Saturday, May 2, 2015

Weekly Indicators for April 27 - May 1 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com.

I am in agreement with ECRI's Lakshman Achuthan (h/t Doug Short).

Friday, May 1, 2015

Four measures of real wage stagna-- ... er, slight improvement

- by New Deal democrat

In the last several years, I have written a number of posts documenting the stagnation in average and median wages, for example here and here. Courtesy of the crash in gas prices, there has been a bit of a change in the last 8 months.

We have a variety of economic data series to track both average and median wages:

- The most commonly known measure is that of average hourly pay for nonsupervisory workers, which is part of the monthly jobs report.

- The Bureau of Labor Statistics, which conducts the household employment survey, also reports "usual weekly earnings" for full time workers each quarter.

- The BLS also measures the Employment Cost Index quarterly.

- The BLS also measures "business sector real compensation per hour" quarterly.

The first graph tracks monthly average (mean, not median) hourly wages (blue), median wages from the employment cost index (red), real compensation per hour (brown), and median usual weekly earnings (green). All are adjusted for inflation. Since the quarterly index of median wages only started in Q1 2001, I have normed the indexes to 100 at that time:

The median measure of the Employment Cost Index made a new high. Real compensation per hour through the end of last year equalled its past highs. Average wages for nonsupervisory workers made a new 35 year high. Only the median measure of real weekly earnings is still languishing well off their 2010 high.

Here is the same data measured YoY:

While this is noisy, it shows the impact of the big decrease in gas prices late in the recession, their increase back to near $4 in 2011 and 2012, and the big decline in late 2014. Here's a close-up of the same YoY data since the beginning of 2014:

How this breakout is affected by the complete absence of inflation is shown when we look at the raw numbers nominally:

Median wages as measured by the Employment Cost Index did indeed show accelerated growth in Q1, while average wage growth actually decelerated, as did growth in real usual weekly earnings. So, there's some qualified good news here. Real wages have actually increased by nearly all measures. But by most measures it isn't due to workers suddenly getting better raises.

Thursday, April 30, 2015

Bernanke 1; WSJ Editorial Board 0

From Bernanke's Blog

It's generous of the WSJ writers to note, as they do, that "economic forecasting isn't easy." They should know, since the Journal has been forecasting a breakout in inflation and a collapse in the dollar at least since 2006, when the FOMC decided not to raise the federal funds rate above 5-1/4 percent.

and then there is this:

The WSJ also argues that, because monetary policy has not been a panacea for our economic troubles, we should stop using it. I agree that monetary policy is no panacea, and as Fed chairman I frequently said so. With short-term interest rates pinned near zero, monetary policy is not as powerful or as predictable as at other times. But the right inference is not that we should stop using monetary policy, but rather that we should bring to bear other policy tools as well. I am waiting for the WSJ to argue for a well-structured program of public infrastructure development, which would support growth in the near term by creating jobs and in the longer term by making our economy more productive. We shouldn't be giving up on monetary policy, which for the past few years has been pretty much the only game in town as far as economic policy goes. Instead, we should be looking for a better balance between monetary and other growth-promoting policies, including fiscal policy.

Just beautiful.

It's generous of the WSJ writers to note, as they do, that "economic forecasting isn't easy." They should know, since the Journal has been forecasting a breakout in inflation and a collapse in the dollar at least since 2006, when the FOMC decided not to raise the federal funds rate above 5-1/4 percent.

and then there is this:

The WSJ also argues that, because monetary policy has not been a panacea for our economic troubles, we should stop using it. I agree that monetary policy is no panacea, and as Fed chairman I frequently said so. With short-term interest rates pinned near zero, monetary policy is not as powerful or as predictable as at other times. But the right inference is not that we should stop using monetary policy, but rather that we should bring to bear other policy tools as well. I am waiting for the WSJ to argue for a well-structured program of public infrastructure development, which would support growth in the near term by creating jobs and in the longer term by making our economy more productive. We shouldn't be giving up on monetary policy, which for the past few years has been pretty much the only game in town as far as economic policy goes. Instead, we should be looking for a better balance between monetary and other growth-promoting policies, including fiscal policy.

Just beautiful.

Rents spike to new record in Q1

- by New Deal democrat

Tuesday the Census Bureau released its quarterly report on homeownership. While the bulk of the commentary focused on the homeownership rate, and price of housing, I would like to focus on apartment rentals. The share of apartment building compared to single family home construction has jumped since the last recession, partly due to the swelling demographic of Millennials entering the market, and partly due to stagnant wages.

Here is the rental vacancy rate compared with the homeowner vacancy rate:

Rental vacancies made a record low in the 4th quarter of 2014, and bounced up just a little in the first quarter of 2015.

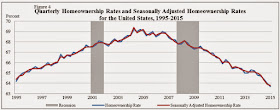

This is the flip side of the 20-year low in homeownership rates:

Unsurprisingly, in nominal terms, the median asking rent has been rising to new records in the last several years:

But that doesn't tell us what has been going on in real terms. To do that, we should adjust for inflation, or alternatively by wages. That is what I have done in the chart below. It shows nominal asking rents vs. median weekly wages as compiled by the BLS. It shows that real rents declined in the 1990s as wages increased, soared in the 2000 - 2009 period, and had remained below that peak ever since -- until this past quarter:

| Year | Median Asking Rent | Usual weekly earnings | Rent as % of earnings | Real median asking rent |

|---|---|---|---|---|

| 1988 | 330 | 382 | 86 | 657 |

| 1992 | 401 | 437 | 92 | 674 |

| 1993 | 422 | 450 | 88 | 688 |

| 2000 | 478 | 568 | 84 | 655 |

| 2002 | 545 | 607 | 90 | 714 |

| 2004 | 620 | 629 | 99 | 774 |

| 2009 | 723 | 739 | 99 | 795 |

| 2012 | 721 | 768 | 94 | 740 |

| 2013 | 734 | 776 | 95 | 743 |

| 2014 Q1 | 766 | 790 | 97 | 765 |

| 2014 Q2 | 756 | 782 | 97 | 751 |

| 2014 Q3 | 756 | 797 | 95 | 749 |

| 2014 Q4 | 766 | 796 | 96 | 760 |

| 2015 Q1 | 799 | 802 | 100 | 799 |

In the first quarter, for the first time in history, the median asking rent equaled the entire weekly earnings of the median worker.

Even worse, the median wage of all workers does not quite accurately capture the median wage of renters, since they tend to be from lower income groups. And as the graph below compiled by the Employment Law Project from last August shows, the median real wage of the 4th and 5th quintile as of then had declined more than the median real wage of workers overall compared with their 2009 peak:

Looking at multi-unit housing construction helps us distill some signal from the noise. First of all, after booming in earlier 2014, apartment construction has declined slightly:

A second important point is the regional difference in the data. Below is a portion of the Census Bureau's table showing median asking rents nationwide (1st column), and broken down by regions: Northeast (2nd column), Midwest (3rd), South (4th), and West (5th):

As you can see, the lion's share of the increase in the 1st quarter was a nearly 10% increase in asking rents in the Western region. As the chart below shows, the West also has the lowest vacancy rate of any of the regions (although the Northeast is also very low):

It's certainly possible that the spike in rents in the Western region is noise due to small sample size, but a comparison of housing permits in the West vs. the Northeast, both of which regions have especially low vacancy rates, shows that from miid-2013 to mid-2014, in all but one quarter issuance of permits slowed more in the West than in the Northeast:

Given the lag in completions of apartment buildings after permits are issued, this is what I would expect given the jump in rental prices in the West.

I do expect that some of the spike in asking rents int he first quarter will prove to have been noise, but it is unwelcome nevertheless. But with low vacancy rates, the big increase in rents, and the continuing tailwind of Millennial household formation, I expect the slowdown in apartment construction to be transitory.

Even worse, the median wage of all workers does not quite accurately capture the median wage of renters, since they tend to be from lower income groups. And as the graph below compiled by the Employment Law Project from last August shows, the median real wage of the 4th and 5th quintile as of then had declined more than the median real wage of workers overall compared with their 2009 peak:

Looking at multi-unit housing construction helps us distill some signal from the noise. First of all, after booming in earlier 2014, apartment construction has declined slightly:

A second important point is the regional difference in the data. Below is a portion of the Census Bureau's table showing median asking rents nationwide (1st column), and broken down by regions: Northeast (2nd column), Midwest (3rd), South (4th), and West (5th):

As you can see, the lion's share of the increase in the 1st quarter was a nearly 10% increase in asking rents in the Western region. As the chart below shows, the West also has the lowest vacancy rate of any of the regions (although the Northeast is also very low):

It's certainly possible that the spike in rents in the Western region is noise due to small sample size, but a comparison of housing permits in the West vs. the Northeast, both of which regions have especially low vacancy rates, shows that from miid-2013 to mid-2014, in all but one quarter issuance of permits slowed more in the West than in the Northeast:

Given the lag in completions of apartment buildings after permits are issued, this is what I would expect given the jump in rental prices in the West.

I do expect that some of the spike in asking rents int he first quarter will prove to have been noise, but it is unwelcome nevertheless. But with low vacancy rates, the big increase in rents, and the continuing tailwind of Millennial household formation, I expect the slowdown in apartment construction to be transitory.

Wednesday, April 29, 2015

Comments on First Quarter 2015 GDP

- by New Deal democrat

This post is up at XE.com. As bad numbers go, this one wasn't too bad. As in, it was expected, and the way it was bad was expected.

Tuesday, April 28, 2015

John Hinderaker: The Dan Rather of the Right

It's no secret that I think John Hinderaker is, at best, a fool. While I've focused exclusively on his remarkable record of economic ineptitude (Powerline has been 100% wrong in their economic analysis for an entire year), his abject tonal deafness on other matters is remarkably striking. We writes from the perspective of pure WASPness; he has had no problems or issues in his life, therefore others should just pull themselves up by their own bootstraps and achieve the same success he has. His lack of empathy is stunning.

For those of you who weren't around on the internet 10+ years ago, the Powerline Blog was a primary participant in the Dan Rather 2004 document scandal. If I recall correctly, Rather ran with a story a few weeks before the election about then candidate Bush's National Guard service. Rather stated he had documents that showed there was an issue with Bush's attendance. Several conservative blogs deconstructed the document and proved it was a fake, eventually leading to Rather's resignation. Powerline was a primary mover in this story, eventually being named Blog of the Year by Time magazine. This was a remarkable story, as it marked the ascendency of blogs to the national debate. It also helped to further the still ever-present "liberal media" meme that remains a staple of the right wing's victimization mentality.

My how the tables have turned. Just like Rather, Hinderaker has been desperate to malign Harry Reid in any manner possible. To further that end, he ran a story on April 3 in which he recanted the tale of an anonymous source who stated he had seen Harry Reid's brother at an AA meeting after the altercation that led to Reid's recent injuries. According to Hinderaker, this story was proof positive that Harry Reid was lying about the source of his injuries. While Hinderaker did add a disclaimer, he only did so after telling the entire tale, essentially relegating it to a mere afterthought.

Well, it turns out the story was deliberately fabricated to see how far the right wing noise machine would go to spread a meme. Here is a link to the story that explains the who, what, where, when and why. Were this a "liberal" media figure at the heart of the scandal, Hinderaker and his ilk would be demanding his resignation. Thankfully for Hinderaker's blogging career, he has no such standards for himself. He'll continue typing away, making shit up as he goes along. And he'll probably continue to receive guest hosting spots because he's been a good solider. But, outside of conservative circles, he now has zero credibility. All others listening to him will know that Hinderaker is not only a pathetically bad reporter and analyst, but he obviously has no standards nor shame. The fall from prominence and respectability is complete.

For those of you who weren't around on the internet 10+ years ago, the Powerline Blog was a primary participant in the Dan Rather 2004 document scandal. If I recall correctly, Rather ran with a story a few weeks before the election about then candidate Bush's National Guard service. Rather stated he had documents that showed there was an issue with Bush's attendance. Several conservative blogs deconstructed the document and proved it was a fake, eventually leading to Rather's resignation. Powerline was a primary mover in this story, eventually being named Blog of the Year by Time magazine. This was a remarkable story, as it marked the ascendency of blogs to the national debate. It also helped to further the still ever-present "liberal media" meme that remains a staple of the right wing's victimization mentality.

My how the tables have turned. Just like Rather, Hinderaker has been desperate to malign Harry Reid in any manner possible. To further that end, he ran a story on April 3 in which he recanted the tale of an anonymous source who stated he had seen Harry Reid's brother at an AA meeting after the altercation that led to Reid's recent injuries. According to Hinderaker, this story was proof positive that Harry Reid was lying about the source of his injuries. While Hinderaker did add a disclaimer, he only did so after telling the entire tale, essentially relegating it to a mere afterthought.

Well, it turns out the story was deliberately fabricated to see how far the right wing noise machine would go to spread a meme. Here is a link to the story that explains the who, what, where, when and why. Were this a "liberal" media figure at the heart of the scandal, Hinderaker and his ilk would be demanding his resignation. Thankfully for Hinderaker's blogging career, he has no such standards for himself. He'll continue typing away, making shit up as he goes along. And he'll probably continue to receive guest hosting spots because he's been a good solider. But, outside of conservative circles, he now has zero credibility. All others listening to him will know that Hinderaker is not only a pathetically bad reporter and analyst, but he obviously has no standards nor shame. The fall from prominence and respectability is complete.