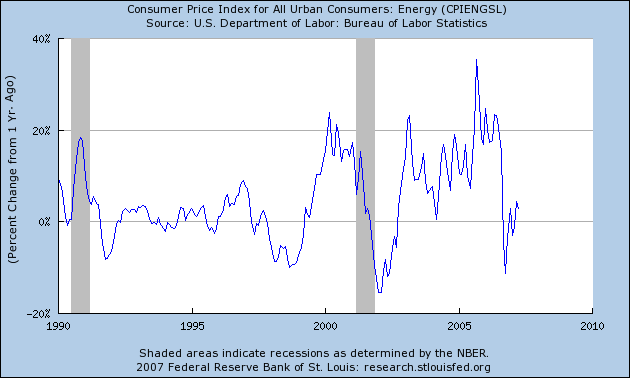

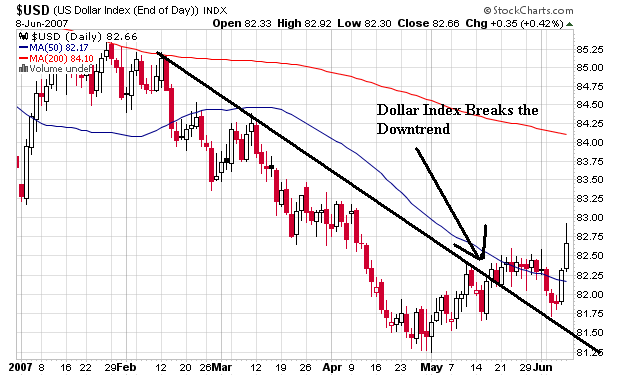

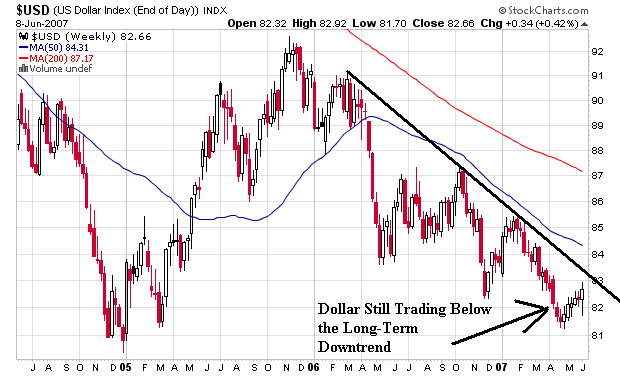

We thought the economy would be sluggish in the first half because of inventory corrections in housing and the automotive market. Things have unfolded more or less along those lines, with the rest of the world looking stronger than the U.S. By the second half of the year the inventory correction in automotive will be out of the way. The housing market will remain sluggish, but the inventory correction in that market will be gone in 2008. In the meantime, exports, nonresidential construction, capital expenditures, wages and the wealth effect provide ballast. At the other end of the economy, consumers will suffer from higher gasoline prices and declining home values. Bottom line, the economy muddles through and starts looking brighter in '08. Short-term interest rates will stay at 5%; long-term rates will go up to 5.5%. The dollar will be weaker, particularly relative to the Japanese yen. Put all that in the mix, add a stock-market correction of 10% to 15% at some point, and the market will be up at most 5% for the year. I'm not negative. I just think '08 will be a lot better.

I really like his use of the word "ballast" to describe the positive areas of economy. If you think of the overall economy as floating in the water and as being made-up of many subparts, those little subparts that are floating provide a counter-weight to those parts of the economy that are sinking.

Fred Hickey points out the bearish argument:

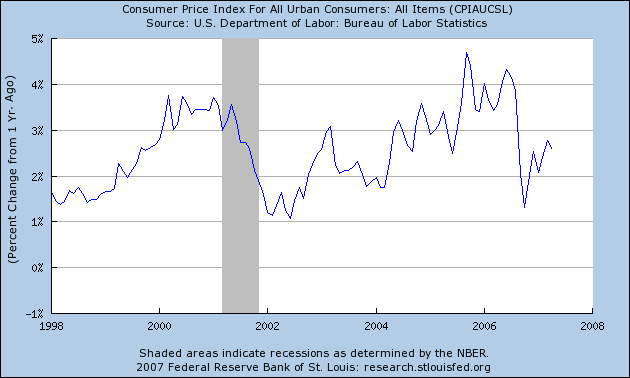

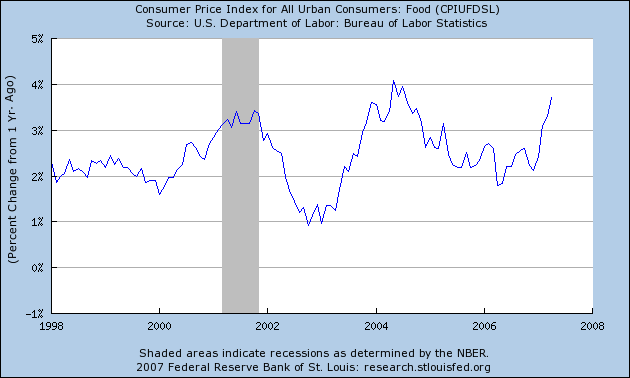

We have real, serious problems. The dollar is deteriorating against almost all currencies. Bond yields are backing up big-time, causing all sorts of ripple effects. Potential leveraged buyouts might not get done. Huge pyramids of leverage could start to implode. The back-up in rates comes at a time when the U.S. consumer has finally had it. Month after month retail sales disappoint. In April, 75% of retailers missed their same-store-sales targets. The consumer, facing hundreds of billions of dollars of mortgage-rate resets, now gets hit with rising rates. Wrong timing. Housing prices are falling nationwide. Mortgage-equity withdrawals have collapsed. In May, foreclosures were up 90% year over year. Gasoline prices are up 30% from the first quarter. We are looking at potentially the greatest food-price inflation in 30 years. Higher health-insurance costs. Lower benefits. You can't have a worse scenario for the consumer.

These area all solid arguments; I believe I have made most of them over the past several months. However, I have learned that counting out the US consumer is not a good idea. They continue to get money from somewhere.

Art Samburg notes the strong cash fundamentals for the markets -- cash as in private equity and corporate profits. He also highlights the overall PE ratio, which isn't cheap, but also not expensive:

The market's multiple has shrunk two years in a row. You might not like everything you see out there, but people are employed and things move forward. Corporate profits are growing at a 10% annual rate and the market is not up 10% yet. The other driver for stocks is the wad of money in private-equity hands. It is absurd, but I have learned one thing in life: It is very important to recognize absurdity, but also very stupid to get in the way of it. I don't see the private-equity boom abating. If corporate profitability in the U.S. is OK, the rest of the world is continuing to grow and private-equity deals are driving stock action in the U.S., the market could be up about 10%. this year.

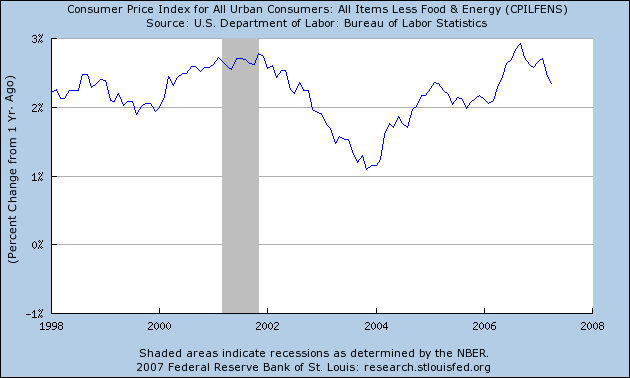

FELIX ZULAUF makes a very interesting observation about why the bond market is selling off:

Suddenly, it seems, everyone agrees the secular downtrend in yields is over, and cyclically and probably secularly yields are on the way up. So far the back-up in yields has not been driven by rising rates of inflation, because inflation in industrial and emerging economies is behaving well. In the later stages of the cycle, inflation will turn up, but it's the supply/demand situation that is driving bonds now. There is less demand. The corporate sector is seeing deteriorating free cash flow because of more capital expenditures. Private-equity companies are buying equities and selling bonds. Also, nations that are running large surpluses, like China and Russia, have announced they plan to buy more equities and other assets, not just government bonds. It's a step-by-step process.

Basically, inflation concerns aren't the issue. Instead, bonds are getting hit because of a global reallocation of assets from debt to equity.

Scott Black notes the lack of fear in the markets:

Another problem is the casino mentality of many market players. Between the hedge funds trading in and out and the private-equity people chasing stocks at very inflated multiples of price to enterprise value, it reminds me a bit of the Michael Milken era -- the leveraged-buyout binge of the late 1980s. And there seems to be no fear. Look at the bond market. Investment-grade debt yields only 83 basis points over Treasuries, the lowest spread in nine years. [A basis point is one one-hundredth of a percentage point.] High-yield debt is 232 points over Treasuries -- a record low. There is no risk premium built into equities, and there is certainly none built into bonds. This belies the real economy, which slowed in the first quarter to about 0.6% growth.

How do you explain the divergence?

The world is awash in liquidity. Last year there were $3.7 trillion worth of deals done, followed by another trillion in the first quarter of this year. All those stocks were retired, and the money has to get recycled. As supply shrinks, demand seems to increase, and it clears the market at higher prices. The run-up in prices is more of a technical event than one based on the fundamental earnings power of companies.

The low spreads on junk bonds is reminiscent of the emerging market situation in the last 1990s. Emerging market debt was trading at very low levels relative to industrial debt. Traders had no fear. After the Asian crisis hit, emerging market debt sold off and a lot of traders got hurt.

That's the end of part 1. I read these observations and interviews slowly because they are very dense.