Saturday, February 1, 2020

Weekly Indicators for January 27 - 31 at Seeking Alpha

- by New Deal democrat

My Weekly Indicator post is up at Seeking Alpha.

Due to panic (warranted or not) about a coronavirus, the yield curve almost completely inverted by close of business Friday.

As usual, clicking over and reading puts a penny or two in my pocket, and should bring you right up to the moment on the economy.

Friday, January 31, 2020

December 2019 real personal income and spending

- by New Deal democrat

Real personal income and spending are both coincident indicators. They don’t tell us where the economy is going, but they do give us a snapshot of how ordinary Americans are doing.

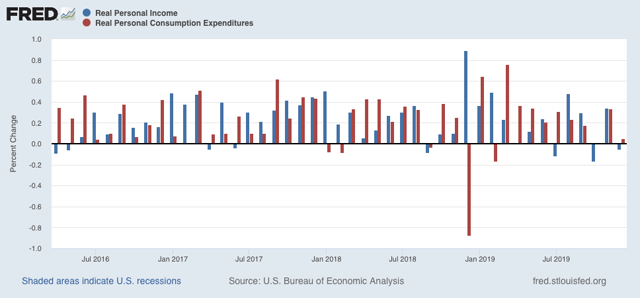

In December, real income declined by less than -0.1%. Real spending rose by less than +0.1%:

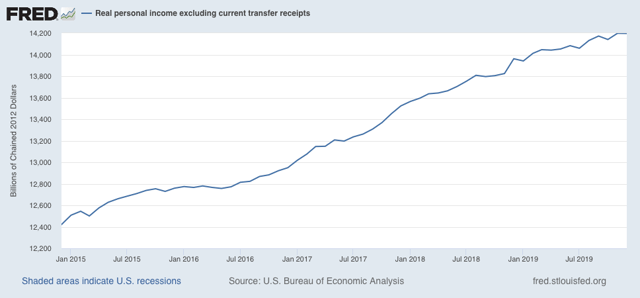

Real personal spending excluding government transfer payments is one of the four indicators used by the NBER to determine if the economy is in recession or not. In December this was flat. Overall in 2019 there was a slow uptrend:

This is one indication that as of one month ago the economy was not in a recession.

Thursday, January 30, 2020

Live-blogging the Fifteenth Amendment: January 27, 1869 (1)

- by New Deal democrat

I have gotten a little behind in this project. Congressional activity picked up considerably in the last week of January 1869.

Rep. Charles A.Eldridge (D-Wisconsin) addressed a civil rights bill by Massachusetts Representative Buckalew under the 14th Amendment as well as the proposed 15th Amendment:

I have not the vanity to suppose that anything I say will cause them to hesitate or consider. Party ends must be accomplished, party purposes must be carried out even though it should revolutionize the Government, overthrow the Constitution, and destroy the Republic.

....

Hamilton on the same subject in No. 59 of the Federalist ... [said], ’Suppose an Article had been introduced into the Constitution empowering the United States to regulate the elections for the particular States, would any men have hesitated to condemn it, both as an unwarranted imposition of power and as a premeditated engine for the destruction of State governments?’

In those days no man would have hesitated to condemn it. The Constitution could never have been adopted if it had contained the grant of power to Congress to determine the qualification of voters for officers of the States. Such a work is left for these days of revolution and usurpation — to the mad fanatics who for particular ends would destroy our Republic of States.

....

The power to determine the qualifications of electors was, in the States conferred ... by the people of the States.... All the powers of the Federal Government come up from the States and people, and it never had and never can have the rightful authority to exercise any power not granted in and by the Constitution. The exercise of any other is rank usurpation.

[I]t seems to me that this bill and resolution for the amendment of the Constitution ... for the evils which exist in his judgment with reference to the persons who ought to exercise the right to suffrage, is a filo de se [crime of suicide]. If the power exists in the Federal government to pass this bill, ... then I admit that Congress has the right to control the whole question of suffrage and the qualification of electors of all officers ....

....

Sir, I do not think the gentleman from Massachusetts gave a proper consideration to the fourteenth amendment, as it is called. I will not consider the question of whether this amendment is part of the Constitution; for myself I do not believe that it is....____________________

Source: Congressional Globe, 40th Congress, Third Seeking, pp. 642-45

What is remarkable about this speech is that Eldridge is not just addressing the Civil Rights bill proposed by Buckalew, but also claims that the even Constitutional amendments are invalid to alter Federal vs. State powers. He considers the power of suffrage in the States to be beyond the control of any proposed revisions to the Constitution itself. Even Chief Justice Roberts, who in the Shelby County case found a right of States to be treated equally in all legislation out in the Constitutional ether, did not go this far.

Mixed signals in Q4 2019 GDP

- by New Deal democrat

This morning’s Q4 2019 GDP gave us mixed signals. As per my usual practice, I am less interested in what happened in the rear view mirror, which was an annualized gain of +2.1%, than what the number tells us about what lies ahead.

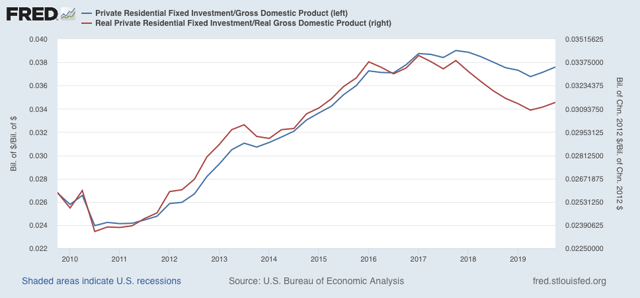

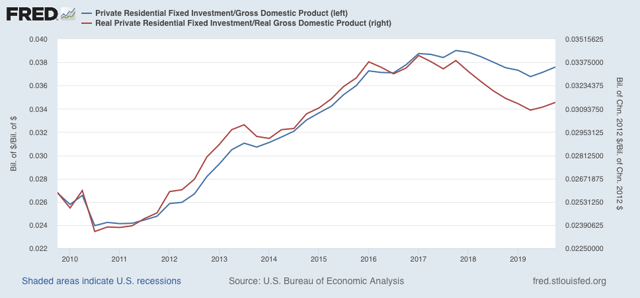

The two forward-looking components of GDP are (1) private fixed residential investment, and (2) corporate profits. Both of these are long leading indicators, i.e., giving us an idea about where the overall economy will be a year or more out from here.

In that regard, the news was mixed.

Private residential fixed investment increased +1.4% q/q. This is in keeping with the rebound in housing construction that we have seen in the monthly data since last spring. Note that residential investment as a share of GDP increased in both nominal (blue) and real (red) terms:

Private residential fixed investment increased +1.4% q/q. This is in keeping with the rebound in housing construction that we have seen in the monthly data since last spring. Note that residential investment as a share of GDP increased in both nominal (blue) and real (red) terms:

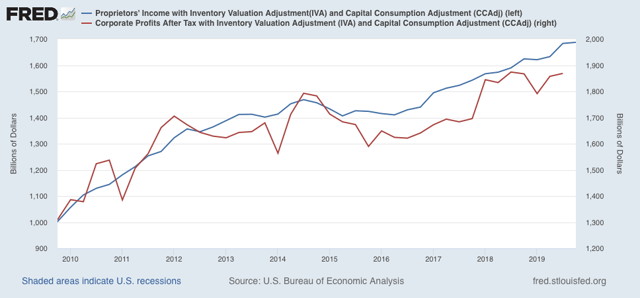

Meanwhile, while corporate profits won’t be reported until the final revision in GDP two months from now, proprietors’ income was. While it does not always move in the same direction as corporate profits, and sometimes lags, it a good placeholder. Here the news was negative, as nominally proprietors’ income rose a mere +0.2% q/q:

Since the GDP price deflator rose +0.4% during the quarter, the “real” measure declined slightly.

In sum, one long leading indicators increased, and one decreased. So, while in the rear view mirror, there was no recession in Q4 2019, there is more evidence of at best a stall in the producer side of the economy.

In sum, one long leading indicators increased, and one decreased. So, while in the rear view mirror, there was no recession in Q4 2019, there is more evidence of at best a stall in the producer side of the economy.

Wednesday, January 29, 2020

My “official” first half forecast for 2020

- by New Deal democrat

My short term 6 month forecast has been posted at Seeking Alpha.

As usual, clicking over and reading should be educational for you, and puts un poco dinero in my pocket.

Tuesday, January 28, 2020

More on house prices

- by New Deal democrat

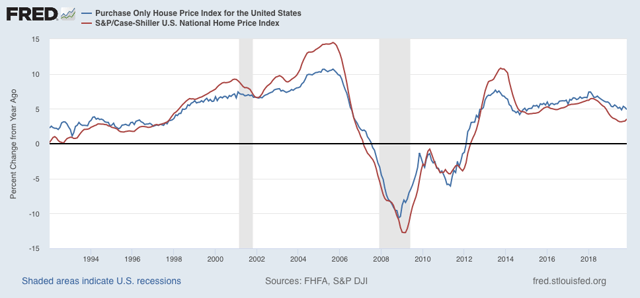

The Case Shiller housing indexes for the three month period ending in November were reported this morning. The YoY% change in the national index increased to 3.5% from 3.2% last month (red in graph below). This is in line with the FHFA purchase price index (blue), and continues the slight acceleration in each from a trough in August:

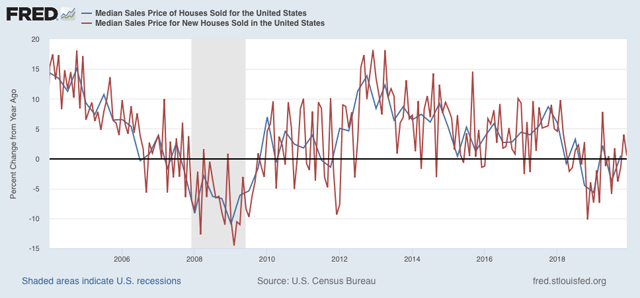

As I mentioned yesterday, the YoY% change in new home prices has also started to rebound (red in the graph below), as does the change in total home prices (blue):

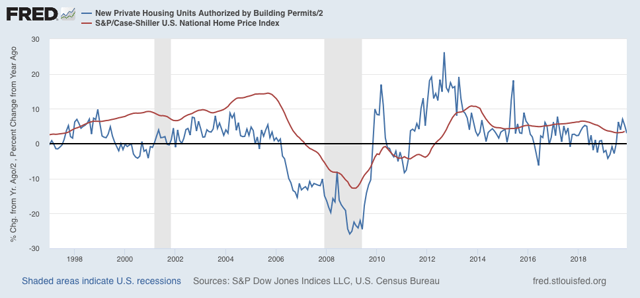

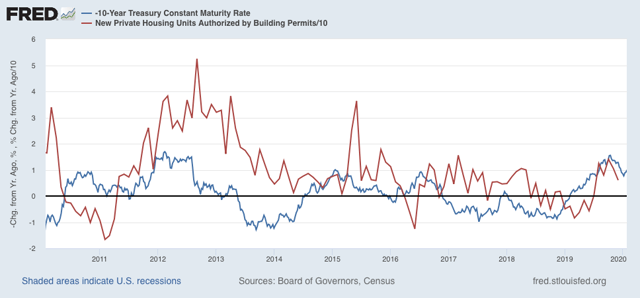

That price appreciation has begun to rebound is not a surprise, as they follow permits (blue in the graph below) with a lag:

So long as permits, sales, and starts continue to increase, we can expect further acceleration in price growth - which is already running ahead of wage growth.

Permits, in turn, follow interest rates. Since interest rates are lower than they were a year ago (inverted, blue, in the graph below), it looks like permits will continue to increase for awhile:

Permits, in turn, follow interest rates. Since interest rates are lower than they were a year ago (inverted, blue, in the graph below), it looks like permits will continue to increase for awhile:

Monday, January 27, 2020

Is the “housing choke collar” kicking in?

- by New Deal democrat

This morning’s December new home sales report raises the question: is the “housing choke collar” kicking in?

The idea of a “housing choke collar” is that house prices are at such a high multiple of the average household’s ability to pay that even with lower interest rates, there is not much room for the housing market to withstand housing price increases.

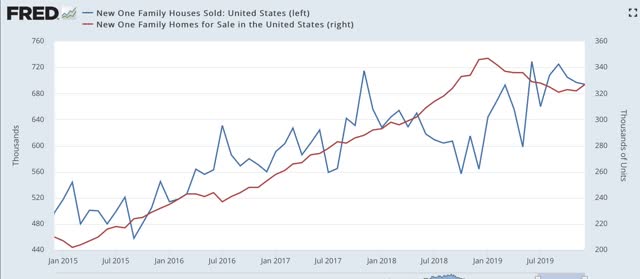

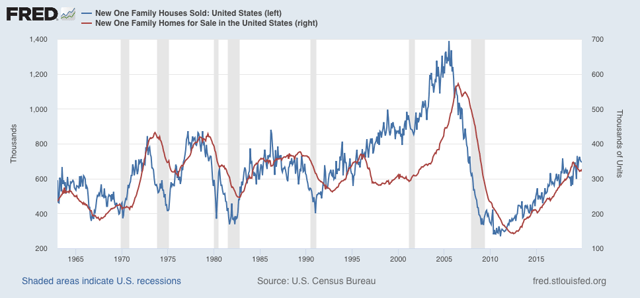

First, to the data: new home sales declined slightly from a downwardly revised November. This data series is very volatile, and heavily revised, but it remains the case that there has been no new high established since last 6 months (blue) (inventory is in red):

In the long term view, note that new home sales have peaked well before the beginning of recessions. Inventory has reliably followed, and with the exception of the shallow 1970 and 2001 recessions, continued to decline throughout the next downturn:

That inventory turned up slightly in December therefore suggests (slightly) that housing is not on a recession trajectory. Also remember that last week housing permits made a new expansion high (sales do typically peak or trough even before permits, but as pointed out above, are much more volatile).

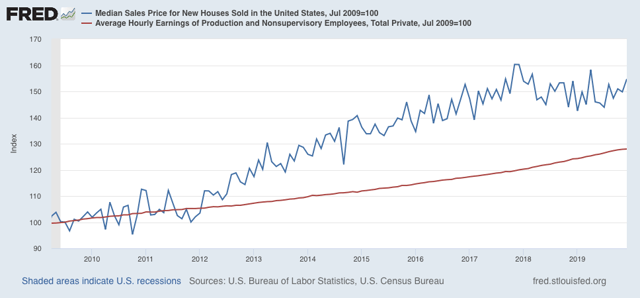

That brings us to median new home prices, which increased sharply, and have been on a pronounced uptrend in the past few months (blue):

The red line represents average hourly wages for non-supervisory personnel. It’s pretty easy to see that, after declining relative to wages in 2018, prices are now outpacing wage growth again.

Remember that last week we saw that existing home prices had increased by more than 9% in 2019.

If I am right, then there is very limited upside for sales growth. Since sales lead prices, new home sales may be telling us that we are reaching the limit of affordability without even lower mortgage interest rates.

Sunday, January 26, 2020

Weekly Indicators for January 20 - 24 at Seeking Alpha

- by New Deal democrat

I neglected to post this yesterday....

My Weekly Indicators post is up at Seeking Alpha. The forecasts remain as they have been recently, but there are several developments in the long leading range.

As usual, clicking over and reading brings you fully up to date, and rewards me a little bit for my efforts.