Saturday, January 25, 2014

Weekly Indicators for January 20 - 24 at XE.com

- by New Deal democrat

Weekly Indicators for this week are up at XE.com.

One week ago rail traffic and consumer spending took a big hit, which I blamed on the extreme cold from the "polar vortex." This week I look to see if they rebounded. The long leading indictors also had something of a rare week of late.

Friday, January 24, 2014

The exception to the rule about interest rates and housing: "Buy now or be forever priced out"

- by New Deal democrat

As I have written extensively in the last several months, a rise in interest rates has almost always - 17 of 21 cases since World War 2, to be precise - been consistent with an outright decline several quarters later in housing. Typically a 1% increase in interest rates has been consistent with a 100,000 decline in the volume of housing permits and starts.

But what about the 4 exceptions? Are they just random outliers, or is there a common thread linking them?

It turns out that, in at least 3 of the 4 cases, there is a common thread: in the immortal words of housing bubbleheads circa 2005, "Buy now or be forever priced out."

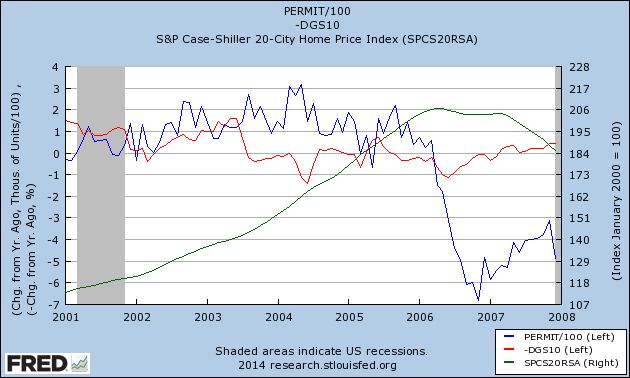

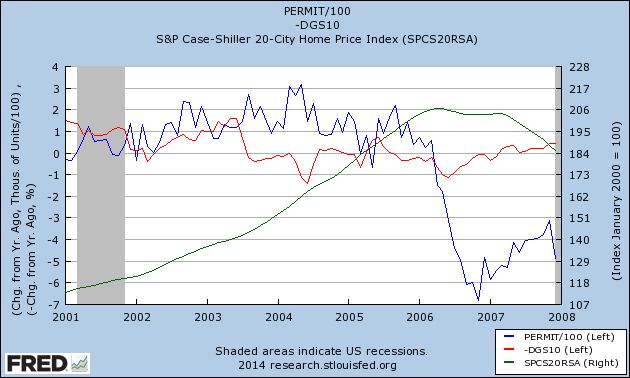

The housing bubble of 2004-06 remains the biggest exception in the nearly 70 year history of housing and interest rates that I've examined. Here's the graph of interest rates YoY change (inverted, red) and housing permits YoY change (blue) during that period and the immediate aftermath:

As you can see, despite the fact that interest rates not only had not fallen, but in fact had risen somewhat and remained elevated for several years, housing permits continued to increase stoutly. As we all recall that housing prices (Case Shiller Index, green, index values at right) were rising at the brisk clip of 10% or more a year for about half a decade at that point. It was a common trope that "real estate only goes up!" If so, you had better buy today, because tomorrow the house you wanted would only get even more expensive. And for a long while it did. Until it didn't, and housing crashed in equally spectacular fashion, as you can see from the latter part of the graph above.

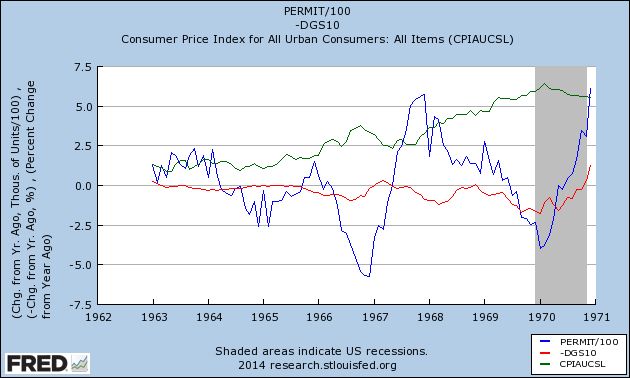

A similar, although not identical, explanation can be found to the exceptional performance of housing in 1968, and to some extent, also in 1979.

Inflation and interest rates had remained tame throughout the 1950s, and slightly increased in the early 1960's.

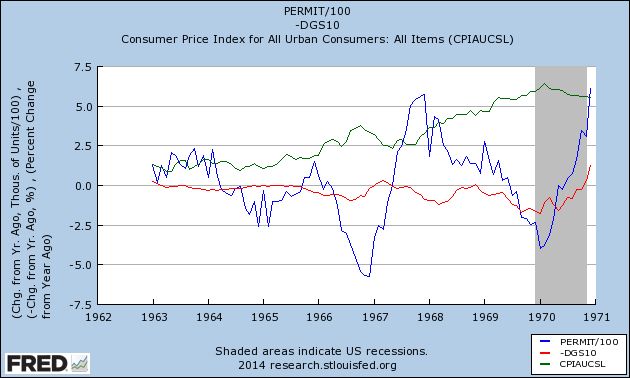

But in 1965, Lyndon Johnson began his "guns and butter" fiscal policy. Previously, it had been understood that you could only either finance wars (guns) or domestic programs (butter). Johnson believed the US was so strong that he could do both. The result wasn't just inflation, but increasing levels of inflation every year beginning in 1965. By 1968, inflation had increased to 4% and showed every sign of accelerating further (and indeed it did). In its report for 1968, the Federal Reserve Bank of St. Louis pointed out this increasing rate of inflation with alarm. It appeared to be the number one economic issue facing the country.

This meant an aspiring homeowner had to deal with not only an increased mortgage rate (which would ordinarily drive housing construction down), but the belief that, if s/he didn't buy a house now, then in 3 or 6 or 12 months those mortgage rates would be even higher. Needless to say, the prudent buyer bought now rather than later, despite the higher interest rates.

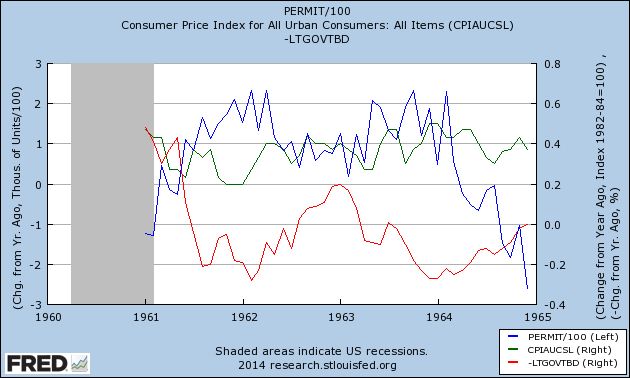

And that's what the graph shows (green line is YoY inflation rate):

Notice that these sales only borrowed from future demand, as at the end of 1969 the US entered its first recession in almost 10 years.

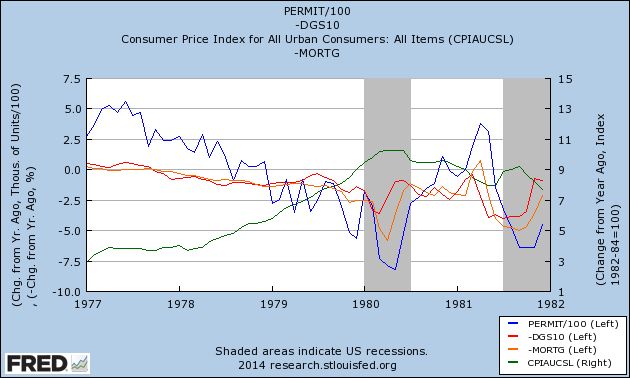

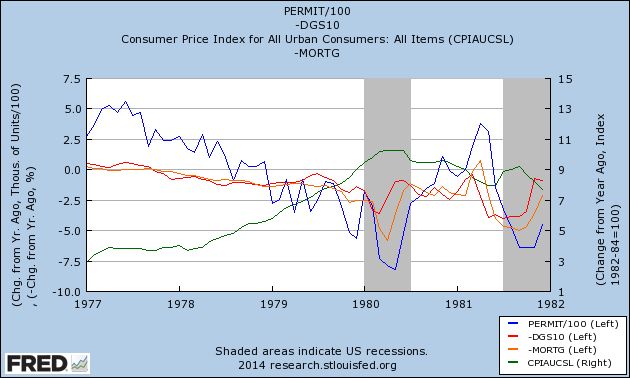

The same dynamic was in play in 1978, with the same result. Here's the graph:

Additionally, in 1978, there were several months that mortgage interest rates (orange) declined significantly, and were in fact negative YoY. This coincided with spikes in housing. Contrarily, there were several months in 1978 that were negative YoY, although not negative enough to result in a negative YoY quarter. Nevertheless, the reckoning was only delayed until 1979.

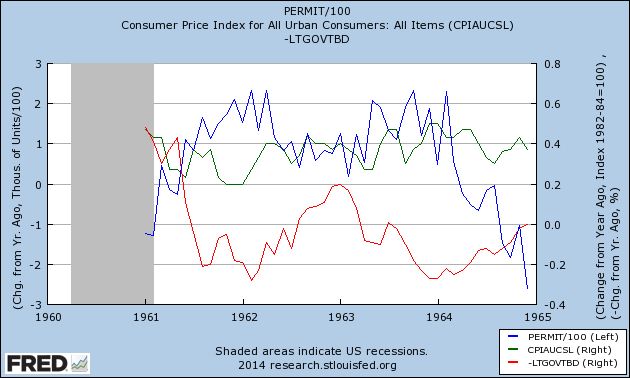

That leaves only 1962. I have been unable to find any reliable source of what may have happened with mortgage interest rates that year. We can say that the increase in interest rates was relatively short-lived, and that while housing never turned negative, it did turn lower for about a year, falling under +50,000 for 3 of those months. You can also see that inflation (green) began to tick up at this point:

In short, the exception to the rule that rising interest rates are associated with a decline in housing about 6 to 12 months later is when the costs of buying a house not only have risen, but it is expected that they will rise even further in the immediate future. In those circumstances, it makes sense not to delay the purchase of a new house even though interest rates have already moved against you.

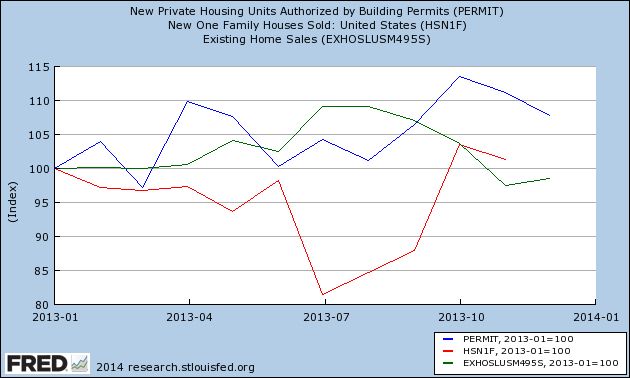

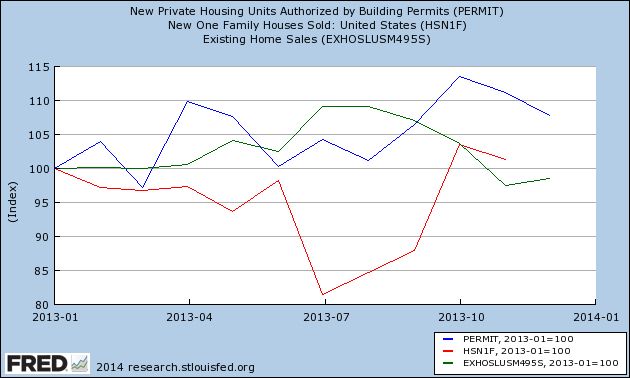

So, is there a component of "buy now or be forever priced out" in the present environment? Actually, I believe there has been, evident in the spikes of demand in July and August in existing home sales, and in October and November in housing starts and permits, as shown in this graph of housing permits (blue), new home sales (red), and existing home sales (green) since January 2013:

A number of buyers may have tried to lock in rates before they rose any further, as evidenced by the surge in existing home sales in July and August, and permits and new home sales in October and November. That dynamic appears to be fading, and there does not appear to be any mentality that mortgage rates will continue to rise significantly from here. If anything, interest rates seem likely to meander around their current level, and buyers will take advantage of the dips. But that is not the same as "buy now or be forever priced out."

The bottom line is that the exception to the rule that rising interest rates cause a decline in the housing market does not appear to be in play at present. So, having considered the exceptions to the rule, I continue to believe that housing will actually experience a decline (that has already begun) in approximately the first 6 months of 2014.

As I have written extensively in the last several months, a rise in interest rates has almost always - 17 of 21 cases since World War 2, to be precise - been consistent with an outright decline several quarters later in housing. Typically a 1% increase in interest rates has been consistent with a 100,000 decline in the volume of housing permits and starts.

But what about the 4 exceptions? Are they just random outliers, or is there a common thread linking them?

It turns out that, in at least 3 of the 4 cases, there is a common thread: in the immortal words of housing bubbleheads circa 2005, "Buy now or be forever priced out."

The housing bubble of 2004-06 remains the biggest exception in the nearly 70 year history of housing and interest rates that I've examined. Here's the graph of interest rates YoY change (inverted, red) and housing permits YoY change (blue) during that period and the immediate aftermath:

As you can see, despite the fact that interest rates not only had not fallen, but in fact had risen somewhat and remained elevated for several years, housing permits continued to increase stoutly. As we all recall that housing prices (Case Shiller Index, green, index values at right) were rising at the brisk clip of 10% or more a year for about half a decade at that point. It was a common trope that "real estate only goes up!" If so, you had better buy today, because tomorrow the house you wanted would only get even more expensive. And for a long while it did. Until it didn't, and housing crashed in equally spectacular fashion, as you can see from the latter part of the graph above.

A similar, although not identical, explanation can be found to the exceptional performance of housing in 1968, and to some extent, also in 1979.

Inflation and interest rates had remained tame throughout the 1950s, and slightly increased in the early 1960's.

But in 1965, Lyndon Johnson began his "guns and butter" fiscal policy. Previously, it had been understood that you could only either finance wars (guns) or domestic programs (butter). Johnson believed the US was so strong that he could do both. The result wasn't just inflation, but increasing levels of inflation every year beginning in 1965. By 1968, inflation had increased to 4% and showed every sign of accelerating further (and indeed it did). In its report for 1968, the Federal Reserve Bank of St. Louis pointed out this increasing rate of inflation with alarm. It appeared to be the number one economic issue facing the country.

This meant an aspiring homeowner had to deal with not only an increased mortgage rate (which would ordinarily drive housing construction down), but the belief that, if s/he didn't buy a house now, then in 3 or 6 or 12 months those mortgage rates would be even higher. Needless to say, the prudent buyer bought now rather than later, despite the higher interest rates.

And that's what the graph shows (green line is YoY inflation rate):

Notice that these sales only borrowed from future demand, as at the end of 1969 the US entered its first recession in almost 10 years.

The same dynamic was in play in 1978, with the same result. Here's the graph:

Additionally, in 1978, there were several months that mortgage interest rates (orange) declined significantly, and were in fact negative YoY. This coincided with spikes in housing. Contrarily, there were several months in 1978 that were negative YoY, although not negative enough to result in a negative YoY quarter. Nevertheless, the reckoning was only delayed until 1979.

That leaves only 1962. I have been unable to find any reliable source of what may have happened with mortgage interest rates that year. We can say that the increase in interest rates was relatively short-lived, and that while housing never turned negative, it did turn lower for about a year, falling under +50,000 for 3 of those months. You can also see that inflation (green) began to tick up at this point:

In short, the exception to the rule that rising interest rates are associated with a decline in housing about 6 to 12 months later is when the costs of buying a house not only have risen, but it is expected that they will rise even further in the immediate future. In those circumstances, it makes sense not to delay the purchase of a new house even though interest rates have already moved against you.

So, is there a component of "buy now or be forever priced out" in the present environment? Actually, I believe there has been, evident in the spikes of demand in July and August in existing home sales, and in October and November in housing starts and permits, as shown in this graph of housing permits (blue), new home sales (red), and existing home sales (green) since January 2013:

A number of buyers may have tried to lock in rates before they rose any further, as evidenced by the surge in existing home sales in July and August, and permits and new home sales in October and November. That dynamic appears to be fading, and there does not appear to be any mentality that mortgage rates will continue to rise significantly from here. If anything, interest rates seem likely to meander around their current level, and buyers will take advantage of the dips. But that is not the same as "buy now or be forever priced out."

The bottom line is that the exception to the rule that rising interest rates cause a decline in the housing market does not appear to be in play at present. So, having considered the exceptions to the rule, I continue to believe that housing will actually experience a decline (that has already begun) in approximately the first 6 months of 2014.

Thursday, January 23, 2014

Existing home sales down YoY and down 10% from high for second month in a row

- by New Deal democrat

Let me be the first to say that, of the measures of the housing market, existing home sales are the least important, because they don't have the impact that new home construction has on the economy.

But, that being said, they typically move in the same direction as new home construction.

So, for the Doubting Thomases who think my forecast of a weakening housing market due to the rise in interest rates last year is off the mark, the title of this post states the simple facts.

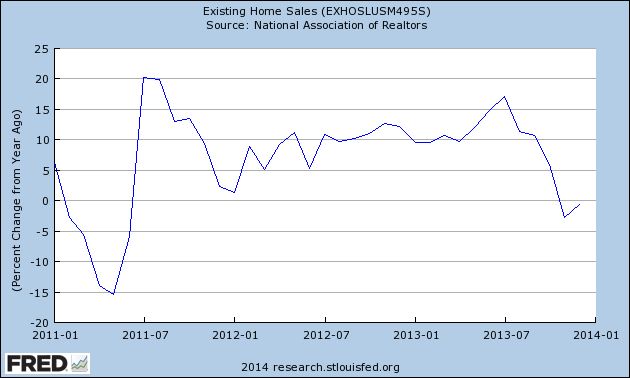

For the second month in a row, existing home sales are less than they were a year ago.

For the second month in a row, existing home sales are down over -500,000 sales annualized from their July and August 2013 peaks. November was off slightly more than 10%, and this month was -9.6% off that peak.

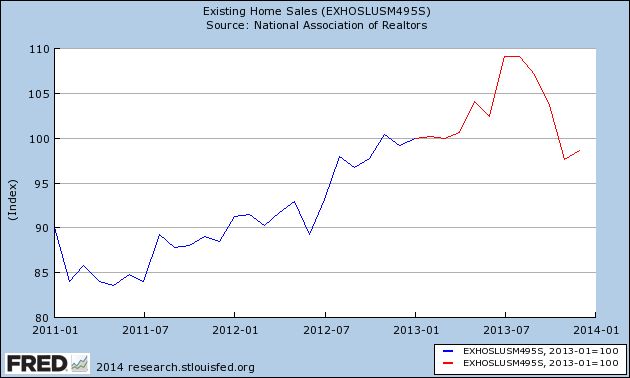

Here's the graph of existing home sales since their bottom at the end of 2010, with 2013 highlighted in red (set to 100 for January 2013):

And here is the same data presented YoY:

In addition to existing sales, both housing permits and starts have cooled down from growing at a 20% rate in 2012 to +4.6% and +1.6% respectively at the end of 2013.

So far, only new home sales have not meaningfully decelerated. Those will be reported next week.

Additionally, Bill McBride reiterated this week why he remains bullish on housing and accelerating economic growth in 2014. He and I do disagree on what some of the facts mean, but I want to wait for next Thursday's GDP report before I explain why.

Wednesday, January 22, 2014

Gas prices stay near seasonal low for nearly 3 months

- by New Deal democrat

Gas prices have stayed at their seasonal nadir at an unusually long time. Over at XE.com, I discuss this in the context of whether the Oil choke collar is continuing to loosen.

Tuesday, January 21, 2014

Chinese Market Continues Moving Lower

The Chinese market has been in a bit of a funk over the last nine months. Prices dropped to the 1950 level in late June. They rose to the 2260 level twice; once in September and once in early December. But since early December, prices have been dropping.

The reason for the lack of any meaningful rally in China is the slowing growth picture. On Sunday, we learned that YOY GDP growth slowed again to 7.7%. While this is still high by developed world standard, it actually represents a decline from the Chinese story. As a result, traders are sending shares lower.

Monday, January 20, 2014

Why the decelerating trend in housing and car sales is a cause for concern

- by New Deal democrat

As I have already written, there are increasing signs that the increase in interest rates and the death of mortgage refinancing are beginning to eat into consumer purchases. Specifically, growth is flagging as to both the two biggest assets owned by families: houses and cars.

I have been sounding the alarm about decelerating housing for awhile, but now this may also have spread to vehicles as well. I say “may” because typically vehicle sales plateau at some point in expansions – but in the last expansion vehicle sales plateaued at a level 1,000,000 vehicles per year above the maximum number sold on an annual basis in 2013.

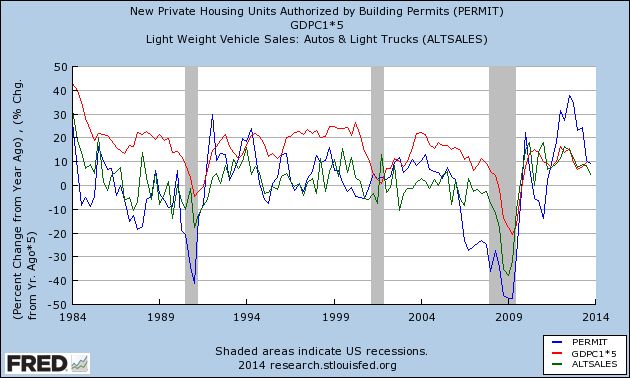

Below is a graph (averaged quarterly to cut down on noise) of the YoY% growth in housing permits (blue) and auto sales (green), compared with GDP (red) for the last 30 years:

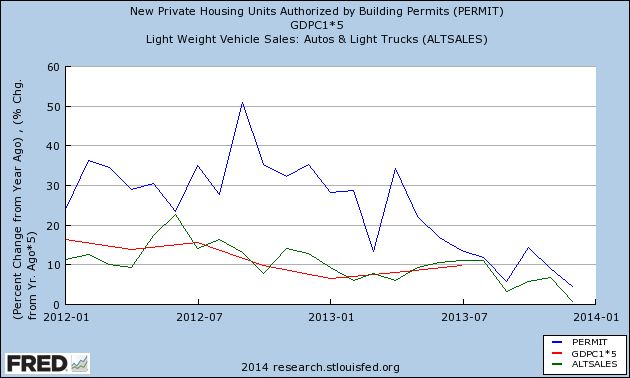

Now here is the same data for the last two years, but monthly better to show up the recent trend:

Note that, measured quarterly, both houses and cars are selling at a level of YoY growth that is very strong compared with the last 30 years, even though there has been a significant decline in that rate of growth. At the same time, when we look at the trend on a monthly basis, both housing and cars look set to turn negative by the end of the first quarter.

That housing and cars are showing relative weakness may not sound like a big deal. Until you remember a paper presented by UCSD economist Edward Leamer at Jackson Hole in 2007, Housing and the Business Cycle, in which he said:

We have experienced 8 recessions preceded by substantial problems in housing and consumer durables....

....

Residential investment consistently and substantially contribute[d] to weakness [in GDP growth] before [these 8] recessions....

....

After residential investment as a contributor to prior weakness come consumer durables, consumer services, and then consumer nondurables. Those are all consumer spending items -- it's weakness in consumer spending that is a symptom of an oncoming recession.... The timing is: homes, durables, nondurables, and services. Housing is the biggest problem in the year before a recession... durables is the biggest problem during the recession [although consumer durables declined even more than housing before 2 of the 10 post World War II recessions]

The same interest rate or other variables [mainly employment] drive both the housing cycle and the durables cycle.... It turns out that much of the amplitude in consumer durables comes from vehicles not furniture

If you look at the first graph above, you'll see at least 3 occasions that were "false alarms." Both houses and car sales turned negative YoY in 1987, 1994, and 1996 without any recession ensuing. But they did turn negative significantly before all three of the last recessions, including the 2007-09 recession that was just about to begin when Leamer gave his presentation at Jackson Hole.

Leamer said that on average housing's relative contribution to GDP turned down about 5 quarters before the onset of a recession, followed several quarters later by cars. *If* the present trend continues, there is an excellent chance that housing and cars will be negative by mid-2014.

Sunday, January 19, 2014

A note for Sunday: a maturing expansion

- by New Deal democrat

I thought I'd pen this note to clarify my 2014 forecast a little.

I wrote that I think this will be a year of decelerating growth. I am still positive about the first three quarters of this year, and almost all of the indicators I use indicate that the present quarter, like the second half of last year, should be very positive.

And I do not foresee any recession, at least through the first three quarters of this year. I'm withholding saying anything definitive about the 4th quarter until I see how corporate earnings play out in the current reporting season.

So I'm actually not pessimistic about this year at all.

Where I differ from most people who have written forecasts is that, while I expect the news to remain positive, I also see it being not quite so positive as the year progresses.

The most obvious difference I have with most is that I expect housing permits and starts to actually turn negative during the first half, in fact if the trend continues they'll be negative within 3 months.

If you want a simple phrase that captures my feeling well, it would be that we are in a maturing expansion.

All of the things that I would expect to turn up early have turned up. With the exception of interest rates, none of the things I would expect to be negative a year or more out from a recession are negative.

Still, I feel a little like I did at the beginning of 2009. We were in the epicenter of the recession, when I noticed that retail sales had stopped dropping like a rock. I also saw that the pace of housing permits had been plummeting at a rate of -500,000 a year or more for several years, and was under the absolute level of 600,000 annualized. Housing almost literally had to bottom in early or mid 2009, unless it was going all the way to zero! So I started to watch for signs of a bottom or a turnaround. And since I had been very bearish, even comparing the situation in 2007 to 1929, Doomers turned on me (and Bonddad) with a vengeance.

For a long time I've been trying to find sort of "anti-coincident" economic indicators. These would be indicators that turn up or down after the lagging indicators but before the leading indicators of the next move. There seem to be several, and they all appear to have peaked.

In general, what I am seeing are trends that I would expect to see in an expansion that is still moving along, but is getting a little long in the tooth. For example, recently an increase in capital expenditures has been cited by bulls. But that may well be a signal of a late point in the cycle.

This week or next week, I plan on writing about these trends, and more about my bearish housing call. There is more supporting data, and I've pretty well figured out why 4 out of 21 times since WW2 that interest rates rose, housing didn't fall, so I'll explain that as well.

So I'm not actually pessimistic about 2014. I am simply increasingly confident that we are in "a maturing expansion." What is depressing is that wages are still stagnant, real disposable personal income has been improving at a pathetic rate, and employment is nowhere near recovering to its pre-recession level on a working-age population basis.