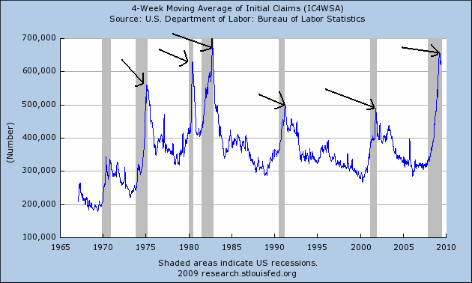

| Year | High | 2009 equiv. | end | 2009 equiv. | % off High |

|---|---|---|---|---|---|

| 1970 | 336 | 504 | 325 | 488 | (-3%) |

| 1974 | 561 | 800 | 547 | 782 | (-2.3%) |

| 1980 | 629 | 840 | 559 | 728 | (-11%) |

| 1982 | 695 | 860 | 612 | 757 | (-12%) |

| 1991 | 501 | 602 | 501 | 602 | 0% |

| 2001 | 489 | 525 | 447 | 480 | (-3%) |

| 2009 | 659? | 659? | ? | ? | ? |

This chart better shows the triangle consolidation pattern that is forming at the top of the rally. Also note that prices are barely hanging on to the upward sloping trend line. In addition, on the daily chart notice the MACD and RSI are moving lower. This chart tells us prices are really thinking about moving lower.

This chart better shows the triangle consolidation pattern that is forming at the top of the rally. Also note that prices are barely hanging on to the upward sloping trend line. In addition, on the daily chart notice the MACD and RSI are moving lower. This chart tells us prices are really thinking about moving lower.

The NMI (Non-Manufacturing Index) registered 47 percent in June, 3 percentage points higher than the 44 percent registered in May, indicating contraction in the non-manufacturing sector for the ninth consecutive month, but at a slower rate. The Non-Manufacturing Business Activity Index increased 7.4 percentage points to 49.8 percent. The New Orders Index increased 4.2 percentage points to 48.6 percent, and the Employment Index increased 4.4 percentage points to 43.4 percent. The Prices Index increased 6.8 percentage points to 53.7 percent in June, indicating an increase in prices paid from May. This is the first time the index has registered above 50 percent since October 2008. According to the NMI, six non-manufacturing industries reported growth in June. Respondents' comments continue to be mixed and tend to be industry- and company-specific about business conditions."

- "Business has improved and holding steady." (Arts, Entertainment & Recreation)

- "Activity level is flat. Clients are delaying capital spending decisions." (Professional, Scientific & Technical Services)

- "Economy may be stabilizing. Second half looks more positive than first half." (Information)

- "Have begun spending government stimulus funding, and expect conditions to gradually improve in the near future." (Public Administration)

- "Occupancy levels continue to increase at a slow pace." (Accommodation & Food Services)

- "Activity is still slow and little has changed since last month." (Wholesale Trade)

The shorter end of the curve is (so far) consolidating gains below the the 50 day EMA. But like the TLTs, prices are getting squeezed between the shorter and longer EMAs, indicating something will have to give soon.

The shorter end of the curve is (so far) consolidating gains below the the 50 day EMA. But like the TLTs, prices are getting squeezed between the shorter and longer EMAs, indicating something will have to give soon.