Saturday, February 29, 2020

Weekly Indicators for February 24 - 28 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

What happened in the past week certainly fits the definition of a crash - a loss of more than 10% in just five days - in my mind anyway. Not just stocks, but commodities also crashed.

Perhaps surprisingly, in the “hard” data of actual production and consumption, there doesn’t seem to have been much of an impact. In any event, clicking over and reading will bring you fully up to date, and put a penny or two in my pocket.

Friday, February 28, 2020

January real personal income consistent with either slowdown or incipient recession

- by New Deal democrat

Real personal income (less government transfers) is one of the four coincident indicators the NBER looks at in determining recessions. Since January’s numbers were reported this morning, let’s take an updated look.

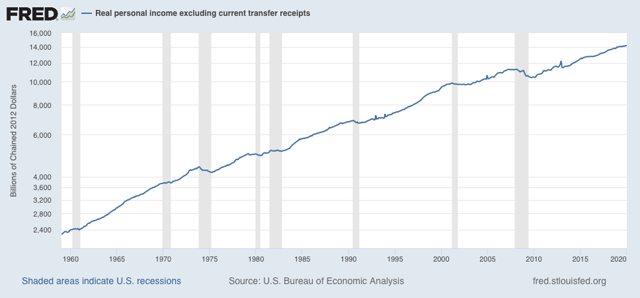

Truth be told, real personal income is actually a short lagging indicator. It frequently continues to improve a few months into a recession - and occasionally never turns down, as shown in the graph below which is rendered in log scale so that data from a few decades ago doesn’t just show up as microscopic squiggles:

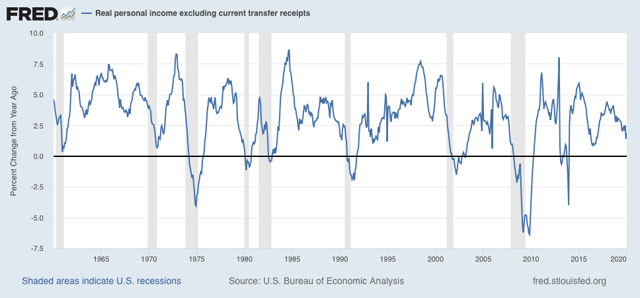

What historically *has* happened as a recession approaches is that the rate of increase decelerates sharply, by 40% or more from the recent peak:

As of December, this threshold was breached. Although real personal income improved by +0.6% in January, once transfer receipts are subtracted the monthly gain shrank to +0.3%. Thus, YoY this metric “improved” to +1.9% YoY, or just -39% below its 12 month peak of +3.1% from last February.

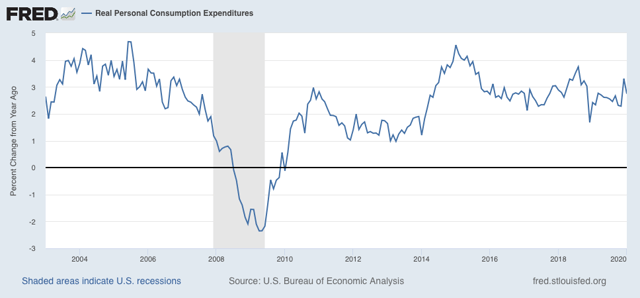

Meanwhile real personal spending rose only +0.1%, while YoY growth, at 2.7%, is in line with spending for the past four years:

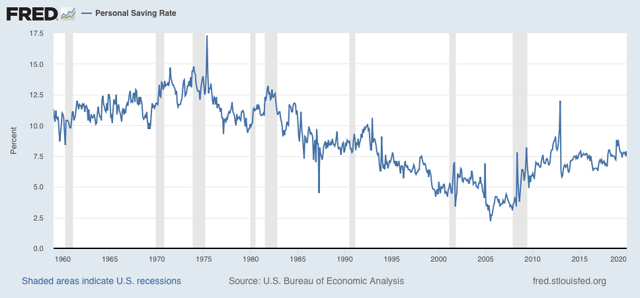

Finally, in the immediate prelude to a recession, consumers have typically decided to increase their savings rate. There was a small uptick in January, but no significant change compared with the past several years:

Bottom line: this coincident measure, just like real sales, is consistent with either a slowdown or an incipient recession. Industrial production continues to show an actual decline. Of the four most important coincident measures of the economy, only jobs growth is unambiguously positive. Any further knock to the economy (like, for example, the fear of a pandemic), could easily tip a slowdown into an outright downturn.

Thursday, February 27, 2020

Yes, coronavirus is roiling the markets

- by New Deal democrat

Back in the day, I used to tease Bonddad whenever he did a “What in the hell happened in the stock market today?” posts. I figured it was a sure sign of a short term bottom.

I’m at risk for the same sort of thing here, so, first of all ... I have no clue what will happen tomorrow. The DJIA could bounce back 1000 points for all I know. When sentiment gets extreme and there are emotional moves, some wolves step in to make a killing.

In any event, there were probably three important reasons for today’s 4% selloff, on top of the declines earlier in the week.

In reverse order of importance, they were:

3. The first apparent community transmission of coronavirus in California. This suggests that containment may already have failed, and coronavirus is spreading to non-target groups in the US. Put another way, that this was just the tip of the tip of the iceberg that is, to mix metaphors, dead ahead.

2. A vote of no-confidence in Trump’s press conference last night. Wall Streeters may, by and large, be right-wingers, but they’re not stupid. And what they saw was that Trump is treating this as a re-election issue. He has put his partisans in charge of the response, and is muzzling the government scientists. In short, he is not taking the steps necessary (like ordering thousands of test kits, I dunno, a week ago) to in any way contain the virus.

1. A realization that corporate profits are going to be strongly negatively affected. The stock market trades on “forward profits,” in other words, what they anticipate profits will be in the quarters just ahead.

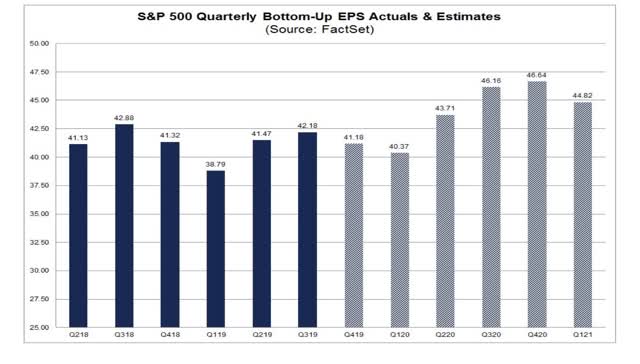

Here’s what the estimates for the quarters ahead looked like one month ago:

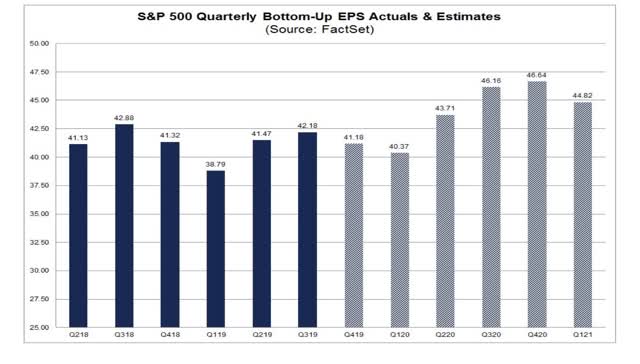

Here is what they looked like last week:

Notice that they were revised down somewhat - but that is typical. Once the Quarter at issue hits, usually a majority of companies are able to “beat” these estimates.

But what has been happening this week is a re-evaluation of what corporate profits in the next few quarters are likely to be. I don’t have the link at hand, but a major Wall Street bank came out this morning and said that they now anticipate *NO* profit growth whatsoever this year. That, dear readers, is a major downward re-evaluation. And the cold-blooded sharks on Wall Street are adjusting their portfolios accordingly.