Saturday, January 19, 2019

Weekly Indicators for January 14 - 18 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

Evidence of the government shutdown may have shown up in tax withholding payments.

As always, clicking over and reading brings you fully up to date, and puts a penny or two in my pocket to reward me for my efforts.

Friday, January 18, 2019

Industrial production: strong finish to 2018

- by New Deal democrat

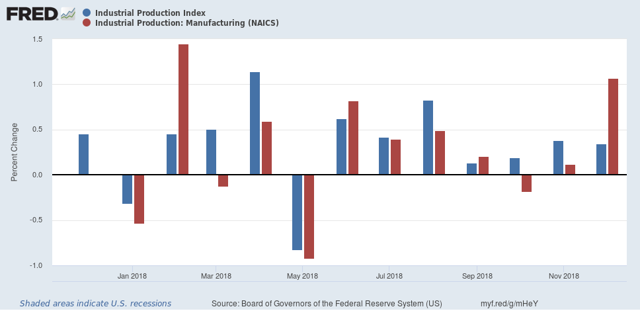

Industrial production for December was reported this morning at +0.3%, slightly better than estimates. But what was really surprising is how strong the manufacturing component was, up over 1%:

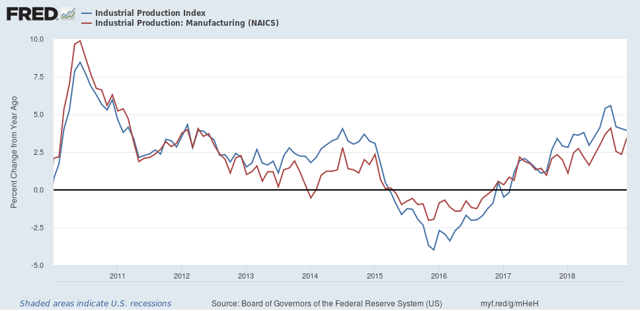

With this reading, YoY industrial production for manufacturing improved to +3.4%, and overall production came in just below 4%:

This is in contrast to the sharp slowdown we saw in both the December regional Fed indexes and the ISM manufacturing index.

This was a good finish to 2018. Despite this, I am expecting a substantial slowdown within the next 6 months. If the government shutdown proves intractable, the odds of recession by mid-year increase strongly.

Thursday, January 17, 2019

Why I’m expecting a 2nd half rebound in housing

- by New Deal democrat

In all of the storm und drang about yield curve inversions in the bond market, one important and overlooked consequence is how it is likely to help the very important housing sector.

This post is up at Seeking Alpha.

As usual, clicking over should be educational for you and helps me with a penny or two.

Wednesday, January 16, 2019

Notes on the government shutdown

- by New Deal democrat

I have a post on the housing market pending at Seeking Alpha. If and when it goes up there, I will link to it here.

In the meantime, here are a few important notes on the shutdown.

I can’t find the quote now, but about a week ago it was floated that Trump could “save face” by declaring an emergency, starting to build the wall, and then allow the government to open. Then Trump indicated that if he declared a state of emergency, that wouldn’t mean that he would open the government even then. This is a win-lose capitulation transaction, and Trump is bound and determined to show dominance over the Democrats.

Aside from the fact that there is a large portion of the GOP that is taking advantage of this to “drown the government in a bathtub,” now that a Federal judge has turned down government workers’ “involuntary servitude” challenge, Trump has a ready-made force of de facto slaves that he can recall — or not — depending on whether he wants a particular government program to work or not:

The nearly 50,000 furloughed federal employees are being brought back to work without pay — part of a group of about 800,000 federal workers who are not receiving paychecks during the shutdown, which is affecting dozens of federal agencies large and small. A federal judge on Tuesday rejected a bid by unions representing air traffic controllers and other federal workers to force the government to pay them if they are required to work.

Don’t hold your breath waiting for SEC workers or those necessary to issue food stamps to be recalled.

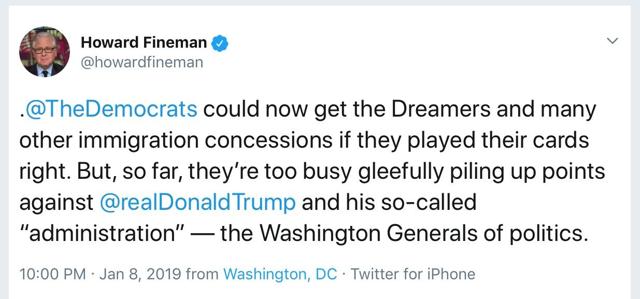

I’m not the only one who is questioning the Democrats’ (lack of?) strategy here, in failing to frame this as a horse-trading negotiation:

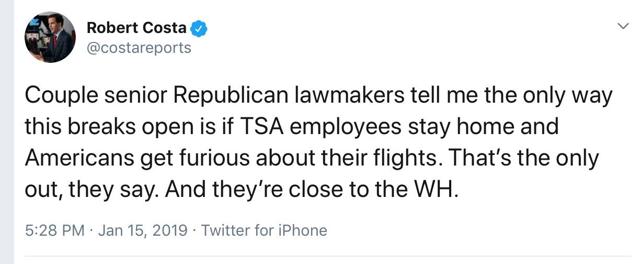

One way that the shutdown might end is if enough of the “essential” workers who aren’t being paid go out on strike:

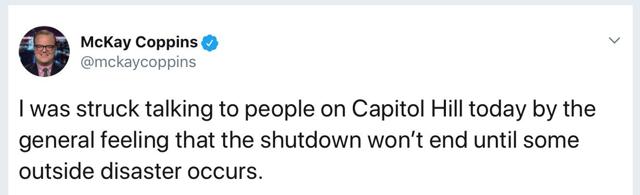

But apparently more and more insiders are coming to the same conclusion I came to a number of days ago. It will take a preventable disaster to force an end to the shutdown:

Meanwhile, the longer the shutdown goes on, the more likely it is that the economic slowdown that I’ve been writing about for months turns into a recession:

Mr. Hassett said on Tuesday that the administration now calculates that the shutdown reduces quarterly economic growth by 0.13 percentage points for every week that it lasts — the cumulative effect of lost work from contractors and furloughed federal employees who are not getting paid and who are investing and spending less as a result. That means that the economy has already lost nearly half a percentage point of growth from the four-week shutdown. (Last year, economic growth for the first quarter totaled 2.2 percent.)

I’m guessing about 10 to 12 weeks of a shutdown would be enough to do the trick.

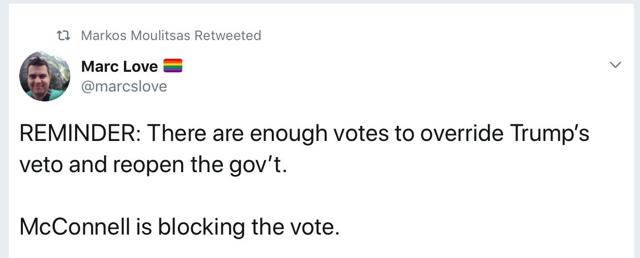

Finally, the focus on MItch McConnell is only half-right:

This is false. Unless Pelosi can round up over 50 GOPers in the House — and there’s no sign that she can — even a Senate bill passed 100-0 would not be enough to overcome a Trump veto.

Tuesday, January 15, 2019

The consumer nowcast and the short term forecast

- by New Deal democrat

First, a quick site note. I am blogging from a new device, and since I am a fossil, that means the transition is far from smooth. In particular, posting of graphs is going to be minimal until I can get a new method working properly. Also, I’m going to be traveling later this week, so don’t be surprised if there is no content for a couple of days. Finally, because the “Blogger” platform is very 2000s, and not supported any more, don’t be shocked if the best way to deal with it turns out to be transitioning to a new website.

No new data economic today, but the Fed did publish data last week that allows me to update one of my “alternate” forecast methods, one that I first laid out over a decade ago: the consumer nowcast.

The way this works is to look at the economy from the viewpoint of the average American consumer. In order for the consumer economy to grow, at least one of the three below items must be happening:

1. Real income is growing.

2. A widely held asset class, in particular stocks or real estate, is appreciating (and thus available to be tapped into to free up cash.

3. Interest rates decline to new lows, allowing existing debt to be refinanced.

If none of these are happening, then a pullback in willingness to spend signals the onset of a recession.

If none of these are happening, then a pullback in willingness to spend signals the onset of a recession.

Let’s take these in reverse order.

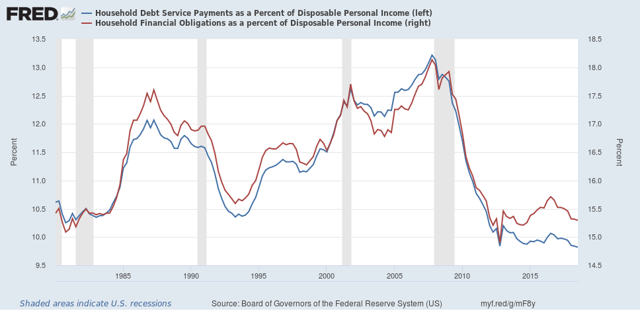

Last week the Fed released its household debt data, showing that household debt as a share of income peaked over two years ago. In Q3 2018 households became slightly more cautious compared with the quarter before:

Needless to say, stock prices last made a peak over 3 months ago. That source of cash has dried up.

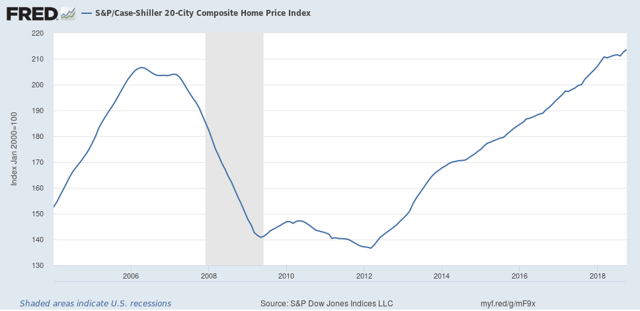

House prices, however, have continued to climb, according to the most recent Case-Shiller index, meaning that home equity withdrawal remains a potential source of spending money:

And perhaps most fundamentally, as I wrote about last week, real average and aggregate non-supervisory wages have continued to grow.

So the consumer nowcast is not signaling recession.

Meanwhile, as I wrote last week at Seeking Alpha, the short term forecast through mid-year is for no a slowdown but no recession, unless caused by poor public policy — like, say, a trade war, or maybe a government shutdown that causes businesses to postpone plans due to lack of transparency.

That sort of policy debacle isn’t going to first show up in the long leading indicators and take an entire year or more to filter through the economy. It will show up, more or less, all at once.

But I would still expect some warning from the short leading indicators, most notably from measures of manufacturing, temp hiring and layoffs.

As of now, neither temp hiring nor layoffs have backed off enough for any sort of warning. On the other hand, although it is just one data point of many, that the Empire State Manufacturing Index’s new orders measure fell to an 18 month low (although still positive at +4) at very least continues the trend of a big slowdown in the industrial sector.

Keep an eye on these three areas (new orders, temp hiring, and new jobless claims). If these turn outright negative, that will be a very strong sign that poor public policy is causing what otherwise would just be a slowdown to tip all the way into recession.

Monday, January 14, 2019

Flying blind

- by New Deal democrat

The government shutdown is affecting some important economic indicators. All of the series published by the Census Bureau, including retail sales, manufacturers’ and wholesalers’ data, personal income and spending, new home sales and housing permits and starts, are not being published. It appears that GDP is not going to be published by the BEA either.

In the past I have created work-arounds for a few economic series, in particular new jobless claims and industrial production, neither of which appear affected at this point, as the former is published by the Department of Labor, and the latter by the Fed.

If the government shutdown continues — and a long shutdown, until there is widespread pain or an avoidable disaster (like a plane crash or widespread food-borne disease outbreak) looks like the most likely scenario for now — I will attempt serviceable work-arounds for at least some of these series.

For starters, retail sales was scheduled to be released this Wednesday. Almost certainly that isn’t going to happen, so on Wednesday I’ll publish a guesstimate that hopefully will at least get the direction correct, and capture some of the strength or weakness of that direction.

For starters, retail sales was scheduled to be released this Wednesday. Almost certainly that isn’t going to happen, so on Wednesday I’ll publish a guesstimate that hopefully will at least get the direction correct, and capture some of the strength or weakness of that direction.

But, make no mistake, not having access to reliable economic data isn’t just a drawback for me, it’s a cost to any enterprises attempting to make decisions. Some of those businesses are going to postpone making a decision — on hiring as well as spending — until they have more clarity. And the postponement of spending decisions means a drag on GDP and employment.

Unfortunately it appears that the spate of short shutdowns in the past several decades have caused Washington to “learn” that, at least in the short term, nothing too bad happens when government is closed. Thus, flying blind will continue until we crash into something.