- by New Deal democratWith this morning's release of the ISM Non manufacturing index, I wanted to update

post I wrote a couple of months ago looking at the correlation between both the ISM Manufacturing and Non manufacturing indexes and nonfarm payrolls.

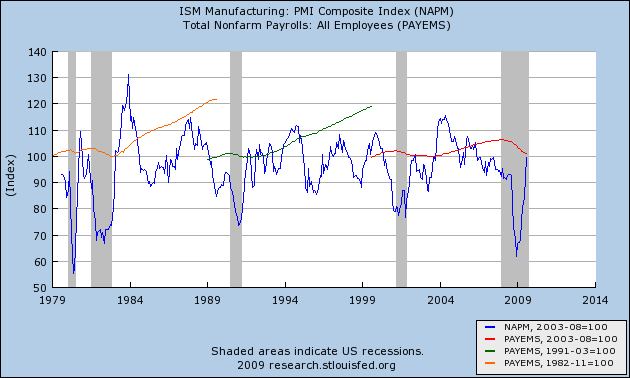

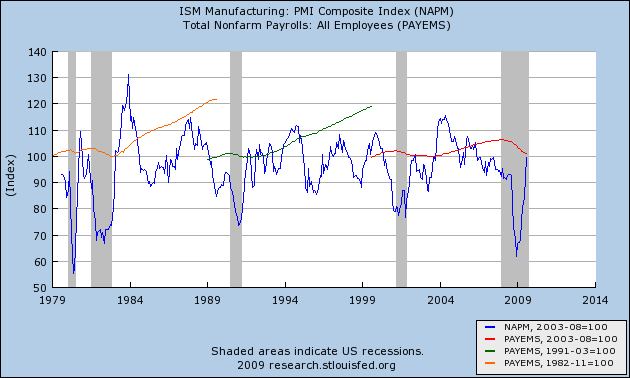

Last September when I was putting together a "Leading Index" exclusively for employment, I included the ISM

Manufacturing index, which had always signaled growth in jobs whenever it crossed 53 (the iindex is a diffusion index, subtracting negative from positive responses, with neutral being at 50. Above 50 is expansion, below is contraction). Here is the graph I created at that time, with the trough in employment for each recession normed at 100, and the ISM

Manufacturing index normed to cross that 100 jobs reading at 53:

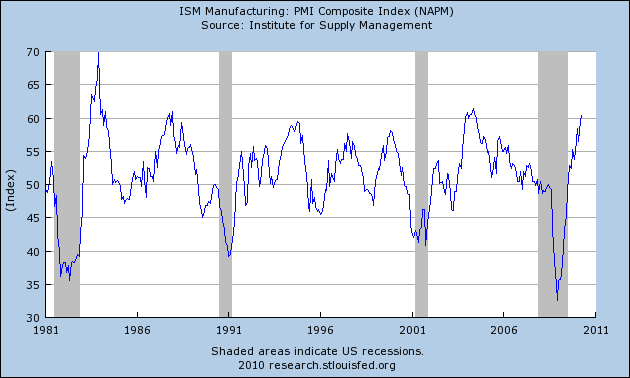

The ISM's

Non manfuacturing index, however, proved to be important in calculating when the jobs number actually turned from negative to positive in this Recovery, even though it is only 13 years old. So in March I refined the jobs leading indicator to include the following:

(1) the ISM manufacturing index be above 50 and ISM non manufacturing business activity above 48 as an initial signal; and

(2) both indexes be above 52 and average 53 or higher as a final signal, which gives one or two months' lead time to job growth. That signal was triggered for one month in October (accurately) and again for February.

With the ISM manufacturing index in April reading 60.4, and this morning's ISM non manufacturing index reading 55.4, the average at 57.9 is well into the job growth range.

[As an aside, the Non manufacturing index itself generally went sideways in April, signalling continued growth, but growth neither accelerating nor decelerating. Notably, new orders grew at a slower rate (a negative), but supplier deliveries slowed down further (a positive). The employment index declined very slightly from 49.8 tp 49.5, essentially a neutral reading.]

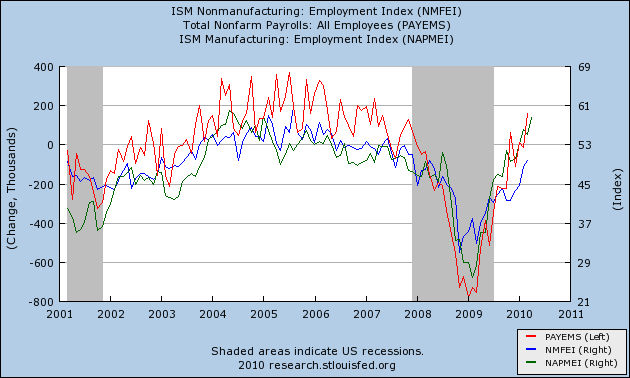

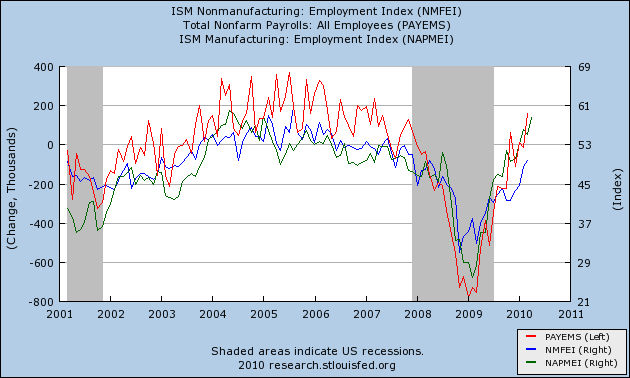

Although the

employment subindexes are not leading but concurrent, they can serve as an important confirmation of growth or contraction in jobs. In the below graph, the ISM Manufacturing employment index is in green, Non manufacturing in blue, and Nonfarm payrolls monthly gain or loss, in thousands, in red (not including this morning's data):

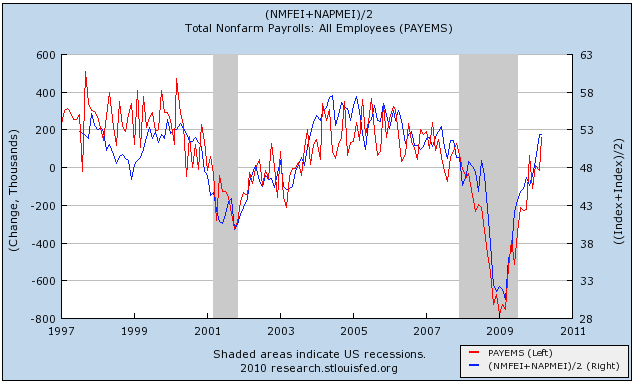

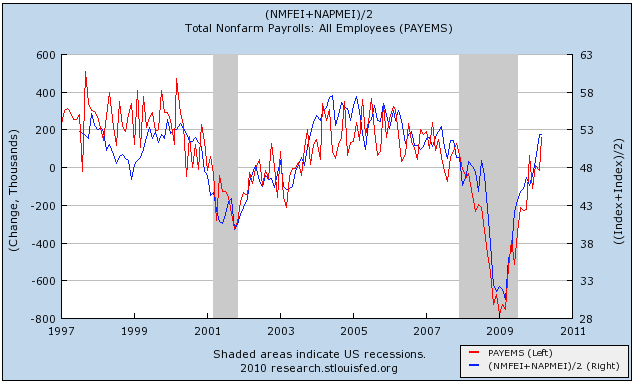

It's pretty easy to see that the ISM employment subindexes indicate job growth at least as strong as the average growth in employment during the last economic expansion. That becomes even more apparent when we edit the above graph to average the ISM Manfucturing and Non manufacturing employment indexes into one line (blue below - does not include this month):

Here's a chart of the improvement in both employment indexes for the last six months, Manufacturing on the left, Non manufacturing in the middle, the combined average on the right:

Month Mfg Nonmfg avg

2009-11-01 49.6 41.7 45.6

2009-12-01 50.2 43.6 46.9

2010-01-01 53.3 44.6 49.0

2010-02-01 56.1 48.6 52.3

2010-03-01 55.1 49.8 52.4

2010-04-01 58.5 49.5 54.0

Because nonfarm payroll data is "noisy," this doesn't translate into a specific number for Friday, but it certainly adds to the evidence that job growth will average a somewhat stronger number than most are anticipating.