As we begin 2010, the cliff-diving declines of earlier 2009 behind us, and most economists agreeing that the Recession bottomed out sometime after June, the biggest issue before us is whether on the one hand the "Gilded Recovery" of the 2nd half of 2009 which was driven by spending by the top 10% income-earners broadens out, or does the economy sink into a new contraction, or double-dip.

The same data that indicated that the end of the recession would come during the summer of 2009, with increased industrial production, retail sales and GDP growth thereafter, enables us to see the first part of 2010 with some certainty, and provide at least some road markers to the second half of the year. The two halves may be similar, or, depending on the price of Oil, may be quite different.

If there is one thing I have been harping on for ages, it is that forecasting based on present or past data is an excellent way to be wrong.

, most people simply project past trends forward, and miss turning points. Furthermore, people tend to only listen to viewpoints, and look at data, that confirms their already-decided-on opinions.

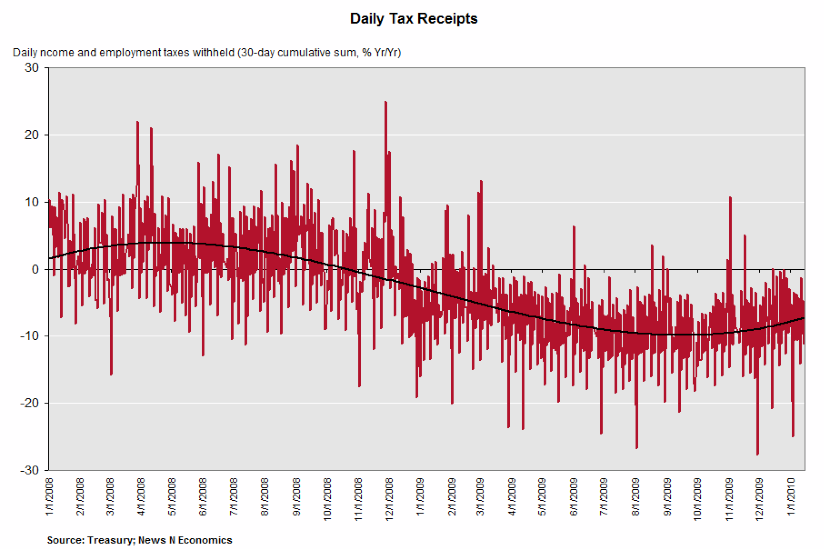

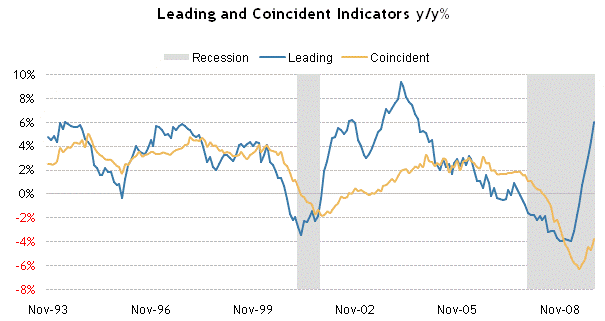

The year 2009 proved in spades Baum's point that the best way to be right about what is going to happen with the economy going forward is simply to look at the Leading Economic Indicators. They began to turn up in April, three months before the bottom in economic output - at a time when very few people besides yours truly believed that economic growth would actually begin in Q3 (for example, my friend and co-blogger Bonddad thought it would take until Q4 2009 or Q1 2010, and he was derided as an optimist). They continued to rise strongly for the rest of the year, turning a loss of nearly a million jobs in a single month at the beginning of 2009 into a small gain in November and an unrevised -85,000 in December.

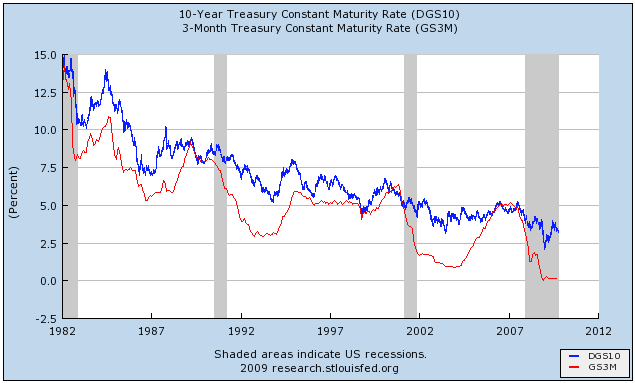

The LEI's will probably be reported later this week a having had another good month in December, given the strongly positive yield curve, big improvement in initial jobless claims, rebound in housing starts, improved consumer sentiment, improved durable goods orders, and stronger manufacturing in the ISM index. On a year-over-year basis, with the exception of 2003 they will be more positive at about +6.5% to 7% than they have been at any time since the mid-1980s, as shown on this graph that is current through November:

The simple fact is, the first 3-6 months of 2010 are probably going to show growth, and indeed more strong growth than few dared to hope for in 2009. Forecasts of a 4%+ GDP report are increasing. Several weeks ago an article in financial weekly Barron's made the case for a GDP reading in excess of 5%. Even that is now tame -- Goldman Sachs just raised their guidance to +5.8%!

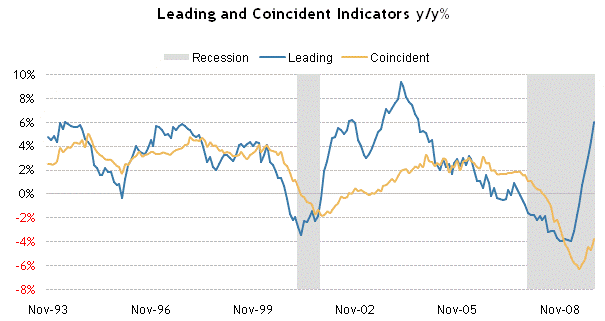

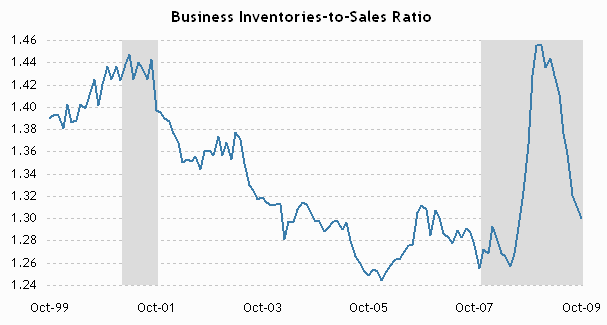

A big part of the improving economic picture generally, and employment picture specifically, is the necessity for manufacturers, wholesalers, and retailers to restock inventory. For the last 16 years, the government has kept track of how much sales change compared with inventories (stock on the shelf), and produced a graph of the Sales to Inventory ratio. Here it is, showing that suppliers brutally cut inventories in 2009. One big reason why the initial 3.5% GDP reading in Q3 2009 was ultimately revised down to 2.2% (still a pretty decent number) was the continuing decline in inventories -- i.e., some of the sales were not new products, but products sitting on shelves.

As you can see in the above graph, inventories are now as tight as they have ever been, and sales are at least slightly increasing. The need to restock shelves creates a strong need to produce new product. This directly feeds into the GDP, and directly enhances employment. Prof. Paul Krugman and Calculated Risk are calling the likely burst of GDP growth a "blip." Whether it is or not I will discuss in Part III below.

Bottom line: the first 3-6 months of 2010 are going to show growth, probably strong growth. Keep in mind that under

"Okun's law", really just a rule of thumb that economists use, we need to see at least 2% YoY GDP growth(some would say as high as 3%) to be consistent with job growth. We're probably going to reach that this quarter, although we won't find out for over another 3 months until this quarter's GDP is reported later in spring.

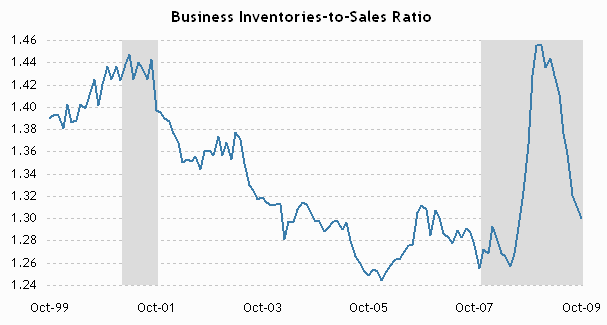

II. The Long term - K.I.S.S. vs. OilThe LEI do not help us out past at most 6 months. There is, however, at least one economic indicator with an excellent track record at forecasting the economy - with one important qualifier - a year out. That is the yield curve of the bond market.

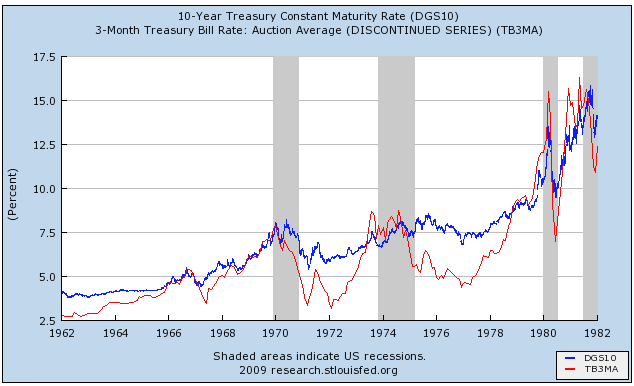

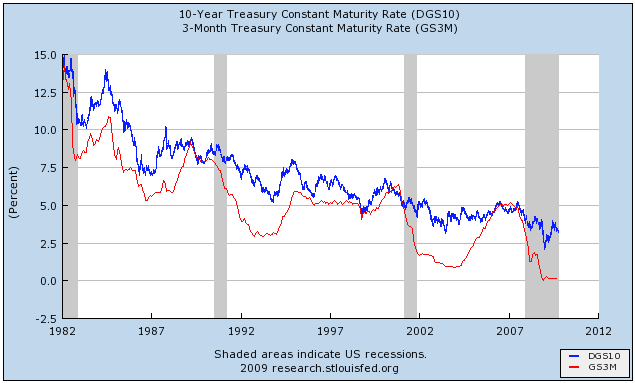

So long as there is inflation, not deflation, a positive sloping yield curve, where long term interest rates are higher than short term rates, has correctly predicted economic expansion 1 year later, without exception, since 1920, including the Great Depression. Here are two graphs of the yield curve going back all the way to 1960. As you can see, with one exception (1966), whenever the red line was higher than the blue line, meaning short term rates were higher than long term rates, there was a recession (in 1966 there was a marked slowdown, but no recession). However, EVERY time the blue line was higher than the red line, one year later there was NO recession, but instead there was economic expansion.

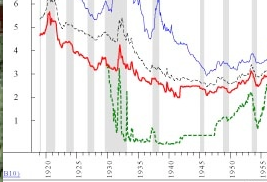

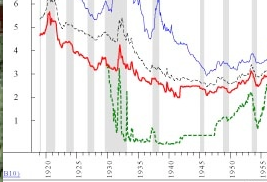

So, what is the qualifier? In times of deflation, the yield curve can give a misleading answer. If the deflation is accelerating, a yield curve gives no comfort. It is only when deflation is abating (prices are declining, but at a slower and slower rate) that a positive yield curve confidently predicts expansion. Here is the most important graph, showing the yield curve during the Great Depression (the red line is long term rates, the green line is short term rates. You can ignore the other two lines):

While the curve was inverted in 1928 (an inverted yield curve in the presence of deflation has only happened twice - in 1928 and in 2007), presaging the beginning of the GD downturn, it reverted to a positive slope for the remainder of the 1930s, and in particular the 1930-32 period.

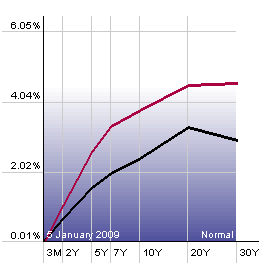

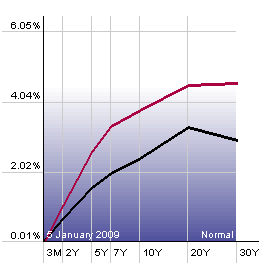

Similarly, the positive slope of the yield curve beginning in late 2007 did not foretell a respite or recovery in late 2008 -- quite the contrary, by then deflation had taken hold, and so the curve was of no help. When deflation began to abate in 2009, and specifically when year-over-year deflation began to improve at midyear, the yield curve did accurately foretell the expansion of the second half. In the graph below, the black line is the curve from one year ago, and the red line is from the end of December several weeks ago. Note that in both cases, the 30 year bond yields more than the 10 year bond, yields more than short term bonds. That is a positive yield curve.

I call this the K.I.S.S. indicator. If you look at only one indicator and nothing else, this is the one to observe. Needless to say, the strongly positive yield curve now foretells strong economic growth throughout the entirety of next year -

provided there is no deflation. More on that in part IV below.

III. About the "Blip"First, a brief but necessary digression. As I indicated above, both Prof. Paul Krugman and Calculated Risk are calling the likely good GDP reading that we are about to see a "blip" that can be attributed to inventory restocking. The implication for the blogosphere being, of course, that it will momentarily pass and we will be back in negative GDP pronto, even though that is not what either are saying. Krugman thinks the odds

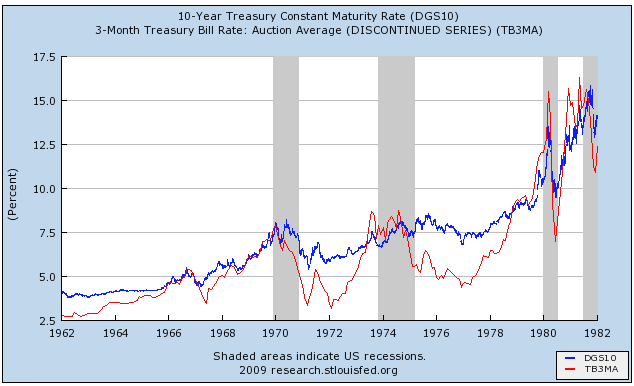

against. a double-dip are 60%- 70%. CR sees 1% to 2% growth. Their template is the temporary bounce following the 1980 recession which promptly resolved into the very deep 1981-1982 recession. I agree that GDP is likely to subside, but disagree with the analogy.

In the first place, as

I've already shown, Prof. Krugman has a long history of forecasting recessions year after year after year. While he is right to remind us that inventory bounces can be transitory, that doesn't mean a return to recession. The need for strong inventory restocking now is simply the reverse of the complete halt in inventory stocking that took place following the Black September 2008 financial panic. As the

Wall Street Journal put it last July:

The rapid pace at which businesses shed jobs during the recession comes with a flip side: Workers will need to be hired back quickly as the economy improves.....

"Firms were unusually aggressive in cutting costs and cutting employment," said James O'Sullivan, an economist with UBS. "The flip side of that remains to be seen, but it could mean that companies will be quicker to bring back people because they were more aggressive about getting rid of them."

Businesses say they are running lean....

In other words, any positive "blip" now is simply the reversal of the negative "blip" in inventory depletion that caused -6% annualized GDP a year ago. It does not stand alone and does not thereby portend Doom afterwards.

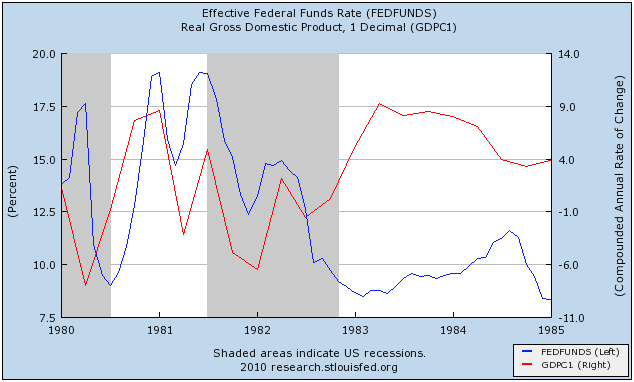

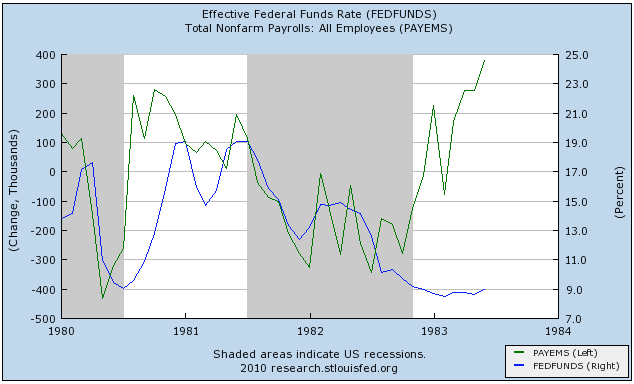

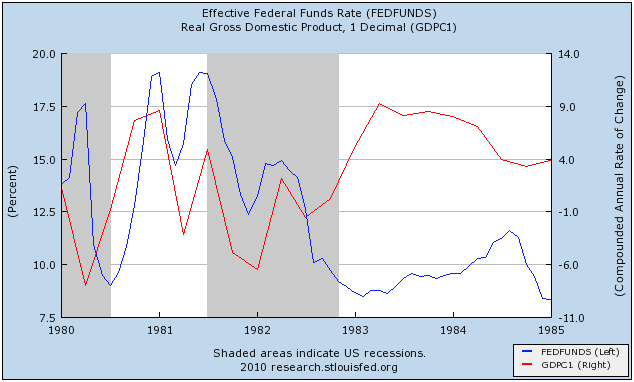

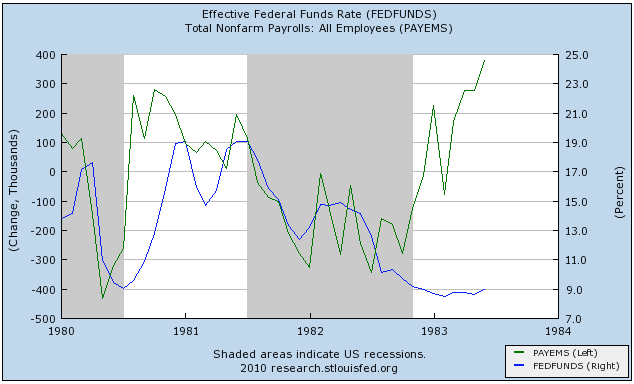

Secondly, the double-dip after the 1980 recession has a very simple and straightforward explanation: Paul Volker of the Fed raised the Federal Funds rate from 9% ti 19% in 6 months, effectively killing the economy and employment in order to kill inflation. Here's two graphs showing it. In the first, the Fed Funds rate is in blue, and the GDP in red:

In the second, the same Fed Funds information is in blue, and jobs are in green:

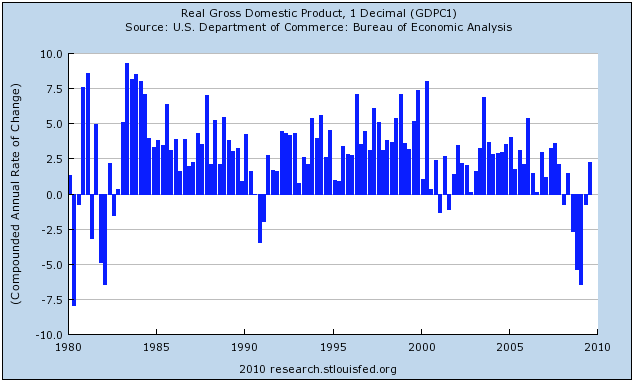

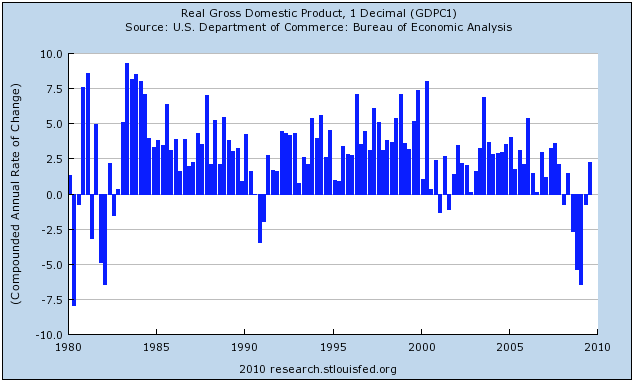

Like I said, the Fed doubled interest rates and killed both GDP and employment. Unless the Fed does the same sort of thing in the next couple of months, a repeat performance is very unlikely. It's true that inventory restocking will enhance GDP readings, but that is commonplace at the beginning of economic expansions. Take a look at this graph of annualized GDP growth from 1980 to the present:

The graph shows Krugman's exemplar "blip", but notice what happens after 1982 -- there is a full year of +7.5% GDP growth from early 1983 to early 1984, that slowly tails off thereafter. Contrast this with the lackluster GDP growth of under 3% in the first 3 or more quarters after the end of the 1991 and 2001 recessions. The quick growth of Industrial Production of the last 6 months shows that this economic expansion has much more in common with the 1983 expansion than the 1992 and 2002 ones. Yes,strongly positive GDP will subside as inventory restocking fades, but that by no means foretells a double-dip.

IV. The Joker in the Deck: OilIf the leading economic indicators are telling us that the first half of the year is likely to be good, and the K.I.S.S. yield curve indicator says the second half as well, are we home free?

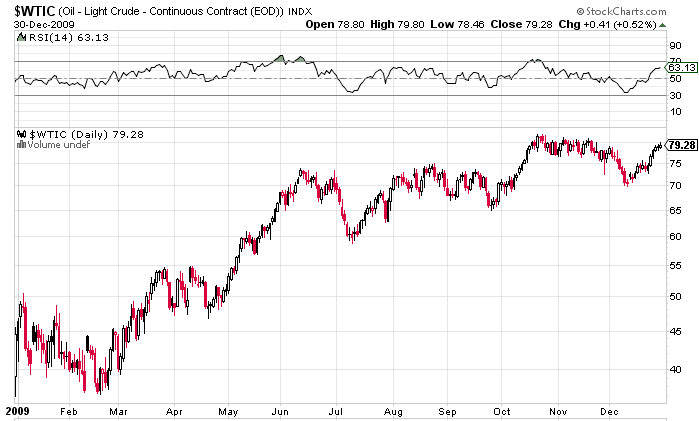

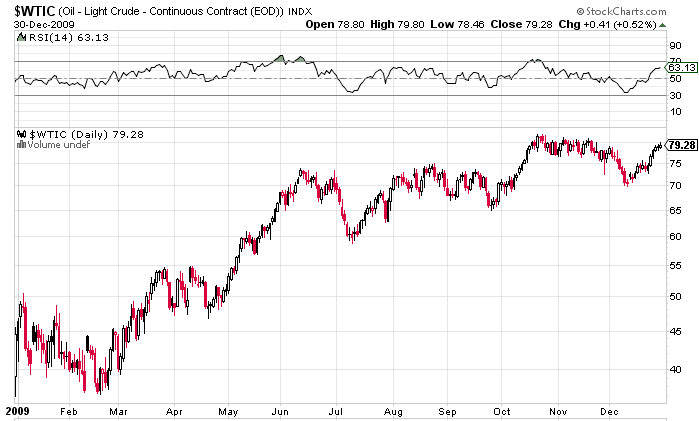

Unfortunately, no. Remember that the Achilles' heel of the yield curve as a forecasting tool is the onset of deflation. That is exactly what happened in the second half of 2008 -- and it was all because of Oil. Once Oil hit about $3/gallon, it started to seriously impact consumers' wallets. It rose as high as $147/barrel before falling to about $35/barrel in December 2008, causing the most serious deflationary bust since 1938. Here's what happened to the price of Oil in 2009:

It is disconcerting to say the least that only 2 quarters into an economic expansion following the most serious destruction of consumer demand in over half a century, Oil is already over $80/barrel. There is a very distinct whiff of the speculative boom in Oil prices of 2007 and early 2008 taking place now. Generally, we can average the top and bottom prices from 2008 at about $90 a barrel, and predict that the more Oil goes over $90 a barrel, the more it will collapse under $90 a barrel in the ensuing downturn caused by the Oil price shock.

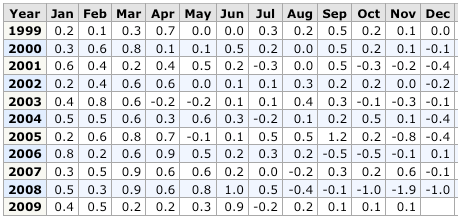

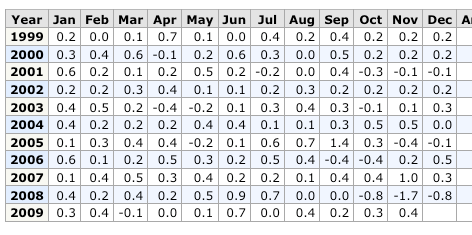

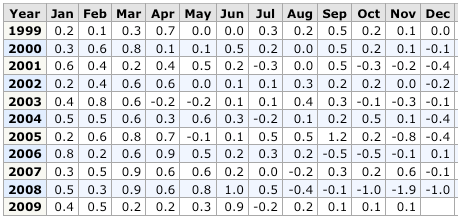

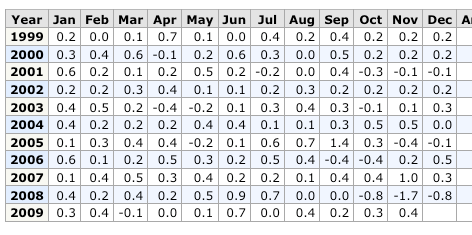

To show you what I mean, here is a chart of the last 10 years of BLS consumer price monthly data, unadjusted:

You can see that there is a marked seasonality in inflation. It tends to increase in the early part of the year, and decrease in autumn. That has a great deal to do with Oil. As spring and summer driving picks up, the price of gas increases. As driving wanes towards the end of the year, gas prices tend to decrease.

Now here is the same chart with the seasonal adjustments added in:

Note that there were 5 incidents of deflation longer than one month shown in this graph: late 2001, early 2003, late 2005, late 2006, and a very serious bout of deflation in the second half of 2008. The first four were not long or deep enough to show up as a serious impact on the economy. The last one, however, exactly coincided with the Panic of 2008. In this regard, it is important to remember that the "Panic of 2008" consisted of two parts: while the part we remember the most now was the "Black September" collapse of banking, lending, and buying, in fact the first part was an Oil-shock induced recession that featured gasoline over $3/gallon for the first two-thirds of the year, going over $4 in June and July.

In summary, if consumers once again have to pay over $3 a gallon for gas (which ~$90 Oil would give us), it will have a psychological as well as economic impact on consumers, and I would expect them to cut back in other areas. This looks likely to be the case. We are just 6 months into renewed economic expansion, and at the seasonal low for Oil prices, and already Oil is at $80 a barrel. It is a near certainty that the expansion will continue for at least 3-6 more months. Does anyone see any reason for Oil prices to decline in that period? Of course it could happen, but it doesn't seem likely. It seems much more likely that Oil prices will continue to increase, but slowly this time as opposed to the skyrocketing speculative blowoff that led to $147 Oil in July 2008.

Whether $90+ Oil will lead to a full-blown double-dip economic contraction, or just a slowdown later in the year, is almost impossible to gauge. It depends upon how far over $90 Oil shoots, and how long it stays there. If there is a dramatic overshooting a la 2007, there will be a double-dip. If there is a gradual increase over $90 that does not last that long before consumers cut back and the feedback loop causes price declines, then there may just be a slowdown, or if there is a contraction, it may be shallow and only last a quarter or two -- which is my best guess, and

only a guess, at this point.

V. The Gilded RecoveryEven if economic growth continues throughout the year, and even if there is an improvement in the number of jobs in the economy, any such recovery will still reflect deep structural problems. In short, if it doesn't feel much like an expansion to you, that's probably because you're not among the top 10% income recipients. This economic recovery is truly a Gilded one, where the wealthy have outlooks so separate from average Americans that we may as well be in two countries. Last September, the

American Affluence Research Center Survey found that:

America's most affluent consumers have a negative opinion of current business conditions but possess a positive 12 -month outlook for improvements in business conditions and the stock market....

The survey was conducted in September [2009]-among 684 respondents representative of the wealthiest 10% of Americans -some 11.2 million households, accounting for about half of total consumer spending. It also reveals that spending plans over the next 12 months have improved since the previous study, in the spring, but continue to be soft in comparison to prior-year reports in the eight-year series of surveys.

You are going to see broad consumer consumption numbers continue to grow. Part of that will be accompanied by jobs growth. This is already happening.

Underlying that, though, is literally a tale of two worlds.

If you have a job and didn’t lose it during this recession, then you are looking around and you have pent-up demand. Prices are lower across the board, noticeably so. That combination means you are going to consume a bit.

If you don’t have a job, you’re not going to do that.

.... If you are earning over $100,000, then your plans are to spend over 50% more than last year. That’s stunning. Equally stunning was that if you are making less than $30,000, then you are going to cut your spending by a third.

In a related backdrop, the wealthiest consumers, say those in the top decile of earnings and net worth – and this is not something new – account for almost half of all spending. The lower 90% account for the other half.

Lakshman Achuthan, quoted above, is a managing director of the

Economic Cycle Research Institute (ECRI), who distinguished themselves last spring, in the teeth of the fiercest part of the Great Recession, by a table-pounding call that expansion was going to start in the second half of 2009. If that breathtakingly correct call wasn't enough,

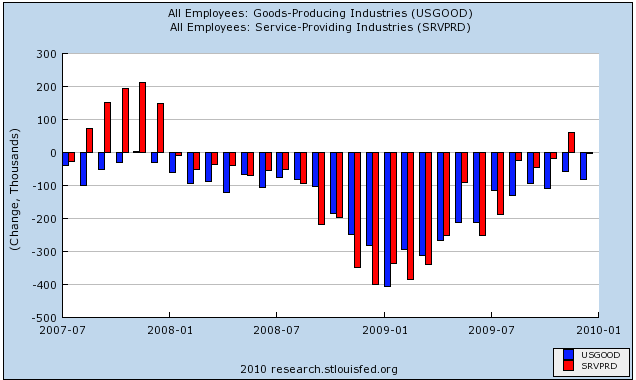

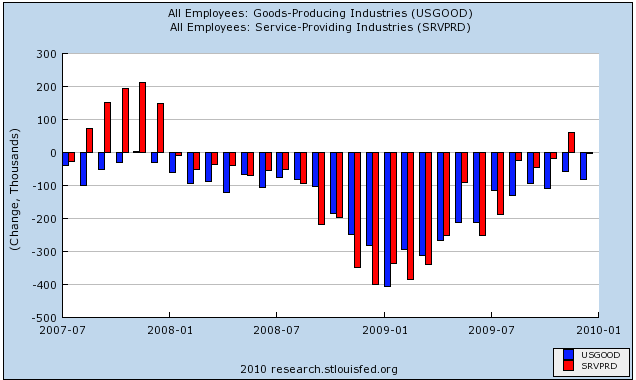

in August he said that the economy would start to add service jobs but not manufacturing improve by end of 2009 -- a call that was exactly accurate, as the 80%+ part of the economy that is in servies, bottomed in October and started to add jobs in November:

(service jobs are red, goods-producing jobs are blue in the graph above).

He sees a resiliant economic recovery, with the job numbers turning positive within the next few months. But he doubts that the upturn will last long enough to put America back to work. Only some of the 7 million lost jobs will be recovered before the next recession strikes. The Teens could well be a decade of more frequent recessions with shorter recoveries in between. That implies chronically high unemployment for years to come.

Ever since World War II, each upturn has been a bit slower than the one before, with the post-2002 upturn the weakest on record. Lakshman’s forecast assumes that that pattern continues. As for the length of the current recovery, everything depends on when the Fed starts raising interest rates. Too soon, and the economy sinks immediately. Too late, and inflation takes hold, which would force even higher rates and a sharper downturn. Even if the Fed gets its decision just right, and the economy keeps coasting along, it won’t gain enough strength to reduce unemployment significantly.

[T]he pace of growth of the US economy during each expansion has been falling for decades. In you combine lower trend growth expansion with higher cyclical volatility, it dictates more frequent recessions. Japan, with a 1% GDP trend growth rate for the last 20 years, has seen four recessions, about one every five years. On the other hand, China, with roughly a 10% GDP trend growth rate, has seen zero recessions in the last 20 years.

That really illustrates the points I am making. Regardless of all the hand waving, those are the hard facts. Our trend growth rate is getting lower and our cycles are getting shorter and more volatile. We only have to look to the second largest economy in the world, which is Japan, to see that that adds up to more frequent recessions.

As others have noted here and elsewhere, in the last twenty years our economy seems to have lived off of one asset bubble after another, each one requiring lower and lower interest rates, and each one requiring more and more pump priming by the Treasury, as the middle class has gradually been hollowed out and gone deeper and deeper into debt. For the consumer and the Fed, that trend is now at its end. Only increased debt issuance by the Treasury, or simply issuing money, is left. That the chief beneficiaries of this largesse have been the very plutocratic entities which enabled the current disaster only exacerbates the problem, as they take that largesse and invest in commodities like -- Oil -- thereby causing its price to rise, acting like a choke collar on economic growth. What Achuthan sees in the long term GDP trends, I see in the long term travails of average Americans. I believe he will be proven right. There will be no long lasting widespread economic growth until the structural issues in the economy are dealt with.

IN CONCLUSION, 2010 looks like it will be a year very much in two halves. The first half will feature growth, and much stronger growth than most anticipate. Depending upon the behavior of Oil, the second half may just show us somewhat more tepid growth or by the fourth quarter there may actually be some contraction, although there is no sign whatsoever at this point at least of a repeat of "cliff-diving."

But even if so, the structural problems behind the economic malaise of average Americans have been completely unaddressed. LIke a drug user, the US economy requires more and more financial narcotic to achieve the same effect, and as a result expansions and recoveries will become shallower and shorter, and recessions deeper, more frequent, and /or longer, until those issues are addressed.