- by New Deal democrat

We can safely say that the front-running of tariffs is over. As usual, real retail sales is one of my favorite indicators, because it tells us so much about consumers, and since consumption leads employment, it gives us information about the trend in that as well. And this morning’s report for May was our earliest indication in the monthly data of the post-Tariff-palooza! trend.

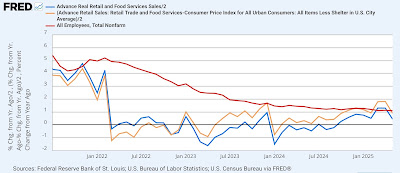

Nominally retail sales declined -0.9% in May, and were up 3.3% YoY. But because consumer prices rose 0.1%, real retail sales declined -1.0% for the month (blue in the graphs below). In recent months I have also been calculated real sales excluding shelter, because that has been distorting the CPI. This month real retail sales ex-shelter were down -1.1% (gold). In the below graph I also show real personal consumption expenditures for goods (red), which tends to track real retail sales well, but won’t be reported for several more weeks (Note: graphs normed to 100 as of just before the pandemic):

With rare exceptions - one of which was in 2023-24 - when real retail sales are negative YoY, a recession has followed shortly. Even after this month’s downturn, in the past 12 months, real retail sales YoY are up 0.9%, and excluding shelter, up 1.8%:

Probably the best way to look at this is to average last month and this month, which would mean that the YoY trend has been about equal with that of the end of last year, when real sales were in the range of 2.0%-2.5% higher YoY. If next month’s report does not show a further decline, the YoY measure will still be positive. But if it is further decline like this month, likely the measure will be negative again.

Finally, let’s compare the YoY% changes with their potential effects on employment (red):

To reiterate, consumption leads employment. Changes in the strength of sales show up with some number of months’ delay in changes in the strength of employment. Because real sales are still positive, and the average of the last few months has not deteriorated, that suggests that the jobs report should stay positive for the next few months, with YoY gains on the order of 1%, with two caveats: (1) the YoY comparisons in employment in the next few months will be with gains of less than 100,000 last summer, meaning that similar numbers might be expected this summer as well; and (2) the QCEW, which is the “gold standard” for employment, has been indicating gains of only about 0.8%-0.9% YoY for the latter parts of last year, meaning that for the YoY gains to remain steady, even weaker job reports in the next few months might be expected.

But to reiterate: the main takeaway from this month’s retail sales report is that the consumer front-running of tariffs has ended, and payback (of unknown duration and strength) has begun.