Saturday, April 5, 2014

Weekly Indicators for March 31 - April 3 at XE.com

- by New Deal democrat

My Weekly Indicators column is up at XE.com.

The spring rebound is continuing.

Friday, April 4, 2014

March jobs report: new highs in aggregate hours worked, private sector jobs

- by New Deal democrat

In March 192,000 jobs were added to the US economy. The unemployment rate was unchanged at 6.7%. January and February were revised upward by +35,000.

As usual, first, let's look at the more leading numbers in the report which tell us about where the economy is likely to be a few months from now. These were mixed but with a tilt towards positive.

- the average manufacturing workweek rose from 40.8 hours to 41.1, returning to its 2013 high. This is one of the 10 components of the LEI, and will contribute towards a strong positive number.

- construction jobs increased by 19,000. YoY 151,000 construction jobs have been added.

- manufacturing jobs fell by -1,000.

- temporary jobs - a leading indicator for jobs overall - increased by 29,000.

- the number of people unemployed for 5 weeks or less - a better leading indicator than initial jobless claims - rose to 2,461,000, compared with December's 2,255,000 low.

Now here are some of the other important coincident indicators filling out our view of where we are now:

- The average workweek for all nonsupervisory workers rose by 0.3 hours from 33.4 hours to 33.7 hours.

- Overtime hours increased from 3.4 to 3.5 hours.

- the index of aggregate hours worked in the economy rose by 0.7 from 106.4 to 107.1. This is a new post-recession high and close to an all-time high.

- The broad U-6 unemployment rate, that includes discouraged workers increased from 12.6% to 12.7%.

- The workforce rose by 503,000. Part time jobs rose by 434,000.

- the alternate jobs number contained in the more volatile household survey increased by 476,000 jobs. The household survey jobs numbers had been lagging the establishment survey numbers, but as expected this difference has now been entirely made up, with the household survey showing a 2,351,000 increase in jobs YoY.

- Government jobs fell by -1,000.

- January was revised up from 129,000 to144,000. February was also revised up by 22,000 to 197,000 Upward revisions happen in expansions, and after a weak spot in late 2013, these revisions in the last several months have all been positive.

- average hourly earnings decreased $.01 to $24.30. The YoY change is +22%. As a result, YoY average real wages probably fell slightly in March, given the expected slight rise in consumer prices due to the weakening of the Oil choke collar.

- the employment to population ratio rose from 58.8% to 58.9%, and has risen +0.4% YoY. The labor force participation rate also from 63.0% to 63.2%, but has declined 0.1% YoY. The usual caveats about discouraged workers and Boomer retirements apply.

- the number of people who are not in the labor force but want a job now (the best measure of long time discouragement) totals 3,050,000.

This report had the best internals of any report in the last six or so months. Aggregate hours, overtime hours, and the manufacturing workweek, all of which had been weakening, made up all of their losses and in at least one case set a new high. Counting by hours vs. jobs, almost all of the losses in the recession have been made up. Private sector jobs have now also made up all of their recession losses.

Wages remain a weak point, and the usual participation rate debate will continue. We still are in the hole by several million jobs considering the population increase in the working age population since 2007, and the decline in wages in March does nothing to help consumer spending.

Wages remain a weak point, and the usual participation rate debate will continue. We still are in the hole by several million jobs considering the population increase in the working age population since 2007, and the decline in wages in March does nothing to help consumer spending.

Thursday, April 3, 2014

A maturing expansion: auto sales; PCE's v. real retail sales

- by New Deal democrat

One of the themes of economic data this year is that the expansion is mature. I'm not expecting to get materially better than it has been for the last several years, and while I see continued expansion throughout this year, I am on the lookout for signs of longer term deterioration.

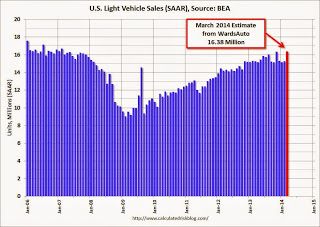

Which brings me first of all to March vehicle sales. The good news is, these made a new post-recession high of 16.4 million annualized. Here's Bill McBride's graph:

New vehicle sales have in the past peaked at least half a year before any economic downturn. So the new high is yet more evidence that the expansion will continue through this year.

But even taking March into account, first quarter 2014 vehicle sales were essentially equal to fourth quarter 2013 sales. So if there was pent-up demand because of the hard winter, there was no evidence of an increase of demand in the last 6 months.

Even this isn't really bad. Vehicle sales can plateau for a long time during an expansion without materially declining. It simply emphasizes the point that this looks like a mature expansion.

Which brings me secondly to an update of my comparison of PCE's and real retail sales. In all cases since World War 2, in the earlier part of an expansion the YoY% increase in real retail sales exceeded that of PCE's. In the latter part, the reverse is true. Since PCE's include more spending on necessities compared with retail sales, it makes sense. People cut down more on discretionary spending first, before they cut back on necessities.

Here, the news is that for the second month in a row in March YoY PCE's have now exceeded YoY real retail sales:

This is absolutely not a sign of DOOOOM!!! But it is the kind of thing I expect to see late in an expansion.

This month as usual I will pay a lot of attention to housing reports. And first quarter earnings will start to be reported, and the reports I have read so far are forecasting relative weakness in this long leading indicator. We'll see.

Wednesday, April 2, 2014

A cautionary note about employment

- by New Deal democrat

A lot of positive anticipation seems to be building about Friday's employment report, with many people predicting 190,000 or even above 200,000. Most of these optimistic scenarios seem to be built around the recent weeks' rebound in weekly and March data, e.g., vehicle sales.

There may indeed be a post-winter rebound, but I remain cautious about the next few months.

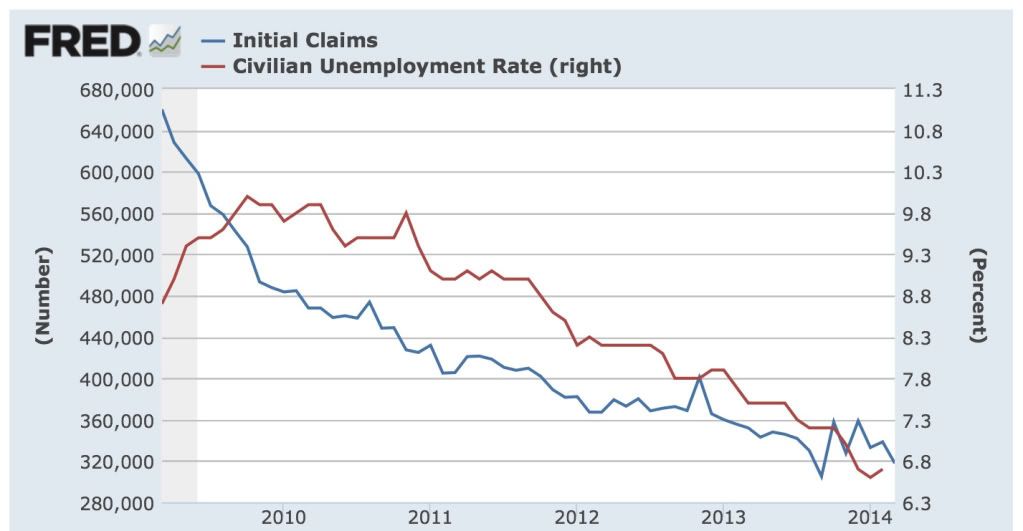

In the first place, initial claims have a good record of anticipating the unemployment rate with a one or two month lag:

While initial claims dropped to near post-recession lows by the end of March, the unemployment rate is more likely to reflect the January and February increases in layoffs.

Secondly, the jobs report tends to move in the direction of real retail sales with a few months' lag. Let's first look at jobs and real retail sales as a YoY% change averaged by quarter to cut down on some of the noise:

Since the above quarterly look ends with last December, now let me show the same data on a m/m basis:

In December through February, real retail sales took quite a hit on a YoY basis. It's likely those poor comparisons are like to show up in the monthly jobs report at some point between now and mid-year. A negative month is well within the range of reasonable probability.

Reported corporate profits as a leading indicator for stock prices: an updated look

- by New Deal democrat

I have a new post up at XE.com updating a previous comment on corporate profits as a long leading indicator for the economy compared with stock prices as a shorter leading indicator.

Italian And Spanish ETFs Break Though Resistance

Both the Italian and Spanish ETFs have been consolidating for the last 2-3 months. The Italian (top chart) in an upward sloping wedge and the Spanish in an ascending triangle. Right now, neither break is particularly convincing. The break out days' candles are crosses rather than strong bars. The lack of a strong bar is more problematic because of the high volume of the Spanish break-out day.

Adding to the concern is the broader EU ETF, which has yet to break out.

Before making a move here, wait until we get broader confirmation.

Monday, March 31, 2014

Defensive Sectors Outperforming Since January 1

Since the first of the year, utilities and health care have outperformed consumer discretionary, consumer staples and the financial ETFs.

US Markets Appear to be Making A Short-Term Top

The IWMs have fallen through short-term support. Momentum is declining and the CMF is showing a slight volume outflow. Prices are below the short-term EMAs. The logical target is the upward sloping trend line.

The QQQs are right below the trend line on declining momentum with a slight volume outflow. Prices are below the short-term EMAs with the shorter EMAs all moving lower.

The DIAs appear to have printed a double top with momentum declining and the CMF weak.

Sunday, March 30, 2014

Satiation, imitation, human error, and variable reinforcement: 4 lessons from psychology for economic theory

- by New Deal democrat

(You know the drill. It's Sunday, and I take a break from graphs and data and voice some opinions. Regular nerdiness will resume tomorrow.)

Noah Smith ignited a discussion this past week with a post about the backlash against behavioral economics. He wrote:

There are two main knocks against behavioral econ. These are:Brad DeLong had a repost here. [Update: Tim Harford's original post is here. Cullen Roche's succinct, and devastating, rebuttal is here.]

1. There is no "grand unified theory" of behavioral econ; instead it's a bunch of specific little theories for different situations. What we want is a widely applicable, unified theory of economic behavior.

2. The behaviors produced in a psychology lab are extreme effects produced by extreme, coordinated manipulations; in the real world, lots of stuff is going on, and what we care about is the average.

This feeds into one of my long time grudges against the imperialism of economic theory. Once upon a time I took my B.A. in psychology and was accepted into a hifalutin "public policy" Ph.D. program at a top ranked school. I very quickly discovered that, despite claims of an "interdisciplinary" approach, in fact it taught "theoretical economics uber alles." When I confronted a professor with my knowledge that the claimed outcomes contradicted actual, empirical psychological studies, he simply said "it all randomizes out." I transferred out of the program.

So, let me briefly discuss 4 specific routes towards a "grand unified theory" of behavioral econ.

1. Satiation.

Econ theory starts out with an assumption that drives are insatiable. We all know that's not true (well, ok, sex might come close). I may thoroughly enjoy steak, but not at every meal all the time. Once we start from the proposition that drives are satiable, demand curves in particular change their shape. Once I have enough of something, I don't want any more at that or any price.

There is a very real world manifestation of this in the demand curve for labor. Econ teaches that the more you pay someone, the more they will work. If anything, over the long term, the reverse is true. Most people work in order to save for one or more purposes: whether paying this month's rent or feeding the kids for the poor, to saving for a house for the middle class, to saving for the kids' college education and retirement for the affluent middle class.

Once all of the targets have been achieved, there is no more economic reason to work (although there may be strictly social reasons in terms of keeping active and interacting with others). If I have decided that I will retire once I have $500,000 set aside, and you double my pay, you have just halved the time I will continue to work. Far from increasing my labor, you have decreased it.

2. Variable reinforcement.

One of the oldest and most durable results from psychology is that the way to maximize a behavior is *not* to reward it all the time. Once the behavior is learned, you decrease the number of times you reward it, and reward it on a random, non-regular schedule. Since your subject is working for a reward, you will get lots more of the behavior if it takes many repeated cycles to get the reward than if the reward is given every time.

I once pointed this out to Prof. Greg Mankiw on his blog. He was not amused.

This point fits in very well with the discussion of satiation above. If my lab rat can press one of two bars in order to get food, and one bar gives out food every time, and the other on a variable schedule, my rat is going for the bar that always rewards him. He'll get satiated quicker, and then he'll stop.

But if I am an employer, or a casino, (of even Kos of DailyKos), what I want is to maximize the behavior that rewards *me.* Casinos are an obvious example, but that's also why so many employers gradually reduce perks over time once an employee is hired, and why they are instituting variable annual bonuses. Once they have the employee trained, variable reinforcement maximizes the employee-equivalent of bar-pressing, and complex bonuses dependent on many metrics increases the employees' performance on each, since they don't know which one will give rise to the biggest reward.

And if you participate in a big bulletin board like DK, the comment system ensures that you will keep coming back for interaction, and the comment recommendations that add up like pinball scores serve exactly as variable reinforcement. I have no doubt that if we could hook up most Kossacks to an fMRI, we'd see endorphins released into the brain every time they see the number of recommendations for a comment increase. It does wonders for Kos's page views.

3. Imitation

"Monkey see, monkey do." Much of, and maybe most, human learning takes place by imitation. You imitate your parents. You imitate your older siblings. You imitate your 'cool' classmates. You imitate your professors and mentors. You imitate a successful profit-making strategy.

In psychology, it is known as "modeling." You model your behavior on others. Economists really haven't explored this at all. I once asked Prof. Mark Thoma about whether economists had ever thought to study learning, and got back a response indicating that some economists had used a system of successive approximation. But brute force practice is not imitation. The closest economists have come to discussing imitation is in the concept of herd behavior.

Imitation shows how a strategy, once novel, becomes commonplace and sometimes overshoots with catastrophic results. A great example of the former is franchising. Pioneered by McDonald's, and by Harlan Sanders, the founder of Kentucky Fried Chicken, franchising was quickly imitated and now there are probably thousands of franchising corporations, explaining why virtually any mall and any large plaza or strip mall looks virtually identical anywhere in America.

The problem arises when a behavior can only be imitated by a limited number of people without turning toxic. A great example of this was house-flipping a decade ago. Originally it was a great success. The flipper buys an old property, fixes it up, and resells it for a profit. During the housing boom, then bubble, the number of flippers probably grew at an exponential rate. At some point the market reached satiation, and then went right past it. A successful profit strategy for some became a disaster for a far larger group of people. Modeling as a psychological concept explains how that happens over time.

4. Human error

It is a trite truth that all humans have different skill levels. And probably everybody engages in some self-destructive behavior. Even in a perfectly competitive market, different participants will better react to changes, or even to extended periods of stability. If there are no barriers to entry, the less skillful (or lucky) participants leave the market, and newer ones come in.

But over time, most businesses tend to become oligopolies. And oligopolists can engage in poor or unlucky decision-making as well. When they do (Arthur Anderson in the Enron scandal, Circuit City), the oligopoly shrinks, tending further towards monopoly.

Too often even the most prominent economists seem to assume that the "free market" participants always make the most "optimal" decisions. We know this isn't true, and the impact of poor human decision-making over time in conditions other than perfect competition appears to have been totally neglected by economists.

TO SUM UP: Psychology isn't just about a bunch of discrete tiny behaviors that randomize out. It is about human variation, how we learn, and how we engage in large systematic behavior patterns. Satiation, imitation, human error, and variable reinforcement are general concepts that have major implications for any "grand unification" economic theory.

.png)

.png)