Saturday, April 18, 2015

Weekly Indicators for April 13 - 17 at XE.com

- by New Deal democrat

My Weekly Indicator post is up at XE.com. Two big changes: consumer spending and temporary staffing.

Friday, April 17, 2015

CPI: there is still no inflation, and real wage growth has stopped

- by New Deal democrat

This inflation report this morning concluded 4 data series that size up where we are at our current crossroads.

Industrial production tanked, as expected. Housing (of which I'll write more later) was a mixed bag: the more forward-looking and less volatile permits, as revised, tied their post-recession high in February but fell back, in a normally variable range, in March. Starts, which were severely impacted by the weather especially in the Northeast during February, only came back partway, as the Western region took a dive (Oil patch weakness?).

As to inflation, the primary takeaway I heard from the talking heads was "OMG! OMG! Core CPI ticked up .1% to 1.8%, thus moving closer to the Fed's 2% ceiling, oops, I mean target."

But the fact is that headline CPI is still just a skosh negative YoY:

The tame CPI number means that real retail sales for March took back almost all February's weakness, although they are still below their November peak:

They also mean that real wages declined slightly more in March from their January peak:

There has been a lot of pushback against the Fed raising rates in June, most recently from former Fed vice-chair Alan Blinder, mainly due to this weakness. At this point I think we can safely assume that rate hikes are off the table in the next few months.

Thursday, April 16, 2015

Johnson and Johnson: A Great Company In a Great Sector

This is not an invitation to buy or sell this security. Do your own research and come to your own conclusions. Heck, you might learn something in the process.

Johnson and

Johnson (JNJ) is just barely the second largest company in the health care

sector. With a market cap of $279.72, it

is just below Novartis’ $272.81 total.

Pfizer and Merck come in 3rd and 4th,

respectively. JNJ recently announced an earnings beat, but also warned on growth thanks to a strong dollar. Despite this warning, JNJ is a buy at current

levels. It has a strong balance sheet, growing revenue, positive cash flow and an attractive dividend yield (2.78%). With an aging population, the US, Europe and Asia will provide an increasing number of customers for the company's products. Finally, the health care sector is in the middle of a three

year rally.

The Health Care

Sector

Global health care

spending is buoyed by two key factors: aging world demographics and broad

insurance coverage.

In the US, 10,000 baby boomers will retire/day through 2029. And with the uninsured level dropping, a

larger percentage of the US will have access to the health care market. Europe has universal coverage and an aging population ,

as does Asia. JNJ has international reach, allowing them to take advantage of these developments.

JNJ’s Charts

The above factors explain why the health care

ETF has been in a three-year rally:

The weekly XLV chart has more

than doubled over the last three years, rising from a low of 33.65 in 2012 to a high of 76.01 earlier this year. JNJ has been a strong participant in this rally:

The weekly chart shows a rally form 2012-2014, when the

stock rose from ~56 to 1~08. There was a

period of consolidation that lasted about 6 months in 2013, when prices moved

between 78-83 on the low end and 89-92 on the top end. Prices broke the longer-term uptrend at the end of last

year and have since been consolidating in a triangle pattern. Pay particular attention to the MACD, which

is nearing a buy signal.

JNJ’s daily chart

shows the company is trading right around the 200 day EMA, near yearly

lows. But with a 2.78% yield and

solid earnings history, this price level looks very attractive, which is supported

by this table from Morningstar:

The company’s PE is 27% lower than the industry average,

despite having better revenue and net income growth. And their ROA is 12.4 compared to the

industry’s 7.3. Despite being one of the

largest companies in their industry, JNJ is undervalued.

JNJ the Company

JNJ is a multi-national health care company with

three divisions: consumer products (~19% of sales), pharmaceuticals (~43% of

sales) and medical devices (~38% of sales).

Each segment has international exposures. All financial information will be analyzed at

the consolidated level.

It doesn’t get

much better than JNJ’s balance sheet. With

a current ratio of 2.36 and quick ratio of 1.76, they have ample liquidity. Accounts receivable decreased from 9.5% of

assets in 2010 (which is still a very low number) to 8.3% in 2014. Inventory has increased, but that statement is

deceptive: it rose from 5.2% of assets in 2010 to 6.2% in 2014. LTD only comprises 11.53% of liabilities. And to be on the safe side, they have 99 days

of cash on hand. While the word “bulletproof”

is a bit cliché, it clearly applies here.

Solid financials

don’t end at the balance sheet. Top line

revenue has grown between 3%-6% for the last four years. While not a gangbusters pace, it’s impressive

for one of the largest health care companies in the world. Additionally, expenses are contained. COGs has been very stable at 30%-31% since

2011. Operating income has been a bit

more variable, coming in between 23%-28% over the same period. And net margin has fluctuated between 14% and

21% for the last four years. Moreover, the

dividend payout ratio is a solid 47.5% while the interest coverage ratio is 39,

meaning the company has more than adequate resources to pay its obligations.

And finally, we

turn to the cash flow statement, where the company has free cash flow levels between

$11.4-$14.7 billion for the last four years.

This is more than adequate to fund the $7.4 billion dollar dividend from

current operations. It also means they have ample financial room to maneuver should

they experience any problems.

JNJ is a well-managed company with solid overall financials, growing earnings and strong cash flow. Thanks to the global aging of various populations, the company's customer base will grow over the next decade. And at current levels, the company is undervalued relative to its peers. What's not to like?

Wednesday, April 15, 2015

Industrial Production: why, if you're not already, you should be reading "Weekly Indicators"

- by New Deal democrat

For the last month, I have been saying, based on the "Weekly Indicators" of poor rail transport and steel production, that March Industrial Production was likely to be poor. And this morning, we found out just how poor: down -0.6%. It is not down over -1% from its peak in November 2014.

Yesterday March retail sales were reported to have increased, also as forecast by the "Weekly Indicators" of stable YoY comparisons in the Johnson Redbook and Gallup Daily Consumer spending. Still, sales are the second of the 4 big coincident indicators of economic growth vs. contraction to have failed to exceed their November peaks.

But if you have been reading my "Weekly Indicator" columns over at XE.com, you already knew that. If you haven't, well, you should.

Tuesday, April 14, 2015

March retail sales: good news, but still below peak

- by New Deal democrat

I have a new post up at XE.com. The March retail sales report, as forecast by consumer spending in the "Weekly Indicators," was positive. But still not positive enough.

Monday, April 13, 2015

Why you should be afraid: the next recession is likely to include wage deflation

- by New Deal democrat

Beginning 3 years ago, I identified poor wage growth as the shortfall in the economy that worries me the most. And it still worries me, even though there has been some modest improvement.

Why? Because unless there is enough of a cushion, the next recession, whenever it comes, there is a significant danger of outright wage deflation. And as we know from the Great Depression, outright wage deflation means that payments on previously contracted debts become, in real terms, higher. This can lead to a vicious spiral of debt-deflation, whereby more and more people fall behind on debt, leading to a further economic contraction, more unemployment, and even more wage deflation, and so the cycle repeats.

So why am I particularly concerned now? Because a decline in wage growth is a feature of virtually all recessions. And we may start the next recession from such a low level of wage growth that the decline in wage growth turns into an absolute decline.

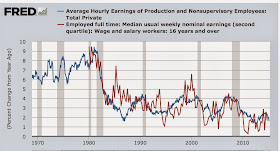

Here's the data. Below is a graph of the YoY% change in average hourly wages (a mean measure) for the last 50 years (blue), and also median usual weekly earnings, a quarterly measure, since the start of the series in 1979 (red):

We are 6 years into this economic expansion. Six years into the last 3 expansions, nominal wage growth already exceeded 3% YoY, and ultimately exceeded 4%. This time, both average and median wage growth is under 2%. Simply put, wage growth is likely to decline by more than that whenever the next recession hits.

More specifically, with only one exception (1974), growth in average hourly wages declined substantially during each recession. Similarly, with one exception (1991), growth in median weekly wages declined substantially during each recession as well. Below I have broken out this data in chart form, showing the pre-recession high and recession or post-recession low in both average and median wages, as well as the net change, for each recession since the start of each series:

| Recession | High/low Average hourly wages | Decline average hourly wages | High/low median weekly income | Decline median weekly income | |

|---|---|---|---|---|---|

| 1970 | 6.9 / 5.5 | -1.4 | --- | --- | |

| 1974 | 6.4 / 5.5 | -0.9 | --- | --- | |

| 1980 | 8.7 / 7.1 | -1.7 | 9.5* / 7.1 | -2.4 | |

| 1981-82 | 9.4 / 1.6 | -7.8 | 9.5 / 3.3 | -6.2 | |

| 1991 | 4.4 / 2.3 | -2.1 | 5.1 / 2.6 | -3.9 | |

| 2001 | 4.3 / 1.6 | -2.7 | 6.6 / 1.2 | -5.4 | |

| 2008-09 | 4.2 / 1.3 | -2.9 | 4.5 / 0.3 | -4.2 |

*Series inception: actual previous high might have been higher

As of now, the highest growth of average hourly wages YoY since 2009 has been +2.5% in August 2014. In 3 of the 7 most recession recessions, growth in average hourly wages have declined by more than that.

Even worse, the highest growth of median weekly income since the end of the Great Recession was +2.9% in Q1 3014. In every recession except possibly one since the inception of the series, median wages have dropped by more than 2.9%. In other words, if the next recession has a similar footprint, median weekly income is going to go into absolute decline.

Hopefully this economic recovery continues for quite a while, and hopefully nominal wage growth improves substantially from here. But if it doesn't, or it doesn't improve enough, we are likely to cross from wage growth into wage declines in the next economic downturn, with the distinct possibility of triggering a debt-deflationary spiral.

We barely escaped such a spiral in 2009. Here is an article by Mike Shedlock: Wage Deflation is starting in, from March 27, 2009, listing 14 companies that had announced wage cuts.

Are you scared now?

Even worse, the highest growth of median weekly income since the end of the Great Recession was +2.9% in Q1 3014. In every recession except possibly one since the inception of the series, median wages have dropped by more than 2.9%. In other words, if the next recession has a similar footprint, median weekly income is going to go into absolute decline.

Hopefully this economic recovery continues for quite a while, and hopefully nominal wage growth improves substantially from here. But if it doesn't, or it doesn't improve enough, we are likely to cross from wage growth into wage declines in the next economic downturn, with the distinct possibility of triggering a debt-deflationary spiral.

We barely escaped such a spiral in 2009. Here is an article by Mike Shedlock: Wage Deflation is starting in, from March 27, 2009, listing 14 companies that had announced wage cuts.