- by New Deal democrat

First of all, a welcome to our many new readers. Every weekend, I look at data that gets reported on a weekly basis. While it can be noisier than monthly or quarterly data, it has the virtue of being virtually up to the minute. Amplifications or reversals of trend will show up here before they show up in monthly data, which can already be two months old by the time they are reported.

Monthly data released in the past week included the Conference Board's Index of Leading Indicators, up .5 for February. January was also revised upward to +.5. After faltering for the second summer in a row in 2012, these have been more positive in recent months, indicating a strengthening economy this spring and summer. Housing starts and permits (a component of the LEI) also made new post-recession highs in February. Existing home sales also rose slightly. The Philly Fed report was also slightly positive.

Let's start again this week's look at the high frequency weekly indicators by checking what is happening with tax withholding:

Employment metrics

Daily Treasury Statement tax withholding

- $157.1 B (adjusted for 2013 payroll tax withholding changes) vs. $162.2 B, -3.1% YoY for the last 20 days. The unadjusted result was $180.8 B for an 10.3% increase.

- $145.2 B was collected for the first 15 reporting days of March vs. $130.1 B unadjusted in 2012, an 11.5% increase YoY.

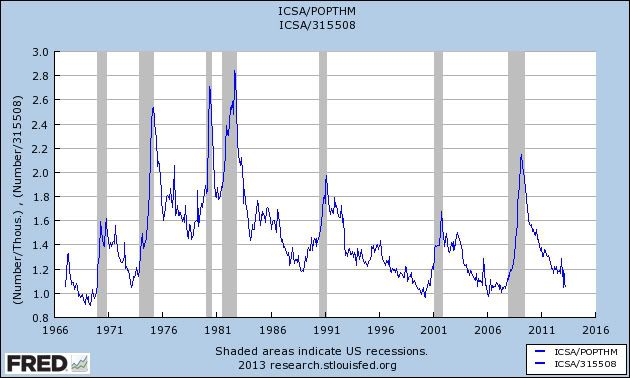

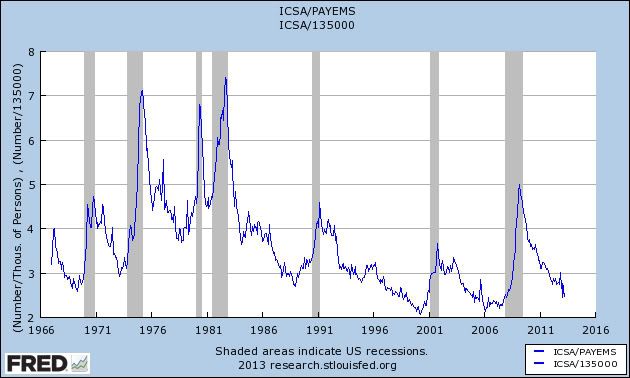

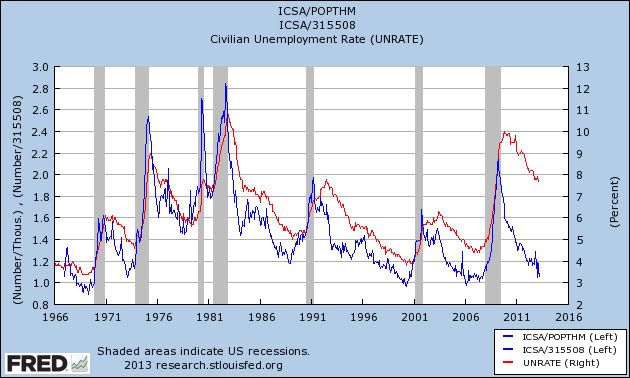

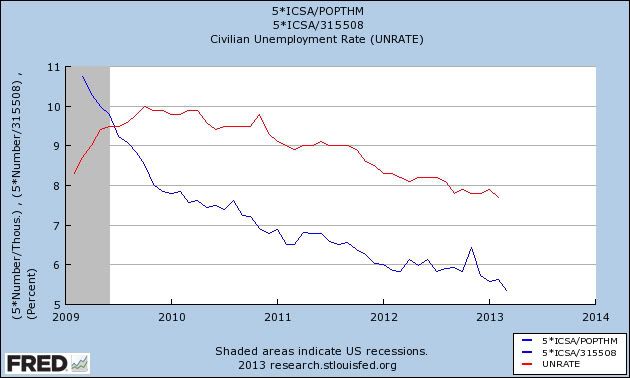

- 336,000 up 4,000

- 4 week average 339,750 down 7,000

- down 1 to 90 w/w up 2.6% YoY

To reiterate, I am adjusting my YoY tax withholding figures to reflect the increase in personal withholding taxes. While the YoY collections are up substantially, they should be up over 15% to compensate for the tax increase. (Last week several commenters asked me to clarify this. Last year's tax withholding for SS was 6.2% from the employer, plus 4.2% from the employee, plus 1.45% Medicare withholding. The total withholding was approximately 12%. This year employee withholding increased to 6.2%, so total withholding increased to approximately 14%. The increase from 12 to 14 is just over 15%) Since I can think of no reason why employment itself should have fallen off a cliff in January, it is very possible that there is a lag in the payment of withholding taxes with the new increase. If this hypothesis were correct, I would have expected tax withholding to be much more reliable before now, but that doesn't appear to have happened.

Consumer spending

- ICSC +1.4% w/w +2.3% YoY

- Johnson Redbook +2.9%YoY

- Gallup daily consumer spending 14 day average at $86 up $11 YoY

Housing metrics

Housing prices

- YoY this week. +4.5%

Real estate loans, from the FRB H8 report:

- down 5 or -0.1% w.w

- unchanged YoY

- +2.1% from its bottom

Mortgage applications from the Mortgage Bankers Association:

- -4% w/w purchase applications

- +6% YoY purchase applications

- -8% w/w refinance applications

Interest rates and credit spreads

- 4.91% BAA corporate bonds up 0.06%

- 2.04% 10 year treasury bonds up 0.08%

- 2.87% credit spread between corporates and treasuries down -0.02%

Money supply

M1

- -2.1% w/w

- -1.6% m/m

- +8.3% YoY Real M1

M2

- unchanged w/w

- -0.2% m/m

- +4.6% YoY Real M2

Oil prices and usage

- Oil $93.71 up $0.26 w/w

- gas $3.70 down $0.01 w/w

- Usage 4 week average YoY +1.5%

Transport

Railroad transport from the AAR

- +1400 or +0.5% carloads YoY

- +4100 or +2.4% carloads ex-coal

- +1600 or +0.7% intermodal units

- +3100 or +0.6% YoY total loads

- Harpex up 3 to 382

- Baltic Dry Index up 50 to 930

Bank lending rates

- 0.22 TED spread up +0.02 w/w

- 0.2000 LIBOR unchanged w/w

JoC ECRI Commodity prices

- down -0.12 to 127.97 w/w

- +2.49 YoY

Rail and shipping are positive, but just barely so. Commodities are neutral. Money supply, especially real M2, reamins positive, but at the very low end of YoY comparisons. Corporate bond rates are up slighly. Spreads between corporates and government bonds are down slightly. Overnight bank lending rates remain somnolent.

Probably the brightest spots are consumer spending, still resilient in the face of the payroll tax increase, and gas prices, which are negative YoY and accomodative, and gas usage, which has been up YoY for several months.

Overall the tone remains positive, but muted. Have a nice weekend.