Saturday, June 21, 2014

International Week in Review: Frothy UK Housing Market Edition

This is up over at XE.com

http://community.xe.com/forum/xe-market-analysis/international-week-review-frothy-uk-housing-market-edition

http://community.xe.com/forum/xe-market-analysis/international-week-review-frothy-uk-housing-market-edition

Friday, June 20, 2014

Epistemic economic closure on the left: Classic Math FAIL by the Pied Piper of Doom

- by New Deal democrat

A few of you are apparently still trying to explain the Big Bang Theory to the Flat Earth Society that is the acolytes of the PPoD at DK. They're not interested. It's all about epistemic closure for them: being told what they want to hear. It may be time to list a few more of the literally over 100 of his false prophecies of DOOOOM. But just to give you a few giggles, here's a classic....

The Pied Piper of Doom didn't think it could be possible that an economic series going down could be a good thing:

(INVERTED?). LOL! "Inverted." What's up is down and what's down is up. That's what "inverted" means. Kind of speaks to the diarist's intent better than anything I could say.Here's what he was reacting to, in the joint diary Bonddad and I published in May 2009 arguing (correctly) that the Great Recession was nearing its bottom:

8 out of 10 of these leading economic indicators have now turned positive or at least neutral. Let's look at them in turn:....

Average weekly initial claims for unemployment insurance (inverted) (3%) [graph omitted]This is an inverted series, so down = good. According to research conducted by Prof. James Hamilton of UC San Diego, whose graph is shown above, the end of a recession typically happens about 2 months after the turn in this indicator. Per the blue dotted line in the graph above, he believes it is substantially more likely than not that we have seen that turn.That's right. The Pied Piper of Doom was such an idiot that he didn't know that initial jobless claims going down was a good thing.

Yahoo -- Interesting Little Company Here

Anybody remember the above yodel? When I was looking at Yahoo for this post, I remembered their ad campaign from the 1990s when they were the internet site.

The ArmoTrader has a post up on Yahoo, with the title, Is Yahoo Headed For Fall?. While his post is based on a solid technical reading of the chart, I wanted to focus on the more fundamental side of Yahoo.

Let's start with the balance sheet, which is one of the best around. They had $3.4 billion in liquid assets in 2013, which gives them a liquid ratio over 2. In fact, their liquid assets (cash and securities) are only about $200 million below their total liabilities, meaning the company is extremely liquid. Even stripping out goodwill (which I usually do), their "Graham and Dodd" book value is $8.4 billion.

Then we get to their Revenue Statement, which is where things get, shall we say, interesting. Revenue has dropped from $4.9 billion in 2011 to $4.6 billion in 2013. After accounting for expenses, Yahoo's core businesses are creating about $1-$1.3 billion in net cash/year. And their cash flow statement indicates they've managed their cash position will over the last three years. They most likely have understood that their net organic growth would be neutral for the foreseeable future.

And then we get to their two big investments: Alibaba Group and Yahoo Japan. Alibaba is a huge online portal that serves China. Here is a general write-up from the Economist:

Since then, Alibaba has come to dominate internet retailing in China, which will soon be the biggest e-commerce market in the world. It has moved beyond its original remit of connecting businesses to each other to ventures that let companies sell directly to the public (Tmall) and enable members of the public to sell to each other (Taobao). Between them, Taobao and Tmall processed 1.1 trillion yuan ($170 billion) in transactions last year, more goods than passed through Amazon and eBay combined (see table 1).

The company that started in Mr Ma’s apartment now employs 24,000 workers at its headquarters in Hangzhou and elsewhere; Ms Dai is president of human resources. A few years ago Alibaba began to turn a profit; in the year to September 2012 it made $485m on revenues of $4.1 billion (see chart 2). Following a recent reorganisation it has 25 separate business units, and on May 10th it will have a new chief executive, Jonathan Lu; Mr Ma will stay on as executive chairman.

According to their latest 10-K, Yahoo owns a 24% interest in the company. Also from their latest 10-K: "Since acquiring its interest in Alibaba Group, the Company has recorded, in retained earnings, cumulative earnings in equity interests, net of tax, of $661 million and $1,078 million as of December 31, 2012 and 2013, respectively. "

Yahoo also owns a 35% interest in Yahoo Japan, which, according to their latest 10-K, "Since acquiring its equity interest in Yahoo Japan, the Company has recorded cumulative earnings in equity interests, net of dividends received and related taxes on dividends, of $2.3 billion and $2.8 billion as of December 31, 2012 and 2013, respectively. "

So, on the domestic front, Yahoo is a stable producer of income. However, the property is languishing as an undeveloped internet property. While they were a high-flyer in the original age of the internet, they have since been trading on that fame while not really adapting to the new age. Yes, they're a landing page for many (myself included), but their lack of revenue growth on the domestic front means they need to change their method of doing business.

However, the are also benefiting from their ownership of Alibaba and Yahoo Japan. Yahoo Japan's revenue was stable last year, but Alibaba is still a huge growth story. And while Yahoo isn't a majority owner, their large minority stake means they will participate in the earnings growth. And, it opens up the possibility of potential business combinations down the road.

So, let's go back to the chart, which does show a potential for a sell-off. The fundamental reading is Yahoo has some type of long-term value as combination of domestic internet company and international investment in two large markets (Japan and China). If we do see a sell-off, I certainly wouldn't read it as a crash in the making.

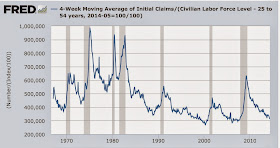

A long term look at initial jobless claims shows that hiring, not firing, is holding back employment growth

- by New Deal democrat

When was the last time you heard friends, family, or acquaintances worry about being laid off? Odds are, you've heard very little of that in the last year or two. That's because, American workforces are down to very taut and efficient levels for the level of economic activity.

The monthly jobs report is the net of hiring minus firing. In recent months, there have been 200,000+ more hirings than firings in each month.

A look at initial jobless claims, representing new layoffs, shows that, adjusting for population, it is at or near all-time low levels going back half a century.

First, here are initial jobless claims adjusted by population:

The level now is equivalent to the tech boom low of the late 1990s, as well as the pre-Great Recession low. You have to go back nearly half a century, to the late 1960s, to find a lower rate.

But this statistic is distorted by the huge volume of retiring Boomers. So, instead of the entire population, let's use the working age 25-54 population:

Even using this population as our denominator, layoffs now are at a low only exceeded by the tech boom and the peak of the pre-Great Recession economy.

JOLTS data on total quits and discharges only goes back to the turn of the Millennium, but the same pattern shows:

We are near the all-time low for this series.

In short, people who hold jobs now are as secure in those jobs as at any point in the last half century. The reason that the percentage of the prime working age population of 25 through 54 is still closer to its recession low than its pre-recession peak has everything to do with the slack pace of hiring, and not with firing.

Wednesday, June 18, 2014

Credit where Doomer credit is due (but get your numbers right)

- by New Deal democrat

There's a rec-listed diary up at the Great Orange Satan now arguing that Congress's cutoff of long term unemployment benefits at the end of last year has led to a significant increase in the number of people who have given up looking for a job. I happen to think he is correct, and he is citing the correct data series - Not in Labor Force, Want a Job Now.

This is because I made the exact same argument last week:

The number of discouraged workers rose by nearly 2,000,000 in the wake of the Great Recession. In 2012 and 2013, it declined by about 1/3 of that number. Disturbingly, it has risen since the beginning of this year by over half a million. This looks like a real trend. I suspect it is fallout from the termination of long term unemployment benefits. Supposedly this was going to spur those lazy moochers < /snark > to finally go out and find employment. Instead, it looks like it has caused a fair number of the long-term unemployed to simply give up hope.This is a real issue, involving real hardship for people for whom there simply aren't enough jobs available.

At the same time, you need to keep your math correct. Since the low of November 2013, those people who want a job now but have stopped looking for work have indeed increased by 659,000. But you can't simply add that number to get to an unemployment rate. That's because the numerator in the unemployment rate is the number of unemployed . Those who stopped looking for work entirely aren't included. And during that same time, the number of unemployed has declined from 10.841 million to 9.799 million, or -1.042 million.

That makes the net change a decline of -383,000 in those who want a job, including both those who have looked, and those who haven't. That's why the number I cited as "the REAL real unemployment rate" has declined since half a year ago, by about -0.3%.

Fifty years of data says, house prices lead housing inventory for sale

- by New Deal democrat

Several years ago, Barry Ritholtz wrote a 5-part series on why housing prices weren't bottoming (hey, nobody's perfect). One of his arguments was that any uptick in prices would bring out such an increase in listings that prices would actually fall further.

I have a post up at XE.com looking at the relationship between house prices and the number of houses listed for sale. The bottom line is, prices lead listings, as potential home sellers take their cues from recent price movements, but it takes a while for the "message" to get through to them.

Since we may be at an inflection point for house prices, this is a relationship we can watch.

Tuesday, June 17, 2014

Housing permits negative YoY, single family homes still stalled

- by New Deal democrat

For the first time this year, housing permits turned negative on a YoY basis, down -1.9% from May 2013:

Interestingly, YoY permits for not only single family homes (blue), but also for multi-unit structures (apartments and condominiums) (red) were negative:

As a rolling 3 month average, however, apartment and condominium permits still have trended upward.

On an absolute level, we can see that building permits for single family homes remain dead in the water,with no growth since January of 2013 (blue). All of the growth has come from apartments and condominiums (red):

[Graph normed to 100 as of January 2013]

Housing starts did remain positive. Single family starts were up +4.7% YoY. Apartments and condos were up +19.2%. Total starts were up +9.4%. Typically permits slightly lead starts, so I expect starts to cool off on a YoY basis in the next month or two.

UPDATED: Here is the comparison of the YoY% change in permits (blue) and starts (red):

Permits have trended to zero, while starts have had an anomalous surge in the last 2 months. I expect this to be resolved in the direction of permits, which slightly lead, in the next several months.

Here are single family home permits (blue) vs. starts (red), normed to 100 as of January 2013, showing that both have stalled:

Finally, here are multi-unit apartment and condo permits (blue) vs. starts (red), also normed to 100 inJanuary 2013:

This is where the growth has been for the last year plus. Note again the anomaly of starts growing more than permits.

The bottom line remains:

- higher interest rates and higher prices have brought the market for new single family homes to a virtual standstill. It has not shown meaningful growth for nearly the last year and a half.

- the large "Echo Boom" Millennial generation is piling into apartments and condominiums, partly due to economic distress (inability to afford single family homes).

- apartment building is also being boosted by historically low vacancy rates and sharp increases in rents, in addition to demographics.

Monday, June 16, 2014

Is LinkedIn's Business Model Already In Need of Repair?

Above are two charts of LinkedIn.com stock. The weekly chart (top chart) shows that prices topped at 257 about a year ago, but have since been moving lower. The daily chart (bottom chart) shows the last year's price action in more detail. This is a classic bear marker chart of lower lows and lower highs. Stock holders overwhelm the market, sending the price lower. At some price level, buyers see the stock as attractive and bid it higher but can never attain sufficient bullish momentum. Key to the top chart is that prices are now below the long-term EMAs. Key to the lower chart is that prices are below the 200 day EMA which is also moving lower.

Clearly, the markets have determined that a high price for this company is not warranted, and they are thereby sending prices lower. The question now is, what have the markets figured out? The answer is simple: despite the glitz of the website, LinkedIn is really nothing more than a glorified monster.com. And while their user base is now growing and will continue to grow as they expand throughout the world, the website will eventually saturate the HR job search market and be unable to print solid earnings growth.

First, like most professionals, I have a profile on LinkedIn (you can see it here). And I've had several conversations over the last few years where I have been asked to send people a link to my profile, largely for validation. This behavior is encouraged by the company which says it has three goals for users:

1.) Managing and sharing who they are through their digital professional identity;

2.) Engaging and expanding who they know through their professional network; and

3.) Discovering professional knowledge and insights making them better at what they do.

I, like many other people, have done number 1 and found it a pretty valuable service, although not central to my business development. I've also expanded my contacts a bit through the network, but probably not to the degree the company had hoped. I've personally heard mixed results from other professionals on this topic; some say their contacts have increased, others not. As for discovering new knowledge, I belong to over 40 groups, but there are really only 3-5 that are meaningful; the rest just don't add much to what I already know.

However, also note a key point of the above three activities: LinkedIn derives no revenue from them. So, in using their platform the way they want me to use it, I'm not helping them make any money.

The company earns revenue from three sources:

1.) Talent Solutions: We provide access to our professional database of both active and passive job candidates with LinkedIn Recruiter, which allows corporate recruiting teams to identify candidates based on industry, job function, geography, experience/education, and other specifications.

Translation: LinkedIn has created a series of algorithms that allow talent recruiters to search through their users to find "active" and "passive" job candidates. Top line revenue from this service increased from $261 million in 2011 to $860 million in 2013. This is a good increase. However, a large percentage of that comes from the US market, which accounted for 67% of gross revenues in 2011 and 61% in 2013. But the number of US users is already at 94.1 million. According to the latest BLS employment report, the US civilian, non-institutional population was 155 million. That means 60% of the US labor force is already on LinkedIn. You've got to wonder if the company is already near saturation in the US market, as the other 40% may not be in an industry that requires a LinkedIn profile. And assuming that to be the case, the company needs to expand into other markets.

Looking at Europe, according to Eurostat, the euro area 17 has a total population of 331 million, 67% who are employed, bringing the total employed population to about 221 million. LinkedIn Currently has 85 million members in the EU region, so there is the potential for growth. But the efficacy of this platform is in question with an unemployment rate at 11.8% and growth close to 0% growth. And then there are the much more stringent EU employment laws to deal with, which could hinder LinkedIn's overall efficacy. This explains why the EU region has only accounted for 21% of Linked in revenue from 2011 and 23% in 2013.

And the Asian market only accounted for 5.5% of revenue in 2011, increasing to 7.7% in 2013.

Either LinkedIn needs to figure out how to increase their revenue penetration in the EU and Asia, or they're looking at some revenue containment within 3-5 years based on simple demographics.

There are two other ways the company earns revenue -- add placement and premium subscriptions. However, ads have provided a declining amount of revenue as it was responsible for 30% of earnings in 2011 and 24% in 2013. This could become a much more fertile revenue source if properly developed, especially considering the large number of users. However, the company hasn't really developed this yet. Premium subscriptions consistently account for 20% of earnings.

So, from a business model standpoint, the market has probably figured out the company may be approaching saturation in the US with little help for additional market development from the EU or Asia. While there is the possibility of ad revenue, the company hasn't really developed this in a significant way.

Financially, the company is in fine shape. Cash generated by operations has increased from $134 million in 2011 to $436 million in 2013. This cash burn more than pays for PPE expansion, which accounts for 46% to 66% of net cash. This means the company has been putting its funds to use in investments to earn a higher return. The company is extremely liquid, and has a book value of $2 billion.

In short, the company has the financial capabilities to change direction or try different ideas out in order to keep revenue growth going. As mentioned above, the best option here is to really up their ad revenue in some way. But, until they do, the market will probably question the company's long-term viability given their near saturation of the US market and the different and perhaps harder to develop international markets.

Sunday, June 15, 2014

A modest proposal for "Medicare Part O"

- by New Deal democrat

The French health care system is frequently touted as the best in the world. The interesting thing is, Obamacare looks a lot like that French system -- if it had been designed by Rube Goldberg.

The French system relies upon private insurers, not nationalized health care. It has standardized policies among which people can choose. It has standardized administrative systems and forms. The biggest difference is, the employer is not involved, and it isn't a question of whether to enroll or not: you are enrolled, it is just a question of with which insurer.

Contrarily, Obamacare relies on individuals to sign up, or to rely upon their employer's healthcare. This creates a situation much like 401k's, where through inertia or laziness many employees do not sign up, or do not take full advantage of it by putting in enough of their own wages/salaries to obtain the full employer match.

Some behavioral economists have recommended that, instead of "opt-in," 401k plans should be set up on the basis of "opt out." That is, an individual is automatically enrolled up to the level of the full employer match, unless they take action not to be included. As expected, firms that have implemented such "opt out" 401ks have a much higher level of participation. For example, an article in Psychology Today pointed out:

An automatic enrollment policy in a 401(k) savings plan results in substantially more employees participating in the pension plan -- a jump from one-third to nearly 90%. ...[M]ost just stay at the default level of contribution and asset allocation.

What if the ACA a/k/a Obamacare, were set up like that? What if, instead of vast and expensive outreach programs, advertising, and assistance, all to beg, plead, and cajole people to sign up for health care as we saw earlier this year, the ACA were set up as an "opt out" system? Under such a system, if a person were employed, an employer would automatically make a deduction for "Medicare part O" just as the employer does for Social Security and existing Medicare. If the employer offered their own health care, the deduction would be $0. If the employer did not offer their own health care, there would automatically be a deduction made that enrolled the worker in the "bronze" health plan offered by the exchange under the ACA (and randomly assigned to one of the qualifying insurers).

Those either not employed, or self-employed, who did not enroll on their own, would be automatically enrolled in the "bronze" plan as well, using their Social Security number, and would either include the payments in their quarterly IRS estimated taxes, or in their yearly filings by April 15 (keeping in mind that with the subsidies for low incomes under the ACA, the net amount owed by somebody who is unemployed might be $0).

It seems to me that such an "opt out" system would make great strides towards universal coverage, and by relying on existing systems already familiar to everybody (Social Security numbers, payroll deductions for Medicare, and tax returns), would have a minimum of administrative cost.

.png)