-

by New Deal democrat

I have a new post

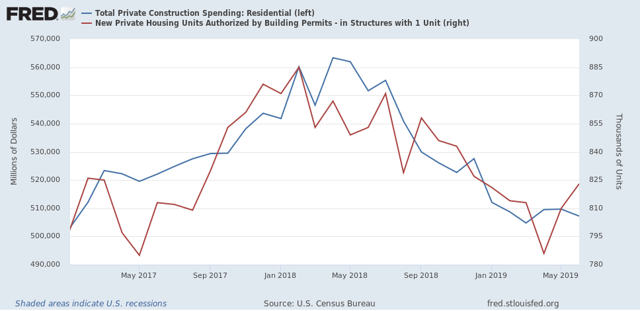

up at Seeking Alpha, discussing how, even though sales went down last year, and have already bottomed, house prices have as usual, followed into decline with a lag.

Beyond that, I discuss the concept of a “housing choke collar,’ similar to the “oil choke collar” I used to write about in 2010-14, whereby prices repeatedly approach the tipping point of unaffordability, causing sales to drop off, causing interest rates and prices to decline, making housing more affordable ... and the cycle repeats.

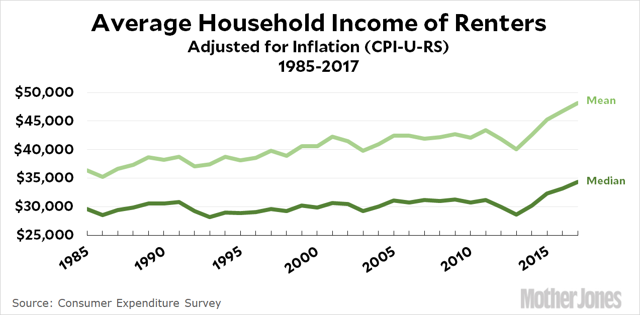

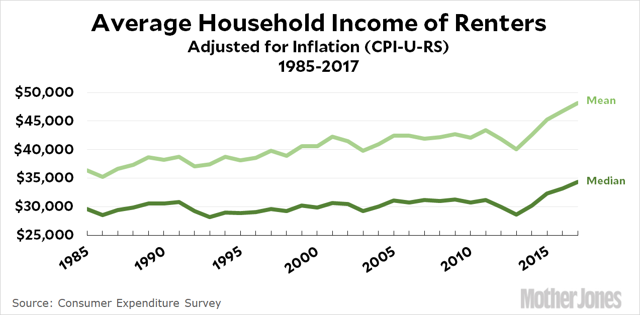

One item that didn’t make it into that article, because I was trying to be concise and not digress, was this graph of the median income of renters that Kevin Drum posted a couple of weeks ago:

Kevin Drum has repeatedly been trying to make the case that, really, housing hasn’t gotten expensive at all compared to historical values — and gotten a lot of blowback (correctly, imo). His take on the above graph is that it shows that renters aren’t stressed at all.

I think the graph actually shows that buying a house has gotten so expensive that it has been prices out of an increasing slice of middle-class incomes, and so people higher up the income scale have been forced into renting.

Anyway, as usual clicking over and reading my piece at Seeking Alpha should bring you up to date on the housing market, and helps me out for my efforts with a little cash in my wallet.