The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The decline in the manufacturing sector continues to moderate. After six consecutive months below the 40-percent mark, the PMI, driven by the New Orders Index at 47.2 percent, shows a significant improvement. While this is a big step forward, there is still a large gap that must be closed before manufacturing begins to grow once again. The Customers' Inventories Index indicates that channels are paring inventories to acceptable levels after reporting inventories as 'too high' for eight consecutive months. The prices manufacturers pay for their goods and services continue to decline; however, copper prices have bottomed and are now starting to rise. This is definitely a good start for the second quarter."

ISM's New Orders Index registered 47.2 percent in April, 6 percentage points higher than the 41.2 percent registered in March. This is the 17th consecutive month of contraction in the New Orders Index. A New Orders Index above 48.8 percent, over time, is generally consistent with an increase in the Census Bureau's series on manufacturing orders (in constant 2000 dollars).

Consumer spending on non-durable goods increased in January and February but decrease in March. However, note again that overall spending is at lower levels relative to September and October.

Consumer spending on non-durable goods increased in January and February but decrease in March. However, note again that overall spending is at lower levels relative to September and October.

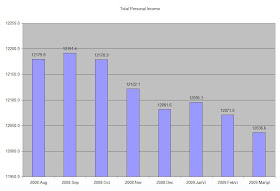

Personal income decreased $34.4 billion, or 0.3 percent, and disposable personal income (DPI) decreased $1.8 billion, or less than 0.1 percent, in March, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $24.2 billion, or 0.2 percent. In February, personal income decreased $24.3 billion, or 0.2 percent, DPI increased $0.2 billion, or less than 0.1 percent, and PCE increased $39.1 billion, or 0.4 percent, based on revised estimates.

A big reason why is a decrease in wage and salary disbursements.

A big reason why is a decrease in wage and salary disbursements.

First there was an increase in transfer payments.

First there was an increase in transfer payments. Secondly, there was a decrease in personal current taxes.

Secondly, there was a decrease in personal current taxes.

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to deteriorate in April, but at a much slower pace than in recent months. The general business conditions index climbed 24 points from its March record low, to -14.7. The new orders index shot up 41 points to a reading just below zero, and the shipments index rose 25 points, also reaching a level near zero. The inventories index continued to fall, hitting a record low -36.0. The indexes for both prices paid and prices received remained negative. The index for number of employees, while negative, improved in April, but the average workweek index fell. Future indexes were much improved, with the future general business conditions, new orders, and shipments indexes rising sharply to levels not seen since September of last year. The capital spending and technology spending indexes remained below zero, although they were considerably above last month’s levels.

The rate of descent is definitely slowing in the Chicago area where the purchasers' index jumped nearly 10 points to 40.1, still sub-50 to indicate contraction but nevertheless a big gain. There's improvement across the report led importantly by new orders which jumped more than 11 points to 42.1. Backlog orders also showed less month-to-month deterioration, at 36.9 vs. March's 21.3. The Chicago report draws its respondents from across industries whether manufacturing or non-manufacturing. Order readings from the ISM had been mixed to improving in recent months and today's results point to solid improvement for both ISM reports.Here's the accompanying chart:

Gas demand was fairly level for the last 4 weeks.

Gas demand was fairly level for the last 4 weeks.

The SPY chart is still bullish and prices are just below important resistance levels. A move about the horizontal line would be a very bullish move. Also note the price/SMA situation is stil very positive. However, the overall lack of volume -- especially on the later part of the rally -- is still concerning.

The SPY chart is still bullish and prices are just below important resistance levels. A move about the horizontal line would be a very bullish move. Also note the price/SMA situation is stil very positive. However, the overall lack of volume -- especially on the later part of the rally -- is still concerning.

Real gross domestic product -- the output of goods and services produced by labor and propertylocated in the United States -- decreased at an annual rate of 6.1 percent in the first quarter of 2009, (that is, from the fourth quarter to the first quarter), according to advance estimates released by the Bureau of Economic Analysis. In the fourth quarter, real GDP decreased 6.3 percent.

The decrease in real GDP in the first quarter primarily reflected negative contributions from exports, private inventory investment, equipment and software, nonresidential structures, and residential fixed investment that were partly offset by a positive contribution from personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, decreased.

The slightly smaller decrease in real GDP in the first quarter than in the fourth reflected an upturn in PCE for durable and nondurable goods and a larger decrease in imports that were mostly offset by larger decreases in private inventory investment and in nonresidential structures and a downturn in federal government spending.

Motor vehicle output subtracted 1.36 percentage points from the first-quarter change in real GDP after subtracting 2.01 percentage points from the fourth-quarter change. Final sales of computers added 0.05 percentage point to the first-quarter change in real GDP after subtracting 0.02 percentage point from the fourth-quarter change.

At least six of the 19 largest U.S. banks require additional capital, according to preliminary results of government stress tests, people briefed on the matter said.

While some of the lenders may need extra cash injections from the government, most of the capital is likely to come from converting preferred shares to common equity, the people said. The Federal Reserve is now hearing appeals from banks, including Citigroup Inc. and Bank of America Corp., that regulators have determined need more of a cushion against losses, they added.

By pushing conversions, rather than federal assistance, the government would allow banks to shore themselves up without the political taint that has soured both Wall Street and Congress on the bailouts. The risk is that, along with diluting existing shareholders, the government action won’t seem strong enough.

“The challenge that policy makers will confront is that more will be needed and it’s not clear they have the resources currently in place or the political capability to deliver more,” said David Greenlaw, the chief financial economist at Morgan Stanley, one of the 19 banks that are being tested, in New York.

Bank of America Corp. needs $60 billion to $70 billion of capital, according to Freidman, Billings, Ramsey Group Inc. analyst Paul Miller, who cited stress tests performed by his firm.

Bank of America should consider converting its preferred shares to common stock, including $27 billion in private hands “as soon as possible,” Miller wrote in a note to clients today. Miller said his firm’s versions of the stress tests were “somewhat tougher” than those performed by U.S. regulators.

Bank of America is among 19 lenders evaluating results of the formal U.S. stress tests. The Charlotte, North Carolina-based lender sold $45 billion of preferred stock to the Treasury’s bank rescue fund. Chief Executive Officer Kenneth Lewis and directors face opposition from shareholders to their reelection at tomorrow’s annual meeting after a 78 percent drop in the share price in 12 months.

“Most major banks will find it very difficult to raise that kind of capital in today’s environment, and we believe the first line of defense would be to convert both private and TARP preferred to common equity,” Miller said. FBR’s stress test included a 12 percent jobless rate, compared with about 10 percent used by the government test, Miller wrote.

The daily chart adds some much needed clarity. Notice first that prices have broken the uptrend that started in late February. Prices have also fallen through the 10 and 20 day SMAs while the MACD has given a sell signal and the RSI is losing strength.

The daily chart adds some much needed clarity. Notice first that prices have broken the uptrend that started in late February. Prices have also fallen through the 10 and 20 day SMAs while the MACD has given a sell signal and the RSI is losing strength.