- by New Deal democrat

My “Weekly Indicators” post is up at Seeking Alpha.

You may be surprised to learn that despite the 10%+ stock market crash on Thursday and Friday, my rating for the short leading indicator of the S&P 500 is still “neutral.” That’s because the market is extremely volatile. There was an all-time high only six weeks ago. And there is no guarantee whatsoever that T—-p won’t declare “VICTORY!” in a week or two, completely reverse this week’s tariffs, and the entire downturn in the market will reverse as well. My discipline says that if there have been both a 3 month high and a 3 month low within the past 3 months, that’s neutral - and it pays to stick with a discipline and not make exceptions.

In any event, you can get caught up to date on the state of all the indicators by clicking over and reading, and I will get rewarded with a little pocket change for the effort.

—-

And now, this week’s special update.

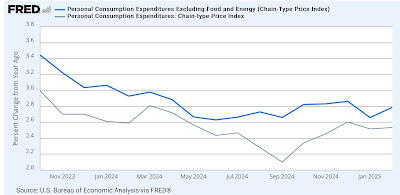

My “quick and dirty” recession indicator consists of two high frequency indicators: (1) a YoY downturn in the S&P 500; and (2) a 10%+ upturn in the four week average of initial jobless claims (inverted in the graph below).

Well, as of Friday, the S&P 500 is now down YoY, fulfilling the first criterion. Jobless claims are only 3.4% higher YoY, so even though that signal is weak, it isn’t negative yet:

If the tariffs do stay in place longer than a few weeks, it would not surprise me to see layoffs increase sharply, fulfilling the second criterion. But we’re not there yet.

BTW, the peak in YoY stock market performance - over 40% - was just before the November 5 elections. A more damning chart would be hard to find.