the end of last year and the beginning of this year the US was losing jobs at a rate of 600,000/month. That lasted for 5 months. Or to put it another way, the US lost 3 million jobs in 5 months. That is almost half of all the jobs created during the last expansion. That tells us the severity of the economic situation was indeed severe. Employers simply cut everybody they could and then some. In addition, we have also learned that the BLS has added an additional 800,000 jobs losses to the official job loss total. These will be added in February. This further indicates we were in an extremely severe economic contraction.

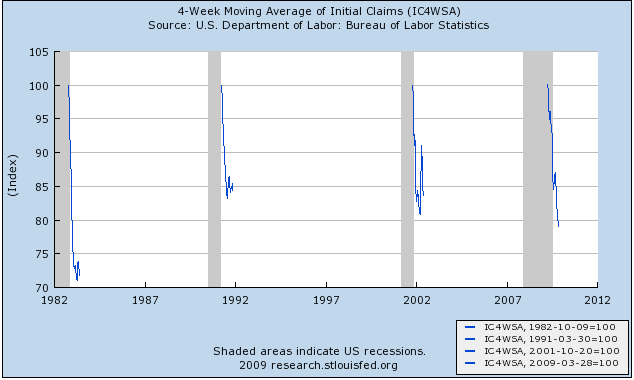

Currently the economy is back from the brink. We printed a solid GDP number last quarter and the rate of job losses continues to decrease. In addition, the pace of initial unemployment claims continues to move lower. All of these facts tell us we're moving in the right direction. BUT -- and this is very important -- remember where we were last year at this time. There were a lot of people talking about depressions and deflationary spirals. These are the most severe economic events we can experience. The repercussions of these events last a long time.

Does this statement imply that I am unsympathetic to the unemployed? No. I have never advocated (and will never advocate) that we decrease or cut off unemployment benefits or show any less sympathy for those who have lost their jobs. That is not the point of the above recitation of historical facts. The point is things are moving in the right direction. Recoveries -- especially from near financial collapses -- don't happen overnight. As the article states we've only just started to use the stimulus money. We've just printed our first quarter of positive GDP growth. By this time next year things should be better.

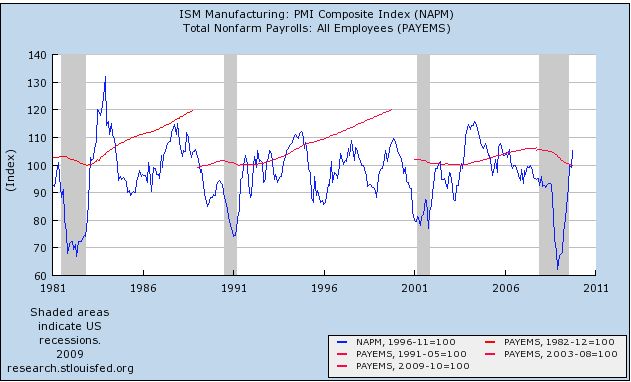

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved in November, but at a somewhat slower pace than in October. The general business conditions index fell 11 points, to 23.5. The indexes for new orders and shipments posted similar declines. Pricing pressures eased, with the prices paid index positive but lower than last month and the prices received index rising to a level just below zero. Employment indexes fell from October’s elevated levels, remaining slightly positive. Future indexes conveyed an expectation that activity and employment would improve in the months ahead and that both input and selling prices would increase significantly.

Also note the employment component of the report is also getting better.

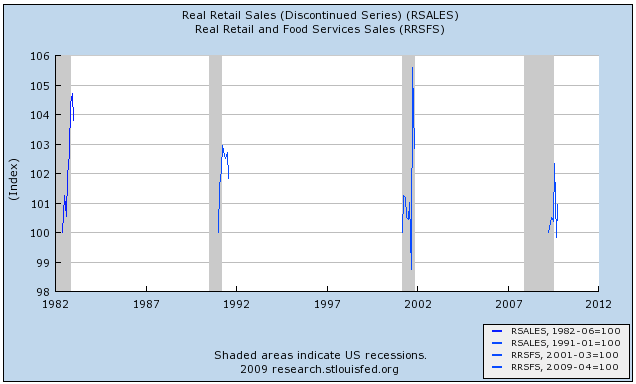

Also note the employment component of the report is also getting better.The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $347.5 billion, an increase of 1.4 percent (±0.5%) from the previous month, but 1.7 percent (±0.5%) below October 2008. Total sales for the August through October 2009 period were up 1.5 percent (±0.3%) from the same period a year ago. The August to September 2009 percent change was revised from -1.5 percent (±0.5%) to -2.3 percent (±0.3%).

Excluding the 7.4% increase in auto sales, retail sales rose 0.2% in October, the data showed. Sales excluding autos have risen for three months in a row and in five of the past six months.

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved in November, but at a somewhat slower pace than in October. The general business conditions index fell 11 points, to 23.5. The indexes for new orders and shipments posted similar declines. Pricing pressures eased, with the prices paid index positive but lower than last month and the prices received index rising to a level just below zero. Employment indexes fell from October’s elevated levels, remaining slightly positive. Future indexes conveyed an expectation that activity and employment would improve in the months ahead and that both input and selling prices would increase significantly.

Also note the employment component of the report is also getting better.

Also note the employment component of the report is also getting better.The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $347.5 billion, an increase of 1.4 percent (±0.5%) from the previous month, but 1.7 percent (±0.5%) below October 2008. Total sales for the August through October 2009 period were up 1.5 percent (±0.3%) from the same period a year ago. The August to September 2009 percent change was revised from -1.5 percent (±0.5%) to -2.3 percent (±0.3%).

Excluding the 7.4% increase in auto sales, retail sales rose 0.2% in October, the data showed. Sales excluding autos have risen for three months in a row and in five of the past six months.

The average difference between the two is just over 4%; it's currently a record 7.3% (17.5 - 10.2). (U-6 is only available since 1994.) Now, we can get back to the long-term average many ways, but it's certainly not out of the realm of possibility that one way we'll do so is to see unemployment at 12% while the U-6 drifts back down toward 16%. Would anyone consider that possibility crazy?

On a related note, continuing to add to the file on the plight of small businesses, I came across the following information over the weekend as to their importance to our economy:

Small firms (<500)

• Represent 99.7 percent of all employer firms.

• Employ just over half of all private sector employees.

• Pay 44 percent of total U.S. private payroll.

• Create more than half of the nonfarm private gross domestic product (GDP).

• Hire 40 percent of high tech workers (such as scientists, engineers, and computer programmers).

• Are 52 percent home-based and 2 percent franchises.

• Made up 97.3 percent of all identified exporters and produced 30.2 percent of the known export value in FY 2007.

• Produce 13 times more patents per employee than large patenting firms; these patents are twice as likely as large firm patents to be among the one percent most cited.

And, perhaps most importantly:

Firms with fewer than 500 employees accounted for 64 percent (or 14.5 million) of the 22.5 million net new jobs (gains minus losses) between 1993 and the third quarter of 2008.

This is the group that, according to the NFIB's monthly SBET [.pdf], is simply not seeing much light at the end of the tunnel. So the question needs to be asked: When the NFIB reports that the country's "job generating machine is still in reverse," and we know that its member firms account for ~64% of net new job creation, how are we going to achieve sufficient job creation to make a meaningful dent in the un- and under- employment rates before Rosie's forecast comes to pass?

Here's what the SBET survey looks like with regard to Hiring Plans:

So, hiring plans for small business are, in fact, incrementally worse now than they were one year ago (-1 vs. 0). There's no more inclination on the part of this business cohort to add employees now than there was one year ago, and in that period the unemployment rate has increased dramatically. Makes Rosie's forecast seem fairly uncontroversial to me.

To support this argument, anti-minimum wage advocates trot out charts that generally look like this:

Now, what I see in this chart is that teen unemployment -- like most unemployment in general -- is much more highly correlated to recessionary periods in the economy than it is to the minimum wage. But that's just me. Honestly, I just can't look at that chart and seriously argue that there's a cause/effect relationship between minimum wage and teen unemployment. But we live in an age where arguments gain traction on the skimpiest of evidence (sometimes even none whatsoever -- see: the 1977 CRA caused the near economic collapse of 2008 -- a time bomb with a 30 year fuse!!!).

Allow me to make another argument, one that I think makes much more sense. I first made this argument over at Blah3, and I'll make it again here with some updated charts.

What I suspect is fairly simple: That simple demographics coupled with the damage wrought by this recession on the Baby Boom generation -- in terms of both real estate and investment portfolios (particularly retirement portfolios) -- is so great that many Boomers have realized they're going to have to postpone retirement (see one story on that here, there are thousands on "postponing retirement" out there on The Google).

Let's look at some charts and see if they might make more sense than the minimum wage argument. First up, let's look at the ratio of 55+ Employed persons/Teen Employed and see what that looks like:

Gee, what do you know -- this ratio has been on the increase since about the turn of the century, the exact time the first of the Boomers were turning...55. Whaddya know, they're staying in the workforce and, arguably, crowding their own kids out of it. There are now over 6 55+ employees in the workforce for every teen -- a record that shows little sign of letting up.

Second, let's look at the 55+ and Teen cohorts as a percent of the Employed Workforce. Again, what we see is that the older generation is crowding out the younger generation in a trend that well predates the recent set of minimum wage hikes we've seen.

Look at the two charts I've presented versus the absurdity at the top and ask yourself, which argument makes more sense? Which argument does the data seem to support?

In short, the minimum wage canard is yet another feeble political attempt to lay the economy's woes at the feet of Democrats. It's shameful, really, but not at all out of character. I expect I'll be revisiting this issue with each passing NFP print. Waste of time, but somebody's got to do it.

And, so I can preempt this ridiculous argument seven years hence (assuming the minimum wage rises again), here's a chart showing the BLS' forecast of exactly how lopsided these two cohorts are going to look in 2016:

What I suspect will happen in 2016, sadly, is that those with a political agenda will look at the numbers and claim the disparity is being caused by -- you guessed it -- minimum wage hikes that ocurred eight years prior.

'Nuf said.

We noticed an interesting piece of research on U.S. GDP from Goldman Sachs’ Economics team that’s worth highlighting. The team questions whether the official government GDP statistics capture how poorly small businesses (ie, sole proprietorships) are doing. The weakness in small business sentiment is seemingly at odds with the recent 3.5% Q3 GDP reading but may explain why the unemployment rate has continued to steadily increase. Part of the reason for small business weakness is that most don’t have the same access to credit as larger firms and larger firms’ output tends to be better captured in the GDP data. While sole proprietorships tend to be small they collectively account for a nontrivial 17% of the U.S. economy.

The Goldman team uses a couple of different statistical approaches to test their thesis. They use timely data from the National Federation of Independent Business (NFIB) confidence survey, which shows that despite a recent improvement, confidence remains exceptionally weak (in fact two standard deviations below long-run trends). The first model suggests that the NFIB survey is consistent with overall GDP growth of 2.5% to 3.0% — not the 3.5% reported. As well, they find that current NFIB readings are more in line with below-50 readings on the ISM manufacturing index versus the actual reading of 55.7.

The second approach has to do with revisions to the GDP data and their relationship to the NFIB. U.S. GDP goes through many revisions as more, and better, information becomes available with lags — historically preliminary numbers are revised down by almost 0.5 percentage point. This second model suggests that Q3 GDP could be revised down by as much a 1-2 percentage points.

I've been trying to get my hands on the Goldman piece to read it for myself, but as yet have been unable to source it. In any event, it would appear that the decoupling story of large vs. small business is, perhaps, beginning to gain some traction. As a new and semi-permanent era of frugality dawns and consumers increasingly gravitate toward low-cost providers, I maintain this story will continue to percolate.

On a related note, I picked up this tidbit via Alan Abelson's Barron's column on Saturday regarding Friday's release of consumer sentiment:

"Richard Curtin, director of the survey, somewhat ruefully noted that a mere one in 10 consumers polled reported an increase in income, the fewest recorded in data that stretch back to 1946."

Stay tuned.