The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a revised reading of -2.3 in December to 8.3 (see Chart).* This month, 25 percent of the firms reported increased activity; 17 percent reported decreased activity. The new orders and shipments indexes offer mixed signals about the strength of this month’s overall improvement. Demand for manufactured goods has not yet recovered much: The new orders index rose two points, from -0.9 to 1.3, after negative readings for two consecutive months. The shipments index increased 10 points from December; 37 percent of the firms reported an increase in shipments; 13 percent reported a decrease. Indexes for delivery times and unfilled orders remained negative, indicating shorter delivery times and a decline in unfilled orders.

Evidence of modest growth in manufacturing is suggested by replies concerning employment and hours worked. The percentage of firms reporting an increase in employment (21 percent) was somewhat higher than the percentage reporting decreases (13 percent). The current employment index was virtually unchanged from its revised December reading. The average workweek index edged four points higher, but the percentage of firms reporting longer hours (16 percent) was nearly the same as the percentage reporting shorter hours (15 percent).

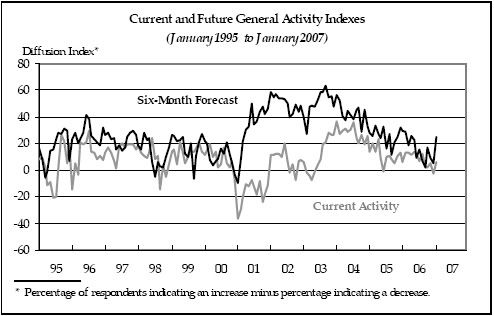

Let's take a look at the general diffusion chart:

The gray line (current conditions) has trended down for the last 6 months or so. We saw a longer downtrend from mid-'04 to mid-'05 without a serious problem. That means the most recent decrease could be nothing more than a natural slowdown from peak activity. In addition, we have seen modest increases over the last year, so the recent increase into positive territory could be the beginning of a return to slower but positive production levels. However, we are near the 0 line, so this trend bears watching.

The new orders index rose two points, from -0.9 to 1.3, after negative readings for two consecutive months.

The new orders index isn't offering us much hope right now.

Here's some good news in the report:

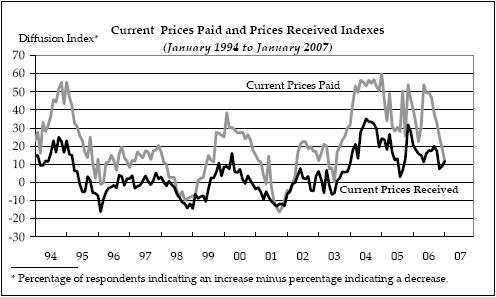

The prices paid component has dropped for the last 6 months. This is good news on the inflation front.

The current employment index was virtually unchanged from its revised December reading.

We've seen manufacturing employment take a big hit during this expansion. Here's a chart of national manufacturing since 2000.

The large productivity gains have translated into fewer manufacturing employees. There is no reason to think this trend won't continue.

The short version is all the recent manufacturing numbers have showed a slightly positive reading not strong enough to warrant extreme optimism, but enough to warrant a soft-landing.