Saturday, June 29, 2019

Weekly Indicators for June 24 - 28 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

Not a lot of movement in any individual indicators, but manufacturing in particular moved very close to a downgrade.

Friday, June 28, 2019

The consumer is alright

- by New Deal democrat

One of my big themes this year is that low gas prices can hide a multitude of economic sins. This morning’s data on personal income and spending confirms that the consumer side of the economic ledger is doing OK.

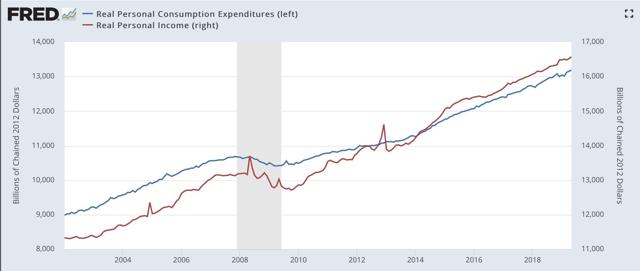

Nominal personal income rose +0.4%, and nominal personal spending rose +0.5%. After adjusting for inflation, the numbers are +0.3% and +0.2%, respectively. As a result, the positive trends for both continue:

On a YoY basis, we can see that spending slightly leads income (similarly point to the way consumption leads employment, not the other way around), and is also more volatile:

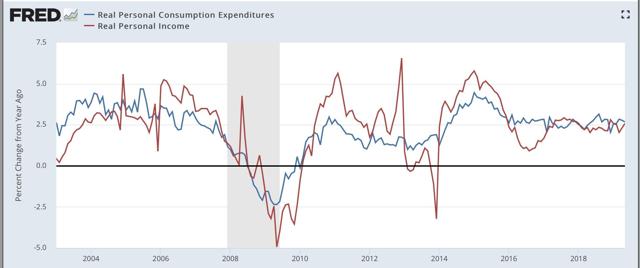

Next, going back 50 years, real retail sales improve further early in expansions, and fade more quickly later in expansions. Here’s the graph for that for the past 20 years:

The trend reversed for 12 months after the August and September 2017 hurricanes sparked lots of extra spending, but not the late cycle pattern has re-asserted itself.

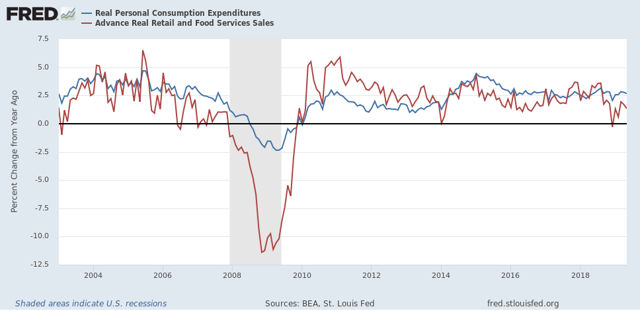

What isn’t spent is saved, and the personal savings rate adjusted for inflation generally declines substantially roughly midway through expansions, and then starts to turn up just before or early during recessions as consumers get more cautious:

What isn’t spent is saved, and the personal savings rate adjusted for inflation generally declines substantially roughly midway through expansions, and then starts to turn up just before or early during recessions as consumers get more cautious:

The former has happened. The latter really hasn’t, although it did briefly spike during the “mini-recession” caused by the government shutdown.

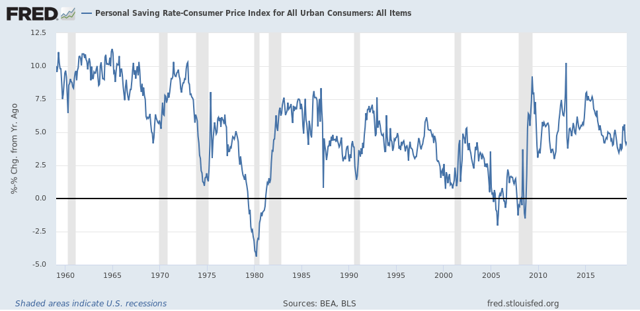

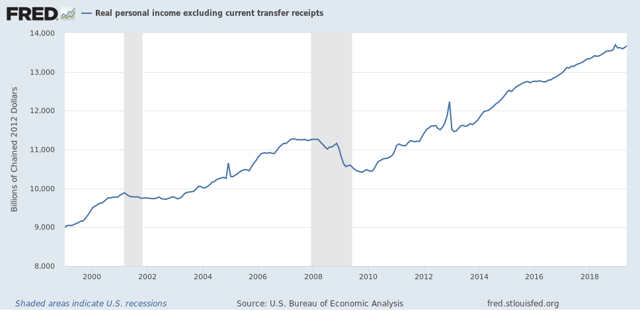

Finally, real personal income minus government transfer payments (e.g., food stamps) is one of the metrics the NBER uses to delineate recessions. Here’s what that looks like for the past 20 years:

Finally, real personal income minus government transfer payments (e.g., food stamps) is one of the metrics the NBER uses to delineate recessions. Here’s what that looks like for the past 20 years:

Again, this is still positive, although for the last 9 months there has been a significant deceleration to +1.0% (or +1.3% annualized).

So, to sum up, as to the consumer side of the economic ledger:

1. Lots of evidence of late cycle deceleration, but

2. No sign of rolling over at this point.

With low gas prices and somnolent inflation, 3%+ YoY wage gains are enough for the consumer to be doing alright. If there is a recession waiting in the wings, it will be producer-led similar to the dotcom bust of 2001.

Thursday, June 27, 2019

Initial jobless claims: positive this week, but close to crossing two thresholds for concern

by New Deal democrat

I have started to monitor initial jobless claims to see if there are any signs of stress.

My two thresholds are:

1. If the four week average on claims is more than 10% above its expansion low.

2. If the YoY% change in the monthly average turns higher.

Here’s this week’s update.

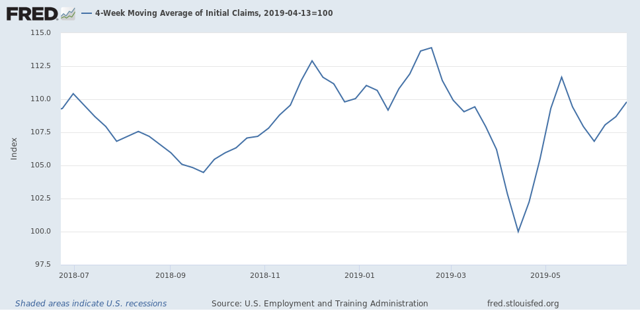

The four week average is 9.8% above its recent low:

On a weekly basis, YoY the average is +0.3% higher than this week last June.

Last June the monthly average was 222,000. With one week still to go this June, it is 221,250:

Depending on revisions to this week’s number, if next week comes in at 222,000 or higher, that will cross the first threshold. If it comes in at 224,000 or higher, it will cross the second threshold as well.

Wednesday, June 26, 2019

Manufacturing job losses now look virtually certain

- by New Deal democrat

I’ll have a post going up at Seeking Alpha later, but between a steep decline in the manufacturing work week, lackluster regional Fed manufacturing indexes (still barely positive), a turndown in durable goods orders (in part due to Boeing’s woes), and increasing inventories, it now looks nearly certain that there will be an actual decline in manufacturing jobs over the next twelve months.

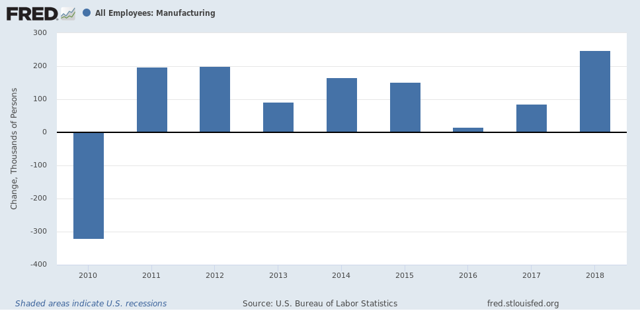

To put this in perspective, here are the annual gains (losses in 2010) in manufacturing jobs through the end of 2018:

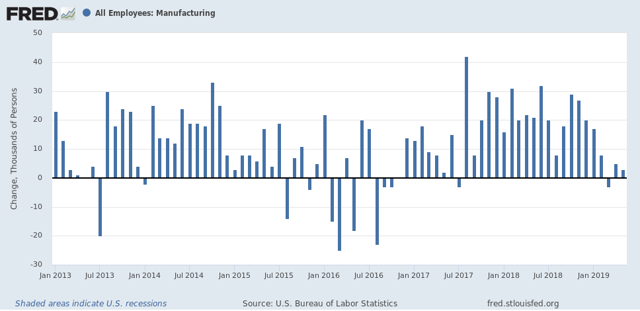

Here is the same data monthly through May from the beginning of Obama’s second term:

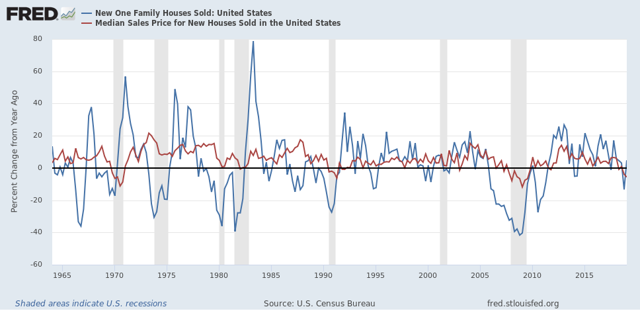

Hillary Clinton ran for President in 2016 in the teeth of a manufacturing recession. That is why the fundamentals-based economic models all forecast a very close election that year.

It increasingly looks like Trump will face a similar dynamic, at least in the first half of next year.

Of course, I’ve been forecasting a steep slowdown with an epicenter of roughly Q4 of this year since the middle of 2018. And — hey, look! — a big name economist or two are beginning to come around:

Sent from my iPad

Tuesday, June 25, 2019

New home sales: is housing developing a price “choke collar”?

- by New Deal democrat

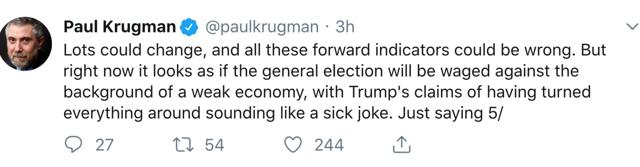

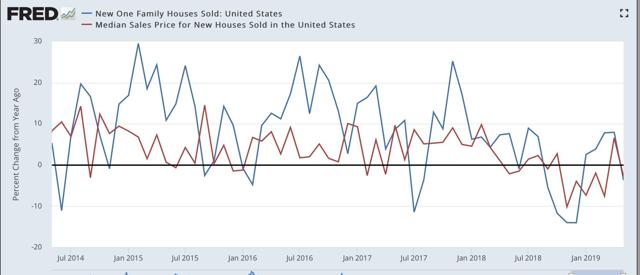

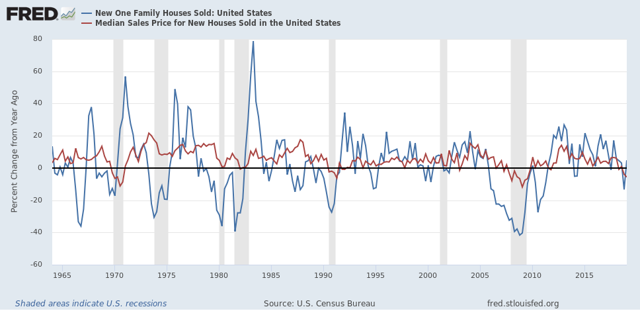

So, new single family home sales for May were reported light this morning:

Because this series is very volatile and heavily revised, as always take this with a grain of salt.

To smooth out some of the volatility, I pay more attention to the three month moving average, which at 670k is slightly below that of that average for the past two reports, and also slightly below the late 2017 peak. Still it is above all of 2018, so it nevertheless adds to the evidence that the bottom for housing is in.

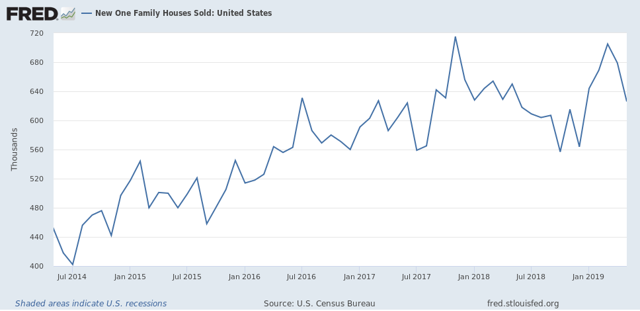

Also, the YoY% change in median price, while reverting to negative this month, is also a significant improvement over the situation over the winter (red in the graph below):

What is interesting here is how quickly price declines, and now price rebounds, have followed sales. Usually there is more of a lag:

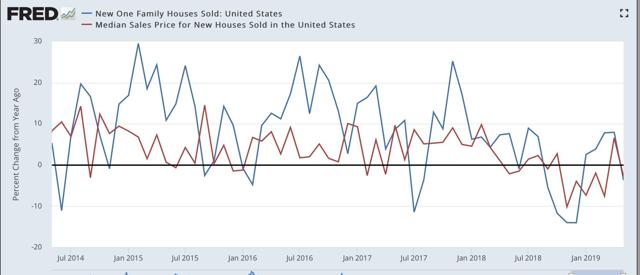

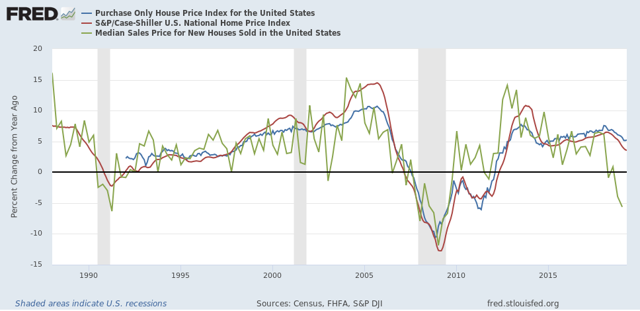

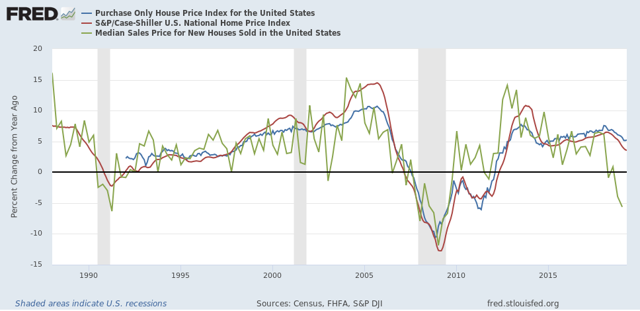

Here’s the quarterly average of YoY% change in median single family home prices (green, through Q1) vs. the monthly FHFA average (blue) and Case-Shiller national index (red):

The FHFA and Case-Shiller price indexes have only decelerated to a point where they roughly match median household income growth. This makes me wonder if prices for new homes will shoot back up again quickly as demand returns. If so, we could wind up in a “choke collar” situation (similar to what we had with gas prices 5 to 10 years ago), where rapid price increases choke off demand, which causes prices to back off, which reignites demand, and so on repeatedly.

This is important, because if the producer side of the economy falters, a choking off of higher new demand for housing would enhance the chances of a recession, and mute the chances of a housing recovery heading that off.

Monday, June 24, 2019

A tale of two timeframes

- by New Deal democrat

No data today, so while we are waiting for new home sales tomorrow, let me step back a little and give you an updated overview of my thinking.

It boils down to: the short term forecast — over the next 4 to 8 months — looks flat at best, and could develop into an actual downturn. The longer term — over one year out — looks more positive.

Let me start with the positive long term forecast first.

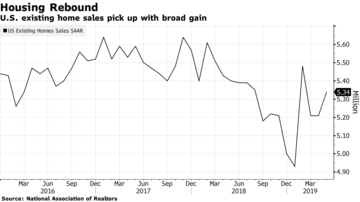

Long term interest rates have gone down significantly. Most importantly, mortgage rates have declined from about 5% to 4%. As a result, overall housing permits and starts, new single family home sales (which will be updated tomorrow) and through last Friday’s release of existing home sales have all turned higher:

The last big holdout, single family permits, probably made a bottom in April.

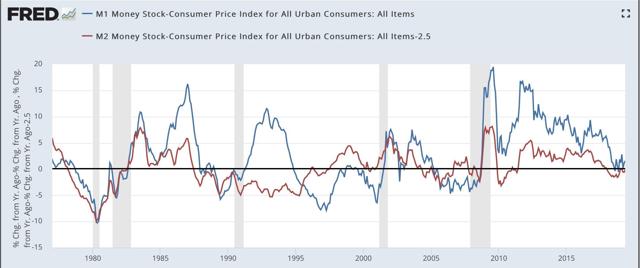

But they aren’t the only long leading indicators to have improved. So has real money supply. Here’s the long term view:

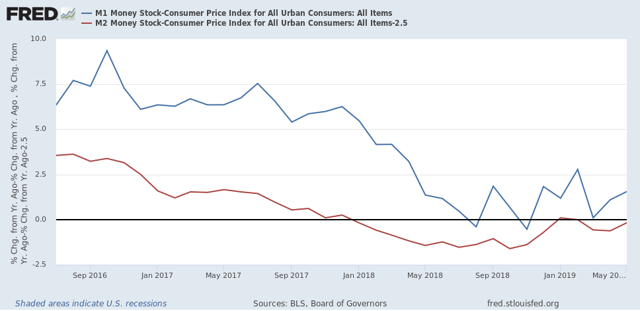

And here’s a close-up of the last few years:

Last year real M2 (minus 2.5%) turned negative, and for several months, so did real M1. Both are now positive again. Note that the closest analogues are 1988 and 2002 - neither of which times coincided with a subsequent recession.

So while the inverted yield curve is a real concern, it isn’t being confirmed by a number of other very valid indicators over the past six months.

So while the inverted yield curve is a real concern, it isn’t being confirmed by a number of other very valid indicators over the past six months.

Now let’s contrast with the short term forecast. The second half of last year, especially Q4, coincided with the greatest number of the long leading indicators turning south. That means we are heading into treacherous waters in the near term.

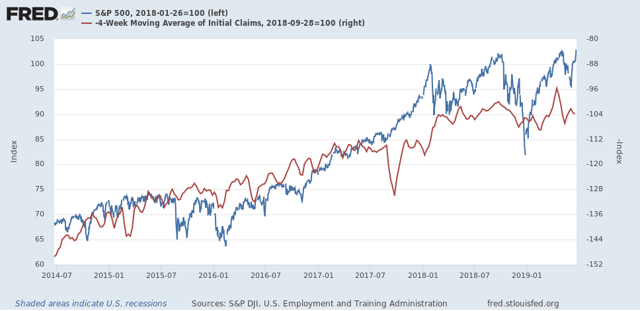

One “quick and dirty” way to look at the short leading indicators is simply to compare stock prices via the S&P 500 (blue in the graph below) vs. initial jobless claims (red, inverted):

In the above graph, stock prices are normed to 100 as of the January 2018 high. Note they have only improved by a little over 3% as of their most recent highs last week. Meanwhile initial claims only improved over their September 2018 lows (shown as a peak) during the three weeks before Easter this year, probably due to residual seasonality.

In short, short leading indicators have been going basically sideways. And as I’ve noted repeatedly in the last few months, the leading employment sectors of manufacturing, residential construction, and temp jobs have all turned flat or downward since January. Whether there’s a recession or not in the short term probably depends on the intensity of Trump’s trade wars, and how much businesses, and business planning, suffers for them.

So if my writing on the economy seems schizoid, it’s because the dour near term forecast depends on the actions of a narcissist who thrives on chaos, while the longer term is being leavened by other very leading sectors.

Sunday, June 23, 2019

Weekly Indicators for June 17 - 21 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is Up at Seeking Alpha.

The Fed moving to a cutting stance helped both stocks and bonds, and improved the long term outlook even more.