Saturday, June 4, 2016

Weekly Indicators for May 30 - June 3 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com.

Despite the punk jobs report, the high frequency data is almost all positive or neutral. There are very few negatives.

Friday, June 3, 2016

Decelerating jobs growth: I told you so

- by New Deal democrat

Every now and then, I like to remind you that you are reading the right blog. Because if I don't pat myself on the back, nobody else is going to, so please bear with me.

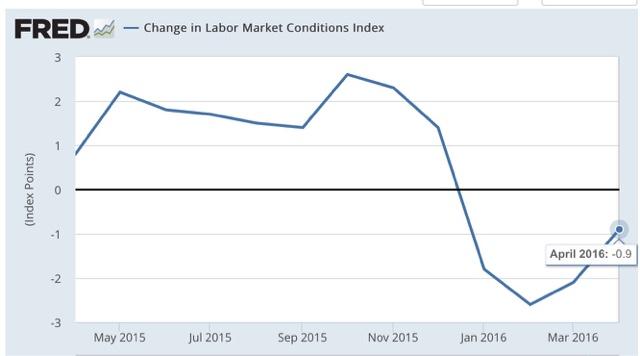

Anyway, the weakness in jobs growth was clearly forecast by a downturn in the Labor Market Conditions Index since last summer. I'm not just talking in retrospect, because I made exactly this forecast. Here I am last August, discussing the LMCI as a leading indicator:

the LMCI consistently leads the YoY% growth in jobs by 6 - 12 months, but YoY job growth (red) is a much smoother measure:

.... since the LMCI does lead the much smoother YoY growth in jobs, it strongly suggests that YoY payroll growth is going to decline over the next 6 months or so. And that can only happen if those payroll numbers generally come in under 225,000, and probably even below 200,000 through next winter.

Six months later, in February, I warned that the LMCI portended further weakness:

Average growth for the last 6 months has been 218,000 per month. with 3 months upnder 200,000.

The LMCI forecasts that the decelerating trend in job growth will continue, which means I expect average jobs growth during the next 6 months to continue to average under 225,000.

With three months more jobs data in, it is clear that the deceleration has continued - and intensified.

April LMCI will be reported next week. In the meantime, here is what I said about last month's report:

This month's report was the 4th such negative report in a row, but the good news is that it was "less bad:"

This is another small addition to the evidence that 2017 might be a poor year. It also suggests that monthly job gains that have already decelerated from a 225,000 rate, will continue to do so. In other words, export more reports of 1xx,000 to come. But at the same time, it is nowhere near as negative as it has been in the past at the onset of recessions.

May Jobs report: Main Street lays an egg

- by New Deal democrat

HEADLINES:

- +38,000 jobs added (would have been 73,000 except for Verizon strike)

- U3 unemployment rate -0.3 from 5.0% to 4.7%

- U6 underemployment rate unchanged at 9.7%

Here are the headlines on wages and the chronic heightened underemployment:

Wages and participation rates

- Not in Labor Force, but Want a Job Now: up 130,000 from 5.793 million to 5.923 million

- Part time for economic reasons: up 468,000 from 5.962 million to 6.430 million

- Employment/population ratio ages 25-54: up 0.1% from 77.7% to 77.8%

- Average Weekly Earnings for Production and Nonsupervisory Personnel: up +$.03 from $21.46 to $21.49, up +2.4% YoY. (Note: you may be reading different information about wages elsewhere. They are citing average wages for all private workers. I use wages for nonsupervisory personnel, to come closer to the situation for ordinary workers.)

March was revised downward by -22,000. April was also revised downward by -37,000, for a net change of -59,000.

The more leading numbers in the report tell us about where the economy is likely to be a few months from now. These were mixed.

- the average manufacturing workweek increased from 41.7 hours to 41.8 hours. This is one of the 10 components of the LEI.

- construction jobs decreased.by -15,000. YoY construction jobs are up +23,000.

- manufacturing jobs decreased by -10,000, and are down -50,000 YoY

- temporary jobs - a leading indicator for jobs overall decreased by -21,000 (this made a peak in December).

- the number of people unemployed for 5 weeks or less - a better leading indicator than initial jobless claims - decreased by -338,000 from 2,545,000 to 2.239,000. The post-recession low was set 9 months ago at 2,095,000.

Other important coincident indicators help us paint a more complete picture of the present:

- Overtime was unchanged at 3.2 hours.

- Professional and busines s employment (generally higher- paying jobs) increased by +10,000 and are up +525,000 YoY.

- the index of aggregate hours worked in the economy rose by 0.1 from 105.1 to 105.2 (but April was revised down substantially from 105.5)

- the index of aggregate payrolls rose by .2 from 128.4 to 128.6 (but April was revised down from 128.7).

Other news included:

- the alternate jobs number contained in the more volatile household survey decreased by -484,000 jobs. This represents an increase of 1,101,000 jobs YoY vs. 2,398,000 in the establishment survey.

- Government jobs rose by 13,000.

- the overall employment to population ratio for all ages 16 and above -was unchange d at 59.7% m/m but is up +0.3% YoY.

- The labor force participation rate fell -0.2% from 62.8% to 62.6% and is now *down* -.0.2% YoY (remember, this incl udes droves of retiring Boomers).

SUMMARY

This was an awful report with the saving grace of a positive jobs number, and a decrease in the unemployment rate. Short term unemployment fell. There was also a slight increase in the core prime age e/p ratio. If you want a positive, it is that the U3 unemployment rate typically starts to rise about half a year before a recession, so a big decrease is inconsistent with recession.

Everything else abouit this report was pre-recessionary. The vast majority of leading indicators in the report were negative. Revisions were down. Those who want a job now increased, involuntary part time work increased, construction, manufacturing, and temporary jobs were down. YoY wage growth is not acceleratiing. Even the positives in aggregate hours and payrolls are overshadowed by the big downward revisions in the prior months.

Two takeaways: 1. One bad employment report shouldn't change an economic forecast, particularly when the Labor Market Conditions INdex has been forecasting decelerating employment gains since last summer - but it does go into the balance.

2. This should stop the Fed dead in its tracks.

Everything else abouit this report was pre-recessionary. The vast majority of leading indicators in the report were negative. Revisions were down. Those who want a job now increased, involuntary part time work increased, construction, manufacturing, and temporary jobs were down. YoY wage growth is not acceleratiing. Even the positives in aggregate hours and payrolls are overshadowed by the big downward revisions in the prior months.

Two takeaways: 1. One bad employment report shouldn't change an economic forecast, particularly when the Labor Market Conditions INdex has been forecasting decelerating employment gains since last summer - but it does go into the balance.

2. This should stop the Fed dead in its tracks.

Bonddad Friday Linkfest

Chile’s solar industry has expanded so quickly that it’s giving electricity away for free.

Spot prices reached zero in parts of the country on 113 days through April, a number that’s on track to beat last year’s total of 192 days, according to Chile’s central grid operator. While that may be good for consumers, it’s bad news for companies that own power plants struggling to generate revenue and developers seeking financing for new facilities.

The main culprit is the northern part of the country, in the Atacama desert. Chile’s increasing energy demand, pushed by booming mine production and economic growth, helped spur the development of 29 solar farms, with another 15 planned, on the country’s central power grid. Now the nation faces slowing demand for energy as copper production slows amid a global glut, and those power plants are oversupplying a region that lacks transmission lines to distribute the electricity elsewhere.

Solar ETF Daily Chart

Hold Your Nose and Buy Europe (WSJ)

Consider price to book value, a measure of corporate net worth. Since 1970, according to data from MSCI, the average price to book value of European stocks has been about 25% below that of U.S. stocks. As of April 30, it is 40% lower. The dividend yield on European stocks, historically about one-third higher than in the U.S., is 69% higher.

.....

The lower prices in emerging markets offer margin for error while investors wait for positive surprises. Larry Swedroe, director of research at Buckingham Asset Management in St. Louis, points out that the average stock in Dimensional Fund Advisors’ Emerging Markets Value Portfolio, a $15 billion fund available only through financial advisors, trades at just 86% of book value. By contrast, U.S. stocks trade at nearly three times their book value.

Daily IEV ETF

Thursday, June 2, 2016

Why does Kevin Drum want to kill Social Security?

- by New Deal democrat

How to kill Social Security in 2 easy steps

Here's Kevin Drum advocating for step 1:

the best way to address retirement security is to continue reforming 401(k) plans and to expand Social Security—but only for low-income workers. Middle-class workers are generally doing reasonably well, and certainly as well as they did in the past. We don't need a massive and expensive expansion of Social Security for everyone, but we do need to make Social Security more generous for the bottom quarter or so of the population that's doing poorly in both relative and absolute terms. This is something that every liberal ought to support, and hopefully this is the bandwagon that President Obama in now on.

Step 2:

Now that 3/4 of the population will be paying into a system to transfer their income to the bottom 1/4, you have instantly created a majority constituency that will benefit from killing the now-welfare program.

Why does Kevin Drum want to kill Social Security?

Bonddad Thursday Linkfest

Millions of Americans enrolled in for-profit colleges in recent years to learn a trade and find decent-paying work. A new study found devastating results for many of their careers.

The working paper, published this week by the National Bureau of Economic Research, tracks 1.4 million students who left a for-profit school from 2006 through 2008. Because students at these schools tend to be older than recent high-school graduates, they’ve spent time in the workforce. The researchers used Education Department and Internal Revenue Service data to track their earnings before and after they left school.

The result: Students on average were worse off after attending for-profit schools. Undergraduates were less likely to be employed, and earned smaller paychecks–about $600 to $700 per year less–after leaving school compared to their lives before. Those who enrolled in certificate programs made roughly $920 less per year in the six years after school compared to before they enrolled.

Economic activity in the manufacturing sector expanded in May for the third consecutive month, while the overall economy grew for the 84th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The May PMI® registered 51.3 percent, an increase of 0.5 percentage point from the April reading of 50.8 percent. The New Orders Index registered 55.7 percent, a decrease of 0.1 percentage point from the April reading of 55.8 percent. The Production Index registered 52.6 percent, 1.6 percentage points lower than the April reading of 54.2 percent. The Employment Index registered 49.2 percent, the same reading as in April. Inventories of raw materials registered 45 percent, a decrease of 0.5 percentage point from the April reading of 45.5 percent. The Prices Index registered 63.5 percent, an increase of 4.5 percentage points from the April reading of 59 percent, indicating higher raw materials prices for the third consecutive month. Manufacturing registered growth in May for the third consecutive month, as 14 of our 18 industries reported an increase in new orders in May (down from 15 in April), and 12 of our 18 industries reported an increase in production in May (down from 15 in April)."

Daily Chart of the XLIs

1-Year Candleglance Charts of the 10 Largest XLI Members (Click for Larger Images)

Wednesday, June 1, 2016

ISM manufacturing suggests shallow industrial recession bottomed in March

- by New Deal democrat

This morning's ISM manufacturing index featured strong new orders growth for the 3rd straight month, and a continuing stout contraction in inventories.

Based on a nearly 70 year history, this adds strongly to the accumulating evidence that the shallow industrial recession has, in fact, bottomed. This post is up at XE.com.

Tuesday, May 31, 2016

Bonddad Wednesday Linkfest (Energy Sector and Yield Curve)

World oil supply

Energy ETF Daily

Fracking ETF Daily

Oil and Gas Exploration ETF Daily

Oil and Gas Services ETF Daily

The FOMC is tightening monetary policy because Fed officials believe that the US economy is showing more signs of sustainable growth with inflation rising back near their 2% target. Yet the yield curve is warning that the Fed’s moves could slow the US economy and halt the desired upturn in the inflation rate. Another possibility is that while the US economy might be strong enough to tolerate the normalization of US monetary policy, the global economy is much more vulnerable to Fed tightening moves.

Bonddad Tuesday Linkfest

People have different priorities and different values. But we share the same data. Over the last few days, we've heard a presidential contender make comments completing ignoring the data. This should concern everyone - ignoring data leads to irresponsible comments and poor policy decisions.

Read the whole article.

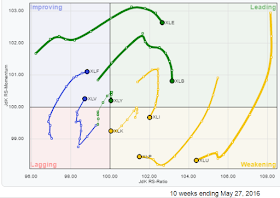

Sector Performance And Sector Rotation and Global Market Rotation (FinViz and Stockcharts)

The financial and healthcare sector are advancing relative to the SPYs. Consumer discretionary is weakly leading. Energy and basic materials continue to outperform.

Russia, Latin America and Brazil are outperforming the US. India is about to move into the outperforming camp. Europe is trying to more up, as is Japan and all Asia less Japan.

Rich people do move for tax reasons, but only about 2.2 percent of the time, the study estimates, with little impact on revenues in the states they leave behind. If states increase their top tax rate by 10 percent, they risk losing just 1 percent of their population of millionaires, the researchers found, using a statistical model based on millionaires' past movements from state to state.

“Millionaire tax flight is occurring, but only at the margins of significance,” write the authors, Stanford University sociology professor Cristobal Young, his Stanford colleague Charles Varner, and two U.S. Treasury Department economists, Ithai Lurie and Richard Prisinzano.

The researchers analyzed 45 million tax records, covering every filer who reported income of at least $1 million in any year from 1999 to 2011, and found that the rich are in fact less likely to move around than the poor. Typically, about half a million households report such an income, and only 2.4 percent of these taxpayers move from state to state in any given year. That compares with 2.9 percent of the general population and 4.5 percent of those earning about $10,000 a year.