- by New Deal democrat

There’s no big economic news today, and as usual very limited COVID reporting over the weekend, so let’s catch up on the state of inflation in the economy.

Three of the biggest components of inflation have been gas, housing, and vehicles. Let’s look at each in that order.

According to GasBuddy, average US prices as of today are $3.86/gallon:

As the above graph shows, that means that almost 80% of the Ukraine war premium in prices has been deflated.

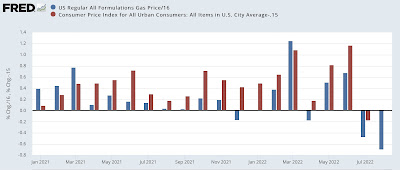

Although we’re only 2/3’s of the way through the month, here’s what the monthly inflation correlation looks like so far:

In the above graph, I’ve divided the change in gas price by 16, roughly in equivalent scale to total inflation. Because these is about a +.15% underlying bias to core inflation, I’ve subtracted that for a better correlation. Based on that, actual inflation in August looks unlikely. Another month of unchanged prices, if not outright deflation for the month appears likely.

That’s the good news.

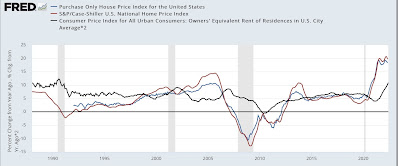

Turning to housing, here’s the graph I ran several weeks ago of the latest FHFA and Case Shiller house price indexes through May, vs. owner’s equivalent rent, how the Census Bureau measures housing in the CPI:

Because OER lags actual house prices, increases in which so far have not decelerated significantly in those indexes, we can expect monthly OER increases in line with the +.5% or +.6% of last few months, if not even slightly higher, as shown in the graph below:

Finally, let’s turn to vehicles. Used car prices started to increase sharply in spring 2021, and are now 50% higher than they were just before the pandemic. The good news there is that seasonally adjusted prices (black in the graph below) are no higher than they were 8 months ago, in December of last year:

New car prices (red) started to appreciate sharply several months after used car prices, and are now 18% higher than just before the pandemic. Further, in the past year, they have increased by at least .6% in every month except for last winter.

As you might expect, new vehicle sales (blue, right scale above) have declined sharply (about 25%) in response to the big price increases.

Via Wolf Street, according to Cox Automotive vehicles in stock and in transit to dealers is still 70% below what it was just before the pandemic:

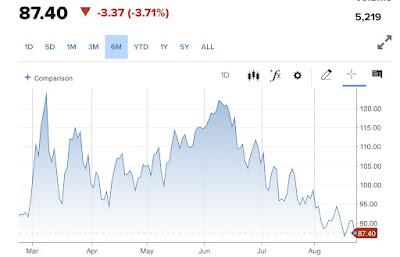

In short, there is no sign of any abatement in inflation either of housing or of new vehicles. The decline in gas prices should result in another good consumer price reading for August, but the future course of oil prices, as shown below, will determine the trajectory of any further gas price declines: