- by New Deal democrat

Monthly data released last week included a paltry nominal increase in retail sales, an actual slight decrease in industrial production (but with prior months revised substantially higher), and a surprising increase in consumer confidence. There was a surprise surplus in the Treasury budget in January.

This week continued to give some indications that tax increases may be affecting the economy. So Let's start this look at the high frequency weekly indicators by checking what is happening with tax withholding:

Employment metrics

Daily Treasury Statement tax withholding

- $80.9 B unadjusted was withheld this year in the first 10 days of February compared with $75.1 B a year ago, a 7.7% increase

- $130.0 B (adjusted -13.1% for 2013 payroll tax withholding changes) vs. $143.2 B, -6.2% YoY last 20 days. The unadjusted result was $149.6 B for a 4.5% increase.

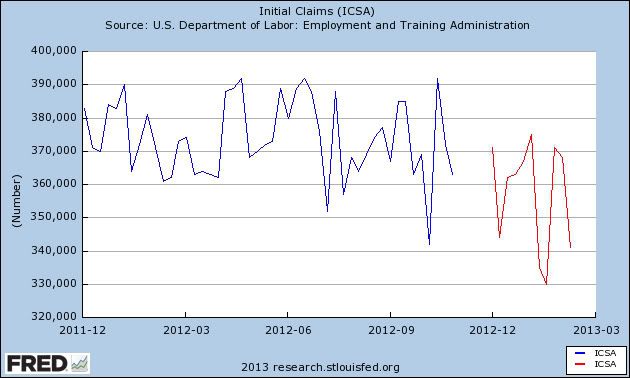

- 341,000 down 25,000

- 4 week average 352,500 up 2,000

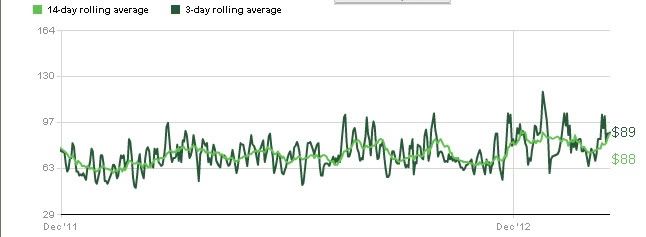

- unchanged at 89 w/w up 3.5% YoY

Let me repeat my comment on tax withholding from last week: I am adjusting my YoY tax withholding figures to reflect the increase in personal withholding taxes. While the YoY collections are up substantially, they should be up over 15% to compensate for the tax increase. Since I can think of no reason why employment itself should have fallen off a cliff in January, it is very possible that there is a lag in the payment of withholding taxes with the new increase. If this hypothesis is correct, I would expect tax withholding to be much more reliable by the end of February. So far, that isn't happening.

Consumer spending

- ICSC -2.5 w/w +2.1% YoY

- Johnson Redbook +2.4% YoY

- Gallup daily consumer spending 14 day average at $86 up $26 YoY !

Housing metrics

Housing prices

- YoY this week. +3.1%

Real estate loans, from the FRB H8 report:

- -0.1% w.w

- +0.7% YoY

- +2.8% from its bottom

Mortgage applications

- -10% w/w purchase applications

- +15% YoY purchase applications

- -6% w/w refinance applications

Interest rates and credit spreads

- +0.01% to 4.86% BAA corporate bonds

- -0.02% to 2.00% 10 year treasury bonds

- +0.03% change at 2.86% credit spread between corporates and treasuries

Money supply

M1

- +0.5% w/w

- +2.3%% m/m

- +10.8% YoY Real M1

M2

- +0.1% w/w

- +0.1% m/m

- +5.4% YoY Real M2

Oil prices and usage

- Oil $95.86 up $0.14 w/w

- gas $3.61 up $.07 w/w

- Usage 4 week average YoY +4.4%

Transport

Railroad transport

- -6400 or -2.3% carloads YoY

- +4100 or +2.6% carloads ex-coal

- +10,500 or +7.7% intermodal units

- +11,400 or +2.2% YoY total loads

- The AAR changed its carload categories this week, so no week over week diffusion index is possible. It should be able to be resumed next week comparing the new categories.

- Harpex up 4 at 370

- Baltic Dry Index up 5 to 753

Bank lending rates

- 0.195 TED spread down -0.030 w/w

- 0.2000 LIBOR unchanged w/w

JoC ECRI Commodity prices

- up 0.12 to 129.03 w/w

- +3.22% YoY

It remains the case that the most important issue at the moment is whether the 2% increase in withholding tax rates is having an effect on consumers. The impending austerity of the budget sequestration is an additional negative, and it looks very likely at this point. The potential consequences of moving income and spending forward into 2012 from 2013 due to tax increases are also noteworthy. For the last three weeks it looks like we got some - but by no means an overwhelming amount of - evidence that there has been an effect.

By far the most negative data was tax withholdings. Temporary jobs aren't negative, but they are flat. M2 money supply has declined since the first of the year. Corporate bond rates are rising and the credit spread is widening, although it is still closer to YoY lows.

Continuing positives once again include the housing market, consumer spending especially as measured by Gallup, bank lending rates, and commodity prices. Gas prices, while rising, haven't turned constrictive yet. Gas usage has turned positive. Rail traffic is also positive again. Jobless claims appear to have established a new, lower range.

As I said last week, while there is some evidence of a consumer and employment slowdown, the majority of the high frequency data continues to support economic expansion.

Have a nice weekend.