NDD will have the weekly indicators up on Sunday, not Saturday.

First of all, below are two pictures of Lita the pit bull; they're

obviously before and after . When we found her in our alley, she was

about 15 pounds underweight, no hair and with some kind of infection in

her eye. Now she's just a big baby; it's like having a really

affectionate defensiveman from a hockey team.

And here are the other three:

Friday, July 6, 2012

No, Really, the US' Infrastructure is in Crap Shape and Costing Us Big Time

From Taylor Marsh:

And it's not just in Houston -- it's all over:

Yes, it costs to bury power lines, as David Frum addresses, but it’s not like there isn’t an economic whallup that comes with the crash of a rampaging storm. From Frum:Folks -- this really isn't that complicated. The US infrastructure is falling apart. Here is the report card from the American Society of Civil Engineers:

1. There’s reason to think that industry estimates of the cost of burying wires are inflated. While the U.S. industry guesstimates costs, a large-scale study of the problem conducted recently in the United Kingdom estimated the cost premium at 4.5 to 5.5 times the cost of overhead wire, not 10. [...]3. Costs can only be understood in relation to benefits. As the climate warms, storms and power outages are becoming more common. And as the population ages, power failures become more dangerous. In France, where air conditioning is uncommon, a 2003 heat wave left 10,000 people dead, almost all of them elderly. If burying power lines prevented power outages during the hotter summers ahead, the decision could save many lives. [...]…and have you heard about America’s unemployment, the latest bad news hitting Monday on manufacturing? This from Frum, a Republican: Burying power lines is a project that could put many hundreds of thousands of the unemployed to work at tasks that make use of their skills and experience. Do I hear an amen?

That Americans won’t join in together to do something so simple as burying power lines, which requires investing in an infrastructure that prepares us for what climate change will continue to deliver, is another sign of our diminishing greatness.

Because of the Tea Party and Republicans no one has to dare mention “climate change.” Just talk about the economic hardship of people who lose their entire refrigerator of food because they don’t have a generator, causing even more economic fallout we don’t need. Talk about the deaths due to extreme heat, when people are left without air conditioning, the inconvenience of businesses that lose capital amid the extreme weather, patterns that show no signs of abating.

2009 GradesAs an example, I live in Houston, Texas. There isn't a street in my neigborhood that doesn't need major repair -- as in, tear the street up and lay down a new street type of repair. And I'm living in the 4th largest city in the US -- and one that is doing pretty well economically.

America's Infrastructure

And it's not just in Houston -- it's all over:

Inland waterways quietly keep the nation's economy flowing as they transport $180 billion of coal, steel, chemicals and other goods each year — a sixth of U.S. freight — across 38 states. Yet, an antiquated system of locks and dams threatens the timely delivery of those goods daily.Right now, the 10-year treasury is yielding 1.63%. The US could borrow $1 trillion for infrastructure spending at an annual cost of $16.3 billion -- that's a steal in corporate finance land. That means that for this to make sense, the annual rate of return on the investment would have to be a mere $20 billion. And considering the jobs and increased efficiency that would result, it's easy to make the claim that the IRR would be far higher than $16.3 billion/year -- especially over the long term (as in 20+ years).

Locks and dams raise or lower barges from one water level to the next, but breakdowns are frequent. For example, the main chamber at a lock on the Ohio River near Warsaw, Ky., is being fixed. Maneuvering 15-barge tows into a much smaller backup chamber has increased the average delay at the lock from 40 minutes to 20 hours, including waiting time.The outage, which began last July and is expected to end in August, will cost American Electric Power and its customers $5.5 million as the utility ferries coal and other supplies along the river for itself and other businesses, says AEP senior manager Marty Hettel......Freight bottlenecks and other congestion cost about $200 billion a year, or 1.6% of U.S. economic output, according to a report last year by Building America's Future Educational Fund, a bipartisan coalition of elected officials. The chamber of commerce estimates such costs are as high as $1 trillion annually, or 7% of the economy......Inland waterways, for example, carry coal to power plants, iron ore to steel mills and grain to export terminals. But inadequate investment led to nearly 80,000 hours of lock outages in fiscal 2010, four times more than in fiscal 2000. Most of the nation's 200 or so locks are past their 50-year design life......The biggest railroad bottleneck is in Chicago. A third of the nation's freight volume goes through the city as 500 freight trains jostle daily for space with 800 passenger trains and street traffic. Many freight rail lines crisscross at the same grade as other trains and cars — a tangle that forces interminable waits. It takes an average freight train about 35 hours to crawl through the city. Shipping containers typically languish in rail yards several days before they can be loaded onto trains.Manufacturers, in turn, must stock more inventory to account for shipping delays of uncertain length, raising product costs about 1%, estimates Ken Heller, a senior vice president for DSC Logistics. Caterpillar has built two multimillion-dollar distribution centers outside the city to increase its freight volumes so it can get loading priority at rail yards......Highways, meanwhile, suffer from Congress's failure in recent years to assure long-term funding for a federal trust fund that pays for upgrades. The fund kicks in about $42 billion a year, but that goes largely to maintenance, and the fund is expected to temporarily run out of money in 2013.Among those affected is UPS. The giant courier says that if each of its 95,000 U.S. vehicles is delayed an average five minutes a day for a year — a realistic figure — it costs the company $103 million in added fuel costs, wages and lost productivity.Con-way, one of the largest trucking companies, often builds an extra day of travel into shipping schedules to ensure it meets customers' exacting just-in-time delivery demands, says Randy Mullet, head of government relations. Customers pay a premium for that.In Texas, worsening delays on Interstate 35 between San Antonio and Dallas, much of which has only two lanes each way, forces regional grocery chain H-E-B to charge about 15 cents more for a gallon of milk, says Ken Allen, a former H-E-B executive and now a consultant for the company......The nation's 600,000 bridges are also falling behind. Nearly a quarter are classified as "structurally deficient" or "functionally obsolete," according to the Federal Highway Administration. As of the end of last year, more than one in 10 were closed or had weight limits that barred trucks. For Illinois corn grower Paul Taylor, such a restriction on the Pearl Street bridge in Kirkland means he must drive three extra miles to deliver his corn to a grain elevator, raising his costs by about 5 cents a bushel.Many unrestricted bridges, meanwhile, are strained, especially at border crossings. The busiest in North America is the 83-year-old, four-lane Ambassador Bridge, the only direct link between Detroit and Canada. The bridge, already impaired by its capacity, often closes lanes for repairs and empties onto a busy city street in Windsor, Ont. Delays, typically lasting two hours, are exacerbated by a Customs checkpoint that's not large enough for the traffic volume.U.S. auto companies store extra parts at factories and closely space deliveries so that if one truck is sidetracked, another isn't far behind, says Kevin Smith, senior vice president for consulting firm Sandler & Travis. Ford Motor told a state legislative committee last fall that such maneuvers, along with extra freight expenses, add up to $800 to the cost of a vehicle.

Did the BLS Just Republish the May Jobs Report?

The BLS released the June Employment Situation Summary this morning, which showed (Establishment Survey) job creation of 80,000 and private sector payroll growth of 84,000. The April jobs number was revised down to 68,000 (from 77,000) and the May jobs number was revised up to 77,000 (from 69,000). Both the regular workweek and manufacturing workweek edged up by .1 hours for the month. The Household Survey showed an unemployment rate of 8.2% with job creation of 128,000. The labor force participation rate remained at 63.8% on a gain of 156,000 and the employment-population ratio remained at 58.6. Overall this report (when compared to recent months) was about the same, showing anemic growth (but still growth) and little change to the unemployment rate. The best news out of this report (in my opinion) was that the May number received an upward adjustment (albeit small) and that the workweek grew a bit. Other than those points, this report continued on the recent weakness in job creation we have seen since April. Read on for more analysis.

Since the seasonal adjustments have been called into question by just about everyone lately, let's take a look at the non-seasonally adjusted numbers from this report. The June Establishment Survey showed job creation (NSA) of 391,000, which means the seasonal adjustment subtracted 311,000 jobs from the NSA number. Also of note is that private sector NSA job creation for June was 815,000, while NSA government jobs posted a loss of 424,000 jobs for the month.

It is also interesting to note that in the last year the number of people 65+ who have left the labor force is 1.47 million (and yes, those people count when determining the labor force participation rate and employment-population ratio).

So, while job growth appears to have stagnated during the 2nd quarter, it also appears to have potentially stabilized at relatively low levels of job creation, hopefully allowing us to skirt another contraction in employment and potential contraction in the economy.

Since the seasonal adjustments have been called into question by just about everyone lately, let's take a look at the non-seasonally adjusted numbers from this report. The June Establishment Survey showed job creation (NSA) of 391,000, which means the seasonal adjustment subtracted 311,000 jobs from the NSA number. Also of note is that private sector NSA job creation for June was 815,000, while NSA government jobs posted a loss of 424,000 jobs for the month.

It is also interesting to note that in the last year the number of people 65+ who have left the labor force is 1.47 million (and yes, those people count when determining the labor force participation rate and employment-population ratio).

So, while job growth appears to have stagnated during the 2nd quarter, it also appears to have potentially stabilized at relatively low levels of job creation, hopefully allowing us to skirt another contraction in employment and potential contraction in the economy.

Morning Market Analysis

Both the Italian (top chart) and Spanish (bottom chart) markets have broken through resistance lines and are meandering higher. Neither rally is particularly strong; instead, prices are now caught around the 50 day EMA. However, the underlying technicals are improving; momentum is increasing as is the volume inflow. The shorter (10 and 20 day) EMAs are both moving higher, with the 10 either crossing or about to cross the 50.

The German and French markets are directly similar to the Italian and Spanish markets.

The above four charts show us that there is some buying on the European side -- but, given the overall weakness of the trends, I'd assume it's mostly technical in nature (traders buying a weak market only because it's weak).

The entire US treasury curve (short end to long end) is still at elevated levels, largely as a result of the safety bid in the market. Until we see these levels move lower, we're not going to see a meaningful rally in the markets.

Weekend Weimar, Beage and Pit Bull

First of all, below are two pictures of Lita the pit bull; they're obviously before and after . When we found her in our alley, she was about 15 pounds underweight, no hair and with some kind of infection in her eye. Now she's just a big baby; it's like having a really affectionate defensiveman from a hockey team.

And here are the other three:

And here are the other three:

Thursday, July 5, 2012

A forecast between Scylla and Charybdis

- by New Deal democrat

I really set myself up for failure in January with my forecast for this year of weakness in the first half, most likely in the first quarter and probably as bad as 2006 but not quite as bad as the recession of 2001, followed by strength in the second half. That's a really narrow passage to navigate!

A nuanced forecast like that also means I'm not being uniformly bullish or bearish, and at least when my stuff gets cross-published at places where nuance isn't exactly a prized commodity it isn't a ticket to popularity.

Initial strength has been followed by progressive weakness that started with a poor March payrolls report. Consumers whose incomes in real terms have fallen in the last two years have started to increase their savings again, meaning less consumption and a slowdown in that major component of the economy. Despite that, I'm still expecting the weakness to end this summer sometime, partly because

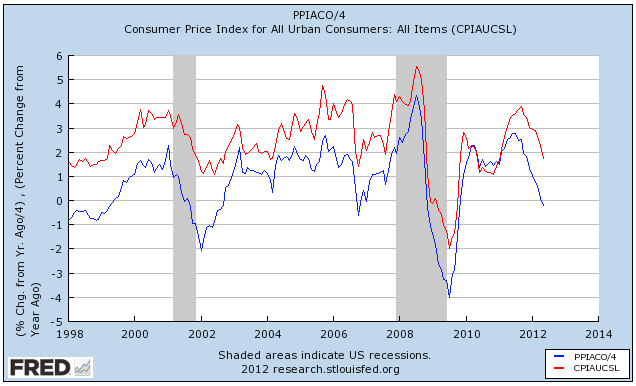

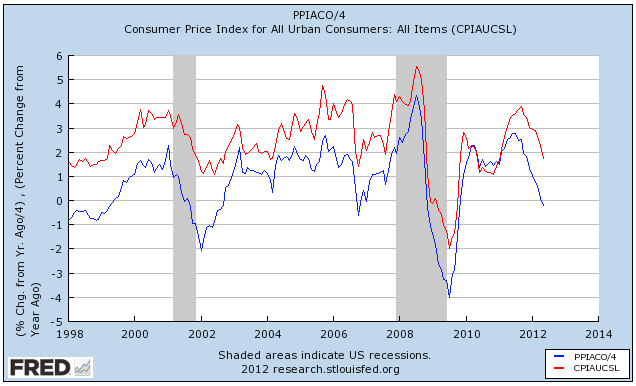

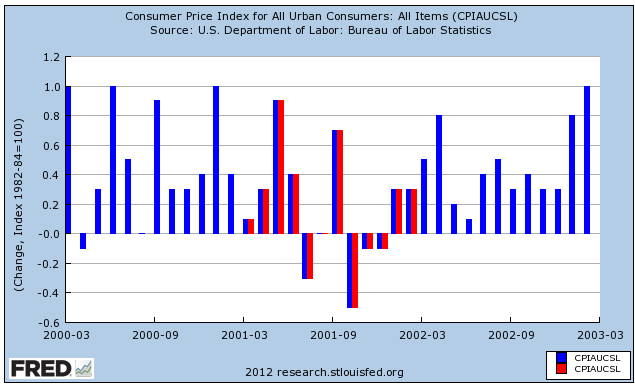

As you can see, YoY consumer and producer prices both bottomed out immediately after the bottom of both recessions - 2 months later in the first, 1 month later in 2009.

Since 11 of the 12 data points in a YoY comparison stay the same with each new month, another way to look at this comparison is to compare any given data point with the same month one year before. If the newer year is higher/lower than the same month the year before, then the YoY comparison is also higher/lower.

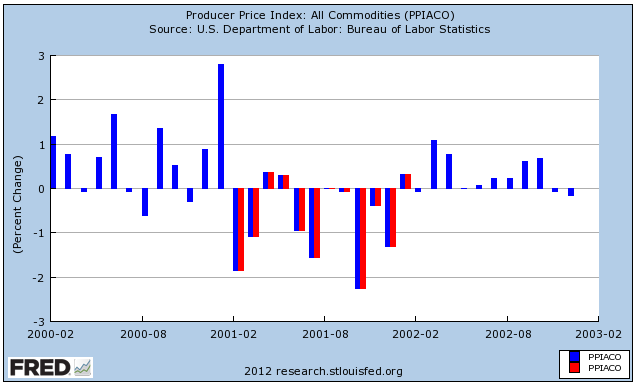

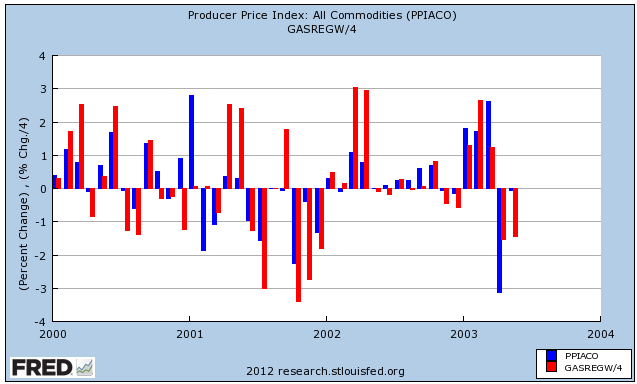

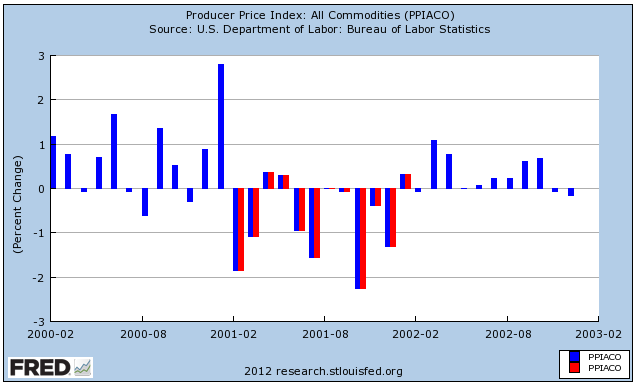

First let's do that with the 2001 recession, which ended in November 2001, and producer prices. The year during which YoY comparisons were almost uniformly weaker is shown in red. So note, for example, that the last red line (January 2002) shows less inflation than January 2001, but the next month (February 2002) shows more inflation than than February 2001.

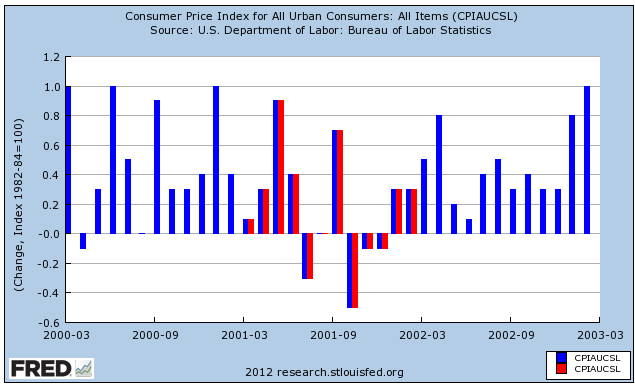

Next let's look at the 2001 recession and consumer prices. Notice that we get the same pattern:

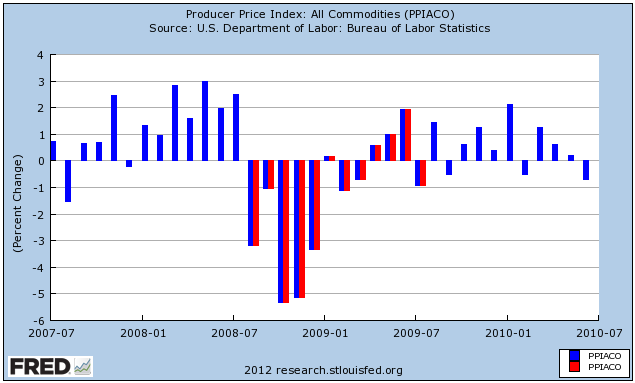

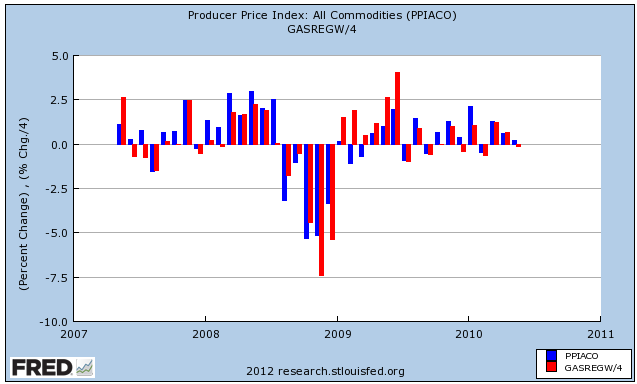

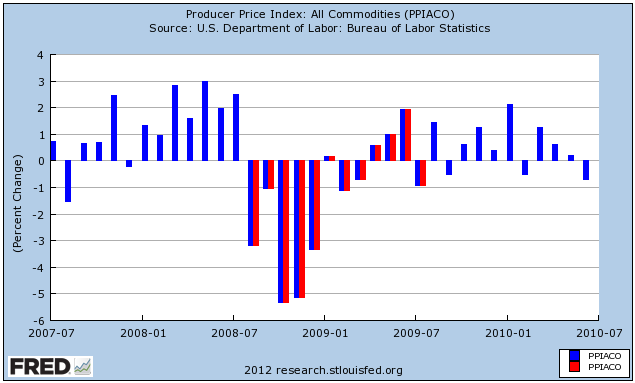

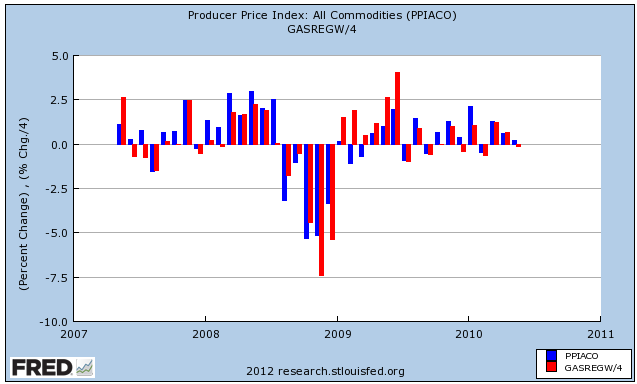

Next let's look at the 2008-09 Great Recession, and producer prices. Note the same pattern, with the last red line representing July 2009, one month after the recession, showing less inflation than July 2008. August 2009, the first blue line thereafter, shows more inflation than August 2008.

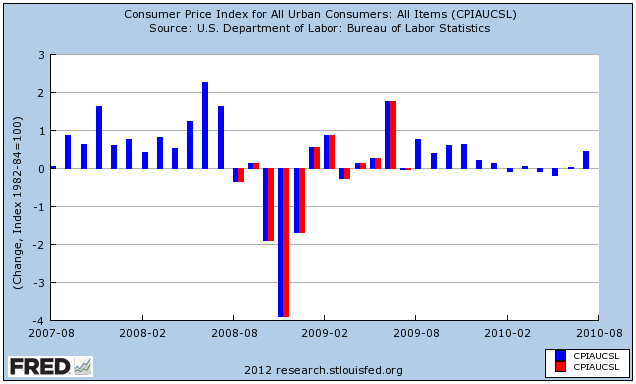

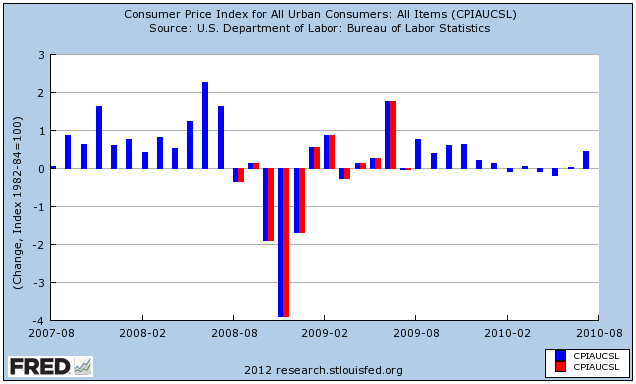

Next, here are consumer prices for the Great Recession. Again we get the same pattern:

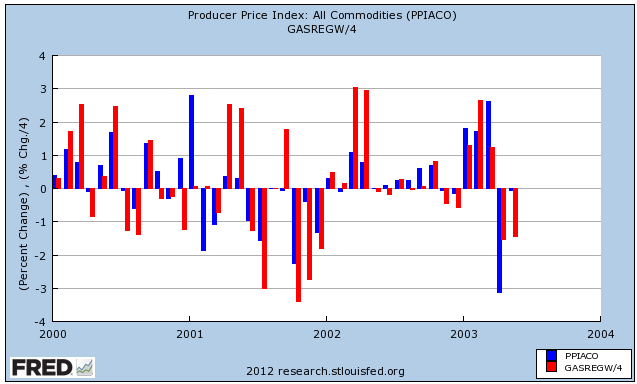

One reason I harp on gasoline prices so much is that they are the primary driver of monthly changes in both producer and consumer inflation. Here are producer prices in the early 2000s (blue) compared with the changes in gasoline prices (red) (again, I've scaled down gasoline price changes simply to better show the comparison):

Here they are for the time leading up to, during, and right after the Great Recession:

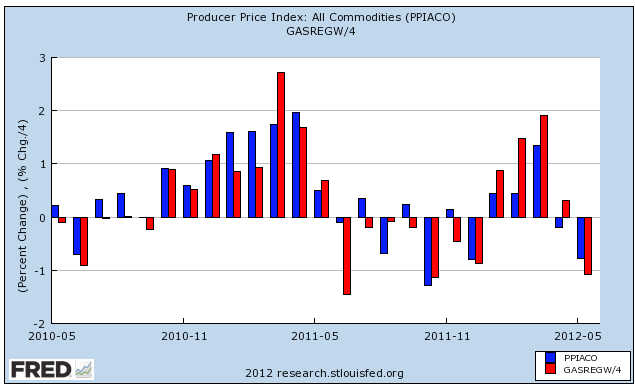

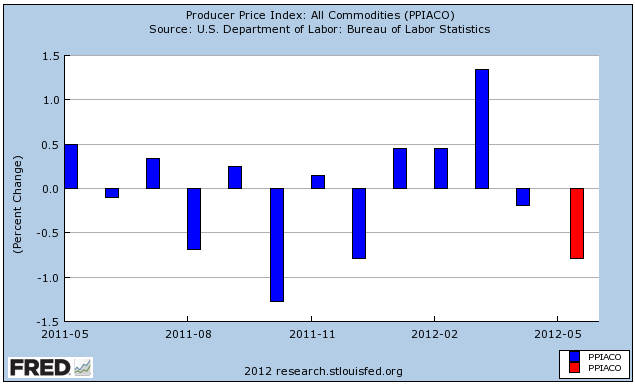

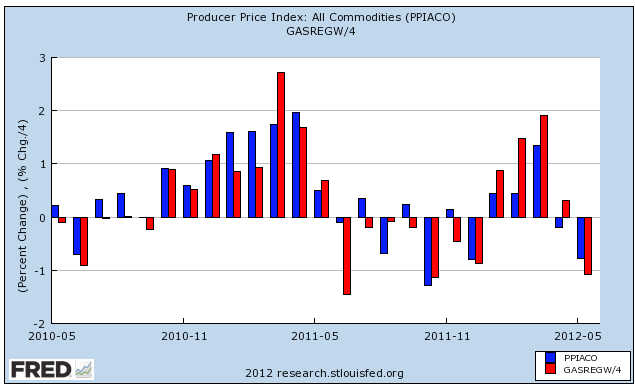

And here they are since the beginning of 2011:

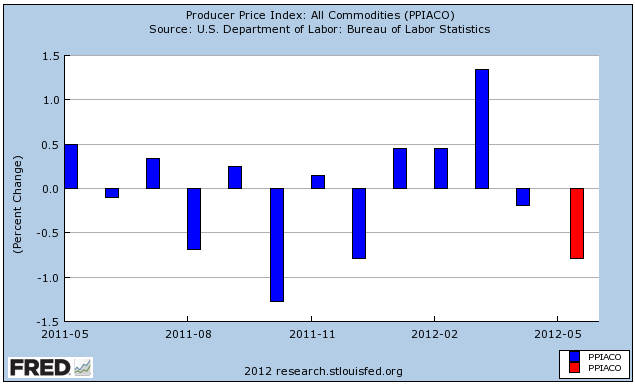

Keeping in mind that gasoline prices have been the main driver of the rate of change in inflation, here are producer prices for the last 2 years:

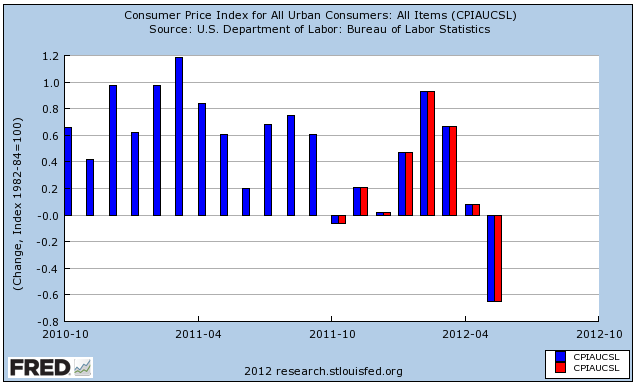

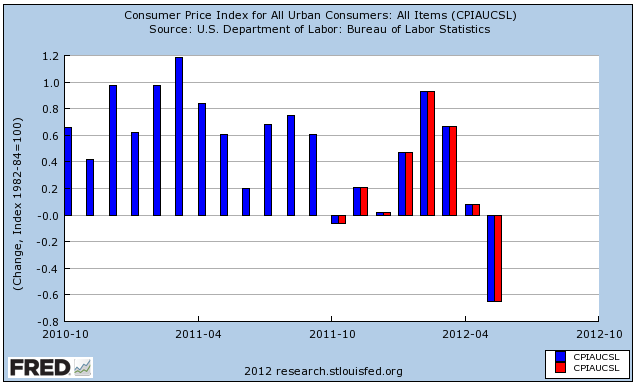

and here are consumer prices:

The red lines in both above graphs represent those months in which YoY inflation has been decreasing.

Barring a Lehman Brothers type catastrophe, I can't see deep deflation continuing for the rest of the year. That would require a decline of more than 10% further in gas prices to take us under $3.00/gallon for a national average, and that means about $60 a barrel for Oil. If that isn't going to happen, then the YoY comparison is going to start turn positive by about September, and based on past patterns that means the weakness bottoming out some time this summer, and stronger growth resuming thereafter.

I really set myself up for failure in January with my forecast for this year of weakness in the first half, most likely in the first quarter and probably as bad as 2006 but not quite as bad as the recession of 2001, followed by strength in the second half. That's a really narrow passage to navigate!

A nuanced forecast like that also means I'm not being uniformly bullish or bearish, and at least when my stuff gets cross-published at places where nuance isn't exactly a prized commodity it isn't a ticket to popularity.

Initial strength has been followed by progressive weakness that started with a poor March payrolls report. Consumers whose incomes in real terms have fallen in the last two years have started to increase their savings again, meaning less consumption and a slowdown in that major component of the economy. Despite that, I'm still expecting the weakness to end this summer sometime, partly because

- (1) the long leading indicators of housing permits and starts, interest rates, and money supply all turned positive by the second quarter of last year and have continued to be positive. By the time 18 months passes, all of those should be filtering through to improvement in the overall economy.

- (2) gasoline prices hit their seasonal peak at about the same level as last year, and have already backed off over 10%, putting more money in consumers' pockets, and

- (3) past patterns of inflation and deflation suggest that when YoY price deflation is at its worst, that is when the economy is at its slowest, improving thereafter.

As you can see, YoY consumer and producer prices both bottomed out immediately after the bottom of both recessions - 2 months later in the first, 1 month later in 2009.

Since 11 of the 12 data points in a YoY comparison stay the same with each new month, another way to look at this comparison is to compare any given data point with the same month one year before. If the newer year is higher/lower than the same month the year before, then the YoY comparison is also higher/lower.

First let's do that with the 2001 recession, which ended in November 2001, and producer prices. The year during which YoY comparisons were almost uniformly weaker is shown in red. So note, for example, that the last red line (January 2002) shows less inflation than January 2001, but the next month (February 2002) shows more inflation than than February 2001.

Next let's look at the 2001 recession and consumer prices. Notice that we get the same pattern:

Next let's look at the 2008-09 Great Recession, and producer prices. Note the same pattern, with the last red line representing July 2009, one month after the recession, showing less inflation than July 2008. August 2009, the first blue line thereafter, shows more inflation than August 2008.

Next, here are consumer prices for the Great Recession. Again we get the same pattern:

One reason I harp on gasoline prices so much is that they are the primary driver of monthly changes in both producer and consumer inflation. Here are producer prices in the early 2000s (blue) compared with the changes in gasoline prices (red) (again, I've scaled down gasoline price changes simply to better show the comparison):

Here they are for the time leading up to, during, and right after the Great Recession:

And here they are since the beginning of 2011:

Keeping in mind that gasoline prices have been the main driver of the rate of change in inflation, here are producer prices for the last 2 years:

and here are consumer prices:

The red lines in both above graphs represent those months in which YoY inflation has been decreasing.

Barring a Lehman Brothers type catastrophe, I can't see deep deflation continuing for the rest of the year. That would require a decline of more than 10% further in gas prices to take us under $3.00/gallon for a national average, and that means about $60 a barrel for Oil. If that isn't going to happen, then the YoY comparison is going to start turn positive by about September, and based on past patterns that means the weakness bottoming out some time this summer, and stronger growth resuming thereafter.

Morning Market Analysis; BRICs Signaling Turnaround?

The Brazil ETF bottomed in the second half of May and has been trading in the 50-53 price range since. However, notice the increase in both the MACD (signaling an increase in momentum) and CMF (indicating an inbound flow of money). The 10 and 20 day EMAs are now moving more sideways than down, indicating the overall trend has at least turned neutral. Prices are right below the 50 day EMA. A move through the 54 price level would signal a change of overall trend.

The Russian ETF has many of the same characteristics as the Brazilian ETF, but here prices have moved through resistance a bit above the 26 price level. In addition, the 10 day EMA has crossed above the 20 day EMA and prices are above the 50 day EMA. There is resistance at the 28 price level (from levels established in early May).

Building on the advancement of the Russian market, the Indian market is just a but further along in its rally, with prices firmly about the 50 day EMA and approaching the 200 day EMA. The shorter EMAs are now approaching the 50 day EMA. Prices are in the middle of the Fibonacci retracement levels where they typically get caught in some type of resistance.

The Chinese chart is more closely aligned with the Brazilian chart; prices here have yet to make a big break-out.

Two of the emerging economies stock markets (Russia and India) have emerged from their bottom and are now rallying higher. Two others (Brazil and China) are close to moving through resistance. This is welcome news in the overall picture.

Wednesday, July 4, 2012

My wishes for America's 236th birthday

- by New Deal democrat

Whatever its other problems, the America of my youth was exuberantly optimistic. We had it better than any generation of humanity before us ever and we knew it, we had the world by the cojones and we knew it, and the future beckoned with wonders so long as we didn't blow it up in nuclear Armageddon.

Now I see a despondent and almost fatalistic "99%" on the one side, and a bitter, surly, and xenophobic rump on the other. There is no optimism in the reactionary radicalism that has ascended to power, it is all social Darwinism in a nasty and brutish war of all against all. There is really no more pretense that continuation down the ideological path we have trod these last 30 years will improve the lot of most people; rather, there is only the brute assertion that the masses are moochers who deserve their fate.

But I can dream, and here are the birthday wishes I would like to see come true for America on its 236th anniversary:

1. Infrastructure spending to replace our crumbling roads, bridges, water and sewer systems.

2. A new WPA to labor at all the government tasks that have been cut, until such time as unemployment drops to 6%.

3. The reinstatement of Glass-Steagall to separate investment banking from FDIC insured banking, and the breaking up of any remaining financial institutions which are "too big to fail."

4. The reinstatement of state usury laws. If for example a Delaware based company wants to offer credit to someone in Nebraska, they should have to abide by Nebraska's usury limits. Five years ago I used to get pushback on the theory of individual responsibility. That didn't exactly work out in the housing bubble, did it? Were only the spendthrifts laid off in the recession? Too much individual debt in the aggregate destroys the innocent and the spendthrift alike.

5. The conviction and imprisonment of the financial wrongdoers, no matter how high and mighty.

6. Repeal of the Bankruptcy "Reform" Act's ridiculous privileging of student loans.

7. Limitation of the Senate filibuster. If the old men want to filibuster, then they should actually have to stay up day and night to do so. Kibuki filibusters should be abolished, and other filibustering too except perhaps for a small number per session or perhaps limited to Supreme Court nominees with their lifetime appointments.

8. The reversal of Citizens United and its corporate corruption of the political process,

9. Replacement of part of the income tax with a revenue neutral Value Added Tax or similar, which would prevent the capture of all the profits gleaned from lower labor costs in the developing world by the uppermost corporate management and large shareholders, and instead give the US Treasury the means to ameliorate the costs of labor arbitrage to the benefit of average workers.

10. A law prohibiting states from offering tax incentives and abatements to out-of-state firms to relocate businesses. This is almost identical to one of the vices in the Articles of Confederation that led to the calling of a Constitutional Convention (European sovereigns were playing the 13 states off against one another for commercial treaties). Similarly, a phasing out of tax incentives that can be offered to sports franchises, in order to end the blackmailing of cities. Both of these are needed to stop the race to the bottom.

11. The prohibition of gerrymandering, whereby officeholders choose their constituents. Either an independent commission must be entrusted with the task, or else state and federal electoral districts must conform as closely as possible to pre-existing county and municipal boundaries.

12. A countercyclical balanced budget amendment, that would mandate surpluses in good times and deficit spending in recessions, enforced against the Congress by either the Courts or better yet, the States.

I'm sure there are a host of other festering excesses that I have missed. In the meantime, here is an American Tune for our time:

Tuesday, July 3, 2012

Bonddad Linkfest

- Feeling the heat (WaPo)

- France needs unprecedented spending cuts (FT)

- Turkey looks to have a soft landing (FT)

- Poland defies EU slowdown (FT)

- USDA downgrades corn crop (Agrimoney)

- Are we seeing the top in the corn markets (Agweb)

- RBA's interest rate decision (RBA)

- French manufacturing weak (Markit)

- UK manufacturing subdued (Markit)

If a Republican Congress had passed the ACA, and a Republican president had signed it, how would the SCOTUS have voted?

- by New Deal democrat

After all, Obamacare is similar to Romneycare, which in turn is based on a Heritage Foundation plan.

If you don't think the vote would have been the same, then it must be true that at least some Justices voted for purely partisan reasons.

h/t DougJ at Balloon Juice

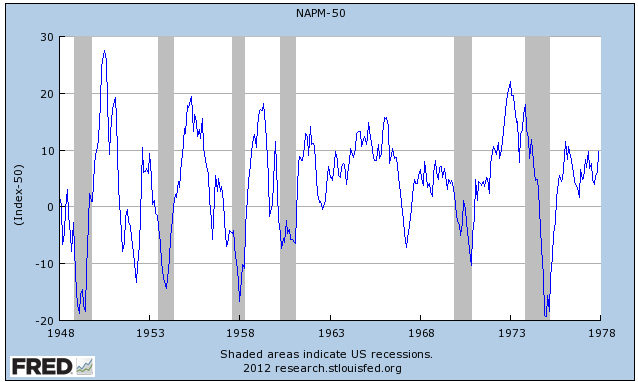

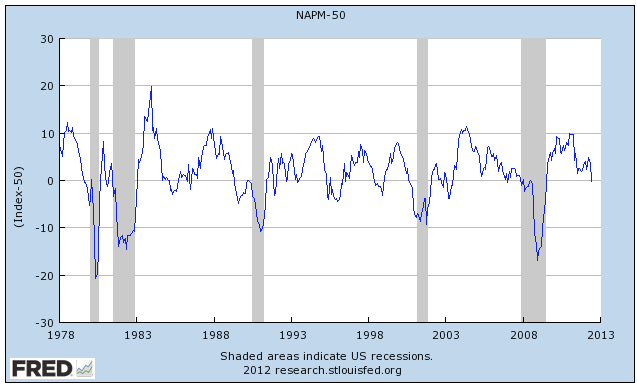

ISM manufacturing contraction and recessions

- by New Deal democrat

The June ISM manufacturing report yesterday was a stinker, there's no sugar-coating it. The contraction in the New Orders sub-index will cause a significant downdraft in the Conference Board's June Index of Leading Indicators.

But does a contracting ISM report mean recession now, or later in the year? The answer to the first question is almost certainly not, and as to the second, the answer is more likely not, although the odds based on past data approach 50/50.

Since the record started in 1948, the report has declined from over to under 50 a total of 32 times. Of those times, 11 were associated with the onset of recession and 3 more occurred during a recession after a brief period above 50. That means the ISM manufacturing index has slipped under 50 a total of 18 times when no recession followed, meaning that a one month contraction in the index was associated with no recession a little more than 50% of the time.

Here is the graph of the ISM index, subtracting 50 so that a positive number means expansion and a negative number, contraction, first from 1948 through 1977:

And here is from 1978 to the present:

There have been many false contractionary readings, notably in the 1950s, 1960s, early 1980s, 1990s, and 2003.

Further, even in those cases where the ISM manufacturing index was associated with the onset of recession, the median lead time was 5 months. The mean lead time was 4 months. Only 4 times was the turn coincident with or after the onset of recession. In other words, while the negative number is of considerable concern as to later in the year, almost certainly it does not mean that a recession already began by the end of the first half of the year.

P.S.: Today vehicle sales for June will be reported. Don't be fooled by YoY comparisons. Total sales, seasonally adjusted, are expected to come in under 14 million. If that's the case, it's bad news since from January through April, the SAAR was over 14 million. If it's under last month's 13.7 rate, meaning it is the worst number of this year, it should be seen as being as bad as yesterday's ISM report.

UPDATE: New vehicle sales for June were reported at a 14.08 million rate. That's still below the first four months of this year, but comfortably above May. Not great, but not bad.

Grain Prices Are No Longer Contained

Over the last few weeks, we've gotten reports that drought and high temperatures are hurting the current grain crop. As a result, we're seeing price spikes across the grains complex. Corn (top chart) has moved through the 6.80 level and now has a lot of open real estate before it hits yearly highs. Soy beans (middle chart) are now at yearly highs, while wheat (bottom chart) has broken through the 7.00/7.20 level.

Morning Market Analysis

After the strong performance on Friday, we need to look and see if there is any follow-through. On that front, there is good and bad news. The good news is the Russell 2000 (IWM) rallied beyond resistance. As this is the higher risk area of the equity market, this move is bullish. However, we didn't see any follow-through on the other markets, which is not good. Ideally, we need to see the QQQs and/or the SPYs make a move higher in conjunction with the IWMs.

All told, the above charts don't bode well for a lot of follow-through in the broader market.

Monday, July 2, 2012

Bonddad Linkfest

- Drop in US corn crop health has further to go (Agrimoney)

- Corn prices could test record highs (Agrimoney)

- Drought behind 50 cent price jump (Agweb)

- Bond yields are still at or near record lows (BB)

- EU unemployment increases to 11.1% (BB)

- Chinese manufacturing indexes drop on EU and US weakness (BB)

- HSBC's Chinese manufacturing index (Markit)

- EU manufacturing shows continued weakness (Markit)

It's a Small World After All

Over the last few weeks, I've noted the overall global slowdown (see here and here). Today's ISM report -- which shows the first manufacturing contraction since 2009 -- highlights this trend. Consider the following anecdotal comments:

In short, other economies are slowing, which is now bleeding into the US economy.

The latest news from both China and the EU is not encouraging.

- "Business is still strong, with some nagging question whether it will be sustained." (Machinery)

- "The economy and general business seem to be getting better even though recent data say otherwise." (Fabricated Metal Products)

- "Significant raw materials price correction underway." (Plastics & Rubber Products)

- "Local labor market shows no signs of slowing down. Competition for technical services/skilled craft remains tight." (Petroleum & Coal Products)

- "Overall demand signals from sales forecast are trending down in all regions." (Computer & Electronic Products)

- "Although our shipments are up year over year and from prior month, we can feel some head winds, especially from Europe. We are watching our expenses very tightly and being cautious." (Apparel, Leather & Allied Products)

- "Business continues to exceed forecast in all markets." (Primary Metals)

- "Economy seems to be slowing slightly due to concerns in Europe; however, production has not changed a great deal." (Transportation Equipment)

- "Business has started to show signs of slowing." (Furniture & Related Products)

- "Slowing world economies, particularly China, are reducing 3Q and later orders and drastically dropping some raw material prices." (Chemical Products)

In short, other economies are slowing, which is now bleeding into the US economy.

Is Housing the Stealth Story of 2012?

Ever since I've been blogging, housing has been a troubled market. I started blogging in mid-2004, and started in earnest in 2005. Sometime after that, I realized that housing was in a bubble -- not because of prices but because of the enormous amount of mortgage debt that was flooding the US economy. Then we had the bubble followed by the crash. So, for the last 6-7 years, housing has been a disaster.

However, there are more and more signs that it is changing. I originally put this idea together in the post, Will Housing Save Us? where I argued that housing had spent the last three years correcting from the bubble and, as such, it was time to revert to the norm. NDD also posted a great series of articles in response to Barry Ritholtz's bearish housing analysis here, here, here and here.

Now, consider the following:

From the latest new home sales report:

First, national inventory figures are far more normal now:

As this chart from Calculated Risk shows, total inventory is now at the upper levels of the pre-bubble levels. In addition, we're starting to see that real estate markets from across the country are starting to heat up. As the blog Carpe Diem has noted, Double-Digit Gains in Sales and/or Prices Have Now Been Reported in 33 Metro or State Markets in June. Granted, these advances are from low levels. But, they are advances across a broad swath of cities. He added an additional seven more news stories to the previous total in this post. Also note this story: Builder Confidence Reaches 5-Year High in June; Framing Lumber Prices Are Back to 2006 Levels.

Also consider this post:

However, there are more and more signs that it is changing. I originally put this idea together in the post, Will Housing Save Us? where I argued that housing had spent the last three years correcting from the bubble and, as such, it was time to revert to the norm. NDD also posted a great series of articles in response to Barry Ritholtz's bearish housing analysis here, here, here and here.

Now, consider the following:

From the latest new home sales report:

There are broad-based shortages of inventory in the lower price ranges in much of the country except the Northeast, and in the West supply is extremely tight in all price ranges except for the upper end. "Realtors® in Western states have been calling for an expedited process to get additional foreclosed properties onto the market because they have more buyers than available property," Yun added. Widespread inventory shortages also are found in much of Florida.Let's take this information with a grain of salt, largely because NAR economists aren't known for presenting information in a non-biased manner. The above information is consistent with the following pieces of information.

First, national inventory figures are far more normal now:

As this chart from Calculated Risk shows, total inventory is now at the upper levels of the pre-bubble levels. In addition, we're starting to see that real estate markets from across the country are starting to heat up. As the blog Carpe Diem has noted, Double-Digit Gains in Sales and/or Prices Have Now Been Reported in 33 Metro or State Markets in June. Granted, these advances are from low levels. But, they are advances across a broad swath of cities. He added an additional seven more news stories to the previous total in this post. Also note this story: Builder Confidence Reaches 5-Year High in June; Framing Lumber Prices Are Back to 2006 Levels.

Also consider this post:

"For the fourth month in a row, the RE/MAX National Housing Report is showing an increasing Median Home Price. In May, home prices were 6.1% higher than those in May 2011. Home sales also rose above the mark set last year by a significant 12. 8%. With 42 surveyed metros showing increases in BOTH sales and prices, the recovery of 2012 appears to be taking hold in all regions of the country. For 11 months in a row, home sales have exceeded the level of the same month a year ago. Inventory continues to fall significantly lower than the previous year, with a 26.6% drop from May 2011. The related Months Supply and Days on Market figures are also trending lower."And then we have this post from the Washington Post's Wok Blog:

The housing market was the first domino to fall in the financial crisis, and it’s been one of the last to recover. But there are a few signs that things may finally be starting to look up, as home sales and housing prices have been creeping upward.It's odd using the term "housing" and "recovery" in the same sentence. I think the extended bearish nature of the market is what is leading some observers to doubt the possibility of a recovery this time around. And, as in all things, skepticism can help to clarify arguments. However, there are more and more signs that housing could be the stealth story of the year.

First, there’s been a consistent rise in the price of distressed homes since the end of 2011. “That’s something we haven’t seen before,” economist Jared Bernstein points out. “If it sticks, it obviously provides support to overall home prices.”

.....

Housing sales have also been recovering, albeit less steadily, as JPMorgan’s Michael Feroli points out in a research note this week. “The gain in pending home sales occurred in all four regions of the country, and the region with the biggest increase — the West, up 14.5% — was the region that had the biggest tumble back in April,” he wrote.

It's Not Often You Beat A Nobel Prize Winner to the Punch

Yesterday, Professor Krugman had a post up on his blog on the Baltic economies where he noted that their GDP and unemployment rates were, shall we say, less than the stellar performance promoted by the fans of austerity.

I made the same observations a few weeks ago, where I noted that the US economy -- where we engaged in stimulus spending -- was actually performing far better than the Baltics.

This is probably the only time in my life where I'll publish an observation before a Noble Price winner, so I'll take the credit.

I made the same observations a few weeks ago, where I noted that the US economy -- where we engaged in stimulus spending -- was actually performing far better than the Baltics.

This is probably the only time in my life where I'll publish an observation before a Noble Price winner, so I'll take the credit.

Morning Market Analysis

The big news last week was the EU deal on Friday. This had a profound impact on some markets as shown by the following charts

The top chart -- the 60 minute SPY chart -- shows that prices were in a roughly 130-133.5 price range for most of the last month. However, on Friday, prices jumped sharply higher, hitting levels last established in mid-late May. The daily chart shows this in more detail. On that chart, prices hovered about the 200 day EMA for most of June -- where they were also entangled with the EMAs. However, prices gapped higher on Friday in reaction to the EU deal.

While treasury prices did drop, they are still in a tight range at the top of a rally. Prices for the IEFs need to move below the 107.5 level before we can say there has been a change in this market.

Oil was also another big winner. Prices had coalesced around the 77.5-80 price level. On Friday, prices moved through the 10 and 20 day EMA and settled in range seen in early June.

The euro jumped sharply, rising to the 61.8% Fib level from the May-June decline. Prices have also moved thought the 10 and 20 day EMAs and are now right below the 50 day EMA.

All of the above moves are one day events; so, don't read too much into them. At the same time, technical trends change as a result of fundamental change. Friday may prove to be important in that area; we'll have to wait and see.

The top chart -- the 60 minute SPY chart -- shows that prices were in a roughly 130-133.5 price range for most of the last month. However, on Friday, prices jumped sharply higher, hitting levels last established in mid-late May. The daily chart shows this in more detail. On that chart, prices hovered about the 200 day EMA for most of June -- where they were also entangled with the EMAs. However, prices gapped higher on Friday in reaction to the EU deal.

While treasury prices did drop, they are still in a tight range at the top of a rally. Prices for the IEFs need to move below the 107.5 level before we can say there has been a change in this market.

Oil was also another big winner. Prices had coalesced around the 77.5-80 price level. On Friday, prices moved through the 10 and 20 day EMA and settled in range seen in early June.

The euro jumped sharply, rising to the 61.8% Fib level from the May-June decline. Prices have also moved thought the 10 and 20 day EMAs and are now right below the 50 day EMA.

All of the above moves are one day events; so, don't read too much into them. At the same time, technical trends change as a result of fundamental change. Friday may prove to be important in that area; we'll have to wait and see.