- by New Deal democrat

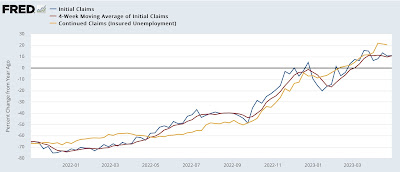

Initial jobless claims rose 13,000 to 242,000 last week, while the 4 week average rose 3,500 to 239,250. Continuing claims, with a one week lag, declined -38,000 to 1.805 million:

This is right in the range of the past 2 months.

YoY initial claims are up 11.0%, the 4 week average is up 10.8%, and continuing claims are up 20.5%:

This is enough to reinstate the “yellow flag” caution, but not across the 12.5% boundary where I would begin to hoist the “red flag” recession warning.

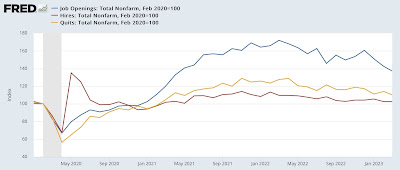

Tomorrow morning we will get the April jobs report, and since initial claims are a leading indicator for the unemployment rate (red in the graph below), here’s what that looks like for the past 18 months:

Initial claims are clearly forecasting an increase in the unemployment rate by 0.2%-0.3% over the next few months, but whether or not there will be an increase tomorrow is impossible to know. But they do certainly suggest there will be no *decrease* in the unemployment rate.

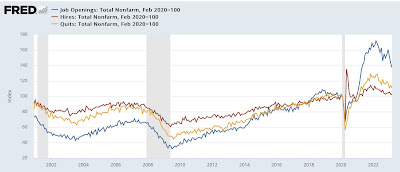

Meanwhile, since real retail sales (showing consumption; blue in the graph below) are a leading indicator for employment (red), here’s the latest update on that comparison:

The gold line represents the quarterly change (*4 to estimate the annualized rate) in job growth.

Real retail sales are plainly forecasting continued deceleration in jobs growth. Deceleration in the YoY rate, as well as deceleration in q/q growth suggests a gain of less than 325,000 tomorrow. A negative outlier would be anything less than 200,000.

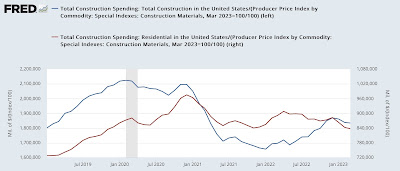

Additionally, tomorrow I’ll be looking for continued deterioration in the leading sectors of manufacturing, construction, and temporary employment, along with the manufacturing workweek and an increase in short term unemployment.