- by New Deal democratIn

both the

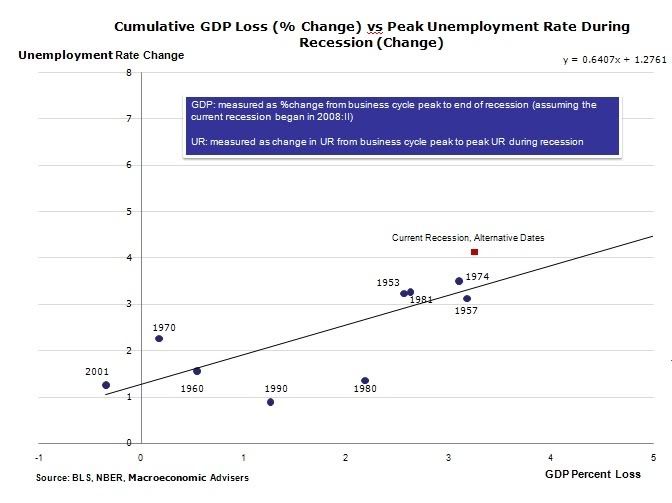

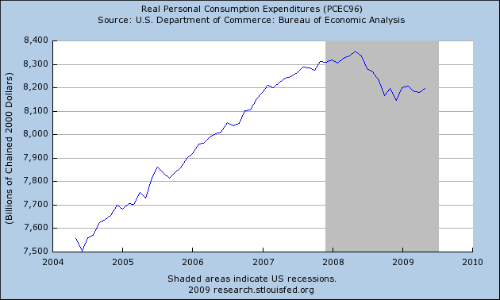

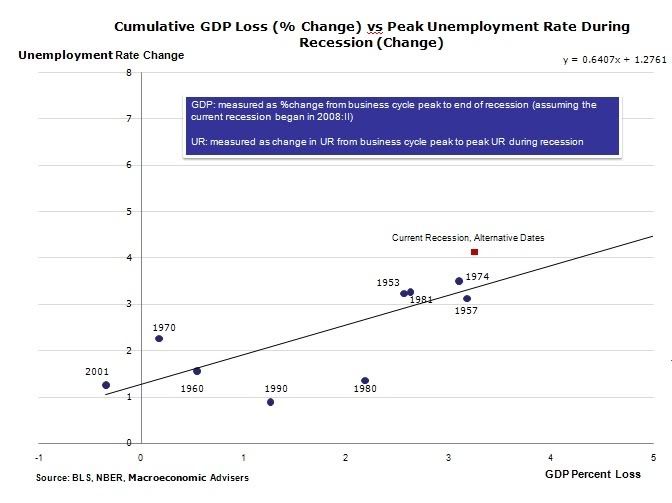

academic and political blogospheres, there are parallel but different discussions going on about the same point: this recession is far more severe in terms of unemployment than the 2.3% loss of GDP from peak would predict. Instead of only an increase of 4.6% in unemployment from its best levels of a few years ago, instead unemployment has increased to near 10%. This violates something academic economist's call "Okun's law":

Here is the gist: if GDP (production and incomes, that is) rises or falls two percent due to the business cycle, the unemployment rate will rise or fall by one percent. The magnitude of swings in unemployment will always be half or nearly half the magnitude of swings in GDP

Thus, in a recession this rule of thumb says thaat the % of jobs lost will approximately equal 1/2 of the GDP loss. In December 2007 when this recession began, the unemployment rate was 4.9%. We have lost ~2.8% of GDP. Thus "Okun's law" says our unemployment rate should now be about 6.3! Instead, at 9.5% and counting, the unempoyment rate during our recession is increasing nearly

four times the predicted rate, as almost 8 million jobs have been lost in the last year and 7 months.

A graph illustrating this point, has appeared frequently in the blogosphere, and is not a stranger to this blog:

In this essay I will posit that it is not the job losses during this recession that are special. Rather, the dramatic increase in unemployment during this recession is an ongoing phenomenon that has been occuring for going on 15 years -- a trend of employment that comes nowhere near its long term average vis a vis GDP growth.

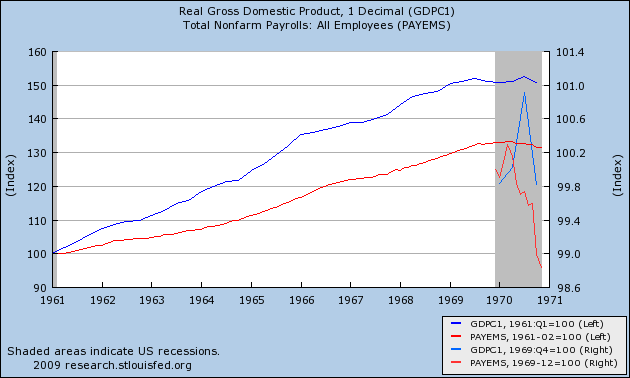

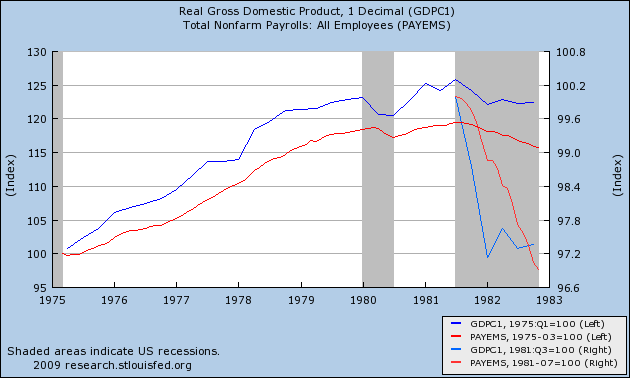

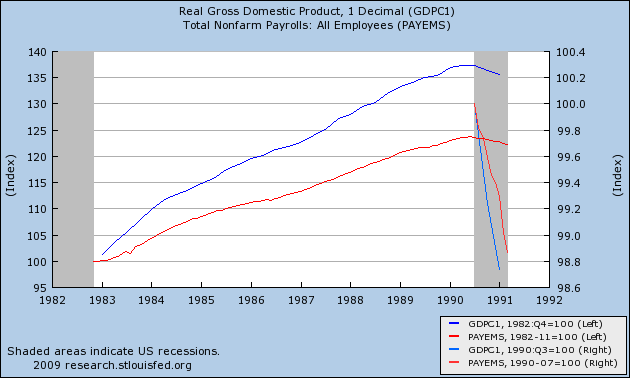

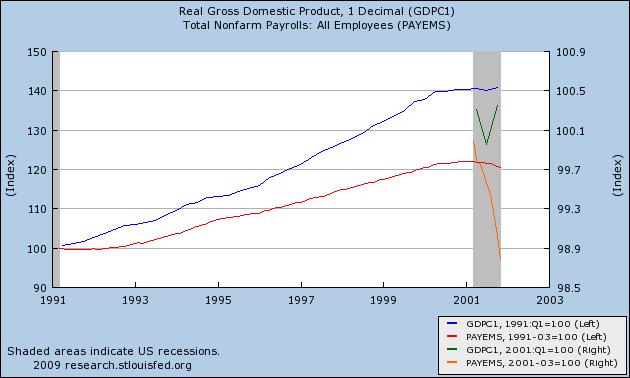

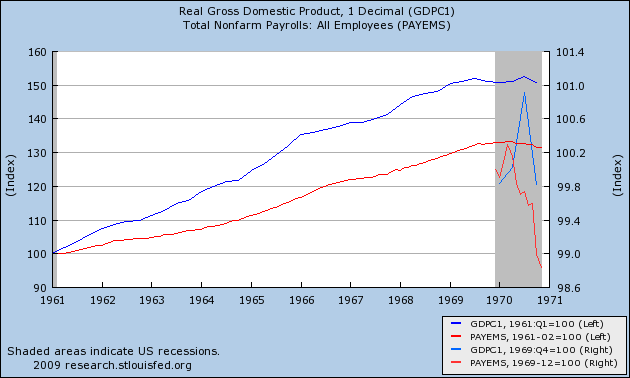

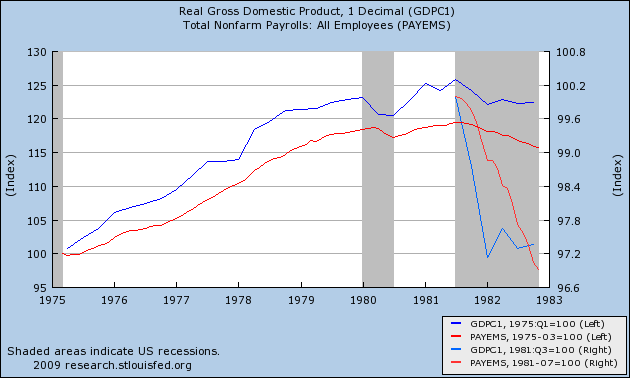

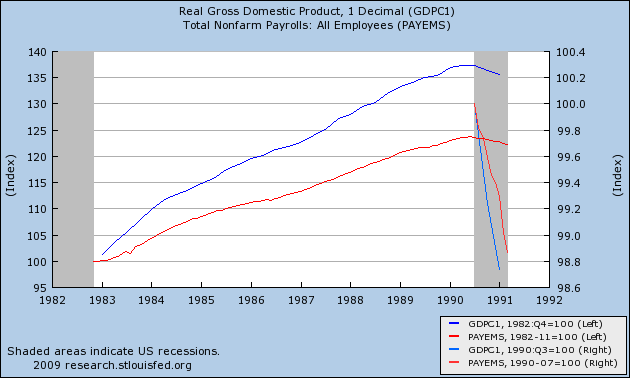

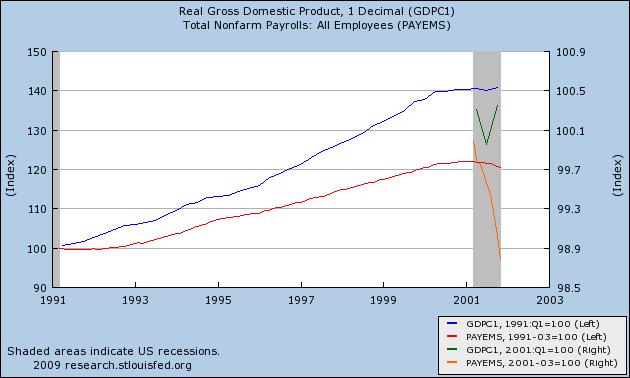

In order to show you how a structurally worse unemployment picture has been built into the structural economy, let me show you a series of graphs of unemployment growth vs. GDP growth covering all of the economic expansions and recessions for the last 50 years. (Note: In all of the graphs below, GDP is in blue, employment gains/losses in red. The longer lines measure the entire cycle from start of expansion to bottom of next recession. The lines at the right measure only the declines during the recession).

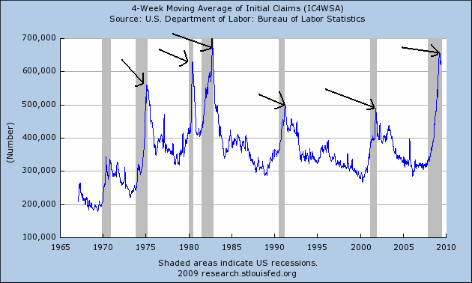

The 1960s were truly the halcyon era of American economic dominance. GDP grew on average about 4.75% a year for the entire decade, and employment by a terrific 3.5% a year. When the 1970 recession hit, it caused a mere 1% decline in GDP and a 1.5% decline in employment.

After the 1974 Oil shock, the economy still grew at a "subpar" 3% a year, with 2% annual employment gains. In the severe 1981-82 recession, GDP fell 2.8% in only 6 months before stabilizing, while employment dropped about the same percent, half of it during the initial 6 month burst.

In the 1980s, the economy again grew at a robust 4% a year, while employment grew by 2.75% a year. The mild 1990 recession knocked about 1.5% off GDP and a smaller percent off employment.

In the 1990s, the economy again grew at a robust 3.5% a year, while employment grew by 2%. Note that this rate, with employment growth only slightly over half of GDP growth, is the weakest so far. But then, things began to really change. The 2001 recession lopped off a paltry 0.4% of GDP, while employment lost 1.2%

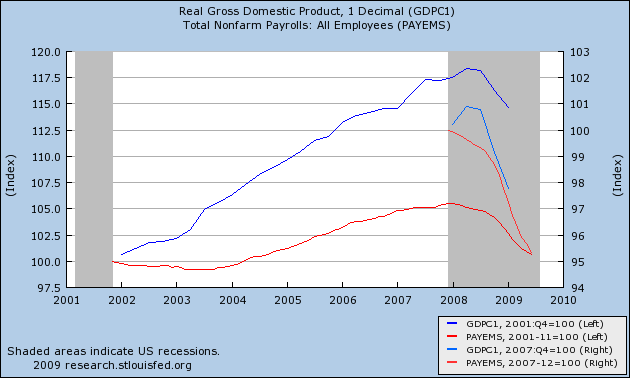

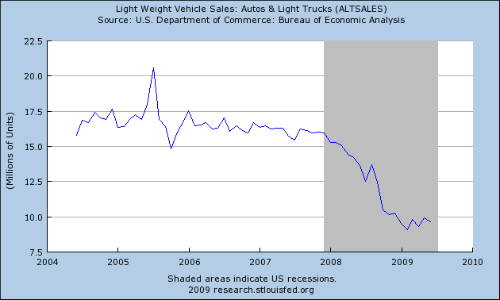

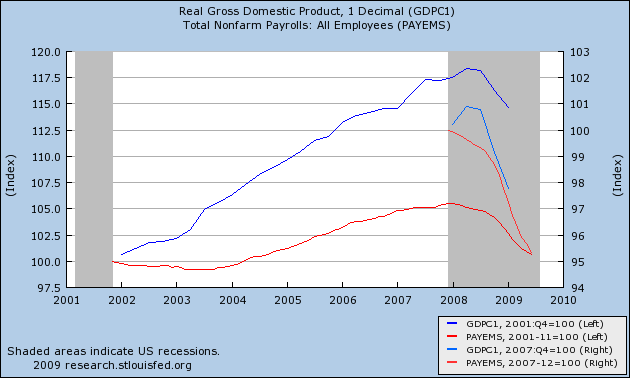

In our own decade, it is clear that something has been different. While the economy as a whole grew by about 2.8% a year during the poor Bush "expansion", employment grew by a paltry 1% a year. When the recession hit, the trend of subpar employment as compared with GDP simply continued. GDP has shrunk some 2.3% from the top, while employment has plummeted by nearly 5%.

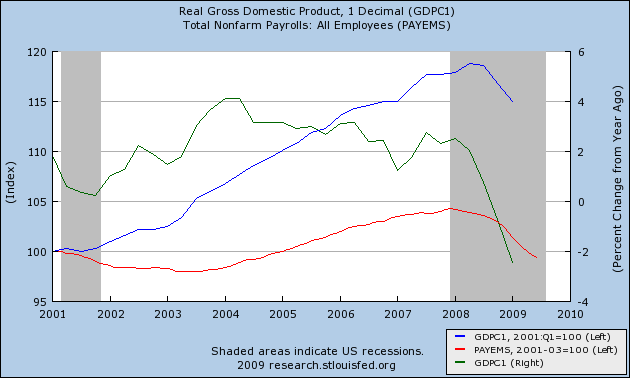

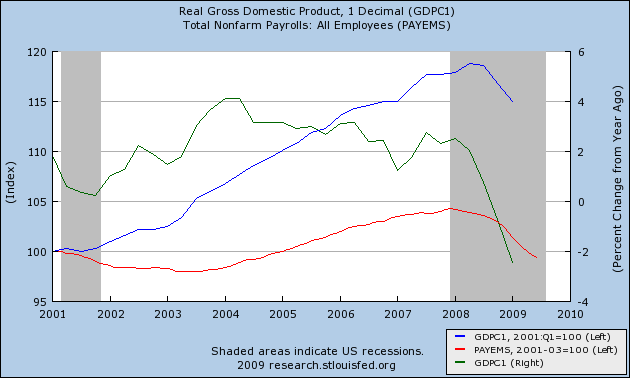

In other words, the steep job losses during this recession should not be looked at in isolation. They are the continuation and intensification of a trend that began in the 1990s, and really took off with the 2001 recession. The trend is that of subpar job growth during economic expansion, and intensified job losses during recessions. Here is a graph starting from January 2001 showing that there has been ZERO job growth in the face of 15% GDP growth even at this point in the "Great Recession". This graph also shows, in green, yearly GDP growth. Note that only in those periods of GDP growth over 2% a year in the last decade, have any jobs been added. It appears that something is happening, something that failed to generate a single American job unless there was at least 2% GDP growth.

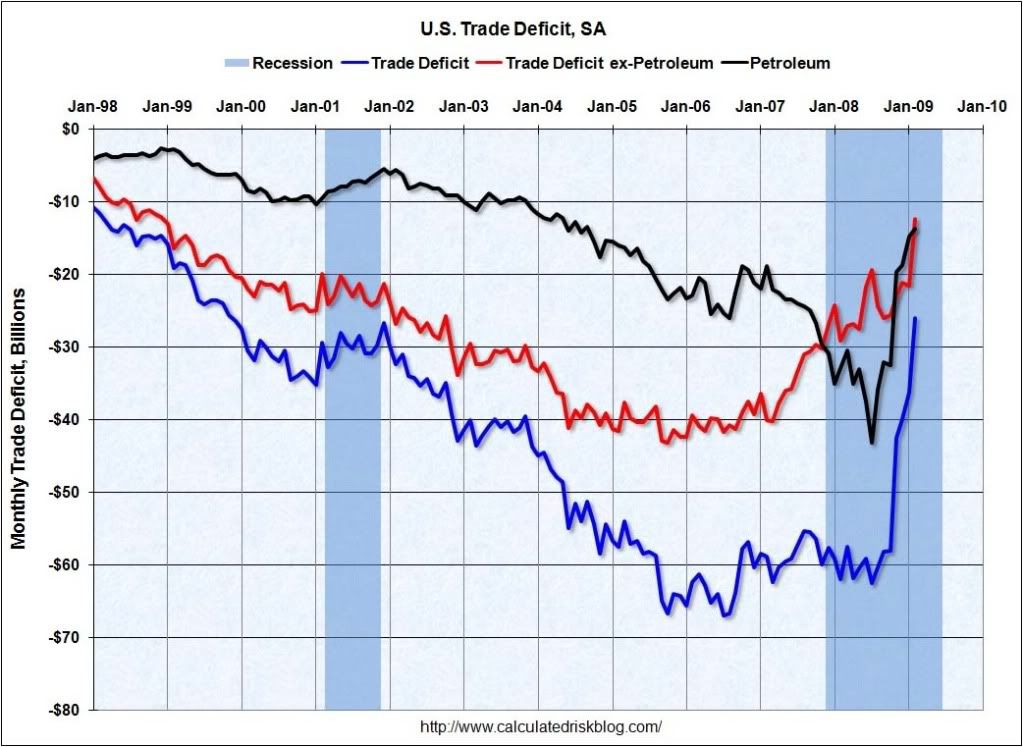

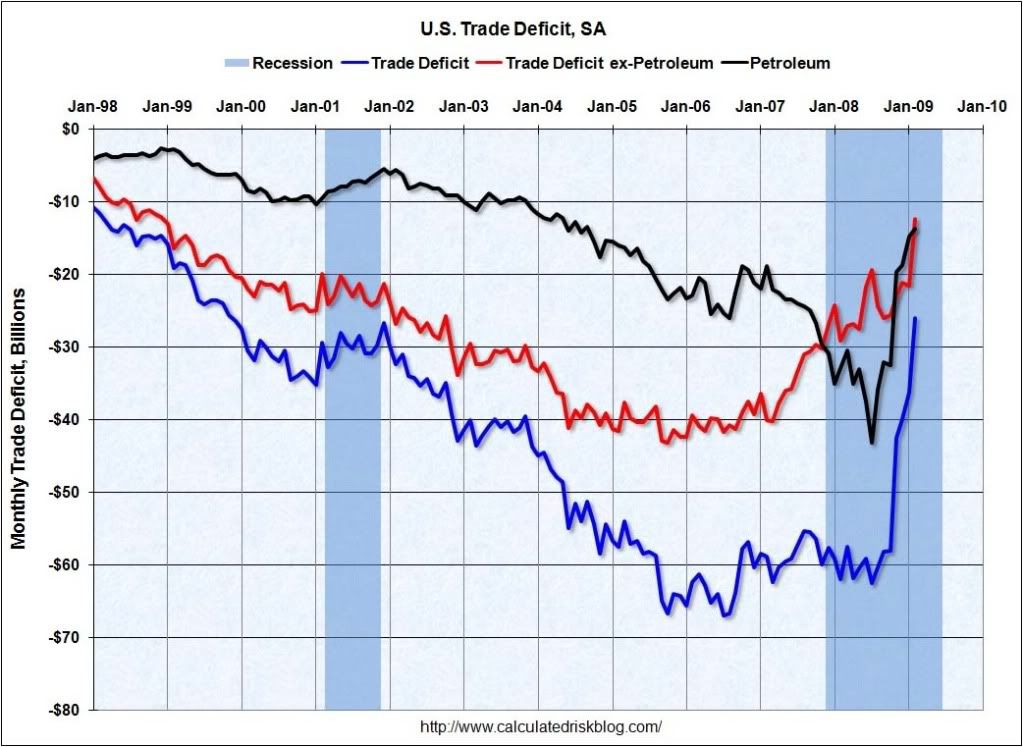

So, what started happening during the 1990s expansion, that accelerated dramatically in the 2000s? There is a candidate the graph for which seems to be a near perfect match. This is a graph of the US trade deficit, current through February 2009 (h/t

Calculated Risk):

Between 1969 and the mid 1990s, the US ran a consistent trade deficit, but in the mid 1990s, the trade deficit really took off, growing from -$10 billion a year to -$65 billion a year at its height. This is almost a perfect match for our GDP and employment data above. It appears that as corporations offshored more and more factory and back office work to China and the rest of Asia, consumer inflation was held in check, but consumers in the aggregate did not have the jobs to pay for the cheap goods which were supposed to be the payoff. Instead, as we all know, American consumers took advantage of easy credit to go deeper and deeper into debt. This cycle required the generation 2% of GDP growth a year before a single net American job was produced.

In short, the employment losses during this recession are not special. Rather, they are the continuation of a trend caused by the ongoing, chronic trade deficit, most particularly the offshoring of employment.

You may astutely notice, however, that since mid 2008, the trade deficit has plummeted, the most recent reading of -$26 billion being only about 40% of the deficit of several years ago. If I am right, that the culprit is offshoring, then we ought to be moving to a more normal relationship between employment and GDP growth and loss. And indeed, in his most recent installment discussing the issue academically,

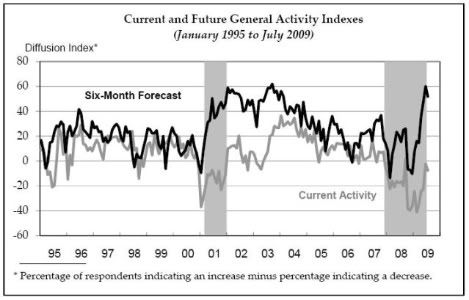

David Altig of the Atlanta Fed notes that if we start the data after the 2nd quarter of 2008, when GDP peaked -- and coincidentally when the trade deficit began to narrow -- the job losses during this recession, while still slightly high, much more closely fit the rule of thumb of "Okun's law":

Should GDP turn positive in the next few months, a test of this hypothesis will be to watch how GDP growth translates into the trade deficit. Has there been an actual change in the structural nature of the trade deficit, so that there will be relatively more robust job growth? Or will the trade deficit increase again, and a "jobless recovery" once again be in store?

higher prices.

higher prices.