The markets close in 10 minutes. It was a good day. I'll review the week tomorrow.

For now -- go do something else.

Merrill Lynch (MER - Cramer's Take - Stockpickr - Rating) said third-quarter profits will be wiped out by a huge writedown tied to this summer's credit crunch.

The New York-based brokerage firm said it expects to lose 50 cents a share for the quarter, reversing the year-ago $2-a-share profit and falling well short of analysts' $1.24-a-share profit forecast.

Merrill will take $4.5 billion in writedowns on its holdings of collateralized debt obligations and subprime mortgages. It will also write off $967 million worth of leveraged lending commitments.

Washington Mutual Inc. said Friday that the weak housing market and the recent mortgage crunch will lead to a 75 percent drop in its third-quarter net income, making it the latest financial institution to warn investors it took a major hit over the summer.

WaMu, the nation's largest savings bank, reported net income of $748 million in the third quarter of 2006, meaning third-quarter 2007 net income is likely to be somewhere around $187 million.

The decline in third-quarter income will mostly come from rising provisions for loan losses and write-downs of mortgages Washington Mutual currently holds.

Employment rose in September, and the unemployment rate was essentially unchanged at 4.7 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Nonfarm payroll employment rose by 110,000 following increases of 93,000 in July and 89,000 in August (as revised). In September, health care, food services, and professional and technical services continued to add jobs, while employment trended down in manufacturing and construction.Average hourly earnings rose by 7 cents, or 0.4 percent.

Payrolls grew by 110,000 after an 89,000 increase in August, the Labor Department said today in Washington. Revisions added 118,000 workers to payroll figures previously reported for July and August.

Orders placed with U.S. factories fell in August by the most in seven months, raising concern the turmoil in credit markets eroded business confidence.

Bookings declined a greater-than-forecast 3.3 percent after a revised 3.4 percent gain in July that was smaller than previously estimated, the Commerce Department said today in Washington. Excluding transportation equipment such as cars and airplanes, demand declined 1.7 percent after a 1.7 percent gain.

The figures suggest business investment will slow in the second half of the year as a worsening housing recession hurts consumer spending. Economists project Federal Reserve policy makers will lower interest rates again to prevent economic growth from stalling.

``The volatility in financial markets in recent months probably introduced an element of caution in ordering,'' said Michael Moran, chief economist at Daiwa Securities America Inc. in New York.

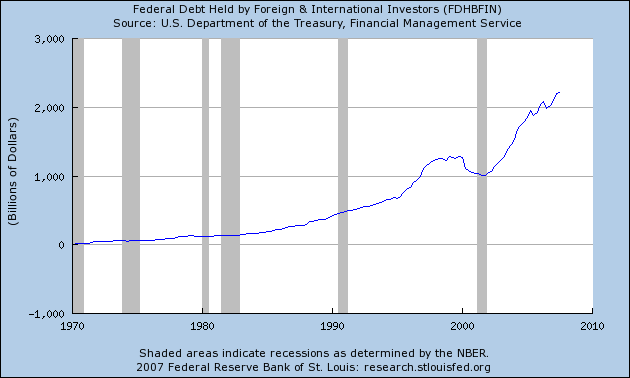

Vietnam is planning to cut its purchases of US Treasuries and other dollar bonds, raising fears that Asian central banks with control over two thirds of the world's foreign reserves may soon join the flight from US assets.

The Saigon Times said this morning that the State Bank of Vietnam was abandoning the attempt to hold down the Vietnamese currency through heavy purchases of dollars. The policy is causing the economy to overheat, driving up inflation to 8.8pc.

advertisement

Vietnam, which has mid-sized reserves of $40bn, is seen as weather vane for the bigger Asian powers.

Together they hold $3,575bn of foreign reserves, over 65pc of the world's total. China leads with $1,340bn, but South Korea, Taiwan, Singapore, and even Thailand all built up massive holdings.

Morgan Stanley said it is firing about 600 employees in its residential-mortgage businesses. The cuts, which primarily affect sales and administrative staff, account for about one-fourth of the New York investment bank's home-lending work force, said a person familiar with the plan. Morgan Stanley, which last year paid $706 million to buy mortgage-lending and servicing firm Saxon Capital, said about 500 people will be fired at its three mortgage units in the U.S. and about 90 at Advantage, its United Kingdom home-lending unit.

........

Zurich-based Credit Suisse will cut 170 positions. Last month it cut about 150 residential-mortgage jobs. Most of the latest cuts will be made in the commercial-mortgage-backed securities area, a spokeswoman for the bank said. "In the current market environment, we have made targeted reductions to adjust our capacity to meet diminished client demand," the bank said in a statement.

The announcements follow layoffs of hundreds of residential-mortgage employees at other securities firms and likely presage even broader cutbacks at many investment and commercial banks. (Meanwhile, Countrywide Financial Corp., the nation's biggest home-mortgage lender, has launched a campaign to shore up its image.

General Motors Corp., the No. 1 U.S. auto maker in terms of volume, posted a 0.28% sales boost during the month compared to September 2006 despite a pull-back in sales to fleet buyers, such as rental-car companies. GM got a lift from a host of new products, including large crossovers such as the GMC Acadia, and tactical sales incentives on pickup trucks and large sport-utility vehicles. GM shares rose $1, or 2.8%, in New York Stock Exchange trading to close at $37.05.

Ford Motor Co., however, suffered a 21% decline in sales, as slumping demand for truck models such as the Explorer SUV and the F-Series pickup offset more robust sales of new crossover vehicles such as the Ford Edge. Still, Ford shares rose on the Big Board to close at $8.57, up 4.1%.

Toyota Motor Corp., now No. 2 in the U.S. market, suffered a 4.4% decline in sales, as sales of Toyota brand SUVs skidded 9%. Among other significant players, Chrysler LLC said sales fell 5.4%, while Honda Motor Co. reported a 9.4% increase in sales, powered by a 27% jump in sales of the Accord sedan, including a redesigned Accord introduced early in the month.

The overall seasonally adjusted annual rate of sales equaled 16.23 million vehicles during the month, according to Autodata Corp. The result was reasonably better than many analysts and auto-company officials had been expecting, after August's relatively weak showing. But the latest sales pace was still well below the trend set over the course of the decade and into the early months of this year. Most analysts now expect total light-vehicle sales in 2007 to crawl to 16 million vehicles, well below the 16.7 million rate that is generally considered healthy.

Deutsche Bank AG Wednesday said it will take charges of up to 2.2 billion euros ($3.09 billion) for the third quarter on leveraged loans, structured credit products and mortgage-backed securities, although it will still achieve a sizeable net profit due to one-time gains.

The German banking giant said the charge on leveraged loans and loan commitments will be up to €700 million, in addition to charges taken on such loans and commitments during the second quarter. It will also take approximately €1.5 billion in charges on structured credit products, residential mortgage-backed securities and valuation losses on both debt and equities.

The National Association of Realtors' index of signed purchase agreements fell 6.5 percent from the previous month, the group said today in Washington. The decline was more than economists anticipated and pushed the measure to the lowest level since the organization began tracking purchases in 2001. The gauge plunged 11 percent in July.

``The existing homes market is now in freefall,'' said Ian Shepherdson, chief U.S. economist at High Frequency Economics Ltd., in Valhalla, New York. ``The downside from here is still substantial.''

Higher credit costs and lending restrictions after the collapse in subprime mortgages may push the industry downturn well into 2008. The Federal Reserve will probably need to make further cuts in interest rates to keep the broader economy expanding, economists said.

While indexes of derivatives that measure the risk of default show increasing investor confidence, the difference between the interest that banks and the U.S. government pay for three-month loans is wider now than a month ago. That's a sign the Fed's Sept. 18 rate decision has yet to persuade bondholders that lower borrowing costs will stop ``disruptions in financial markets'' from hurting the economy.

``The reality is the fundamentals haven't gotten any better, and, if anything, they've gotten worse,'' said Mark Kiesel, an executive vice president at Newport Beach, California-based Pimco who oversees $85 billion in corporate bonds.

About three-quarters of 30 fund managers who oversee $1.25 trillion expect a hedge fund or credit market blowup in the ``near future,'' according to a survey by Jersey City, New Jersey-based research firm Ried, Thunberg & Co. dated Oct. 1.

More than 65 percent of investors in mortgage-backed securities are struggling to find bids for their holdings, according to a survey of 251 institutions last month by Greenwich Associates, a Greenwich, Connecticut-based consulting firm. Among holders of CDOs, the figure is 80 percent.

The U.S. commercial paper market is shrinking. The amount of debt outstanding that matures in 270 days or less fell $13.6 billion the week ended Sept. 26 to a seasonally adjusted $1.86 trillion, according to the Fed. It's down 17 percent in the past seven weeks.

U.S. stocks rallied, sending the Dow Jones Industrial Average to a record, as investors speculated the worst may be over for banks and construction companies hurt by subprime mortgage losses.

Citigroup Inc. and UBS AG warned they suffered significant loan-related losses in the third quarter, becoming the latest and biggest banks to reveal huge ill effects from the spike in mortgage defaults and freeze-up in the credit markets.

The report was issued today by Norbert J. Ore, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "Manufacturing growth continued in September while some sectors of the economy are apparently struggling. The trend is toward slower growth in manufacturing as the rate of growth in both the New Orders Index and Production Index slowed. The sector is apparently in excellent shape with regard to inventories as the Inventories Index fell to 41.6 percent, indicating significant inventory liquidation, and the rate of growth in the Employment Index increased slightly in September. Overall, September looks like a good month for manufacturing."

*"Business continues strong across all market segments." (Primary Metals)

* "Outlook going forward is cloudy due to concerns from the mortgage market." (Fabricated Metal Products)

* "Economy appears to be in neutral. Waiting to see if the consumer confidence shows itself for the Christmas season as gasoline prices level off." (Transportation Equipment)

* "Signs of softening in pace of new orders." (Miscellaneous Manufacturing)

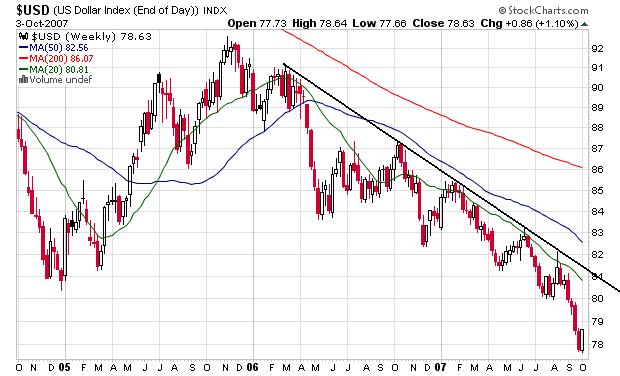

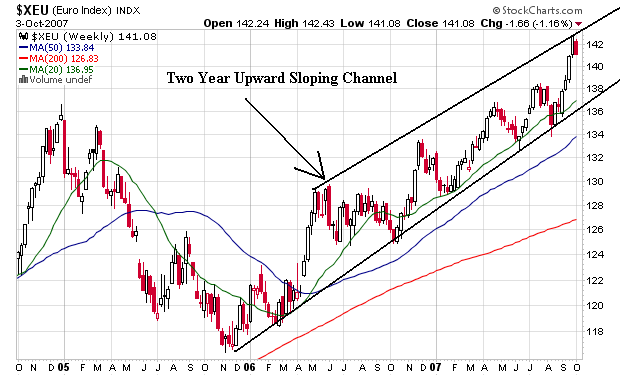

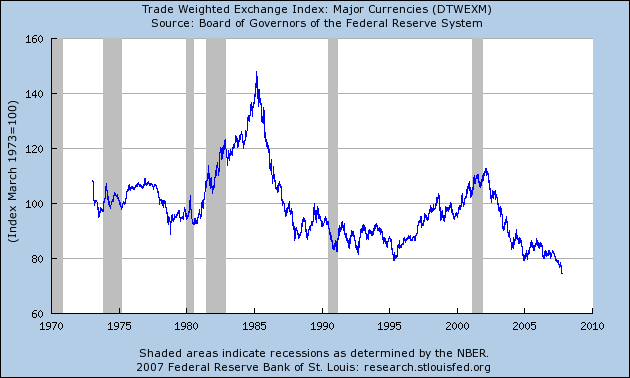

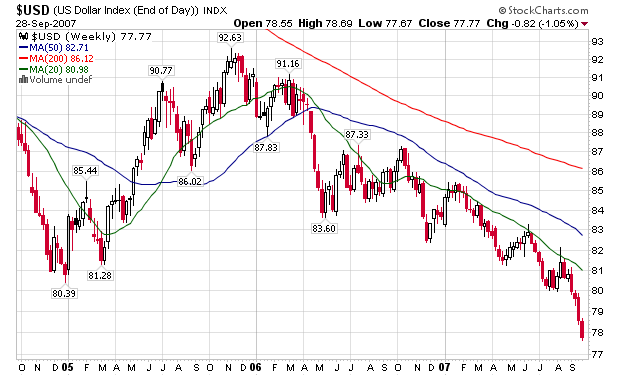

Mr. Bence is one of the people benefiting from one of the few bright spots in a slowing U.S. economy. While a weaker dollar hurts consumers by raising the price of imported goods, it also is helping the economy stave off a deeper slowdown, by making U.S. exports more competitive and influencing more foreigners to visit Disney World or the Statue of Liberty.

If the dollar falls too far and too fast, it could spur a run-up in interest rates and shake the stock market -- which would be bad for the economy. A rapidly falling dollar would raise the price of imports, stoking inflation, and in an extreme case could prompt foreign investors to dump U.S. bonds, pushing their yields higher.

...

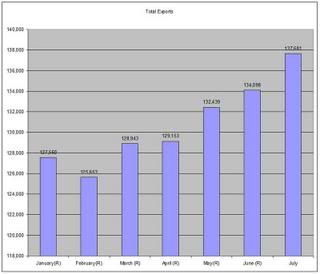

But as long as the dollar's decline is gradual, most economists see it as a modest plus overall. Joshua Feinman, chief economist at Deutsche Asset Management, wrote in a recent note to investors that the export upswing is one of the factors "poised to help cushion the impact of the housing correction." Real exports have grown faster than real imports for nearly two years, notes Mr. Feinman, and he expects this trend to continue. U.S. exports rose 2.7% to a record $137.68 billion in July, according to the Commerce Department. Mr. Feinman estimates stronger exports have contributed a half percentage point of added growth to gross domestic product since 2005.

Swiss banking giant UBS AG, which recently ousted its chief executive in the wake of losses at an in-house hedge fund and defections of top investment bankers, plans to write down as much as 4 billion Swiss francs, or $3.41 billion, in assets, including securities tied to U.S. subprime mortgages.

The big write-downs will make UBS one of the highest-profile casualties of the recent turmoil in global credit markets and raises questions about the management of its securities business, especially its expansion into the U.S.

..................

After taking a third-quarter write-down of between 3 billion francs and 4 billion francs on its fixed-income assets, UBS expects a loss for the quarter ranging from about 600 million francs to 700 million francs, people familiar with the matter said. For the year-earlier quarter, UBS reported net profit of 2.2 billion Swiss francs. (See related article.)

Citigroup Inc., the biggest U.S. bank, cut its third-quarter earnings forecast, citing ``weak performance'' in fixed-income credit markets and writedowns on leveraged loan commitments and mortgage-backed securities.

Citigroup expects to report a decline in net income of about 60 percent from the same period a year earlier, the New York- based bank said today in a statement distributed by Business Wire.