Saturday, January 4, 2014

International Week in Review

Last week, the big news was from the manufacturing sector, which was the primary driver of most market activity. Here's a link.

Weekly Indicators for Dec.30 - Jan. 2 at XE.com

- by New Deal democrat

My Weekly Indicators column is up at XE.com. The coincident data looks good, but deceleration in the long leading indicators shows signs of spreading to short leading indicators.

Friday, January 3, 2014

Real money supply: significant deceleration, but still positiive

- by New Deal democrat

It won't be a surprise to anyone who reads my "Weekly Indicators" column that I have something of a bifurcated outlook for the economy. The short leading indicators have generally been very positive (and manufacturing got two excellent numbers in the past week), while the long leading indicators have cooled considerably -- but are still positive.

Real M2 is a perfect example of this issue. It was one of Prof. Moore's original 4 long leading indicators, and was part of the LEI for several decades before being dropped a couple of years ago.

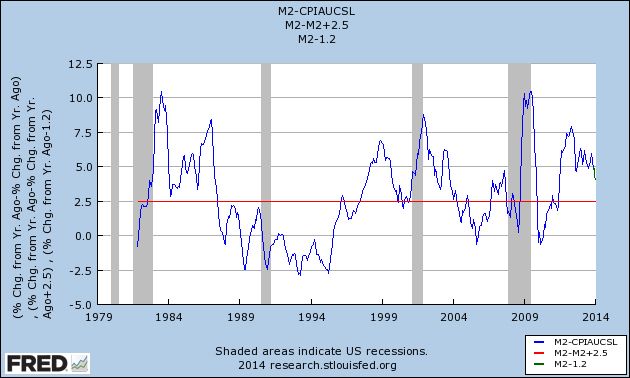

Below is a graph of real M2 since 1980. The red line is at the level of +2.5% YoY:

As you can see, on the one hand it has decelerated considerably from its peak about 2 1/2 years ago. As of yesterday's New York Fed report, for the week it is at about +4.3% YoY. Which, of course, is still comfortably above the +2.5% level below which, if it remains for a several quarter period, is necessary but not sufficient to signal an oncoming recession. In fact, it is probably above its average level for the last 30 years.

My gut feeling is that it will continue to decelerate. But it is just that: a gut feeling, and nothing on which to base any hard analysis.

Thursday, January 2, 2014

Calculated Risk and I have made a bet on housing's direction in 2014

- by New Deal democrat

Bill McBride, a/k/a The Nicest Blogger on the Internet, and I have almost always seen eye-to-eye on the matter of housing. Both of us thought that housing was in a bubble in 2005. Both of us thought in 2011 that housing prices would bottom in early 2012.

But we have totally different opinions about the direction of housing in 2014.

In his forecast for 2014 residential investment, CR says, "I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013."

By contrast, several weeks ago, in a post at XE.com, I said that "If the typical past pattern is followed, we will shortly see permits running 100,000 less than one year previously."

This is quite a difference. Bill expects sales and starts to average about 1.150 million annualized this year. I expect that at some point permits and starts will sink under 900,000 annualized.

The difference is one in approach. Bill's post argues from the fundamentals:

demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That means starts will come close to increasing 60% over the next few years from the 2013 level.From there he deduces his forecast of 20% this year.

While I agree with CR over the long term that demographics and pent-up demand are a tailwind behind the housing market, my argument stems from strong past correlations of increases in interest rates and decreases in housing demand. The graphs I posted in the XE.com article show 15 occasions in the last 50 years that interest rates have backed up by at least 1% YoY. On 12 of those occasions, housing permits fell by at least 100,000 shortly thereafter. Those are pretty good odds.

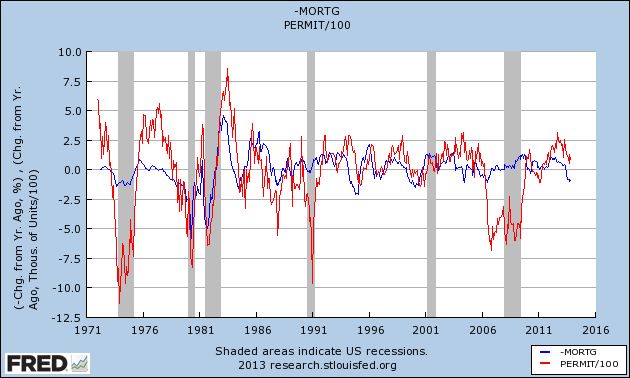

When one compares mortgage rates and housing permits, as in the below graph covering the last 40 years, the relationship is even stronger:

Of the 9 previous times in the last 40 years that mortgage rates have increased by 1% YoY, housing permits fell by at least 100,000 YoY on 8 of those occasions. The 9th time, briefly during the bubble year of 2004, was followed by a YoY decline of -65,000 permits in spring 2005.

My working principle is to look at the data in as dispassionate and detached manner as I can, and to default to the idea that "it's not different this time." Although permits have not even turned negative YoY at this point, their improvement has decelerated considerably since the low of interest rates in 2012.

So here are the terms of our bet: If starts or sales are up at least 20% YoY in any month in 2014, I will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.

Note that since our forecasts are not mirror images of one another, it is possible that both or us will win this bet. Or neither! And to be honest, since my forecast implies a weakening economy, probably with less hiring and wage growth, I hope I lose.

But I think this frames the biggest US economic issue of 2014 - will the rise in interest rates derail economic growth? - in a succinct manner.

Tuesday, December 31, 2013

Marking my forecast for 2013 to market

- by New Deal democrat

It's time to mark my 2013 forecast from back in January to market.

Here's what I said back in January about the first part of the year:

Here was my forecast for the second half of the year:for the next 3 to 6 months, the economy will continue to shamble along just barely avoiding recession. Thereafter all of the long leading indicators are suggesting further improvement

....

.... It appears that gas prices bottomed in December 2012 at the identical price they were in 2011. It is reasonable to expect that the Oil choke collar will engage by spring and remain engaged, with gas quite likely hitting $4 a gallon by summer.

So is the balance tipped towards expansion or contraction in the first part of the year?.... Congress and President Obama just threw a monkey wrench into the works, in the form of a 2% payroll tax increase on the first $110,000 of income. ... A new and significant drag has been added to consumer spending..... Frankly, I expect to see a significant pullback in consumer spending as a result of the decrease in disposable income within the next 3 months. Unless a further opportunity to refinance at even lower interest rates appears, that may be enough to tip us into a short term contraction at some point in the first 6 months of this year, specifically including one or more months of actual job losses beginning in March or April.

... the K.I.S.S. signal of a positive yield curve and positive M2 suggest that the economy continues to grow throughout 2013.My forecast for a cutback in consumer spending due to the reinstatement of an additional 2% withholding for Social Security, and a likely actual month or two of job losses as a result certainly did not occur. But then, just about everybody thought that consumers would pull back. It just goes to show that the American consumer is the world champion of their art!

.... the resurgence of the housing market, and the continuing accommodation in interest rates and monetary policy, look like they will come to the rescue again later in the year, provided Washington can avoid burdening the consumer with further austerity measures taking effect this year.

On the other hand, my forecast from January of a first half just shambling along, followed by stronger growth in the second half, and for the Oil choke collar to begin to loosen, was pretty much on target. First quarter GDP was just barely over 1% - which is usually consistent with a recession - but then improved to 2.5% in the second quarter, and 4.1% in the third quarter. Gas prices on average were down $0.10 for the entire year on a YoY basis. Industrial production, sales, payrolls, and wages all improved as the year went along.

Thanks for reading this year. I'll be back again with a 2014 forecast after New Year's!

Monday, December 30, 2013

The Important economic trends of 2013

- by New Deal democrat

I have a look back at 12 important economic trends of 2013 up at XE.com.

Before I post my 2014 forecast, I still need to rate my 2013 forecast.

Sunday, December 29, 2013

A thought for 2013: The Progressive Economic Case is still Equality, not Armageddon

- by New Deal democrat

Six years ago I posted an essay on Daily Kos entitled The Progressive Economic Case: Inequality,not Armageddon. On this final Sunday of 2013, I think it remains timely. I've posted it below in somewhat abridged from. To put it in context, two months previously in an essay called The Panic of 2008? I had said:

[E]very now and then it is prudent to be fearful. Not panic-stricken, but instilled with enough caution to focus on a serious problem, to check and double-check if one's house is truly in order.

Now appears to be such a time....

There is an excellent chance that the dominant issue of the 2008 election campaigns will not be Iraq nor Iran nor executive power nor immigation, It will be the economy, in the form of this "Panic. "

....Now here is my January 2008 essay:

This is NOT the Great Depression II. Nor is this the stagflationary 1970s. It is going to unfold as some other Beast. Only the broad outlines of this Beast appear discernable now: it will likely feature (1) increasing import prices; (2) wage stagnation (that does not keep up with price inflation; (3) real asset deflation; and (4) possibly a Japan-style "liquidity trap."

---------------------------

Recent surveys show that over 80% of Americans believe the country is on the wrong track. Increasing percentages of Americans identify themselves as democrats. They are "ready to jump," [like what a frog in water being heated actually does].

In order to convince them to jump, we need to provide them with the coherent, persuasive, intellectual underpinnings of why the Right Wing has failed, and why they should embrace a new New Deal.

There is an absolutely compelling case to be made, but too often among the blogosphere, that case seems to be marginalized, and drowned out by the shouts of "The Sky is Falling!" The case to be made isn't Armageddon. It is Inequality of Economic Opportunity, that has already, slowly but inexoribly, eaten into the standard of living of average Americans.

Recent surveys show that over 80% of Americans believe the country is on the wrong track. Increasing percentages of Americans identify themselves as democrats. They are "ready to jump," [like what a frog in water being heated actually does].

In order to convince them to jump, we need to provide them with the coherent, persuasive, intellectual underpinnings of why the Right Wing has failed, and why they should embrace a new New Deal.

There is an absolutely compelling case to be made, but too often among the blogosphere, that case seems to be marginalized, and drowned out by the shouts of "The Sky is Falling!" The case to be made isn't Armageddon. It is Inequality of Economic Opportunity, that has already, slowly but inexoribly, eaten into the standard of living of average Americans.

Now, it could very well be that disaster -- of devastating inflation or deep recession -- is around the corner, but is that what people have to be persuaded of in order to vote for a Democratic economic agenda? Relying on the idea that an economic Apocalypse is imminent makes us look like tin-hatters every time cataclysm doesn't show up on average Americans' front doorstep. And it isn't the case we need to make.

The progressive economic case is straightforward: the 28 years since Ronald Reagan's election have resulted in the middle class suffering, and suffering more acutely as time has gone on. Reagan used the hoary old line that "a rising tide lifts all boats" but we have seen in the generation since, that it just isn't so. The rich got bigger and more ornate yachts, while everybody else had to make do with the same old dinghy, a dinghy ever more difficult to maintain. And every year, about 10% of those dinghies get a hole, spring a leak and sink.

The case to be made isn't Armageddon. It is Inequality of Economic Opportunity: the corporations and the wealthy have gotten the benefits, and the average American has taken on the risk and picked up the bill.

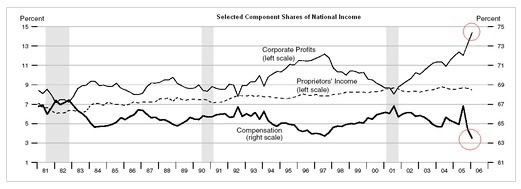

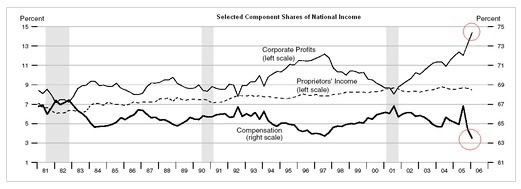

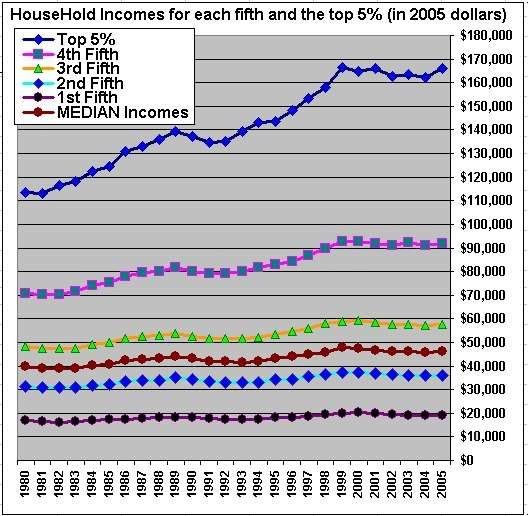

The case is compelling. The percentage of wealth concentrated on big corporations and financial institutions compared with labor is at a high not seen since the 1920s:

It's not a case of the average American's wealth growing, just more slowly than that of the wealthy. Rather, the middle class hasn't made any economic progress at all in the last 10 years, and is about to see their wealth decline again in this recession. Measured by quintiles, the lowest 20% has actually lost ground since the GOP came to power.

This is a permanent loss in middle class earning power.

To try to keep up, Americans have been taking on

Meanwhile pension plans have evaporated. And while CEOs get golden parachutes even for poor performance, if the company files for bankruptcy, it can

suspend benefits or terminate that pension plan. Indeed, the average American now lives in a society where each year about 1 in 10 households faces a 50% or more loss of income. But when large financial institutions get in trouble, savers are punished in order to bail them out with low interest rates, if they aren't bailed out directly.

The problem isn't Armageddon, it is inequality. Specifically, there is one set of rules for the Lords of Finance, and another set for the peon on Main Street. Finance is "too big to fail". The little guy or gal gets crushed, and has to deal with an onerous new Bankruptcy Law to boot. So profound is this inequality of economic opportunity that there is less social mobility now in America than there is in Europe.

suspend benefits or terminate that pension plan. Indeed, the average American now lives in a society where each year about 1 in 10 households faces a 50% or more loss of income. But when large financial institutions get in trouble, savers are punished in order to bail them out with low interest rates, if they aren't bailed out directly.

The problem isn't Armageddon, it is inequality. Specifically, there is one set of rules for the Lords of Finance, and another set for the peon on Main Street. Finance is "too big to fail". The little guy or gal gets crushed, and has to deal with an onerous new Bankruptcy Law to boot. So profound is this inequality of economic opportunity that there is less social mobility now in America than there is in Europe.

This can't go on forever. And for the young, already it hasn't. Crushed by debt, the average 35 year old maleis less well off now than his forebear of the 1970s.

This is an absolutely stunning, devastating indictment of GOP economic policies. After 28 years, the statistics and the graphs can no longer be ignored. The historical record has been made. They have worked to engorge those already wealthy, while leaving all the risk on the backs of the middle and working classes. Profit has been privatized and risk left to the public, again and again and again.

A pro-middle class agenda is all we need to create a generation of progressive middle Americans who will vote Democratic. That agenda isn't too hard to imagine: an increase in progressive taxation. A re-commitment to reasonably priced higher education. An end to the system whereby your medical insurance and care depend on your job and medical costs are exploding. The re-invigoration of Usury Laws and action against predatory payday lending. A firm commitment to minimize leverage and speculative bubbles in the financial markets. Methods to make sure existing regulations are enforced. Real reform of the Bankruptcy Law to discourage unsuitable lending, and protect pensions from predation during bankruptcy reorganizations. Enacting a VAT or similar tax to capture profits from overseas outsourcing and to make sure the funds are directed at those in the US who suffered as a result. A commitment to rebuilding and modernizing our physical infrastructure. Sufficient budget discipline that progressive needs can be funded while the nation's long term financial well being is safeguarded. [And by no means least, a thorough refurbishing of the nation's Estate Tax laws, that prevents inherited wealth three or four or five generations removed from the earned fortune, becoming the basis of an entrenched plutocracy. ]

It is neither necessary nor particularly productive to base the appeal of progressive economic solutions on the idea that the four horsemen of the economic Apocalypse -- insolvency due to national debt, or hyper-inflation, or peak oil, or Great Depression 2 -- are just around the corner. Telling the truth about the slow, decades long assault on average Americans will suffice.

--------------

Postscript: Six years later, my beliefs are exactly the same. What is different is that the centrality of inequality - and by that I mean in particular inequality of opportunity, and unequal application of the law - has become accepted far and wide in the progressive econoblogosphere, by such people as Profs. Brad DeLong, Dean Baker, Mark Thoma, Robert Reich and Prof. Paul Krugman. Even Larry Summers has recognized that inequality is "profoundly corrosive." And of course President Obama recently described inequality the "defining challenge" facing America.

For reasons many of you already know, I detest even moreso than before those Pied Pipers of Doom who squeal with glee any time they can seize upon some "Sky is Falling" meme. The case to be made is not Armageddon. It is that America is failing as a land of equal opportunity.

--------------

Postscript: Six years later, my beliefs are exactly the same. What is different is that the centrality of inequality - and by that I mean in particular inequality of opportunity, and unequal application of the law - has become accepted far and wide in the progressive econoblogosphere, by such people as Profs. Brad DeLong, Dean Baker, Mark Thoma, Robert Reich and Prof. Paul Krugman. Even Larry Summers has recognized that inequality is "profoundly corrosive." And of course President Obama recently described inequality the "defining challenge" facing America.

For reasons many of you already know, I detest even moreso than before those Pied Pipers of Doom who squeal with glee any time they can seize upon some "Sky is Falling" meme. The case to be made is not Armageddon. It is that America is failing as a land of equal opportunity.