Saturday, May 7, 2016

Weekly Indicators for May 2 - 6 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com. There was little change this week, although an important negative is coming up on a one year anniversary of a negative pivot, and may be reversing course.

Friday, May 6, 2016

April jobs report: good on wages, but ongoing signs of late cycle deceleration

- by New Deal democrat

HEADLINES:

- +160,000 jobs added

- U3 unemployment rate unchanged at 5.0%

- U6 underemployment rate down -0.1% from 9.8% to 9.7%

With the expansion firmly established, the focus has shifted to wages and the chronic heightened unemployment. Here's the headlines on those:

Wages and participation rates

- Not in Labor Force, but Want a Job Now: up +81,000 from 5.712 million to 5.793 million

- Part time for economic reasons: down -61,000 from 6.123 million to 5.962 million

- Employment/population ratio ages 25-54: down -0.3% from 78.0% to 77.7%

- Average Weekly Earnings for Production and Nonsupervisory Personnel: up +$.05 from $21.40 to $21.45, up +2.5%YoY. (Note: you may be reading different information about wages elsewhere. They are citing average wages for all private workers. I use wages for nonsupervisory personnel, to come closer to the situation for ordinary workers.)

February was revised downward by -12,000. March was also revised downward by -7,000, for a net change of -19,000.

The more leading numbers in the report tell us about where the economy is likely to be a few months from now. These were neutral to mixed.

- the average manufacturing workweek was unchanged at 41.7 hours to 41.- hours. This is one of the 10 components of the LEI.

- construction jobs increased.by +1,000. YoY construction jobs are up +261,000.

- manufacturing jobs increased by +4,000, and are now *down* -19,000 YoY

- temporary jobs - a leading indicator for jobs overall increased by +9,300 (but is still down from December's high).

- the number of people unemployed for 5 weeks or less - a better leading indicator than initial jobless claims - increased by 133,000 from 2,412,000 to 2.545,000. The post-recession low was set 8 months ago at 2,095,000.

Other important coincident indicators help us paint a more complete picture of the present:

- Overtime was unchanged at 3.3 hours.

- Professional and business employment (generally higher-paying jobs) increased by +65,000 and are up +511,000 YoY.

- the index of aggregate hours worked in the economy rose by 0.4 from 105.1 to 105.5.

- the index of aggregate payrolls rose by 1.0 from 127.7 to 128.7.

Other news included:

- the alternate jobs number contained in the more volatile household survey decreased by -316,000 jobs. This represents an increase of 2,495,000 jobs YoY vs. 2,692,000 in the establishment survey.

- Government jobs fell by -11,000.

- the overall employment to population ratio for all ages 16 and above fell by -0.2 from 59.9 to 59.7 m/m but is up +0.4% YoY.

- The labor force participation rate fell -0.2% from 63.0% to 62.8% and is now up +.0.1% YoY (remember, this incl udes droves of retiring Boomers).

SUMMARY

This looks like a classic late-cycle expansion report to me. The more coincident measures, like aggregate hours and wages, improved significantly, and were the best parts of the report, which is good for labor. Many of the leading indicators in the report, however, declined, including revisions to prior months, the short term unemployed, the YoY change in employment, and the failure of temporary jobs to make a new high (although they were positive this month).

While the U6 underemployment rate declined slightly, progress in involuntary part time employment and those out of the work force who want a job now has stalled. The decline in the employment population ratio and the labor force participation rate will probably get lots of notice, but all these really did is take back some of the strong numbers in the last few reports, so I am less concerned about those -- although from a long-term point of view, it remains a big negative that so far into this expansion these participation numbers remain so depressed compared with 10 years ago.

So -- some definite bright spots, no cause for imminent concern, but showing ongoing signs of late cycle deceleration

From Bonddad:

The primary reason for the drop was a decline in retail and construction employment. Retail lost 3,000 employees while construction only added 1,000 jobs. In the previous report, these numbers were 39,000 and 41,000, respectively.

This highlights the potential topping out of retail sales and new home construction for this cycle. The following chart clarifies:

While the U6 underemployment rate declined slightly, progress in involuntary part time employment and those out of the work force who want a job now has stalled. The decline in the employment population ratio and the labor force participation rate will probably get lots of notice, but all these really did is take back some of the strong numbers in the last few reports, so I am less concerned about those -- although from a long-term point of view, it remains a big negative that so far into this expansion these participation numbers remain so depressed compared with 10 years ago.

So -- some definite bright spots, no cause for imminent concern, but showing ongoing signs of late cycle deceleration

From Bonddad:

The primary reason for the drop was a decline in retail and construction employment. Retail lost 3,000 employees while construction only added 1,000 jobs. In the previous report, these numbers were 39,000 and 41,000, respectively.

This highlights the potential topping out of retail sales and new home construction for this cycle. The following chart clarifies:

The above chart shows retail sales and new home starts for the last year, both converted to a scale of 100. Retail sales (the red line) have moved sideways since July 2015. New housing starts (the blue line) moved sideways for the last year.

The latest GDP report confirmed the retail slowdown but not the housing numbers. PCEs are slowing; they increased 3.6% in 2Q15 but only 1.9% in the latest report. However, residential investment increased a very strong 14.8%. Here's a table of the data:

Bonddad Friday Linkfest

Almost $10tn of negative yielding government bonds are costing investors about $24bn annually, according to calculations by Fitch, posing challenges to long-term investors that rely on sovereign debt as a bedrock of their portfolios.

The rating agency warned that the previously unthinkable scenario of negative-yield bonds is having a “broad impact” on investors such as insurers, banks, pension funds and money market funds. Analysts say insurance companies and pension schemes in particular are struggling to get the returns they need to plug widening deficits.

Citigroup this year estimated that UK and US companies have pension deficits of $520bn, and put the developed world’s public sector pension underfunding at $78tn. Those deficits have been aggravated by the drooping yields of bonds, the traditional mainstay of their investment holdings.

Why Has the Labor Force Participation Rate Increased? (Macroblog)

During the last year, the negative effect on participation attributable to an aging population (0.22 percentage points) has been offset by a 0.23 percentage point decline in the share of people who want a job but are not counted as unemployed (including people who are marginally attached). This decline is an encouraging sign, and consistent with a tightening labor market.

The Dividend Aristocrats Index is comprised of 50 stocks that have paid dividends for 25+ consecutive years.

In addition to requiring 25+ years of consecutive dividend increases, Dividend Aristocrats must also:

Be members of the S&P 500 Index

Meet certain size and liquidity requirements.

What's the big deal about being a Dividend Aristocrat?

The Dividend Aristocrats Index has outperformed the market by a wide margin over the last decade.

Thursday, May 5, 2016

Four measures of real wage improvements: good news and bad news

- by New Deal democrat

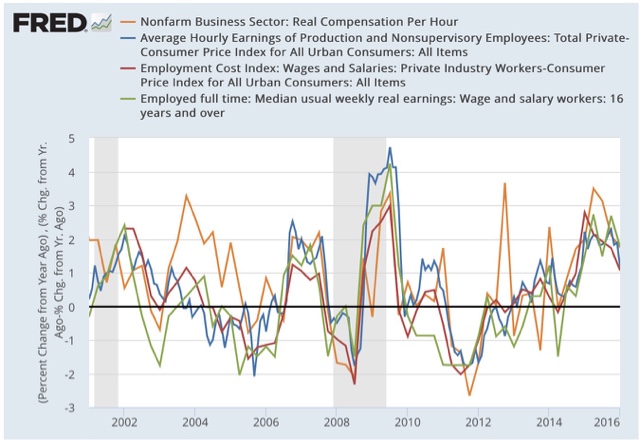

In the last several years, I have written a number of posts documenting the stagnation in average and median wages, for example here and here. Several of the series were just updated for the first quarter, so now is a good time to take another look.

We have a variety of economic data series to track both average and median wages:

First, the good news: the below graph tracks monthly average (mean, not median) hourly wages (blue), median wages from the employment cost index (red), real compensation per hour (brown), and median usual weekly earnings (green). All are adjusted for inflation. Since the quarterly index of median wages only started in Q1 2001, I have normed the indexes to 100 at that time:

And here is a longer term view. The ECI only started in 2001, but the other 3 go back in time at least into the 1960s:

With the exception of average hourly earnings (blue line), the other three are at all time record highs. I don't want to oversell this, because it has been a very slow process, but it is still certainly positive and worth two cheers anyway.

Now, the bad news. Here is the same information YoY:

In the last several years, I have written a number of posts documenting the stagnation in average and median wages, for example here and here. Several of the series were just updated for the first quarter, so now is a good time to take another look.

We have a variety of economic data series to track both average and median wages:

- The most commonly known measure is that of average hourly pay for nonsupervisory workers, which is part of the monthly jobs report.

- The Bureau of Labor Statistics, which conducts the household employment survey, also reports "usual weekly earnings" for full time workers each quarter.

- The BLS also measures the Employment Cost Index quarterly.

- The BLS also measures "business sector real compensation per hour" quarterly.

First, the good news: the below graph tracks monthly average (mean, not median) hourly wages (blue), median wages from the employment cost index (red), real compensation per hour (brown), and median usual weekly earnings (green). All are adjusted for inflation. Since the quarterly index of median wages only started in Q1 2001, I have normed the indexes to 100 at that time:

And here is a longer term view. The ECI only started in 2001, but the other 3 go back in time at least into the 1960s:

With the exception of average hourly earnings (blue line), the other three are at all time record highs. I don't want to oversell this, because it has been a very slow process, but it is still certainly positive and worth two cheers anyway.

Now, the bad news. Here is the same information YoY:

All 4 series made YoY% highs for this expansion in the first half of 2015, and have showed decelerating growth since then. This shows us how dependent real wage growth has been on the price of gas really ever since the start of the Millennium. Gas prices have probably bottomed, and YoY wage growth has probably peaked for this cycle. And with just under 10% underemployment, we have yet to reach full labor utilization.

Bonddad Thursday Linkfest

I think there are 5 reasons: slower growth of capital per worker, slower TFP, capital misallocation, the absence of full employment, and dysfunctional government (labor quality has been pretty constant, so it isn’t much implicated in the slowdown).

Employment growth at US companies slowed in April to the weakest gain in three years, according to this morning’s update from ADP. The private sector added only 156,000 positions to payrolls last month in seasonally adjusted terms—well below expectations for a gain of nearly 200,000. Today’s data raises new questions about expectations for a second-quarter rebound in economic activity following the weak Q1 GDP report. The numbers du jour also revive the focus on a question I asked last week: Will Job Growth Kill The Bear-Market Signal For Stocks?

Markets continue to recover from the growth scare that set in beginning around the end of last year. Oil prices were plunging, creditors feared a wave of defaults, commodity prices were plunging, China was thought to be on the verge of a huge slowdown, and central banks appeared powerless to avoid another recession. What a difference a few months make. "Avoiding a recession is all it takes" has been a recurring theme of this blog for more than three years, and it's still relevant. Here are some more charts which suggest that instead of tipping over into a recession, the economy is more likely picking up a bit. Growth is still slow, but slow growth is a lot better than a recession, especially when cash yields almost nothing.

Wednesday, May 4, 2016

The Dollar is Right At Important Technical Support

The above 5-year chart of the dollar shows its value is right at key technical support levels.

Expect continue manufacturing improvement if prices continue in this direction.

Decent news on houses and cars

- by New Deal democrat

The two most leading parts of the consumer economy are houses and cars. Both were going strong last year before wobbling in the last few months. In the last week, however, we've received some positive news on both.

First, the existing negative stats about housing: new home sales, which peaked over a year ago, and permits, which peaked last June:

The good news we got last week was that real private residential investment rose as a share of GDP to a new post recession high (blue in the graph below). This typically peaks over a year before the next recession. Single family permits (red) also remain positive:

Yesterday April motor vehicle sales returned to 17 million plus annualized (h/t Bill McBride):

Car sales tend to plateau during expansions and decline at least 6 months before a recession. Had car sales had another month under 17 million, that would have been a bad sign. April returned us to the plateau range, so March might have been just a one-off exception.

I don't want to oversell either of these data points. But they are positives that are consistent with the economy continuing to grow into next year.

From Bonddad:

I'd like to add the following point:

If there is any reason to be hopeful about the future, it's the continued strong housing numbers contained in GDP reports. Economist Ed Leamer famously noted that housing is the business cycle. Frankly, he's pretty much spot on with that statement. A new home requires labor, raw materials, a large outlay for durable goods, and financing. That means there are strong ripple effects from the new homes market.

Something to think about: despite low inventory, housing companies continue to build at a good but not exceptional pace, which is contributing to higher new home prices. I had an email exchange with an analyst about this and asked if the homebuilding companies were deliberately keeping inventory low to get higher prices. While he didn't have any proof, he did suspect that to be the case. This is a hunch on my part; I have no proof. It makes sense, especially when you consider the shellacking the home builders took as a result of the Great Recession.

From Bonddad:

I'd like to add the following point:

If there is any reason to be hopeful about the future, it's the continued strong housing numbers contained in GDP reports. Economist Ed Leamer famously noted that housing is the business cycle. Frankly, he's pretty much spot on with that statement. A new home requires labor, raw materials, a large outlay for durable goods, and financing. That means there are strong ripple effects from the new homes market.

Something to think about: despite low inventory, housing companies continue to build at a good but not exceptional pace, which is contributing to higher new home prices. I had an email exchange with an analyst about this and asked if the homebuilding companies were deliberately keeping inventory low to get higher prices. While he didn't have any proof, he did suspect that to be the case. This is a hunch on my part; I have no proof. It makes sense, especially when you consider the shellacking the home builders took as a result of the Great Recession.

Bonddad Wednesday Linkfest

I was at a conference in New York City on Monday and Tuesday; so I was unable to post.

The global economy is continuing to grow, though at a slightly lower pace than earlier expected, with forecasts having been revised down a little further recently. While several advanced economies have recorded improved conditions over the past year, conditions have become more difficult for a number of emerging market economies. China's growth rate moderated further in the first part of the year, though recent actions by Chinese policymakers are supporting the near-term outlook.

Commodity prices have firmed noticeably from recent lows, but this follows very substantial declines over the past couple of years. Australia's terms of trade remain much lower than they had been in recent years.

Sentiment in financial markets has improved, after a period of heightened volatility early in the year. However, uncertainty about the global economic outlook and policy settings among the major jurisdictions continues. Funding costs for high-quality borrowers remain very low and, globally, monetary policy remains remarkably accommodative.

In Australia, the available information suggests that the economy is continuing to rebalance following the mining investment boom. GDP growth picked up over 2015, particularly in the second half of the year, and the labour market improved. Indications are that growth is continuing in 2016, though probably at a more moderate pace. Labour market indicators have been more mixed of late.

Inflation has been quite low for some time and recent data were unexpectedly low. While the quarterly data contain some temporary factors, these results, together with ongoing very subdued growth in labour costs and very low cost pressures elsewhere in the world, point to a lower outlook for inflation than previously forecast.

Monetary policy has been accommodative for quite some time. Low interest rates have been supporting demand and the lower exchange rate overall has helped the traded sector. Credit growth to households continues at a moderate pace, while that to businesses has picked up over the past year or so. These factors are all assisting the economy to make the necessary economic adjustments, though an appreciating exchange rate could complicate this.

Monday, May 2, 2016

April ISM manufacturing new orders strong, inventory liquidation continues

- by New Deal democrat

I have been tracking and averaging the new orders components of the regional Fed indexes to see if they anticipate the dirrection of the monthly ISM new orders, which in turn is a leading indicator for business sales and industrial production.

This morning' April ISM manufacturing report - the second strong monthly report in a row - is potent evidence of a coming change in trend for manufacturing and industry. (up at XE.com)

Sunday, May 1, 2016

US Equity, US Bond Market and International Week in Review

My weeking columns are up at XE.com

US Equity Week in Review

US Bond Market Week in Review

International Week in Review

US Equity Week in Review

US Bond Market Week in Review

International Week in Review

A thought for Sunday: gerrymanders are like levees

- by New Deal democrat

A gerrymander acts like a levee. A river in flood stage can be contained within a channel, so long as the water level is less than the height of the levee. Similarly, by packing democrats into relatively few districts, and spreading the remaining, smaller GOP majorities over many, the GOP was able to withstand a 52%-48% numerical voting loss for Congressional seats in 2012 and retain a comfortable majority.

But if the water level from a river in flood exceeds - even slightly - the height of the levee, this is what happens:

Similarly, by taking what would otherwise be 60/40 or 65/35 GOP districts and turning them into a greater number of, say, 55/45 districts, then, should the democratic vote this November be 55.1%, you get the electoral version of the above picture.