Saturday, March 26, 2016

Weekly Indicators for March 21 - 25 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com.

I have inaugurated coverage of a rolling average of the regional Fed manufacturing new orders reports. Right now they are sending a powerful signal, and we'll find out how probative that is this coming Friday.

Friday, March 25, 2016

Corporate profits head south

- by New Deal democrat

At long last, the BEA has released corporate profits for Q4 2015. Here's the bad news:

Corporate profits are a long leading indicator, and they have now turned negative for the second quarter in a row. Usually proprietors' income (blue in the graph below), reported much more timely, tracks their direction well, but sometimes corporate profits (red) turn first - and in the 4th Quarter, that's what happened:

I'll be updating my look at all of the long leading indicators next week. Stay tuned ....

Note from Bonddad: this has been one of my biggest issues with the market for the last 6-12 months. Both Zack's and Factset.com have documented a deteriorating revenue and earnings picture. Just last week, I made the following observation in my weekly market commentary:

Market Outlook: the market is still expensive. The current and forward PE for the SPYs and QQQs is 23.61/21.45 and 17.05/18.09, respectively. The revenue and earnings picture is weak. From Factset:

The estimated revenue decline for Q1 2016 is -0.8%. If this is the final sales decline for the quarter, it will mark the first time the index has seen five consecutive quarters of year-over-year declines in sales since FactSet began tracking the data in Q3 2008. Five sectors are projected to report year-over-year growth in revenues, led by the Telecom Services and Health Care sectors. Five sectors are predicted to report a year-over-year decline in revenues, led by the Energy and Materials sectors......

The estimated earnings decline for Q1 2016 is -8.4%. If this is the final earnings decline for the quarter, it will mark the first time the index has seen four consecutive quarters of year-over-year declines in earnings since Q4 2008 through Q3 2009. It will also mark the largest year-over-year decline in earnings since Q3 2009 (-15.7%). Only three sectors are projected to report year-over-year growth in earnings, led by the Telecom Services and Consumer Discretionary sectors. Seven sectors are projected to report a year-over-year decline in earnings, led by the Energy, Materials, and Industrials sectors.

To reiterate: we’re potentially looking at 5 consecutive quarters of revenue declines and four consecutive quarters of earnings declines. These are bear market statistics. And they go a long way to explaining why I continue to be slightly bearish regarding the markets.

Bonddad Friday Linkfest

Next Thursday, March 31 at 3PM CST, I'll be doing a free webinar that will review the last month or so of US economic data along with an overview of the major markets (equities and bonds). It's free! It'll last at most 30 minutes (probably shorter). You can sign up here.

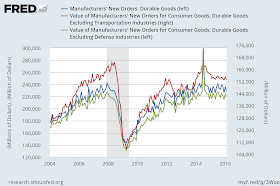

- Durable goods orders drop (again)(Census)

- Are we late in the housing cycle (NDD at XE)

- Initial unemployment claims are really low (Scott Grannis)

- Dissecting opportunity cost (Conversible Economist)

- Great set of charts on China from the CFA blog

- Forecasters see modest 1Q Growth (Capital Spectator)

- Is new home growth stalling (Political Calculations)

- The Fed has slack (Dr. Ed)

- Kerry says ISIL is faltering in the ME (NYT)

- Abortion rights advocates cry foul over new Congressional tactics (NYT)

- Insiders to Trump: no majority, no nomination (Politico)

- ECB Economic Bulletin (ECB)

US Durable Goods

Thursday, March 24, 2016

Has housing peaked? An updated look

- by New Deal democrat

The relationship is weak, but various housing series tend to peak in order. With February data completed with yesterday's report on new home sales, I take an updated look over at XE.com

Bonddad Thursday Linkfest

A week from today (Thursday, March 31) at 3PM CST, I'll be doing a free webinar that will review the last month or so of US economic data along with an overview of the major markets (equities and bonds). It's free! It'll last at most 30 minutes (probably shorter). You can sign up here.

- Commodity rebound outruns fundamentals (FT)

- Fed President Lockhart sees a rate hike soon (FT)

- More on Canada's fiscal stimulus (Alphaville)

- New home sales increased 2% (Census)

- Crude oil inventories surge (BeSpoke)

- Richmond Fed Spikes (BeSpoke)

- Mission still not accomplished (EPI)

- Kerry says Brussels attacks renew urgency for ME initiative (NYT)

- UK retail sales up 3.8% Y/Y. .4% M/M (ONS)

- Bullard sees a possibility for an April rate hike (BB)

- Three consequences of negative interest rates (BB)

- Japanese bond market close to breaking point (BB)

- Earnings season cools mood (FT)

- Inflation stirs as the Fed stands still (FT)

The Earnings Environment Isn't Promising

Wednesday, March 23, 2016

Is Industrial Production "less bad"?

- by New Deal democrat

One of my pet peeves is analysis that relies too much on Year-over-year comparisons, as in "X is still YoY positive/negative." If you do that, you are going to miss turning points, which happened sometime during that year - perhaps many months before the sign turned.

But one good use of YoY comparisons is to see if they are getting "less good/bad." This will help you spot a change in trend.

A few analyses in the last several weeks noted an improvement in the YoY comparison in Industrial Production, and I also made mention of it in my last Weekly Indicators column. But let's take a little closer look, first at the long term:

YoY industrial production tends to bottom right at the end of recessions (this is true of most recessions over the last 100 years, the above graph is limited better to show the current situation). That little hook at the right is the recent improvement in YoY industrial production.

Here is a close-up of the lastl year:

There have only been two months of "less worse" readings, and they are well within the range of noise. I would like to see several more months of such improvement before I would be confident that the shallow industrial recession has bottomed -- although, with the recent decline in the US$, that is the more likely scenario.

Bonddad Wednesday Linkfest

Don't forget about our monthly economic and market review on Thu March 31 at 3PM. It's a free webinar. You can sign up at this link.

- UK Inflation at .3% (ONS)

- The US will avoid a recession (Blackrock)

- EU Deflation will on the table (BB)

- German manufacturing is sluggish (BB)

- German business sentiment improved a bit (IFO)

- French growth just above expansion level (BB)

- Australian debt levels are really high (Debtwatch)

- Five important equations (Jared Bernstein)

- NY Fed's Monthly Snapshot (NYFED)

- The earnings gap is getting concerning (Motley Fool)

- Canada goes Keynesian (BB)

- Chicago Fed President Evans Speech (BB)

- Oil Market overview (BB Video)

- Three signs of a safe dividend (Morningstar)

- Fed President Harker speech (Phil. Fed)

- The failure of the Kansas Experiment (The Big Picture/Seth Rogan; video)

- The profits recession is not good (BI)

Tuesday, March 22, 2016

Global Economy Has Taken Some Hits Already This Year ... And It Shows

This is quite a series of events from Fed President Lockhart.

We know that in January and early February, the world's financial markets, including our own, went through an episode of significant volatility. From the first trading day of January, investors appeared to go "risk off" and headed for safety. A number of concerns seemed to gang up on investors: the weak fourth quarter here in the United States, economic weakness globally in advanced economies and emerging markets, the apparent economic slowdown in China, Chinese currency depreciation, and the falling oil price and what that could mean for global demand.

We know that an important index that measures financial volatility—the VIX—rose to a level above 28 (a very high reading) on February 11 and has since settled back to a much calmer reading around 15. We know that financial markets here have substantially recovered lost value, but we do not know if the volatility investors experienced and the public observed in January and early February will have any extended impact on the broad economy.

We know that on March 5, the government of China stated its GDP growth target for the next measurement period at a range of 6.5 to 7.0 percent. The introduction of a range was interpreted as allowing for lower growth than recorded in the past, reinforcing the sense that China's economy is slowing.

We know that the Bank of Japan—Japan's central bank—unveiled a negative rate policy on January 29. Japan joined the eurozone in using negative official rates to spur inflation and growth.

We know that on March 10, the European Central Bank deployed Mario Draghi's "bazooka." The ECB pushed its policy rate more into negative territory and took other strong measures in an attempt to pull the eurozone out of its persistent weak state evidenced by very low inflation.

These are some highlights of a rough start to the year. As I said, the context has mutated somewhat since December, even if, all things considered, the economy remains on a positive trajectory.

Combine that with this chart of global growth from the Dallas Fed

We know that in January and early February, the world's financial markets, including our own, went through an episode of significant volatility. From the first trading day of January, investors appeared to go "risk off" and headed for safety. A number of concerns seemed to gang up on investors: the weak fourth quarter here in the United States, economic weakness globally in advanced economies and emerging markets, the apparent economic slowdown in China, Chinese currency depreciation, and the falling oil price and what that could mean for global demand.

We know that an important index that measures financial volatility—the VIX—rose to a level above 28 (a very high reading) on February 11 and has since settled back to a much calmer reading around 15. We know that financial markets here have substantially recovered lost value, but we do not know if the volatility investors experienced and the public observed in January and early February will have any extended impact on the broad economy.

We know that on March 5, the government of China stated its GDP growth target for the next measurement period at a range of 6.5 to 7.0 percent. The introduction of a range was interpreted as allowing for lower growth than recorded in the past, reinforcing the sense that China's economy is slowing.

We know that the Bank of Japan—Japan's central bank—unveiled a negative rate policy on January 29. Japan joined the eurozone in using negative official rates to spur inflation and growth.

We know that on March 10, the European Central Bank deployed Mario Draghi's "bazooka." The ECB pushed its policy rate more into negative territory and took other strong measures in an attempt to pull the eurozone out of its persistent weak state evidenced by very low inflation.

These are some highlights of a rough start to the year. As I said, the context has mutated somewhat since December, even if, all things considered, the economy remains on a positive trajectory.

Combine that with this chart of global growth from the Dallas Fed

One of these business metrics is giving a false signal

- by New Deal democrat

The recent poor numbers on wholesaler and retailer inventories and sales stand in stark juxtaposition to the improvement in weekly reports of steel production, rail transport (until last week!), and consumer spending by the likes of Goldman Sachs and Gallup. The monthly numbers say deterioration, while the weekly numbers say improvement.

A similar contradiction is playing out in ISM new orders vs. business inventories and sales. Typically new orders turn positive first (red, left scale in the graph below), followed by sales (green, right scale), and finally inventories (blue, right scale):

Sales and inventories are shown YoY for easier visual comparison. Here are the raw numbers for both sales and inventories:

ISM new orders have show two months of slight improvement, while inventories are no better than flat, and sales continue to decline.

Now here is a close-up on the last several years of the first graph above:

Inventories haven't really followed sales at all. If this is an incipient recession, then I would expect inventories to follow sales, which means that ISM new orders are giving a false signal. On the other hand, if this is simply a slowdown, like 1998 (far left in the first graph), then sales should turn positive, and like 1998 inventories will not decline, in which case it is elevated inventories that are giving the false signal.

Bottom line: either ISM new orders are falsely signaling optimism, or business inventory accumulation is falsely signaling pessimism. A cause for optimism that the discrepancy will resolve to the upside is that the regional March Empire State, Philly, and as of this morning Richmond manufacturing indexes have all shown a positive spike in new orders.

Bottom line: either ISM new orders are falsely signaling optimism, or business inventory accumulation is falsely signaling pessimism. A cause for optimism that the discrepancy will resolve to the upside is that the regional March Empire State, Philly, and as of this morning Richmond manufacturing indexes have all shown a positive spike in new orders.

Bonddad Tuesday Linkfest

Don't forget about our monthly economic and market review on Thu March 31 at 3PM. You can sign up at this link.

- Existing home sales drop 7.1% (CR)

- Fed President Lacker on the Outlook for Inflation (Richmond Fed)

- The next big M&A boom is here (The Conversible Economist)

- Treasuries Piling Up at a number of firms (BB)

- Brexit will lower growth big time (Telegraph)

- International Outlook Dimming (Dallas Fed)

- Fed President Lockhart on the Economic Outlook (Atlana Fed)

- China's new macro strategy (FT)

- GDI or GDP? (St. Louis Fed)

- Dividend Cuts Are Increasing (Political Calculations)

- Japanese Markit Manufacturing (Markit)

- EU Markit Composite (Markit)

- A profits recession would be really bad (Marketwatch)

- Dividends Beat Buybacks (Ritholtz)

Monday, March 21, 2016

Five graphs for 2016: March update

- by New Deal democrat

At the beginning of this year, I identified graphs of 5 aspects of the economy that most bore watching. With the first 2 months of data under our belts, let's take a look at each of them.

#5 The Yield Curve

The Fed having embarked on a tightening regimen as of December, the question is, will the yield curve compress or, worse, invert, an inversion being a nearly infallible sign of a recession to come in about 12 months.

Here's what has happened so far:

Rates on 2 year treasuries have risen slightly, while the 10 year treasury yield has fallen (typically long rates only start to fall once the tightening cycle has caused the economy to weaken).

Still the difference in the two rates, at about 1%, is typical when measured over the long term. There is no particular tightness here. At the same time, if the trend continues (no guarantee of that), then even as few as two more .25% rate hikes by the Fed could cause the yield curve to invert.

#4 The trade weighted US$

#4 The trade weighted US$

Perhaps the biggest story of 2015 was the damage done by the 15%+ surge in the US$ that began in late 2014 -- which not only harmed exports, but pretty much cancelled out the positive effect on consumers' wallets by lower gas prices.

Here there has been a big change:

Against all currencies, the US$ is now only up 3% -- a typical reading. Against major currencies, the US$ has actually declined YoY. This is good news.

#3 The inventory to sales ratio

An elevated ratio of business inventories to sales means that businesses are overstocked. This has frequently but not always been associated with a recession. Here the news is not good at all:

Typically sales peak/trough first, and inventories catch up with a lag. In late 2015, inventories went sideways, even as sales continued to slide. In the last two months, not only have sales continued to decline, but more inventory has been accumulated. This is going in the wrong direction, and is about the single worst statistic in the economy.

#2 Discouraged workers

While 2015 saw a big improvement in involuntary part time employment, the number of those so discouraged that they did not even look for work, even though they want a job, went stubbornly sideways until the last quarter of 2015. In the last two months it has actually retreated from its December low, and is still elevated well above its rate in the later part of the 1990s through 2007:

This may be just noise, or it may herald a stagnation in improvement.

#1 Underemployment and wages

The single worst part of this economic expansion has been its pathetic record for wage increases. Nominal YoY wage increases for nonsupervisory workers were generally about 4% in the 1990s, and even in the latter part of the early 2000s expansion. In this expansion, however, nominal increases have averaged a pitiful 2%, meaning that even a mild uptick in inflation is enough to cause a real decrease in middle and working class purchasing power.

There is increasing consensus that the primary reason for this miserable situation has been the persistent huge percentage of those who are either unemployed or underemployed, such as involuntary part time workers.

The single worst part of this economic expansion has been its pathetic record for wage increases. Nominal YoY wage increases for nonsupervisory workers were generally about 4% in the 1990s, and even in the latter part of the early 2000s expansion. In this expansion, however, nominal increases have averaged a pitiful 2%, meaning that even a mild uptick in inflation is enough to cause a real decrease in middle and working class purchasing power.

There is increasing consensus that the primary reason for this miserable situation has been the persistent huge percentage of those who are either unemployed or underemployed, such as involuntary part time workers.

This expanded "U6" unemployment rate ( minus 10%) is shown in blue in the graph below, toether with YoY nominal wage growth (minus 2%):

In the 1990s and 2000s, once the U6 underemployment rate fell under 10%, nominal wage growth started to accelerate. U6 is now 9.7%, and there has been some mild improvement off the bottom. More than anything, the US needs real wage growth for labor, and the present nominal reading of slightly over 2% still isn't nearly good enough.

Bonddad Monday Linkfest

Don't forget about our monthly economic and market review on Thu March 31 at 3PM. You can sign up at this link.

- The drama increases in Brazil (NYT)

- Jared Bernstein on the Republicans tax plan (WaPo)

- Republican big-wigs try to stop Tump (NYT)

- The decline of high-growth entrepreneurship (Vox)

- Urban Camel on the market (more bullish than me) (Fat Pitch)

- What CEOs said about the economy this week (Skisloff's Tumblr)

- Brexit is escalating tensions in the UK government (NYT)

- Senators begin pressuring Sanders to withdraw (Politico)

- Trump creating down-ticket problems (Politico)

- It is what it is (The Reformed Broker)

- Goldman: a dovish Fed will increase US growth, which will strengthen the dollar (BB)

- China has an A/R Problem (BB)

Oil's weekly chart broke through major resistance last week

Sunday, March 20, 2016

US Equity, US Bond and International Week in Review

These are over at XE.com

US Equity Market Week in Review

US Bond Market Week in Review

International Week in Review

Don't forget about our monthly economic and market review on Thu March 31 at 3PM. You can sign up at this link.

US Equity Market Week in Review

US Bond Market Week in Review

International Week in Review

Don't forget about our monthly economic and market review on Thu March 31 at 3PM. You can sign up at this link.